US LNG Infrastructure Market Size and Trends

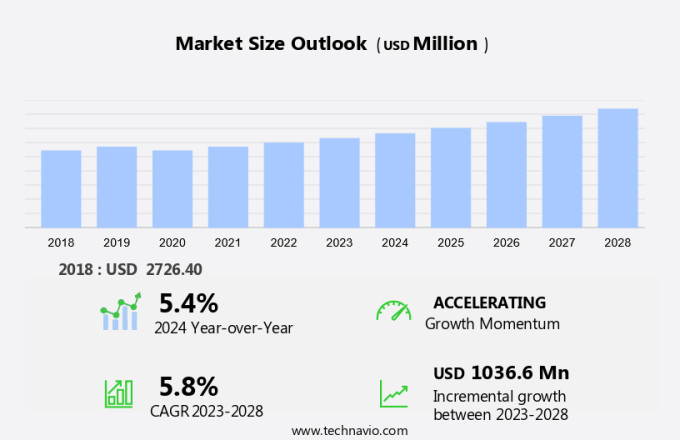

The US LNG infrastructure market size is forecast to increase by USD 1.04 billion at a CAGR of 5.8% between 2024 and 2028. The market is experiencing significant growth due to several key drivers. The increasing concern over emissions and air pollution from carbon-intensive fuels has led to a surge in demand for cleaner alternatives, such as LNG. This shift is particularly evident in the maritime industry, where LNG is being increasingly used as a bunker fuel to reduce sulfur oxides and nitrogen oxides emissions. The market encompasses the construction and operation of various facilities, including liquefaction terminals, regasification terminals, and floating LNG terminals. Furthermore, the ongoing trade war between the US and China has boosted LNG demand as both countries seek to diversify their energy sources. In terms of trends, the project lifecycle of infrastructure projects, including LNG terminals and regasification facilities, is becoming increasingly complex. Regulatory requirements, environmental concerns, and technological advancements are all factors that must be considered in the planning and execution of these projects. Additionally, the need to mitigate the environmental impact of LNG production and transportation is a major challenge facing the industry. This includes reducing methane leakage and finding ways to capture and utilize associated emissions. In conclusion, the market is experiencing robust growth due to increasing demand for cleaner fuels and the ongoing trade war between major economies. However, the complexities of the project lifecycle and the need to address environmental concerns present significant challenges that must be addressed in order to ensure the long-term sustainability of the industry.

The market plays a pivotal role in the power sector's transition towards cleaner energy sources. Natural gas, a sustainable alternative to coal and oil for power generation, has gained significant traction due to its lower carbon footprint. The increasing focus on reducing emissions and pollutants, such as sulfur oxides, from power generation has further boosted the demand for natural gas. Natural Gas Consumption and Imports: A Growing Trend Natural gas consumption has been on the rise in the power sector due to its cleaner burning properties compared to coal and oil. The US is among the leading consumers of natural gas for power generation. The country's natural gas imports have also been increasing to meet the growing demand. LNG imports have become a crucial energy source for the US, especially during peak demand periods. LNG Infrastructure: A Necessity for Natural Gas Imports. These terminals play a crucial role in the import and regasification of LNG for further distribution to power plants and other consumers. Types of LNG Terminals: Liquefaction and Regasification Liquefaction terminals are used to convert natural gas into LNG for export or storage. Regasification terminals, on the other hand, convert LNG back into its gaseoUS state for distribution to consumers. Both types of terminals are essential components of the market. Floating LNG Terminals: A Modern Solution Floating LNG terminals are a modern solution for LNG imports in regions with limited onshore infrastructure. These terminals can be deployed in deep waters and are particularly useful for countries with large offshore gas fields. Environmental Benefits of LNG The use of natural gas for power generation results in lower carbon emissions compared to coal and oil.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Type

- Liquefaction terminal

- Regasification terminal

- End-USer

- Power generation

- Transportation fuel

- Others

- Geography

- US

By Type Insights

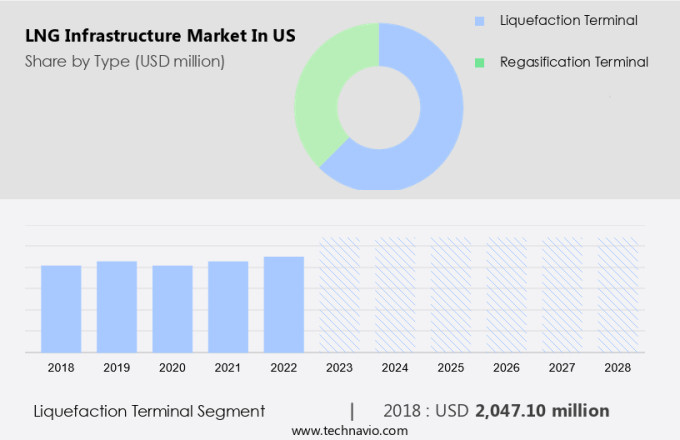

The liquefaction terminal segment is estimated to witness significant growth during the forecast period. The market is anchored by the liquefaction terminal segment, which plays a significant role in the country's position as a major global LNG exporter. These terminals convert natural gas into liquefied natural gas (LNG) by cooling it to -260 degrees Fahrenheit, facilitating efficient storage and transportation to international markets.

Get a glance at the market share of various segment Download the PDF Sample

The liquefaction terminal segment was the largest segment and valued at USD 2.05 billion in 2018. The US has developed extensive liquefaction capacity due to the abundance of shale gas reserves and advancements in hydraulic fracturing, primarily along the Gulf Coast. Key facilities, including Sabine Pass, Corpus Christi, and Cameron LNG, lead the market, with numerous new projects under construction or expansion. Air pollution and climate change concerns have led to a shift towards cleaner, less carbon-intensive fuels. LNG, as a cleaner alternative to coal and other carbon-intensive fuels, is gaining popularity. Hence, such factors are fuelling the growth of this segment during the forecast period.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

US LNG Infrastructure Market Driver

Increase in LNG production is notably driving market growth. Natural gas has emerged as a significant energy source in the US due to the abundant supply of unconventional resources such as coalbed methane, shale gas, and tight gas. The US natural gas production surge has led to an increase in LNG infrastructure development, including LNG receiving terminals and city gas distribution networks.

Compressed Natural Gas (CNG) and Small-Scale LNG are gaining popularity as alternative fuel sources for transportation. Natural Gas Imports have also become essential for meeting the country's energy demands, especially during peak consumption periods. LNG projects, including transportation and infrastructure, are crucial for the efficient distribution of natural gas. ThUS, such factors are driving the growth of the market during the forecast period.

US LNG Infrastructure Market Trends

Growing demand for LNG bunkering is the key trend in the market. Liquefied Natural Gas (LNG) is gaining significance as a cleaner energy source for power generation and transportation, particularly in the maritime sector. With increasing focus on reducing carbon footprint and embracing sustainable alternatives to coal and oil, LNG is becoming an attractive option for fueling marine vessels and heavy-duty vehicles.

In response to this trend, ports are investing in LNG bunkering facilities to cater to the growing demand for LNG as a marine fuel. According to various market research firms like the International Energy Agency (IEA), the maritime industry continues to rely heavily on heavy fuel oil (HFO) for fuel. However, stringent environmental regulations, such as those enforced by the International Maritime Organization (IMO), are driving the need for cleaner energy sources. Thus, such trends will shape the growth of the market during the forecast period.

US LNG Infrastructure Market Challenge

Impact of ongoing trade war between US and China is the major challenge that affects the growth of the market. The market, encompassing Construction, Alternative Energy Sources, and Renewable Energy, has faced challenges due to the US-China trade dispute since 2023. This conflict has resulted in increased costs and reduced profitability for vendors through tariffs and trade restrictions.

The Chinese government's continued announcements of higher tariffs on US-sourced products have further complicated the situation. These protective measures, intended to shield domestic bUSinesses and employment, have led to decreased import and export activities, negatively impacting the financial performance of LNG infrastructure vendors. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

CUStomer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Bechtel Corp: The company offers LNG infrastructure solutions such as Bechtel LNG Plant.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Cheniere Energy Inc.

- Chevron Corp.

- Chiyoda Corp.

- Dominion Energy Inc.

- Dow Inc.

- Exxon Mobil Corp.

- Fluor Corp.

- Freeport LNG Development LP

- McDermott International Ltd.

- Mitsubishi Corp.

- NextDecade Corp.

- Saipem S.p.A.

- Sempra Energy

- TotalEnergies SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Liquefied Natural Gas (LNG) is a sustainable alternative to coal and oil for power generation, as it emits fewer pollutants and contributes less to carbon footprint compared to traditional fossil fuels. The increasing awareness of air pollution and climate change has led to a shift towards cleaner energy sources, making LNG an attractive option for energy consumers. The infrastructure market for LNG is witnessing significant growth due to the abundance of natural gas resources and the shale gas revolution driven by horizontal drilling and hydraulic fracturing. The energy sector's energy mix is evolving, with a focus on reducing carbon emissions and providing a cleaner environment. The market includes various projects such as liquefaction and regasification terminals, floating LNG terminals, and LNG receiving terminals. The project lifecycle involves liquefaction, regasification, logistical constraints, and city gas distribution. LNG is used as an energy source for heavy-duty vehicles and marine transport, and its imports are increasing due to energy security concerns. The global regasification capacity is expected to grow, and the use of LNG as a fuel for electric power generation is gaining popularity. LNG infrastructure projects face challenges such as high capital costs and complex construction processes. However, the benefits of using LNG as a cleaner energy source and reducing emissions from coal-to-gas conversion make it a worthwhile investment. The infrastructure market for LNG is also driven by the growing demand for alternative energy sources, including renewable technology, nuclear energy, and Compressed Natural Gas (CNG). The terminal type, heavy-duty vehicles, and marine transport sectors are significant consumers of LNG, making it an essential part of the energy mix.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

133 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2024-2028 |

USD 1.04 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.4 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Bechtel Corp., Cheniere Energy Inc., Chevron Corp., Chiyoda Corp., Dominion Energy Inc., Dow Inc., Exxon Mobil Corp., Fluor Corp., Freeport LNG Development LP, McDermott International Ltd., Mitsubishi Corp., NextDecade Corp., Saipem S.p.A., Sempra Energy, and TotalEnergies SE |

|

Market dynamics |

Parent market analysis, market report, market forecast, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

CUStomization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch