Investment Casting Market Size 2025-2029

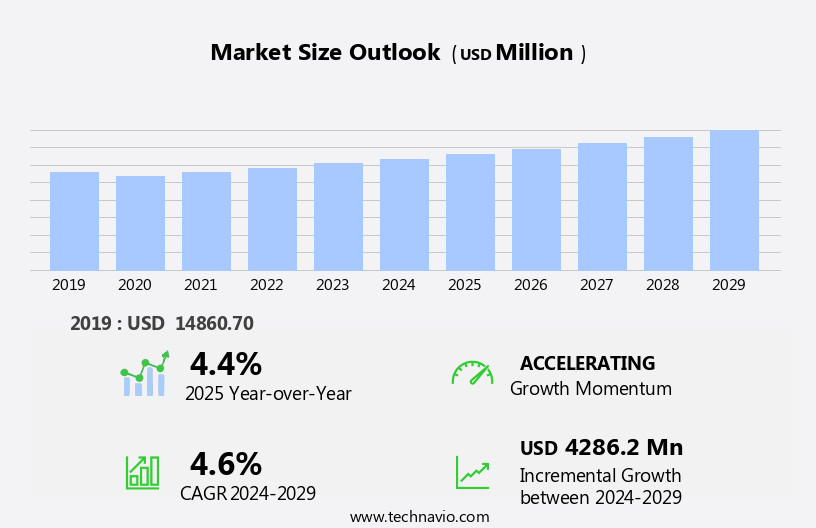

The investment casting market size is forecast to increase by USD 4.29 billion, at a CAGR of 4.6% between 2024 and 2029.

- The market is experiencing significant growth due to several key trends. The expansion of the automotive industry, driven by increasing demand for lightweight and fuel-efficient vehicles, is a major growth factor. Additionally, the rise in air passenger traffic has led to an increase in demand for aerospace components produced through investment casting. Furthermore, the energy-intensive nature of industries such as power generation and oil and gas requires the use of strong and durable components, which are often produced via investment casting. These trends, coupled with the high precision and complexity that investment casting offers, make it an attractive option for various industries. However, challenges such as high production costs and the need for specialized equipment and expertise can hinder market growth. Despite these challenges, the market is expected to continue its growth trajectory due to its unique advantages and the increasing demand for high-performance components in various industries.

What will be the Size of the Investment Casting Market During the Forecast Period?

- The market encompasses the production of high-precision components using the investment casting process, primarily serving industries with stringent requirements for dimensional accuracy and surface finish. Key end-use sectors include defense and aerospace, where investment casting is utilized in the manufacture of components for military vehicles, weapons systems, and advanced military technology, as well as In the aerospace industry for aircraft components in commercial jets, private jets, satellites, and aerospace plants. Materials commonly used in investment casting include steel, aluminum, and titanium. The market is driven by global tension and the demand for advanced military technology and infrastructure development in sectors such as transportation (railways, construction), energy consumption, and the medical field. Advanced casting technologies, including silica sol casting, sodium silicate casting, and ceramic casting, continue to evolve, enhancing the capabilities and efficiency of investment casting processes.

How is this Investment Casting Industry segmented and which is the largest segment?

The investment casting industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Automotive

- Industrial

- Aerospace and defense

- Others

- Material

- Superalloys

- Steel

- Aluminum

- Titanium

- Others

- Geography

- North America

- Canada

- US

- APAC

- China

- India

- Japan

- Europe

- Germany

- UK

- France

- Middle East and Africa

- South America

- Brazil

- North America

By Application Insights

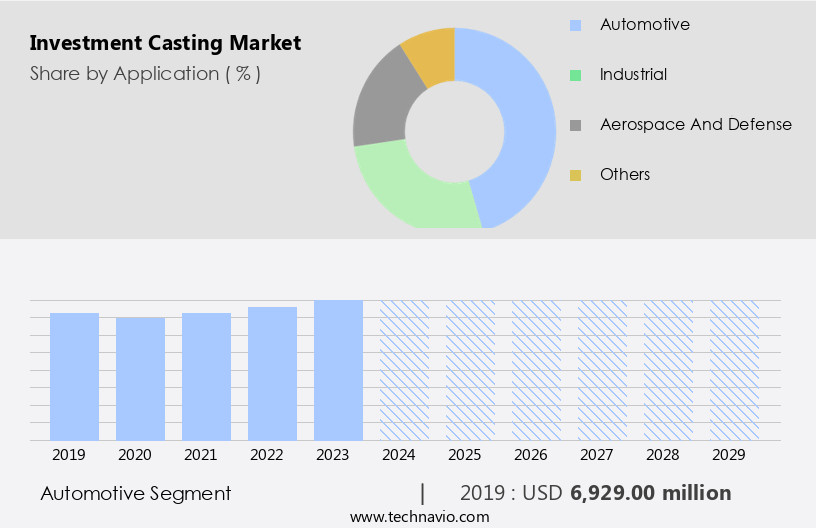

- The automotive segment is estimated to witness significant growth during the forecast period.

The market experiences significant growth In the automotive sector due to the production of lightweight, cost-effective components for vehicles. Iron, steel, and aluminum are commonly used metals for investment casting in automotive applications, including engines and brakes. The increasing number of vehicles in use, driven by the rising demand across all categories, positively influences market expansion. The automotive industry's fluctuating demand for light commercial vehicles (LCVs) has further boosted market growth. In addition to the automotive industry, investment casting is also utilized extensively In the defense, aerospace, medical, and construction sectors for producing high-precision components from steel, titanium, and other advanced alloys.

Technology advancements, such as 3D printing and digital technologies, and automation integration, including robotic arms and mechanical engineering, are transforming the investment casting process. Industries like agriculture, energy, and infrastructure also benefit from investment casting for producing various components, such as compressor parts and turbine airfoils. Key industries, including defense, aerospace, and medical, require high-performance components with dimensional accuracy and excellent surface finish, which investment casting provides. The investment casting process, using techniques such as the silica sol process, sodium silicate process, and ceramic casting, offers a high casting yield and is naturally suited for producing small-scale and large-scale components. The market is expected to continue growing due to the increasing demand for lightweight and high-performance components across various industries.

Get a glance at the Investment Casting Industry report of share of various segments Request Free Sample

The automotive segment was valued at USD 6.93 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

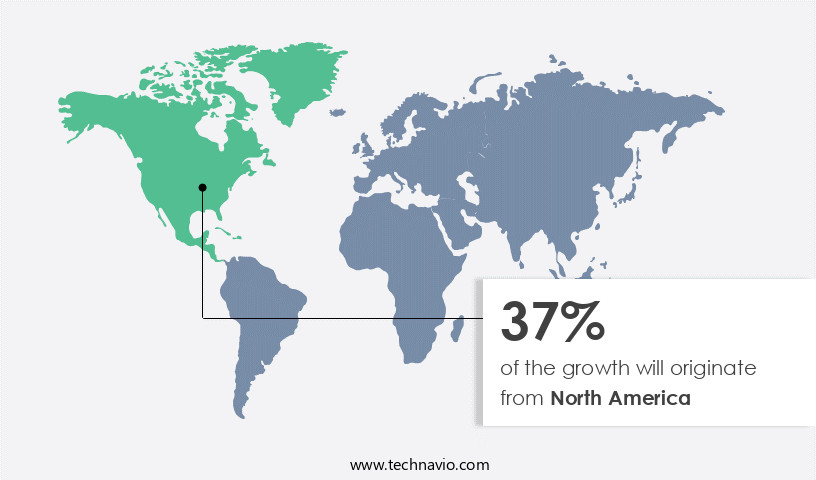

- North America is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America held the largest market share in 2024, with significant contributions from the aerospace and automotive industries. The US and Canada are the primary revenue-generating countries in this region. The US economy is experiencing growth due to increasing consumer and government spending. The FAA's new Part 23 regulations aim to reduce the weight of general aviation aircraft, increasing the demand for lightweight materials like aluminum. The US is a significant market for automotive sales and production worldwide. In the aerospace sector, the trend towards advanced military technology and lightweight components, such as those made from steel, aluminum, and titanium, is driving market growth.

Similarly, in the automotive industry, the focus on high-performance components and technology advancements, including 3D printing and digital technologies, is propelling market expansion. Industries such as defense, railways, infrastructure, transportation, medical, satellites, commercial jets, private jets, and agriculture are also significant consumers of investment cast products. The investment casting process, which includes technologies like CFS foundry, silica sol process, and sodium silicate process, enables the production of high-precision components with excellent dimensional accuracy and surface finish. Industries like industrial gas turbines, construction, and automotive are major beneficiaries of these advanced casting technologies. The market is further expected to grow due to the increasing demand for high-performance alloy parts and new-generation alloys in various industries.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Investment Casting Industry?

The growth of automotive industry is the key driver of the market.

- Investment casting is a critical manufacturing process used to produce high-precision components, primarily In the defense and aerospace industries. Components for military vehicles, weapons systems, and advanced military technology are often made using metals such as steel, aluminum, and titanium. The global tension in defense and the advancement of aerospace technology have driven the demand for investment cast products. Beyond defense and aerospace, it is also utilized in the medical sector for producing lightweight and high-performance components, as well as in industrial gas turbines, construction, railways, infrastructure, transportation, satellites, commercial jets, and private jets. Technology advancements, including 3D printing and digital technologies, are transforming the process, enabling the production of new-generation alloy parts with improved dimensional accuracy and surface finish.

- The process involves the use of robotic arms, automation integration, and mechanical engineering In the creation of complex components. Industries like agriculture, energy, and automotive also rely on various components, including compressor components, small-scale manufacturing, and foundries. The adoption of advanced casting technologies, such as silica sol casting, ceramic casting, and water glass casting, is further expanding the scope of investment casting applications. Key industries, such as the military industry, aircraft components, and energy consumption, are driving the demand for high-performance alloy parts. The process is essential in producing these components, ensuring the highest level of quality and efficiency.

What are the market trends shaping the Investment Casting Industry?

An increase in air passenger traffic is the upcoming market trend.

- The market experiences growth due to the expanding aerospace industry, driven by rising air passenger traffic. Commercial aircraft production increases in response to this trend, leading to heightened demand for high-precision components made from steel, aluminum, and titanium. Major industry players are meeting this demand by establishing new facilities to produce advanced military technology and aerospace components, including for satellites, commercial jets, and private jets. Furthermore, the process benefits from technology advancements, such as automation integration, robotic arms, and digital technologies like 3D printing.

- The market also caters to various sectors, including defense, railways, infrastructure, transportation, medical, and the energy industry, which utilizes investment cast products in industrial gas turbines, compressor components, and shale gas production. The process yields high-performance alloy parts, including for military industry applications and aircraft components, while maintaining dimensional accuracy and excellent surface finish.

What challenges does the Industry face during its growth?

Energy-intensive nature of industries is a key challenge affecting the industry growth.

- The market is characterized by its energy-intensive nature, making energy efficiency and alternative energy sources essential for its growth. As the industry expands, so will the demand for energy to manufacture high-precision components in steel, aluminum, and titanium for the defense industry, aerospace, military vehicles, weapons systems, and advanced military technology. To mitigate environmental concerns and energy crises, it is crucial to adopt modern technologies and energy-saving techniques. These include technology advancements in 3D printing and digital technologies, automation integration, and the use of new-generation alloys and high-performance alloy parts. The process involves the use of silica sol and sodium silicate, ceramic casting, water glass casting, and automotive components manufacturing.

- Industries such as industrial gas turbines, construction, defense, railways, infrastructure, transportation, medical, satellites, commercial jets, private jets, agricultural equipment, shale gas, and energy consumption all rely on investment cast products. Energy savings can be achieved through good housekeeping procedures and the implementation of robotic arms and mechanical engineering in foundries. The facility and turbine airfoil facility are significant contributors to the industry's energy consumption. Casting yield and dimensional accuracy are essential factors in process, with surface finish and sodium silicate casting also playing crucial roles.

Exclusive Customer Landscape

The investment casting market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the investment casting market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, the market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ABB Ltd. - The company offers robotized investment casting solutions, enhancing productivity and precision in the casting process through automation and advanced robotics.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alcoa Corp.

- Arconic Corp.

- Berkshire Hathaway Inc.

- Dongying Giayoung Precision Metal Co. Ltd.

- Form Technologies

- Georg Fischer Ltd.

- Hitachi Ltd.

- Impro Precision Industries Ltd.

- Lestercast Ltd.

- MetalTek International

- Milwaukee Precision Casting Inc.

- Ningbo Jiwei Melt Mould Castings Co. Ltd.

- PBS Group AS

- RLM Industries Inc.

- Ryobi Ltd.

- Taizhou Xinyu Precision Manufacture Co. Ltd.

- ZOLLERN GmbH and Co. KG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Investment casting, a process that involves creating complex shapes by using a liquid metal and a disposable wax or ceramic shell, has gained significant traction in various industries due to its ability to produce high-precision components. This process is particularly valuable In the production of high-performance components for the defense and aerospace sectors. The defense industry and aerospace sector are two primary markets that heavily rely on investment casting for manufacturing high-precision components. These industries demand components made from materials such as steel, aluminum, and titanium, which can withstand extreme temperatures and pressures. The global tension in the geopolitical landscape has led to an increased focus on advanced military technology, driving the demand for investment cast components in military vehicles, weapons systems, and satellites.

Moreover, the aerospace industry's continuous pursuit of lightweight and high-performance components has fueled the adoption of investment casting In the production of aircraft components, including commercial jets, private jets, and even spacecraft. The medical sector is another significant market, with a growing emphasis on producing lightweight and high-performance components for medical devices and implants. Technological advancements in the form of 3D printing and digital technologies have disrupted the market, offering alternatives to traditional casting processes. However, it remains a preferred choice for producing complex shapes and large-scale components, particularly in industries where dimensional accuracy and surface finish are critical.

In addition, the process involves several techniques, including the CFS foundry process, silica sol process, sodium silicate process, and ceramic casting. These techniques enable the production of components with high yield and excellent mechanical properties. Industrial gas turbines, construction, defense, railways, infrastructure, transportation, and the energy sector are some of the industries that extensively use for manufacturing heavy parts and small parts. The market is diverse, with a range of applications across various industries. Small-scale manufacturers and foundries also play a crucial role in catering to the demand for investment cast parts. The development of new-generation alloys and high-performance alloy parts has further expanded the market's scope, with applications in the military industry, automotive components, and compressor components.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

213 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market Growth 2025-2029 |

USD 4.29 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, India, Canada, France, Germany, UK, China, Japan, Brazil, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Investment Casting Market Research and Growth Report?

- CAGR of the Investment Casting industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the investment casting market growth of industry companies

We can help! Our analysts can customize this investment casting market research report to meet your requirements.