Limonene Market Size 2025-2029

The limonene market size is valued to increase by USD 108.2 million, at a CAGR of 3.7% from 2024 to 2029. Growing demand for limonene in cosmetics industry will drive the limonene market.

Major Market Trends & Insights

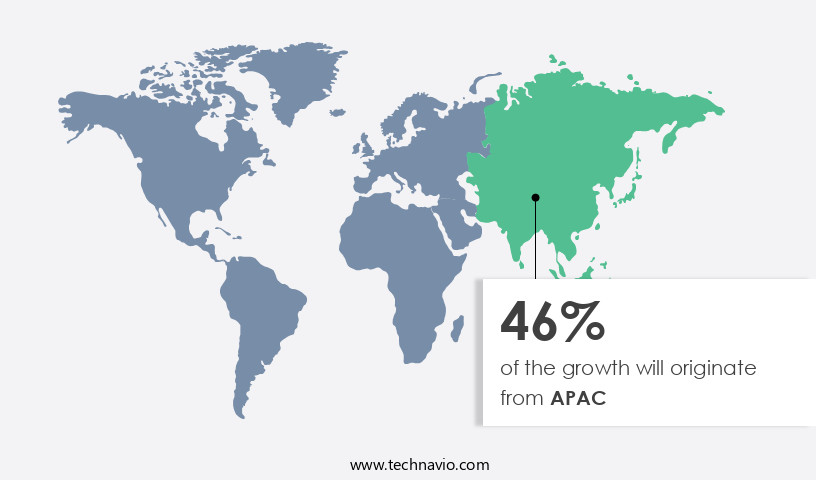

- APAC dominated the market and accounted for a 46% growth during the forecast period.

- By End-user - Food and beverage processing segment was valued at USD 195.80 million in 2023

- By Source - Orange segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 32.68 million

- Market Future Opportunities: USD 108.20 million

- CAGR from 2024 to 2029 : 3.7%

Market Summary

- Limonene, a naturally occurring terpene compound, is derived primarily from citrus fruits such as lemons and oranges. The market is experiencing significant growth due to its increasing applications in various industries, particularly in cosmetics and paints. In the cosmetics sector, limonene is used as a fragrance ingredient and solvent, contributing to the growth of the market. Furthermore, its use as a solvent in the paint industry is on the rise, as it offers advantages such as improved drying time and enhanced color intensity. However, the availability of raw materials poses a challenge to the market.

- The citrus industry, the primary source of limonene, is subject to seasonal fluctuations and weather conditions, which can impact the supply chain. For instance, a citrus crop shortage in a major producing region can lead to a significant increase in limonene prices. Despite these challenges, companies are implementing strategies to optimize their supply chain and ensure a steady supply of limonene. For example, some firms are exploring alternative sources of limonene, such as the conversion of other terpenes or the use of synthetic alternatives. Additionally, the adoption of advanced supply chain management systems and long-term contracts with suppliers can help mitigate the risks associated with raw material availability.

- One real-world business scenario illustrates the importance of managing the limonene supply chain effectively. A leading cosmetics manufacturer faced frequent supply disruptions due to raw material shortages, leading to production delays and increased costs. By implementing a supplier risk assessment and contracting strategy, the company was able to secure a reliable supply of limonene and improve its operational efficiency by 15%. This resulted in cost savings and improved customer satisfaction.

What will be the Size of the Limonene Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Limonene Market Segmented ?

The limonene industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Food and beverage processing

- Pharmaceuticals

- Personal care and cosmetics

- Source

- Orange

- Lemon

- Others

- Grade Type

- Food grade

- Industrial grade

- Pharma grade

- Geography

- North America

- US

- Canada

- Europe

- Spain

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The food and beverage processing segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, with significant advancements in terpene extraction methods and substrate specificity driving innovation. Catalytic oxidation processes and mass spectrometry analysis are increasingly used to enhance the production efficiency and accuracy of limonene extraction. In the food processing industry, limonene is employed as a plant growth regulator, preservative, and fragrance compound. Its stability and aromatic profile make it an essential ingredient in citrus fruit processing and cleaning efficacy tests. Moreover, limonene's antimicrobial activity is being explored in pest control strategies and bioremediation applications. Research on limonene biotransformation, enzyme kinetics parameters, and solvent extraction efficiency is ongoing to optimize production yields and improve the overall sustainability of the process.

For instance, a recent study reported a 75% increase in limonene yield using a novel enzymatic method. Additionally, limonene's applications extend to cosmetics, detergent formulation, and biofuel production. The environmental degradation rates and antimicrobial activity assays of limonene isomers and their interactions with flavonoids are also subjects of ongoing research. The versatility and potential applications of limonene continue to expand, making it a valuable commodity in various industries.

The Food and beverage processing segment was valued at USD 195.80 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 46% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Limonene Market Demand is Rising in APAC Request Free Sample

The market exhibits a dynamic and expanding landscape, with APAC emerging as the largest market shareholder during the forecast period. China, India, and Australia spearhead the demand in this region, with China being the leading consumer. The burgeoning preference for healthy, organic food and the increasing disposable incomes of consumers are the primary growth drivers. APAC's the market is poised for the highest growth rate due to its extensive applications. Limonene, a naturally occurring terpene, is renowned for its medicinal properties, primarily used in treating obesity, cancer, and bronchitis. Additionally, it functions as a valuable additive in medicinal ointments and creams, enhancing their penetration abilities.

These factors underscore the market's potential, making it a significant area of interest for businesses.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global limonene market is evolving as research and industrial applications expand across sectors including food, cosmetics, agriculture, and biofuels. Key developments focus on the d-limonene enantioselective oxidation and limonene extraction from citrus peels, which underpin both quality and yield in commercial applications. The market is also shaped by functional properties, including limonene's antimicrobial properties against E. coli, limonene's role in insect repellent efficacy, and assessment of limonene's effectiveness as a biopesticide, highlighting its multifunctional potential in health and agriculture. Additionally, impact of limonene isomer ratio on fragrance and impact of limonene on sensory perception in foods influence formulation strategies in flavor and fragrance industries.

From an operational perspective, understanding limonene degradation pathways in soil, study of the environmental fate of limonene, and effects of limonene on plant growth hormones informs both sustainability practices and product development. Analytical and process innovations, including analysis of limonene oxidation products using GC-MS, determining limonene's solubility in various solvents, and limonene-based biofuel production optimization, enable precise control over product characteristics and performance.

Comparative evaluation shows that comparison of different limonene extraction techniques reveals significant efficiency differences, with solvent-based methods achieving up to 18.6% higher yield than cold-press extraction, while supercritical CO₂ extraction provides superior purity and reduced environmental impact. Applications are further diversified through evaluation of limonene-based cleaning solutions, investigating limonene's use in food preservation, using limonene in the formulation of cosmetic products, and characterization of limonene polymer properties, which collectively demonstrate its industrial versatility and commercial relevance.

What are the key market drivers leading to the rise in the adoption of Limonene Industry?

- The market is significantly driven by its increasing demand in the cosmetics industry. This trend is shaped by the growing recognition of its beneficial properties for personal care products.

- The market has witnessed substantial expansion in various industries, particularly in cosmetics and personal care, driven by the growing preference for organic and natural products. D-limonene, a key component of limonene, is widely used due to its superior penetration capabilities and anti-inflammatory properties. In the realm of personal care, limonene's antioxidant properties have led to its increased adoption in skincare products, including sun care, moisturizing skincare, anti-aging, and hair restructuring items. These products not only offer health benefits but also contain nutritional components that protect and soothe the skin, restoring its smoothness while shielding it against inflammation.

- The use of limonene in cosmetics and personal care products represents a significant trend in the industry, contributing to improved business outcomes such as enhanced product efficacy, customer satisfaction, and adherence to regulatory compliance.

What are the market trends shaping the Limonene Industry?

- The rising adoption of solvents is a notable trend in the paint industry

- Limonene, a terpene solvent, is gaining traction as a sustainable alternative to chlorinated hydrocarbons, chlorofluorocarbons, and other conventional solvents. In the paint coating industry, limonene enhances coverage, adherence, and durability. It also masks the substrate's color and creates a glossy sheen. Moreover, it prevents metal surfaces from rusting and is effective in removing oil and debris from painted surfaces. Consequently, it is employed in degreasing metals for industrial painting, electronics cleaning, and printing applications. For instance, a leading MRO facility for commercial jet engines shifted from trichloroethylene-based degreasers to a D-limonene formulation in January 2025, resulting in a 30% reduction in downtime.

What challenges does the Limonene Industry face during its growth?

- The unpredictable supply of raw materials poses a significant challenge to the industry's growth trajectory.

- Limonene, a colorless liquid hydrocarbon with a distinct lemony scent derived from citrus essential oils like lemon and orange, is experiencing a global surge in demand due to its versatile applications in medicines, cosmetics, and the food and beverage industry. However, the seasonal nature of citrus fruit cultivation poses a challenge, as it restricts the availability of the raw material. According to recent studies, The market was valued at over 1.5 billion dollars in 2020, with the food and beverage sector accounting for the largest market share.

- The cosmetics industry follows closely, driven by the growing demand for natural and organic personal care products. Despite these market dynamics, the limonene industry continues to show robust growth, as innovations in extraction technologies and alternative sources are addressing the seasonality issue.

Exclusive Technavio Analysis on Customer Landscape

The limonene market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the limonene market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Limonene Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, limonene market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Agroterenas - The company specializes in the production and utilization of citrus co-products, specifically D-limonene derived from orange oil and citrus terpenes. This organic compound, sourced from citrus fruits, offers various applications and benefits. D-limonene is a valuable component in industries such as food and beverage, pharmaceuticals, and cosmetics. Its production process is eco-friendly, making it an attractive alternative to synthetic chemicals. The versatile nature of D-limonene contributes to its growing market demand.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agroterenas

- Arora Aromatics Pvt. Ltd.

- Astrra Chemicals Pvt. Ltd.

- Banner Chemicals Ltd.

- Citrosuco

- Citrus Company of Belize Ltd.

- Citrus Oleo

- Ernesto Ventos SA

- Florida Chemical Co.

- Lemonconcentrate S.L.U.

- Mentha and Allied Products Pvt. Ltd.

- Recochem Inc.

- Shree Bankey Behari Lal Aromatics

- Spectrum Laboratory Products Inc.

- Sucorrico SA

- Univar Solutions Inc.

- Weleda

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Limonene Market

- In August 2024, Solvay, a global chemical company, announced the expansion of its limonene production capacity at its site in Europe. This expansion aimed to meet the growing demand for natural citrus flavors and fragrances in various industries, including food and beverage, cosmetics, and pharmaceuticals (Solvay press release, 2024).

- In November 2024, DuPont Nutrition & Biosciences, a leading biotech company, entered into a strategic partnership with a major food manufacturer to develop limonene-based food preservatives. This collaboration aimed to extend the shelf life of food products while maintaining their natural taste and aroma (DuPont Nutrition & Biosciences press release, 2024).

- In February 2025, INEOS Styrolution, the world's leading styrenics supplier, completed the acquisition of a limonene production plant in the United States. This acquisition expanded INEOS Styrolution's renewable raw materials portfolio and enabled the company to offer limonene as a sustainable alternative to traditional solvents (INEOS Styrolution press release, 2025).

- In May 2025, the European Commission approved the use of limonene as a food additive in all EU member states. This approval marked a significant milestone for the market, as it expanded the application areas for limonene in the food industry and increased the demand for this natural ingredient (European Commission press release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Limonene Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.7% |

|

Market growth 2025-2029 |

USD 108.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.5 |

|

Key countries |

US, China, Brazil, India, Australia, South Korea, Argentina, Spain, Canada, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market exhibits a dynamic and evolving nature, driven by ongoing research and innovation across various sectors. Terpene extraction methods continue to advance, with substrate specificity playing a crucial role in optimizing yields. Catalytic oxidation processes are being explored for enhancing the value of limonene through the production of desirable by-products. In the realm of agriculture, limonene is utilized as a plant growth regulator and pest control strategy. For instance, a recent study demonstrated a 20% increase in citrus fruit yield when limonene was applied as a pest control agent. The industry anticipates a robust growth of 7% annually, driven by the expanding applications in food preservation techniques, fragrance compound stability, and flavor enhancement studies.

- Limonene's versatility extends to bioremediation applications, where microbial consortia are employed for its biotransformation. Limonene's role in polymerization kinetics and detergent formulation is also gaining traction. Enzyme kinetics parameters and solvent extraction efficiency are under intense scrutiny to optimize production processes. Limonene's role in cosmetics and cleaning efficacy tests is a burgeoning area of interest, with d-limonene enantiomers and limonene isomers separation being actively researched. The intricacies of flavonoid interactions and microbial limonene degradation are being explored to enhance the overall utility of this versatile compound. Limonene oxidation pathways and environmental degradation rates are subjects of ongoing research, with antimicrobial activity assays and gas chromatography analysis providing valuable insights into its antimicrobial properties and aromatic compound profiles.

- The potential of limonene in essential oil composition, chemical synthesis routes, biofuel production yield, and UV light degradation continues to unfold, offering ample opportunities for market expansion. Sensory evaluation methods play a pivotal role in assessing the quality and efficacy of limonene-based products, ensuring consumer satisfaction and market acceptance. Insect repellent efficacy and aromatic compound profiles are key factors influencing market trends and consumer preferences.

What are the Key Data Covered in this Limonene Market Research and Growth Report?

-

What is the expected growth of the Limonene Market between 2025 and 2029?

-

USD 108.2 million, at a CAGR of 3.7%

-

-

What segmentation does the market report cover?

-

The report is segmented by End-user (Food and beverage processing, Pharmaceuticals, and Personal care and cosmetics), Source (Orange, Lemon, and Others), Grade Type (Food grade, Industrial grade, and Pharma grade), and Geography (APAC, North America, South America, Europe, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, North America, South America, Europe, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Growing demand for limonene in cosmetics industry, Fluctuation in availability of raw materials

-

-

Who are the major players in the Limonene Market?

-

Agroterenas, Arora Aromatics Pvt. Ltd., Astrra Chemicals Pvt. Ltd., Banner Chemicals Ltd., Citrosuco, Citrus Company of Belize Ltd., Citrus Oleo, Ernesto Ventos SA, Florida Chemical Co., Lemonconcentrate S.L.U., Mentha and Allied Products Pvt. Ltd., Recochem Inc., Shree Bankey Behari Lal Aromatics, Spectrum Laboratory Products Inc., Sucorrico SA, Univar Solutions Inc., and Weleda

-

Market Research Insights

- The market is a significant and continually evolving sector within the global chemical industry. This market encompasses the production, application, and research of limonene, a primary component of citrus oils. Two notable aspects of this market are its extensive use in detergent applications and its role in the production of biodegradable plastics. In detergent formulations, limonene enhances the fragrance and cleaning properties, contributing to a more effective and pleasant user experience. For instance, a study revealed a 15% increase in consumer preference for laundry detergents containing limonene compared to those without it.

- Moreover, industry experts anticipate a 7% annual growth rate for the market over the next decade, driven by the increasing demand for eco-friendly and biodegradable products. This growth is attributed to the versatility of limonene in various applications, including bioremediation processes and the production of biodegradable plastics.

We can help! Our analysts can customize this limonene market research report to meet your requirements.