Japan Insurance Market Size 2025-2029

The japan insurance market size is forecast to increase by USD 46.7 billion billion at a CAGR of 3% between 2024 and 2029.

- The Japanese insurance market is experiencing significant growth driven by demographic shifts and the integration of technology. With a rapidly aging population, the demand for long-term care and health insurance is increasing. According to the Ministry of Health, Labor and Welfare, over 28% of the Japanese population was aged 65 or above in 2020, and this number is projected to reach 34% by 2030. Technological advancements are transforming the insurance industry in Japan, with the integration of IT and analytic solutions becoming a key trend. Insurers are leveraging data analytics to personalize products and improve customer experience.

- Additionally, the adoption of digital channels for distribution and claims processing is gaining momentum. However, this digital transformation also exposes insurers to new risks, particularly cybercrime. The number of reported cyberattacks in Japan increased by 25% in 2020, according to the National Police Agency. Companies seeking to capitalize on the growth opportunities in the Japanese insurance market must navigate these challenges effectively by investing in cybersecurity measures and leveraging technology to enhance their offerings while addressing the unique needs of an aging population.

What will be the size of the Japan Insurance Market during the forecast period?

- The Japanese insurance market encompasses both life and non-life sectors, with the third-party administrators playing a crucial role in facilitating the distribution of insurance products. The market's size is significant, with life insurers and non-life insurers, including general insurers, standalone health insurers, and specialized insurers, collectively contributing to a substantial portion of the country's financial services sector. Foreign direct investment in the Japanese insurance industry has been on the rise, attracting global players seeking to capitalize on the market's growth potential. In the life insurance segment, consumers primarily focus on securing coverage for medical expenses, life protection, and retirement planning.

- Non-life insurance, on the other hand, caters to various risks, such as property damage, liability, and personal accidents. Common insurance products include dental emergency, travel plans, and international travel insurance, offering reimbursement for medical expenses, loss of passports, identity proof, accident assistance, medical evacuation, and more. The market is characterized by a growing demand for comprehensive insurance solutions, reflecting the population's increasing awareness of risk management and financial security.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Life

- Non-life

- Channel

- Sales personnel

- Insurance agencies

- Sector

- Public/government insurance companies

- Private insurance companies

- Geography

- Japan

By Type Insights

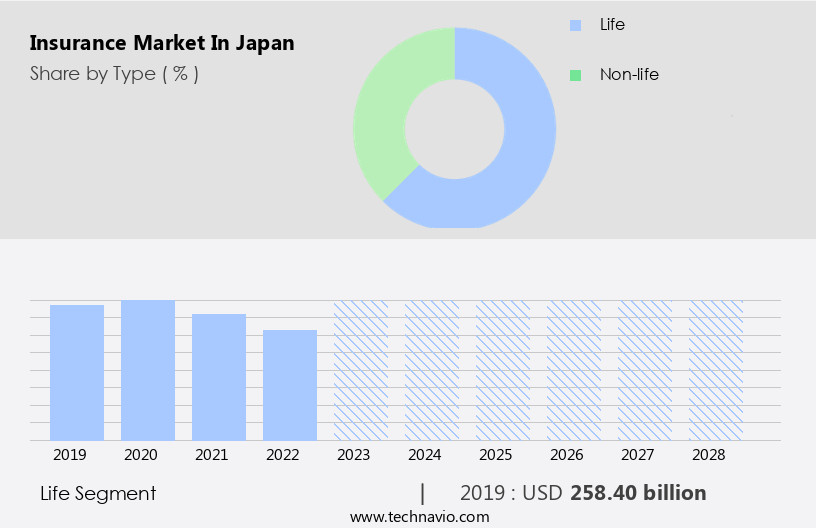

The life segment is estimated to witness significant growth during the forecast period.

Life insurance is a significant segment in Japan's insurance market, with nearly 90% of the population holding coverage. The primary driver of this trend is the low-interest rate charged by insurers due to Japan's aging population. In 2023, over 30% of the population was aged 65 and above, increasing life expectancy and reducing insurers' risk. Furthermore, many Japanese companies provide life insurance as an employee benefit. Non-life insurance, including third-party administrators, covers areas like property, casualty, and liability. Life insurers, general insurers, and specialized insurers cater to various customer needs.

Digital innovation, such as InsurTech, is transforming the industry, addressing customer pain points and enhancing the digital customer experience. The World Bank, IoT, and vaccine rollouts are shaping the future of insurance service businesses. : life insurance, non-life insurance, third-party administrators, World Bank, digital innovation, customer pain points, insurtechs.

Get a glance at the market share of various segments Request Free Sample

The Life segment was valued at USD 258.40 billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Japan Insurance Market?

- Growing geriatric population in Japan is the key driver of the market.

- Japan's demographic shifts have significantly influenced the insurance market. With one of the largest aging populations globally, the number of people over 65 years old reached approximately 37.4 million in 2023, according to World Bank data. Simultaneously, Japan's birth rate has been declining, dropping from 18.8 children per 1,000 people in 1971 to around 7.01 children per 1,000 people in 2023.

- These demographic trends have led insurers to adjust their offerings, providing insurance at lower interest rates and longer maturity periods. Consequently, Japanese consumers are increasingly purchasing insurance products to secure their financial future.

What are the market trends shaping the Japan Insurance Market?

- Integration of IT and analytic solutions is the upcoming trend in the market.

- The Japanese insurance market is characterized by the integration of IT and analytical solutions to enhance sales and marketing strategies. Data analytics plays a pivotal role in this market, enabling firms to forecast potential market scenarios through simulation and stochastic techniques. This data-driven approach assists in product design improvement and customer targeting. Currently, insurance brokers utilize data analytic tools to gain customer insights and maintain a competitive edge.

- These tools help uncover hidden data patterns using complex models and predict future market outcomes. Major players in the market prioritize business intelligence, which involves converting raw data into valuable marketing insights and information. This data-centric approach enables firms to make informed decisions and stay competitive in the dynamic insurance landscape.

What challenges does Japan Insurance Market face during the growth?

- Vulnerability toward cybercrime is a key challenge affecting the market growth.

- The digital transformation of businesses worldwide offers numerous advantages, such as improved data organization, increased data accessibility, and enhanced management capabilities. Technology plays a pivotal role in this shift, with advancements in processing systems, online data storage, and electronic communications streamlining operations. However, this reliance on technology also introduces new risks, particularly in the form of cybercrime. Instances of cyberattacks, including computer and software hacking, as well as intrusions into intranet portals, pose a significant threat to the insurance industry in Japan.

- The potential misappropriation and sale of confidential client information to competitors can negatively impact market dynamics. As a , it's crucial to acknowledge and address these concerns to ensure the security and integrity of sensitive data.

Exclusive Japan Insurance Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AFLAC Inc.

- Allianz SE

- Asahi Mutual Life Insurance Co.

- Dai ichi Life Holdings Inc.

- JAPAN POST INSURANCE Co., Ltd.

- Lifenet Insurance Co. Ltd.

- Manulife Financial Corp.

- Medicare Life Insurance Co., Ltd.

- Meiji Yasuda Life Insurance Co.

- Metlife Inc.

- MS and AD Insurance Group Holdings Inc.

- Nippon Life Insurance Co.

- Orix Corp.

- Pruco Life Insurance Company

- Rakuten Group Inc.

- SBI Insurance Group Co., Ltd.

- Sompo Holdings Inc.

- Sony Financial Group Inc.

- Tokio Marine Holdings Inc.

- Zurich Insurance Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a significant sector, encompassing both life and non-life insurance providers. This industry plays a crucial role in the country's economic landscape, offering various types of insurance policies to meet the diverse needs of its population. Third-party administrators (TPAs) are integral to the Japanese insurance market, facilitating the processing and payment of claims on behalf of insurers. Foreign direct investment (FDI) has been a driving force in the growth of life insurers and general insurers in Japan. Specialized insurers cater to unique risks, such as dental emergencies and travel plans, further expanding the market's scope. The World Bank reports that the Japanese insurance sector is and well-regulated, with a focus on financial stability and customer protection.

Life insurers and general insurers have adopted digital innovation, such as Digi Locker, to streamline processes and enhance the customer experience. Insurtechs have emerged as key players in the Japanese insurance market, addressing customer pain points through digital solutions. These innovative companies leverage technology to offer services like medical expenses reimbursement, loss of passports, identity proof, accident assistance, and medical evacuation. Travel insurance policies cover in-trip crises, including flight delays, and provide peace of mind for travelers. The insurance sector in Japan has shown resilience amid economic downturns, such as the Great Depression and recessions. Vaccine rollouts have brought renewed optimism, with insurers offering coverage for COVID-19-related risks.

Customer expectations continue to evolve, driving the need for insurers to prioritize digital customer experiences. Incumbents are adapting to this trend by integrating technology into their services, offering cashless hospitals, and addressing in-trip crises effectively. The insurance service businesses in Japan are at the forefront of the digital transformation, embracing technology to cater to the evolving needs of their customers. This includes the Internet of Things (IoT) and other advanced technologies to provide customized solutions and improve overall efficiency. In , the market is a dynamic and innovative sector, with a focus on customer needs and digital transformation. Life insurers, general insurers, and specialized insurers are adapting to the changing landscape by offering comprehensive insurance solutions and leveraging technology to enhance the customer experience.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

159 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3% |

|

Market growth 2025-2029 |

USD 46.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.8 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Japan

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch