Integrated Stepper Motor Market Size 2025-2029

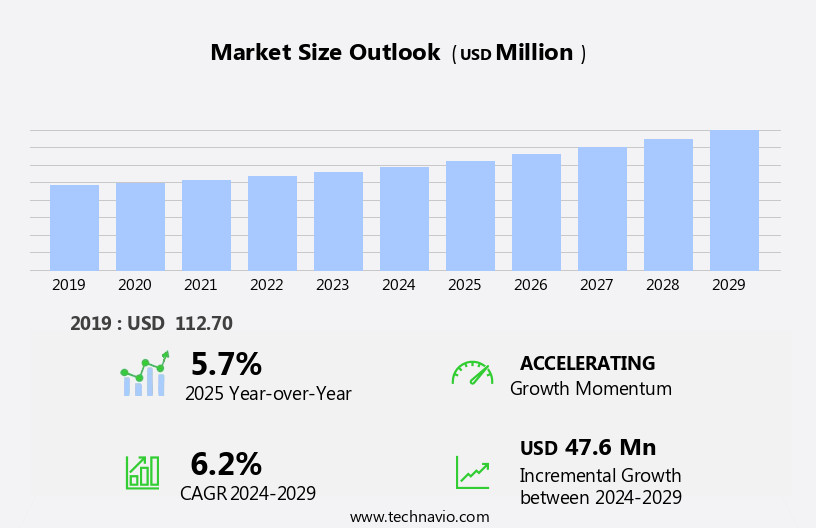

The integrated stepper motor market size is forecast to increase by USD 47.6 million, at a CAGR of 6.2% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand for automation in various industries, including packaging machinery, industrial automation, semiconductor equipment, robotics, printers, and medical devices. The integration of Internet of Things (IoT) technology in motors and drives is another major trend driving market growth. This technology enables real-time monitoring and remote control of motors, enhancing efficiency and productivity. Additionally, the adoption of Industry 4.0 and smart city initiatives is fueling the demand for advanced motion control systems. However, intense competition from low-cost Asian manufacturers poses a challenge to market growth. Magnet-based integrated stepper motors, driven by microcontrollers, are gaining popularity due to their high precision, energy efficiency, and compact design. These motors are used in a wide range of applications, from pumps and printing machinery to semiconductor equipment and medical devices.

What will be the Size of the Market During the Forecast Period?

- The market encompasses the production and sales of stepper motors that come integrated with their control electronics. This market caters to various industries, including packaging machinery, experimental apparatus, semiconductor equipment, and industrial automation. Integrated stepper motors find extensive applications in process industries and discrete industries, such as in ACE matrix tables, IoT devices, smart city projects, and synthesis machines. These motors are available in various sizes, including Nema17 and Nema23, and can be classified into bipolar and unipolar types. These are widely used in robotics, 3D printers, CNC machines, and automation systems due to their high precision, compact design, and ease of use.

- The market's growth is driven by the increasing demand for automation and digitization across industries, leading to a larger adoption of stepper motors in various applications. The integration of it with control electronics simplifies installation and operation, making them a preferred choice over conventional motors and electrical pulses.

How is this Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Process industries

- Discrete industries

- Type

- NEMA17

- NEMA23

- Product

- Rotary stepper motors

- Linear stepper motors

- Application

- Industrial automation

- Medical devices

- Automotive

- Consumer electronics

- Geography

- Europe

- Germany

- France

- Italy

- North America

- Canada

- Mexico

- US

- APAC

- China

- India

- Japan

- South Korea

- Middle East and Africa

- South America

- Europe

By End-user Insights

- The process industries segment is estimated to witness significant growth during the forecast period. The market encompasses various industries such as Packaging Machinery, Experimental Apparatus, Semiconductor equipment, and Industrial Automation. These are integral components in numerous applications, including Ace matrix, IoT, Smart city projects, Synthesis, and Promotions. These motors are utilized in Industrial Automation and Office Automation applications, such as Robotics, 3D printers, CNC machines, and Automation systems. The market growth is driven by factors like the increasing demand for automation processes in industries and the integration of IoT in various applications. These come in different types, including Bipolar and Unipolar, and offer varying rotation angles. Industrial activities in Process industries and Discrete industries require reliable and accurate motor performance.

Get a glance at the market report of share of various segments Request Free Sample

The process industries segment was valued at USD 70.30 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- Europe is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The market in Europe is experiencing significant growth due to increasing industrial automation activities in key sectors such as Packaging Machinery, Experimental Apparatus, Semiconductor equipment, and Industrial Automation. The region's focus on reducing dependence on oil imports and enhancing energy security is driving investments in Industrial activities, particularly in Process Industries and Discrete Industries.

For more insights on the market size of various regions, Request Free Sample

Moreover, the adoption of advanced technologies like IoT, Smart City projects, and Synthesis in various applications, including Robotics, 3D printers, CNC machines, and Automation systems, is fueling the demand for accurate and reliable stepper motors. The market growth is expected to remain consistent due to the increasing use of Bipolar and Unipolar stepper motors in various applications, the development of advanced Driver circuits and Control algorithms, and the integration of Microcontroller capabilities. The market is highly competitive, with key players offering comprehensive data and reliable market growth projections.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Integrated Stepper Motor Industry?

- Increase in demand for automated equipment in industrial premises is the key driver of the market. The market experiences significant growth due to the increasing adoption of automation in various industries. These motors find extensive applications in sectors such as packaging machinery, semiconductor equipment, industrial automation, and experimental apparatus. In the process industries, these are used in automation processes for machinery like cranes, conveyors, and robots for pick-and-place applications. In the discrete industries, they are utilized in CNC machines, 3D printers, and automation systems. The Internet of Things (IoT) and smart city projects are also contributing to the market growth. These come in various types, including bipolar and unipolar, and differ in rotation angle, driver circuit, and control methods.

- Bipolar stepper motors use electrical pulses to move the motor in a specific direction, while unipolar stepper motors use a single winding for each coil. Industrial activities in sectors like robotics, medical devices, and printing equipment also rely on stepper motors for precise control and accuracy. The market growth is driven by the increasing demand for reliable data, accurate market growth, and the microcontroller capabilities and control algorithms of these motors. Additionally, servo motors are also gaining popularity due to their advanced features.

What are the market trends shaping the Integrated Stepper Motor Industry?

- Increased adoption of IoT in motors and drives is the upcoming market trend. In the realm of industrial automation, motors play a pivotal role in powering various machinery and equipment. With the advent of Internet of Things (IoT), industries are integrating motor systems with smart technology to enhance control, efficiency, and productivity. Motors, particularly stepper motors, are gaining popularity due to their precision and reliability in applications such as Packaging Machinery, Experimental Apparatus, Semiconductor equipment, and Industrial Automation. Stepper motors, which operate based on the principle of electric pulses, come in various types like Ace matrix, Bipolar stepper motors, Unipolar stepper motors, and Hybrid stepper motors. These motors are integral to applications like Robotics, 3D printers, CNC machines, and Automation systems, where precise rotation angles are required.

- Industries, including Process industries and Discrete industries, are increasingly adopting stepper motors for their automation processes due to their high accuracy and compatibility with IoT. IoT integration enables real-time monitoring, predictive maintenance, and remote control, leading to increased efficiency and reduced downtime. Moreover, the integration of IoT in stepper motors is not only limited to industrial applications but also extends to Office Automation applications like Printing Equipment. The market for stepper motors is expected to grow significantly due to the increasing demand for automation systems and the integration of IoT in various industries.

What challenges does the Integrated Stepper Motor Industry face during its growth?

- Intense competition from low-cost Asian manufacturers is a key challenge affecting the industry growth. Integrated stepper motors are finding extensive applications in various industries, including Packaging Machinery, Experimental Apparatus, Semiconductor equipment, and Industrial Automation. The Ace matrix of this market comprises of bipolar stepper motors and unipolar stepper motors, with the former dominating the market due to their higher torque output. The market growth is driven by the increasing demand for automation processes in process industries and discrete industries. The market is witnessing significant competition among key players, with a focus on IoT integration, smart city projects, and Synthesis of advanced control algorithms and microcontroller capabilities. Industrial activities in Asia are attracting substantial investments due to the availability of low-cost labor, land, and raw materials.

- End-users in this region are prioritizing power-efficient machinery and solutions. However, the market is also facing challenges from low-cost imports from Asian manufacturers, including China. These imports have significantly impacted the pricing dynamics of the market in the US and Europe. Companies are focusing on building relationships with sub-component suppliers to reduce costs. Key applications of integrated stepper motors include Robotics, 3D printers, CNC machines, Automation systems, and various Industrial Automation applications, such as Printing Equipment, Medical devices, and Infusion pumps. The market growth is expected to remain accurate and reliable, with a focus on open-loop control, variable-reluctance, Permanent Magnet, Hybrid stepper motors, and Servo motors.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - The company offers integrated stepper motor such as DSMS series, with advanced second generation current control for exceptional performance, and smooth quiet operation.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACT Motor Co. Ltd.

- Advanced Micro Controls Inc.

- Anaheim Automation Inc.

- Arcus Servo Motion Inc.

- Beckhoff Automation

- Changzhou Fulling Motor Co. Ltd.

- Danaher Corp.

- DMI Technology Corp.

- FAULHABER GROUP

- Japan Pulse Motor Co. Ltd.

- Leadshine Technology Co. Ltd.

- MinebeaMitsumi Inc.

- Nanotec Electronic GmbH and Co. KG

- Oriental Motor Co. Ltd.

- Panasonic Holdings Corp.

- Parker Hannifin Corp.

- Schneider Electric SE

- Shanghai MOONS Electric Co. Ltd.

- TAMAGAWA SEIKI Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of electric motors that convert electrical pulses into precise rotational movements. These motors are essential components in various industries, including process industries and discrete industries, where automation and precision are key. Integrated stepper motors are utilized in numerous applications, such as packaging machinery, experimental apparatus, semiconductor equipment, and industrial automation systems. The versatility of these motors is attributed to their ability to provide accurate positioning and movement, making them indispensable in robotics, 3D printers, CNC machines, and automation processes. Bipolar and unipolar stepper motors are the two primary types of integrated stepper motors.

In addition, bipolar motors employ external power supplies to create a magnetic field, while unipolar motors utilize internal coils to generate the field. Both types have distinct advantages, with bipolar motors offering higher torque and unipolar motors boasting faster switching times. Integrated stepper motors can be found in various configurations, including variable-reluctance, permanent magnet, and hybrid stepper motors. The choice of motor type depends on the specific application requirements, such as torque, speed, and efficiency. The market for integrated stepper motors is driven by the increasing demand for automation in various industries. The adoption of Industry 4.0 and the Internet of Things (IoT) in smart city projects and industrial premises is expected to fuel the growth of this market.

Furthermore, the integration of microcontroller capabilities and advanced control algorithms in stepper motors is enabling more complex automation processes and applications. The market is characterized by a diverse company landscape, with numerous players offering a range of products catering to different application requirements. The competition in this market is driven by factors such as product innovation, pricing, and customer service. Accurate market growth data indicates that the market is expected to witness steady growth in the coming years. This growth is attributed to the increasing adoption of automation in various industries, the development of advanced motor technologies, and the growing demand for precision and accuracy in manufacturing processes.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

235 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.2% |

|

Market growth 2025-2029 |

USD 47.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.7 |

|

Key countries |

Germany, US, Italy, Mexico, China, France, Japan, Canada, South Korea, and India |

|

Competitive landscape |

Leading Companies, market growth and forecasting , Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Integrated Stepper Motor industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.