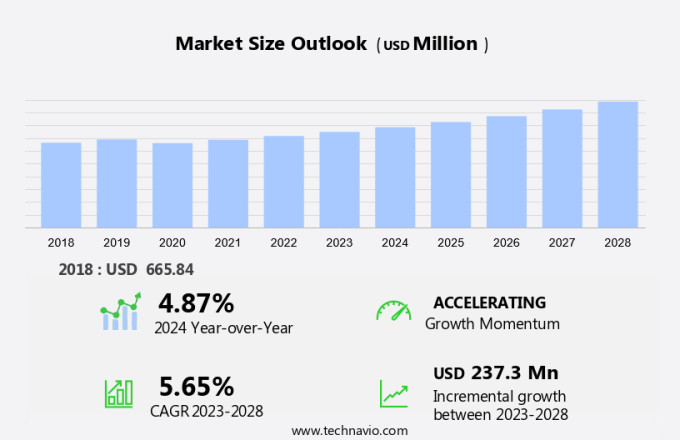

Infrared Aerial Camera Market Size 2024-2028

The infrared aerial camera market size is forecast to increase by USD 237.3 million at a CAGR of 5.65% between 2023 and 2028. The market is experiencing significant growth due to the increasing use of these cameras in Unmanned Aerial Vehicles (UAVs) for various applications such as surveillance, agriculture monitoring, and search and rescue operations. Additionally, the adoption of infrared aerial cameras in solar farms for thermal imaging and efficiency analysis is another major growth factor. However, the high cost of Research and Development (R&D) in infrared aerial camera technology remains a significant challenge for market growth. Manufacturers are investing heavily in R&D to reduce costs and improve the performance and functionality of these cameras, which is expected to drive innovation and market expansion. Overall, the market is poised for strong growth due to these trends and the increasing demand for advanced imaging solutions in various industries.

The market is experiencing significant growth due to the increasing adoption of UAVs for various applications such as mining, construction, surveillance, search and rescue, and railways. These UAVs are equipped with thermal cameras that capture radiometric data streams, converting infrared radiation into electrical signals to produce thermal images. Thermal performance is a crucial factor in the selection of these cameras, as they need to function optimally in various environmental conditions. External infrared cameras can be linked to UAVs via USB for real-time data transmission to the ground station. IR flash software is used to enhance the quality of thermal images, while autonomous capability and infrared software development are essential for advanced thermal analysis solutions.

Thermal imaging is also finding applications in smart devices, embedded systems, power infrastructure, healthcare, and security and surveillance. Radiometric technology, temperature sensing products, and FLIR systems are key players in the market, offering advanced features and solutions for diverse industries.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Application

- Commercial

- Military

- Geography

- North America

- Canada

- US

- APAC

- China

- Japan

- Europe

- Germany

- Middle East and Africa

- South America

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period. Infrared aerial imaging cameras, utilizing radiometric data streams and USB link for seamless data transfer, are gaining significant traction in various industries. Thermal cameras, equipped with advanced IR Flash software, enable temperature sensing products to capture thermal images with high thermal performance. These cameras are integrated into drones, UAVs, and ground stations for applications in mining, construction, surveillance, search, firefighting, rescue, and more. FLIR Systems and other leading manufacturers provide radiometric technology and thermal analysis solutions for commercial and military applications. Infrared cameras convert infrared radiation into electrical signals, generating thermal images for visual imaging and autonomous capability. The market for these smart devices and embedded systems extends to power infrastructure, security and surveillance, healthcare, and more. Infrared software development continues to advance, enhancing the capabilities of these thermal performance solutions.

Get a glance at the market share of various segments Request Free Sample

The offline segment was valued at USD 577.00 million in 2018 and showed a gradual increase during the forecast period.

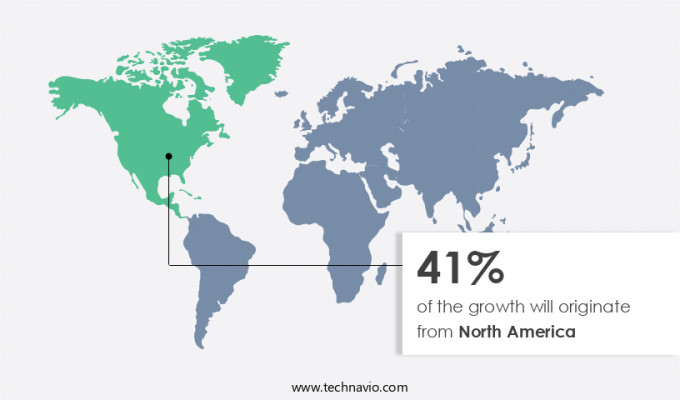

Regional Insights

North America is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is experiencing significant growth in North America, driven by expanding applications in both civil and military sectors. In the civil domain, industries such as chemical, agriculture, public safety, and law enforcement are witnessing increased demand for these cameras. The chemical industry's growth in this region is a key factor, as enterprises benefit from the availability of more abundant and cost-effective feedstock, leading to increased capital investments for expanding production capacity in countries like the US and Mexico. In the military sector, infrared aerial cameras find extensive use in border monitoring, army camps, and defense applications. Additionally, commercial surveillance and automotive applications are also contributing to the market growth. Short-wavelength IR, medium-wavelength IR, and long-wavelength IR technologies cater to various use cases, with image data playing a crucial role in ensuring effective monitoring and analysis.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Infrared Aerial Camera Market Driver

The increasing use of infrared aerial cameras in UAVs is the key driver of the market. The integration of infrared aerial cameras into drones is gaining significant traction in various industries due to their ability to provide radiometric data streams in real-time. These cameras, which are also known as thermal cameras, have become essential tools for drones in sectors such as mining, construction, surveillance, search, firefighting, and rescue. Infrared radiation is the foundation of these cameras, converting electrical signals into thermal images. The thermal performance of these cameras is crucial, as they are used to detect heat and provide visual imaging in the absence of visible light. USB link connectivity allows for seamless data transfer from the drone to a ground station, where IR Flash software can be used for thermal analysis solutions.

External infrared cameras can also be attached to visible cameras for enhanced capabilities. UAVs equipped with infrared aerial cameras offer autonomous capability, making them indispensable in sectors like power infrastructure, security and surveillance, and healthcare. Companies like FLIR Systems lead the market in radiometric technology and temperature sensing products, providing high-quality sensors, lenses, and signal generators. The use of infrared aerial cameras in drones is transforming industries, from military applications to commercial uses, making them smart devices and embedded systems for efficient and effective operations.

Infrared Aerial Camera Market Trends

The increasing use of infrared aerial cameras in solar farms is the upcoming trend in the market. The market has witnessed significant growth due to the increasing demand for thermal imaging cameras technology in various sectors. USB link-enabled IR cameras offer radiometric data streams for superior thermal performance, making them ideal for applications such as mining, construction, surveillance, search, firefighting, rescue, and UAVs. Companies like FLIR Systems lead the market with advanced radiometric technology and thermal camera solutions, providing high-resolution thermal images for temperature sensing products. These cameras are integrated with IR Flash software, lens, sensor, signal generator, display, and are compatible with both commercial and military applications. The autonomous capability of UAVs equipped with infrared cameras enhances their usage in power infrastructure monitoring, security and surveillance, healthcare, and smart devices.

Infrared software development and thermal analysis solutions cater to the growing demand for embedded systems and power-efficient electrical signals. Infrared radiation plays a crucial role in visual imaging, and the market is expected to grow further with advancements in technology.

Infrared Aerial Camera Market Challenge

The high cost of R&D in infrared aerial camera development is a key challenge affecting the market growth. Infrared aerial cameras are gaining significant traction in various industries and military applications due to their ability to capture thermal images in complete darkness or under adverse weather conditions. These cameras use radiometric data streams and IR Flash software to convert infrared radiation into electrical signals, which are then processed to generate thermal images. Thermal cameras come with advanced features like a USB link, lens, sensor, signal generator, display, and thermal performance for enhanced thermal analysis solutions. External infrared cameras can be integrated with drones, visible cameras, ground stations, UAVs, and smart devices for commercial and military applications. The customization of infrared cameras is on the rise to cater to specific requirements in sectors like mining, construction, surveillance, search, firefighting, rescue, power infrastructure, security and surveillance, healthcare, and more.

Despite the high development cost, the increasing demand for infrared technology in various applications warrants continuous research and development efforts. companies are investing in infrared software development and thermal analysis solutions to meet the evolving needs of customers. Infrared technology is being adopted by various industries and militaries for its autonomous capability and ability to sense temperature, making it an essential tool for various applications.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

CONTROP Precision Technologies Ltd. - The company offers infrared aerial camera such as T stamp XD, M stamp, and T stamp XR.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- DIAS Infrared GmbH

- EchoBlue Ltd

- HGH Systemes Infrarouges SAS

- Infrared Cameras Inc.

- InfraTec GmbH

- Jenoptik AG

- L3Harris Technologies Inc.

- Leonardo Spa

- Seek Thermal Inc.

- Teledyne Technologies Inc.

- Workswell Sro

- Yuneec International Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for thermal imaging in various industries such as mining, construction, surveillance, search, firefighting, and rescue. Infrared cameras convert infrared radiation into electrical signals, generating thermal images that provide valuable information on temperature sensing products. These cameras are integrated with USB link for easy data transfer and can be mounted on drones or UAVs for aerial surveillance. Radiometric data streams and IR flash software enable advanced thermal performance, while the integration of visible cameras enhances visual imaging. The market for infrared cameras includes both external and integrated solutions, with the latter gaining popularity due to their autonomous capability and compact design.

The market caters to both commercial and military applications, with FLIR Systems being a key player in the radiometric technology domain. The market also includes thermal analysis solutions, smart devices, and embedded systems for power infrastructure and healthcare sectors. Lens, sensor, signal generator, display, and battery are essential components of an infrared camera system.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

157 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.65% |

|

Market growth 2024-2028 |

USD 237.3 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.87 |

|

Regional analysis |

North America, APAC, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 41% |

|

Key countries |

US, Canada, China, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

CONTROP Precision Technologies Ltd., DIAS Infrared GmbH, EchoBlue Ltd, HGH Systemes Infrarouges SAS, Infrared Cameras Inc., InfraTec GmbH, Jenoptik AG, L3Harris Technologies Inc., Leonardo Spa, Seek Thermal Inc., Teledyne Technologies Inc., Workswell Sro, and Yuneec International Co. Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch