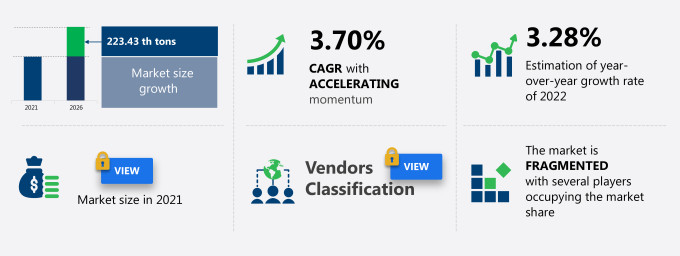

The lime market share in Mexico is expected to increase by 223.43 thousand tons from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 3.70%.

This lime market in Mexico research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers the lime market in Mexico segmentation by product (hydrated lime and quicklime) and distribution channel (offline and online). The Mexico lime market report also offers information on several market vendors, including Adbri Ltd., Boral Ltd., Brookville Manufacturing, CEMEX SAB de CV, Cheney Lime, and Cement Co., Graymont Ltd., Linwood Mining and Minerals Corp., Minerals Technologies Inc., Mississippi Lime Co., and United States Lime and Minerals Inc. among others.

What will the Lime Market Size in Mexico be During the Forecast Period?

Download the Free Report Sample to Unlock the Lime Market Size in Mexico for the Forecast Period and Other Important Statistics

Lime Market in Mexico: Key Drivers, Trends, and Challenges

The rising adoption of lightweight machinery across industries is notably driving the lime market growth in Mexico, although factors such as health hazards associated with hydrated lime may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the lime industry in Mexico. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Lime Market Driver in Mexico

The rising adoption of lightweight machinery across industries is one of the key drivers supporting the lime market growth in Mexico. Aluminum is the most popular metal in the manufacture of lightweight machinery. Several manufacturers prefer aluminum due to its recyclability and resistance to corrosion. Rising concerns about the impact of industries on the environment have led to the enforcement of stringent regulations to reduce the carbon footprint of industries in Mexico. Also, aluminum leaves a smaller carbon footprint and helps reduce both energy and fuel consumption in different types of construction and industrial machinery, and automobiles. Therefore, the growing adoption of lightweight machinery in manufacturing is expected to boost the growth of the lime market in Mexico during the forecast period.

Key Lime Market Trend in Mexico

The rising demand for alkaline-based papermaking is another factor contributing to the Mexico lime market growth. Hydrated lime finds high application in alkaline-based papermaking, especially for customization. Growing concerns over environmental sustainability in the last few years have resulted in a revival of alkaline-based papermaking. The papermaking improves energy efficiency and minimizes the carbon footprint through secondary fiber recycling and reduced water consumption in the papermaking process. For instance, several vendors, such as Mineral Technologies, are developing high filler technologies to minimize fiber consumption during alkaline-based paper manufacturing. Overall, it is expected to gain traction and gradually replace the traditional papermaking process during the forecast period, which will support the growth of the lime market in Mexico during the forecast period.

Key Lime Market Challenge in Mexico

The health hazards associated with hydrated lime is hindering the lime market growth in Mexico. Hydrated lime finds applications in several industries, such as food and beverage and paper. However, the Material Safety Data Sheet (MSDS) for hydrated lime holds a rating of 1-3, indicating its hazardous nature. Overexposure to hydrated lime may severely damage skin and eyes. Additionally, it may lead to lung damage, choking, loss of consciousness, and death in extreme cases. Therefore, safe storage equipment is required for transporting the material during production, which increases the overall production costs. Also, hydrated lime may affect blood pH levels and result in multiorgan failure. Therefore, the health hazards associated with hydrated lime may limit its application in key end-user industries during the forecast period.

This lime market in Mexico analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the lime market in Mexico as a part of the global construction materials market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the lime market in Mexico during the forecast period.

Who are the Major Lime Market Vendors in Mexico?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Adbri Ltd.

- Boral Ltd.

- Brookville Manufacturing

- CEMEX SAB de CV

- Cheney Lime and Cement Co.

- Graymont Ltd.

- Linwood Mining and Minerals Corp.

- Minerals Technologies Inc.

- Mississippi Lime Co.

- United States Lime and Minerals Inc.

This statistical study of the Mexico lime market encompasses successful business strategies deployed by the key vendors. The lime market in Mexico is fragmented and the vendors are deploying organic and inorganic growth strategies to compete in the market.

Product Insights and News

- Agroindustrias Peimbert S.A. de C.V. - The company offers fresh fruits such as avocado and Lemon.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The lime market in Mexico forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Lime Market in Mexico Value Chain Analysis

Our report provides extensive information on the value chain analysis for the lime market in Mexico, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chains is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the construction materials market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Service

- Support activities

- Innovations

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

What are the Revenue-generating Product Segments in the Lime Market in Mexico?

To gain further insights on the market contribution of various segments Request for a FREE sample

The lime market share growth in Mexico by the hydrated lime segment will be significant during the forecast period. The hydrated lime market segment is primarily driven by the rapid growth in wastewater treatment infrastructure. It is the primary ingredient used in treating acidic impurities and restoring the pH balance of water. The growth in population and the rising scarcity of freshwater resources in Mexico are leading to the need for significant investments in domestic and industrial wastewater treatment and recycling. such factors will continue to boost the growth of the market in focus through the hydrated lime segment during the forecast period.

This report provides an accurate prediction of the contribution of all the segments to the growth of the lime market size in Mexico and actionable market insights on post COVID-19 impact on each segment.

|

Lime Market Scope in Mexico |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.70% |

|

Market growth 2022-2026 |

223.43 th tons |

|

Market structure |

Fragmented |

|

YoY growth (%) |

3.28 |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Adbri Ltd., Boral Ltd., Brookville Manufacturing, CEMEX SAB de CV, Cheney Lime and Cement Co., Graymont Ltd., Linwood Mining and Minerals Corp., Minerals Technologies Inc., Mississippi Lime Co., and United States Lime and Minerals Inc. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Lime Market in Mexico Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive lime market growth in Mexico during the next five years

- Precise estimation of the lime market size in Mexico and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the lime industry in Mexico

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of lime market vendors in Mexico

We can help! Our analysts can customize this report to meet your requirements. Get in touch