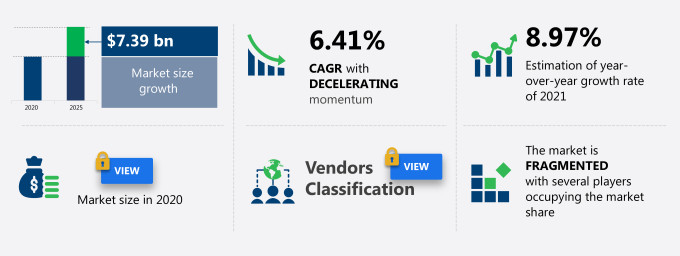

The IVD market share in the US is expected to increase to USD 7.39 billion from 2020 to 2025, at a CAGR of 6.41%. This report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches.

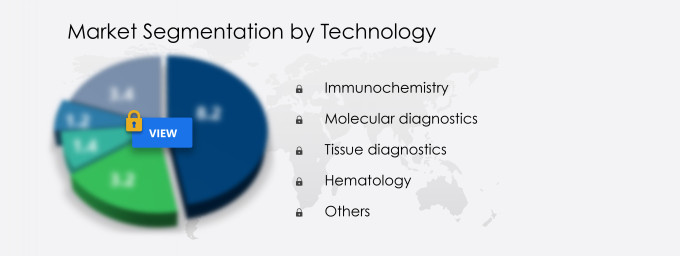

This IVD market in the US research report extensively covers market segmentation in the US by technology (immunochemistry, molecular diagnostics, tissue diagnostics, hematology, and others) and component (consumables, instruments, and services).

The IVD market in the US report also offers information on several market vendors, including Abbott Laboratories, Becton Dickinson and Co., Bio Rad Laboratories Inc., bioMerieux SA, Danaher Corp., DiaSorin SpA, F. Hoffmann-La Roche Ltd., Siemens Healthineers AG, Sysmex Corp., and Thermo Fisher Scientific Inc. among others.

What will the IVD Market Size in the US be During the Forecast Period?

Download the Free Report Sample to Unlock the IVD Market Size in the US for the Forecast Period and Other Important Statistics

IVD Market in the US: Key Drivers, Trends, and Challenges

The increasing geriatric population, chronic, and infectious diseases is notably driving the IVD market growth in the US, although factors such as stringent regulatory bodies guiding IVD manufacturers may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the IVD industry in the US. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key IVD Market Driver in the US

The increasing geriatric population, chronic, and infectious diseases is one of the key drivers supporting the IVD market growth in the US. Viruses such as hepatitis B virus (HBV), hepatitis C virus (HCV), and others cause infectious diseases which require the need for IVD tests. The rising incidence rates of diseases such as diabetes and cancer are increasing the need to diagnose diseases at an early stage to ensure regular monitoring of patients to identify, treat, control, and limit the prevalence of diseases. Molecular diagnostic techniques like enzyme-linked immunoassay (ELISA) help in the early detection of infections through antigen and antibody interactions to mitigate diseases. Thus, changing demographics in the US, primarily including the aging population and incidence rates of diseases, will contribute to the growth of the IVD market during the forecast period.

Key IVD Market Trend in the US

Technological advances in IVD is another factor supporting the IVD market growth in the US. Advanced cutting-edge technologies like POCT, next-generation sequencing, near-patient testing, and others have revolutionized the IVD sector by providing an accurate and precise diagnosis at rapid rates. Furthermore, vendors focus on providing customized solutions through advancements in genomic technologies, contributing to the growth of personalized treatment care. Diagnostic companies collaborate with pharmaceutical companies to develop and provide targeted therapy solutions. For instance, bioMerieux provides personalized care diagnostic solutions. Thus, the increasing focus on personalized medicines will lead to the IVD market growth during the forecast period

Key IVD Market Challenge in the US

The stringent regulatory bodies guiding IVD manufacturers is hindering the IVD market growth in the US. IVD are tests conducted to examine blood, tissue, or fluid samples to monitor health conditions and to treat or prevent diseases. The design of devices, malfunctioning, and technical errors are some of the issues associated with the usage of these devices. Such issues can lead to misdiagnosis and improper patient management and treatment of several blood conditions and diseases. Hence, stringent government regulations are imposed on these devices. Also, during the submission for pre-market approval, the company must pay a minimum of USD 62,000 to the FDA, and the approval procedure is time-consuming. Even after the submission, there might be chances for devices to get approved or disapproved. Sometimes, the products may be recalled after approval due to malfunctioning issues. Hence fulfilling stringent government guidelines pose a threat to the growth of the IVD market in the US.

This IVD market in the US analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the IVD market in the US as a part of the global healthcare equipment market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the IVD market in the US during the forecast period.

Who are the Major IVD Market vendors in the US?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Abbott Laboratories

- Becton Dickinson and Co.

- Bio Rad Laboratories Inc.

- bioMerieux SA

- Danaher Corp.

- DiaSorin SpA

- F. Hoffmann-La Roche Ltd.

- Siemens Healthineers AG

- Sysmex Corp.

- Thermo Fisher Scientific Inc.

This statistical study of the IVD market in the US encompasses successful business strategies deployed by the key vendors. The IVD market in the US is fragmented and the vendors are deploying growth strategies such as quality and price to compete in the market.

Product Insights and News

- Abbott Laboratories - The company offers a wide range of IVD devices such as i-STAT ALINITY, ID NOW.

- Abbott Laboratories - Diagnostic products segment of the company focuses on core laboratory, molecular solutions, point of care solutions, and rapid diagnostics.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The IVD market in the US forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

IVD Market in the US Value Chain Analysis

Our report provides extensive information on the value chain analysis for the IVD market in the US, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chains is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the healthcare equipment market includes the following core components:

- Research and development

- Inputs

- Operations

- Distribution

- Marketing and sales

- Post-sales and services

- Industry innovations

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

What are the Revenue-generating Technology Segments in the IVD Market in the US?

To gain further insights on the market contribution of various segments Request for a FREE sample

The IVD market share growth in the US by the immunochemistry segment will be significant during the forecast period. Immunochemistry is a branch of chemistry, which involves the study of molecular mechanisms and functions of the immune system through interactions between antigens and corresponding antibodies. This technique primarily focuses on identifying and documenting high-resolution cellular components within cells and tissue constituents such as proteins and lipopolysaccharides in clinical diagnostics and medical research laboratories. It is more effective when compared with the effectiveness of traditional enzyme staining techniques as it involves specific antigen-antibody reactions. Such factors will drive the segment's growth during the forecast period.

This report provides an accurate prediction of the contribution of all the segments to the growth of the IVD market size in the US and actionable market insights on post COVID-19 impact on each segment.

You may be interested in:

China In-vitro Diagnostics (IVD) market - The market share will grow steadily over the next four years and post a CAGR of more than 14% by 2021.

Europe IVD market - The market share is expected to grow at a CAGR of around 5% during the forecast period.

|

IVD Market Scope in the US |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Decelerate at a CAGR of 6.41% |

|

Market growth 2021-2025 |

$ 7.39 billion |

|

Market structure |

Fragmented |

|

YoY growth (%) |

8.97 |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Abbott Laboratories, Becton Dickinson and Co., Bio Rad Laboratories Inc., bioMerieux SA, Danaher Corp., DiaSorin SpA, F. Hoffmann-La Roche Ltd., Siemens Healthineers AG, Sysmex Corp., and Thermo Fisher Scientific Inc. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this IVD Market in US Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive IVD market growth in the US during the next five years

- Precise estimation of the IVD market size in the US and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the IVD industry in the US

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of IVD market vendors in the US

We can help! Our analysts can customize this report to meet your requirements. Get in touch