Integrated Traffic Systems Market Size 2025-2029

The integrated traffic systems market size is forecast to increase by USD 22.92 billion, at a CAGR of 14.8% between 2024 and 2029.

- The market is driven by the escalating demand for efficient traffic management in response to the increasing number of passenger vehicles on the roads worldwide. This trend is further fueled by the growing issue of road traffic congestion, which negatively impacts urban mobility and productivity. However, the market faces significant challenges. The high setup cost and operating cost associated with implementing integrated traffic systems can act as a barrier to entry for potential market entrants. Despite these challenges, the market offers opportunities for companies to innovate and provide cost-effective solutions that address the pressing need for effective traffic management.

- Companies that successfully navigate these challenges and deliver solutions that enhance urban mobility and reduce congestion are poised to capture a significant share in this growing market.

What will be the Size of the Integrated Traffic Systems Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market is characterized by its continuous evolution and dynamic nature, with various entities interplaying to optimize traffic flow and enhance road safety. Traffic simulation modeling and pedestrian signals work in tandem to anticipate and manage foot traffic, while traffic monitoring systems and traffic control software ensure real-time data collection and analysis. Traffic signal foundations and signal timing adjustment maintain the infrastructure's stability and efficiency, with vehicle detection sensors and traffic signal poles facilitating seamless communication between components. Network management systems and traffic data visualization enable effective centralized traffic control, integrating traffic accident data, signal timing plans, and traffic violation detection.

Traffic signal optimization and coordination are essential for congestion management, with roadway capacity analysis and dynamic message signs providing valuable insights. Traffic data acquisition and traffic incident management are crucial for maintaining optimal traffic flow, while traffic signal installation and maintenance ensure the longevity and reliability of the systems. Moreover, emerging technologies such as automated traffic enforcement, emergency vehicle preemption, and variable speed limits are transforming the landscape of traffic management, offering innovative solutions for traffic flow analysis and traffic signal hardware. Intersection design and traffic volume counts continue to evolve, incorporating the latest advancements in video image processing and traffic signal controllers. The integration of these entities fosters a comprehensive, adaptive traffic management ecosystem, addressing the ever-changing demands of modern transportation infrastructure.

How is this Integrated Traffic Systems Industry segmented?

The integrated traffic systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Solution

- Traffic monitoring system

- Traffic control system

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

.

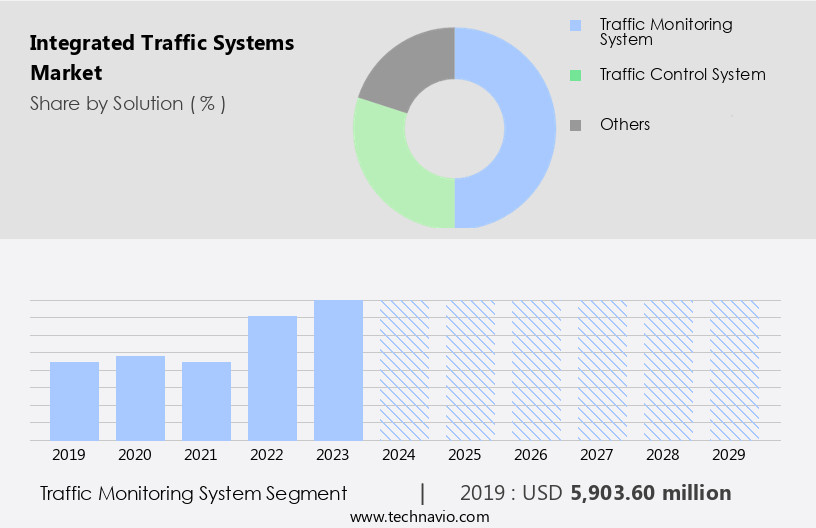

By Solution Insights

The traffic monitoring system segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to the increasing demand for efficient and effective traffic management solutions. Traffic monitoring is a crucial aspect of these systems, enabling traffic analysts to identify patterns and address issues such as congestion, inefficient routing, and poor road conditions. Traffic monitoring systems, like those offered by SWARCO, provide real-time observations, traffic operation monitoring, and video management. The rising urbanization rates in developing countries, where traffic personnel may be scarce, further emphasize the importance of these systems. Additionally, advanced technologies such as loop detectors, traffic violation detection, and traffic signal optimization contribute to the market's expansion.

The integration of network management systems, traffic data collection, and traffic incident management also enhances the overall functionality and effectiveness of these systems. Furthermore, the implementation of centralized traffic control, traffic signal coordination, and real-time traffic management further streamlines traffic flow and improves roadway capacity analysis. The market's future direction is towards the adoption of automated traffic enforcement, traffic signal controllers, and dynamic message signs for enhanced traffic management and safety. The integration of pedestrian signals, traffic volume counts, and variable speed limits also caters to the needs of diverse road users. Overall, the market's evolution reflects the growing emphasis on optimizing traffic flow, improving road safety, and enhancing the overall transportation experience.

The Traffic monitoring system segment was valued at USD 5.9 billion in 2019 and showed a gradual increase during the forecast period.

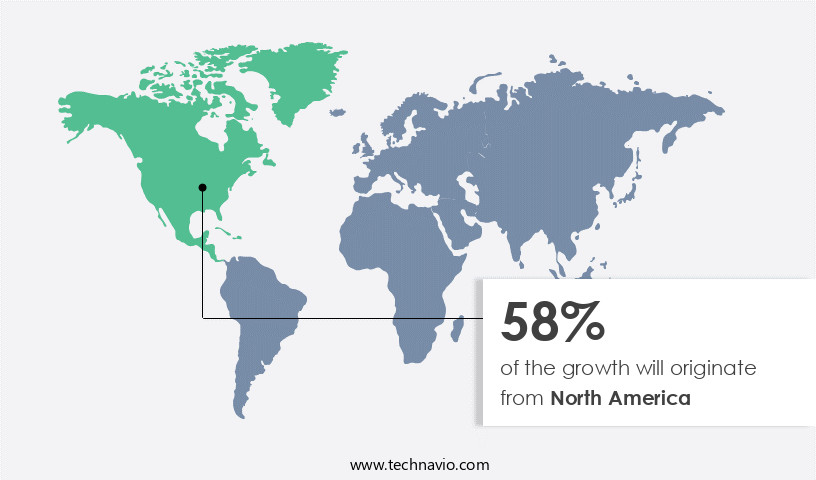

Regional Analysis

North America is estimated to contribute 58% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing steady growth, driven by the early adoption of technology and the necessary infrastructure for deployment. Cities such as Houston, Chicago, and New York City in the US, and those in Canada, are leading the way in implementing advanced traffic management solutions. These systems include traffic signal optimization, real-time traffic management, and centralized traffic control, among others. The increasing socioeconomic cost of traffic congestion is a significant factor fueling demand for these systems. Technologies like loop detectors, vehicle detection sensors, and video image processing are integral to these solutions, enhancing traffic flow analysis, signal timing adjustment, and incident management.

Additionally, the integration of bicycle signals, pedestrian signals, and dynamic message signs further improves the overall efficiency of traffic systems. The market is expected to continue its growth trajectory, with a focus on roadway capacity analysis, intersection design, and congestion management.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Integrated Traffic Systems Industry?

- The increasing demand for efficient traffic management, driven by the growing number of vehicles, is a primary market catalyst.

- The market is witnessing significant growth due to the increasing need for efficient traffic management. With over 1.4 billion vehicles on the road in 2023, the demand for advanced traffic systems is escalating. Major contributors to the passenger vehicle industry, such as the US and Europe, are experiencing increased congestion. For instance, London, which ranks first in Europe and third globally on the Traffic Scorecard, saw drivers spend an additional 3% more time in congestion compared to pre-pandemic levels, totaling USD3.99 billion in costs, averaging USD947 per driver.

- Traffic volume counts, roadway capacity analysis, and intersection design are crucial components of integrated traffic systems. These systems also include traffic signal hardware, dynamic message signs, traffic signal maintenance, emergency vehicle preemption, traffic flow analysis, variable speed limits, and congestion management. By implementing these advanced traffic management solutions, cities can improve traffic flow, reduce congestion, and enhance safety.

What are the market trends shaping the Integrated Traffic Systems Industry?

- Global road traffic congestion is a growing trend in transportation markets. The increasing demand for mobility solutions is leading to heavier traffic in cities around the world.

- Urban traffic congestion is a significant challenge in many parts of the world, driven by increasing disposable income and inadequate public transportation. In 2023, the economic cost of traffic congestion in the US reached over USD 70.4 billion, a 15% increase from the previous year. Similarly, the UK and Germany saw costs of USD 7.9 billion and USD 3.5 billion, respectively, marking an 11% and 14% rise, respectively. The growing middle-income population in emerging economies, particularly in China and Southeast Asian countries like Indonesia, Malaysia, the Philippines, Thailand, and Vietnam, is leading to a surge in new vehicle registrations, exacerbating traffic congestion.

- To mitigate this issue, advanced traffic management solutions are gaining popularity. Traffic simulation modeling, pedestrian signals, traffic monitoring systems, traffic control software, traffic signal foundations, signal timing adjustment, and vehicle detection sensors are key components of these systems. Video image processing technology is also being employed to enhance traffic management efficiency. These solutions aim to reduce travel time, minimize fuel consumption, and improve overall road safety.

What challenges does the Integrated Traffic Systems Industry face during its growth?

- The high setup and operating costs pose a significant challenge to the growth of the industry.

- Integrated traffic systems have become essential infrastructure in modern transportation networks due to the growing global urban population and increasing demand for traffic safety. The high capital investment required to install these systems is primarily due to the manufacturing costs of software platforms, electronic chips, cameras, sensors, and transponders. However, marketing and promotion costs are minimal as integrated traffic systems are increasingly viewed as a necessity. Integrated traffic systems offer numerous functionalities, including traffic management centers, signal timing plans, network management systems, traffic accident data analysis, traffic signal calibration, traffic detection systems, traffic signal optimization, traffic data visualization, loop detectors, and traffic violation detection.

- These features enable efficient traffic flow, improved safety, and enhanced mobility. The market growth for integrated traffic systems is driven by the need to address traffic congestion and improve overall transportation efficiency. Key functionalities include real-time traffic monitoring, adaptive signal control, and incident management. The integration of bicycle signals and other advanced features further enhances the value proposition of these systems. In conclusion, the market for integrated traffic systems is growing due to the increasing demand for efficient and safe transportation infrastructure. The high initial investment is offset by the long-term benefits of improved traffic flow, safety, and operational efficiency.

- Integrated traffic systems offer a comprehensive solution for managing and optimizing transportation networks, making them an essential investment for public players and large corporates.

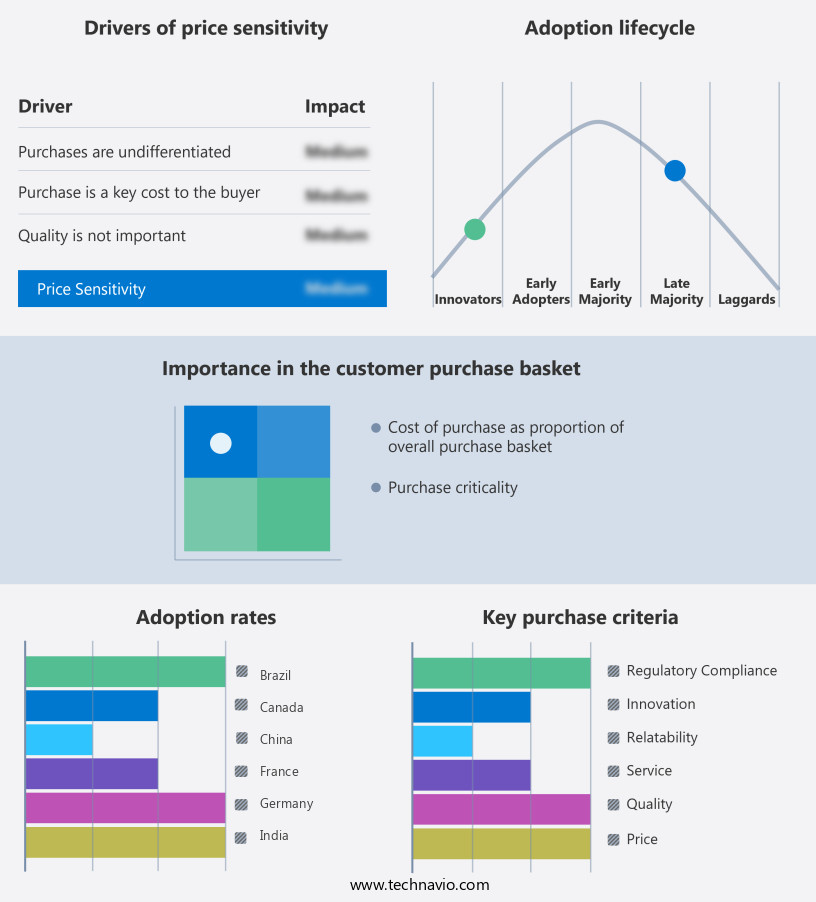

Exclusive Customer Landscape

The integrated traffic systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the integrated traffic systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, integrated traffic systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Cisco Systems Inc. - Integrating advanced traffic technologies, we optimize roadway safety and efficiency. By reducing congestion and lowering carbon emissions, our systems enhance operational performance. This approach prioritizes a sustainable transportation infrastructure.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Cisco Systems Inc.

- Cubic Corp.

- Dahua Technology Co. Ltd.

- EFKON India Pvt. Ltd.

- Global Traffic Technologies LLC

- IMTAC LLC

- International Business Machines Corp.

- Iteris Inc.

- Jenoptik AG

- Kapsch TrafficCom AG

- LG Corp.

- PTV Planung Transport Verkehr AG

- Samsung Electronics Co. Ltd.

- Siemens AG

- SNC Lavalin Group Inc.

- Sumitomo Electric Industries Ltd.

- SWARCO AG

- Teledyne Technologies Inc.

- Thales Group

- TransCore

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Integrated Traffic Systems Market

- In March 2024, Kapsch TrafficCom, a leading provider of intelligent transportation systems, announced the launch of its new cloud-based traffic management solution, Kapsch Freeflow Traffic Management System (KFTMS). This innovative system aims to improve traffic flow and reduce congestion in urban areas by utilizing real-time traffic data and predictive analytics (Kapsch TrafficCom press release, 2024).

- In July 2025, Siemens Mobility and Cisco Systems entered into a strategic partnership to integrate their respective Intelligent Transportation System (ITS) offerings. This collaboration is expected to result in advanced ITS solutions, combining Siemens' traffic management expertise with Cisco's networking technology (Siemens Mobility press release, 2025).

- In September 2024, TransCore, a leading provider of ITS solutions, was acquired by the French transportation technology company, Indra Sistemas. This acquisition is expected to strengthen Indra's position in the global ITS market and expand its presence in North America (Business Wire, 2024).

Research Analyst Overview

- The market encompasses various solutions aimed at optimizing traffic flow rate, enhancing transportation planning, and ensuring traffic safety. Traffic performance metrics, such as congestion index and travel time reliability, are essential indicators monitored by traffic operations management systems. Roadway design standards and traffic noise reduction measures contribute to urban mobility, while intersection safety analysis and advanced traffic management systems employ connected vehicles and autonomous vehicles for improved safety and efficiency. Sustainability in transportation is a significant trend, with traffic calming measures and smart city initiatives focusing on reducing carbon emissions. Public transit integration and multimodal transportation solutions are crucial components of these initiatives.

- Cloud-based traffic systems and traffic modeling software facilitate real-time traffic demand management and travel time prediction. Advanced traffic management systems also incorporate route guidance systems and traffic engineering principles to optimize traffic flow and reduce congestion. Urban mobility improvements, such as traffic safety improvements and traffic infrastructure upgrades, are essential for maintaining a high quality of life in densely populated areas. Connected vehicles and autonomous vehicles are transforming the traffic management landscape, offering new opportunities for traffic demand management and real-time traffic operations. The integration of public transit systems and smart city initiatives further enhances the potential for efficient and sustainable transportation solutions.

- In summary, the market is dynamic and evolving, driven by the need for efficient, safe, and sustainable transportation solutions. Traffic flow optimization, safety enhancements, and the integration of advanced technologies are key trends shaping the future of transportation infrastructure.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Integrated Traffic Systems Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

176 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.8% |

|

Market growth 2025-2029 |

USD 22916.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.6 |

|

Key countries |

US, Japan, China, UK, Germany, Canada, France, India, Brazil, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Integrated Traffic Systems Market Research and Growth Report?

- CAGR of the Integrated Traffic Systems industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the integrated traffic systems market growth of industry companies

We can help! Our analysts can customize this integrated traffic systems market research report to meet your requirements.