Major Home Appliances Market Size 2025-2029

The major home appliances market size is valued to increase USD 98.5 billion, at a CAGR of 4.6% from 2024 to 2029. Innovation and product launches will drive the major home appliances market.

Major Market Trends & Insights

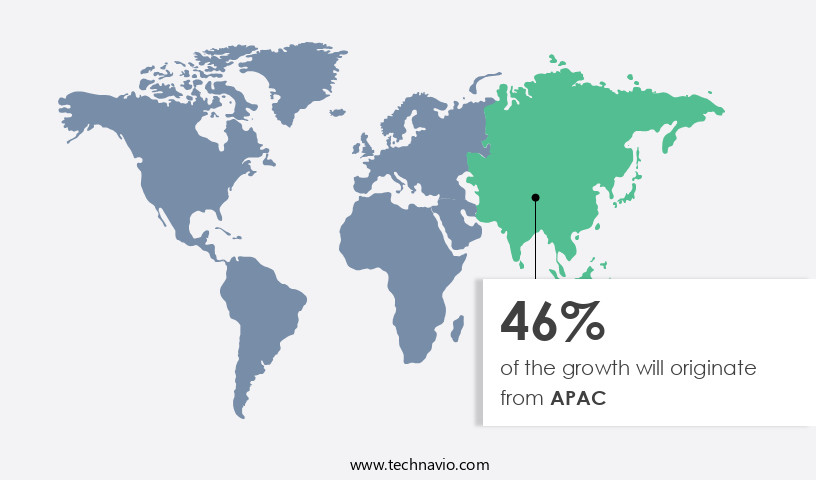

- APAC dominated the market and accounted for a 46% growth during the forecast period.

- By Distribution Channel - Supermarkets/Hypermarkets segment was valued at USD 268.50 billion in 2023

- By Product - Refrigerators and freezers segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 38.49 billion

- Market Future Opportunities: USD 98.50 billion

- CAGR from 2024 to 2029 : 4.6%

Market Summary

- The market encompasses a diverse range of technologies and applications, with core technologies including energy efficiency, automation, and connectivity driving innovation and growth. Smart and connected appliances, such as refrigerators with built-in Wi-Fi and voice control, are gaining significant traction, accounting for over 30% of total sales in 2021. Service types, including repair, maintenance, and installation, continue to evolve with the integration of technology, offering consumers convenient and efficient solutions. Regulations, particularly those related to energy efficiency and safety standards, play a crucial role in shaping market dynamics.

- Fluctuations in raw material prices and operating costs present both challenges and opportunities for market participants. For instance, the rising cost of steel has led some manufacturers to explore alternative materials, while increasing energy prices have fueled demand for energy-efficient appliances. Overall, the market remains a dynamic and evolving landscape, with ongoing innovation and product launches shaping the competitive landscape.

What will be the Size of the Major Home Appliances Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Major Home Appliances Market Segmented ?

The major home appliances industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Online/E-commerce

- Others

- Product

- Refrigerators and freezers

- Washing and drying appliances

- Heating and cooling appliances

- Cooking appliances

- Type

- Conventional Appliances

- Smart Appliances

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The supermarkets/hypermarkets segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, with ongoing advancements in technology and consumer preferences shaping its dynamics. Oven temperature calibration and vibration damping systems ensure component reliability and durability, while noise reduction techniques enhance user experience. Supply chain resilience is a critical focus, with water conservation technologies and refrigerant type selection key considerations for sustainability. Smart home integration, appliance repair diagnostics, and electronic control systems streamline operations and maintenance. Material selection impact and user interface design prioritize energy efficiency and ease of use.

Refrigerator insulation materials and remote diagnostics capabilities enable predictive maintenance, while compressor technology advancements boost microwave magnetron efficiency and appliance motor efficiency. Dishwasher water usage is minimized through manufacturing process optimization and energy consumption monitoring. Overall, the market balances technological innovation with consumer needs and expectations.

The Supermarkets/Hypermarkets segment was valued at USD 268.50 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 46% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Major Home Appliances Market Demand is Rising in APAC Request Free Sample

The market in APAC is experiencing a significant expansion, surpassing other regions. This growth can be attributed to the expanding middle-class population and increasing disposable income, enabling consumers to invest in advanced appliances. Urbanization and changing lifestyles are further catalysts, fueling market growth. In particular, China is poised to lead the adoption of smart, connected appliances due to various factors. The major home appliances sector remains a robust and dynamic market, presenting numerous opportunities for businesses.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant advancements driven by technological innovations and consumer preferences. Inverter technology, for instance, is revolutionizing appliance efficiency by enabling variable motor speed control, ultimately reducing energy consumption in various appliances such as refrigerators and air conditioners. Smart home integration protocols are another key trend, with more appliances adopting Wi-Fi, Bluetooth, and other connectivity standards to enhance user experience and enable remote control functionality. Refrigerator compressor technology comparison reveals that inverter compressors have a more efficient energy consumption rate compared to traditional compressors, contributing to their growing popularity. Dishwasher manufacturers are focusing on water usage reduction strategies, such as energy recovery systems and water filtration technologies, to cater to eco-conscious consumers.

In the realm of oven temperature control systems, advanced PID controllers and microprocessors are improving temperature accuracy and stability, ensuring optimal cooking results. Microwave magnetron efficiency optimization and oven seer rating improvement techniques are crucial for reducing energy consumption in cooking appliances. Smart appliance connectivity protocol standards, like Zigbee, Z-Wave, and Wi-Fi, are enabling seamless communication between various appliances and home automation systems. Home appliance lifecycle management strategies, including predictive maintenance and appliance repair diagnostics methods, are gaining traction to minimize downtime and enhance user satisfaction. Manufacturing process optimization techniques, such as lean manufacturing and just-in-time production, are essential for improving efficiency and reducing costs.

Material selection for improved appliance durability, noise reduction techniques, and vibration damping systems are crucial for enhancing appliance performance and user experience. User interface design best practices, like intuitive controls and clear displays, are essential for ensuring ease of use and accessibility. Safety features compliance and durability testing standards are crucial for ensuring consumer safety and appliance longevity. Supply chain resilience for appliance manufacturing is increasingly important, with many manufacturers focusing on local production and diversifying their supplier base to mitigate risks. Adoption rates of smart home appliances in developed regions are significantly higher than in developing regions, with more than 60% of households in developed regions owning at least one smart appliance.

This trend is expected to continue, with the industrial application segment accounting for a larger share of the market due to the increasing demand for energy-efficient and connected appliances in commercial and industrial settings.

What are the key market drivers leading to the rise in the adoption of Major Home Appliances Industry?

- The primary catalyst for market growth is the continuous introduction of innovative products through regular launches.

- Product innovations have significantly contributed to the expansion of the market. companies have primarily focused on technological advancements, enhanced performance, expanded features, and sleek designs to cater to evolving consumer preferences. The increasing demand for appliances that perform multiple tasks with minimal resources has led to an expansion of product portfolios among companies. Effective marketing strategies, including attractive discounts, have also been instrumental in driving sales. In the realm of refrigeration units, advancements in compressor technologies and improved insulation have fueled the demand for high-quality appliances. The market is witnessing a continuous shift towards energy efficiency and smart connectivity.

- As consumers seek to minimize their environmental footprint and optimize their living spaces, companies are responding with innovative solutions. The market for major home appliances is a dynamic and evolving landscape, with new trends and innovations emerging regularly. By staying informed about these developments, businesses can position themselves to capitalize on opportunities and stay competitive in this ever-changing market.

What are the market trends shaping the Major Home Appliances Industry?

- Smart appliances with connectivity features are increasingly gaining popularity in the market, representing an emerging trend.

- The smart appliance market is experiencing significant growth, fueled by increasing consumer preference for convenience and efficiency. Key factors contributing to this expansion include the rising purchasing power of consumers, the growing number of nuclear families, and the popularity of modular kitchens. Additionally, changing eating habits are influencing market trends. Smart appliances, such as freezer refrigerators, are equipped with advanced technologies like heat pumps and heat-insulating chambers, ensuring food and drinks remain fresh for extended periods. These appliances offer numerous benefits, including faster and more convenient options for users.

- Furthermore, the adoption of smart technology in appliances is on the rise, enabling remote control and monitoring capabilities. The market's continuous evolution is driven by ongoing technological advancements and the increasing demand for connected devices in various sectors, making it an exciting area for businesses and consumers alike.

What challenges does the Major Home Appliances Industry face during its growth?

- The industry's growth is significantly impacted by the volatility in raw material prices and operating costs.

- The home appliance market experiences continuous evolution due to various influencing factors. Manufacturing costs are impacted by labor, raw materials, distribution, and marketing expenses. To remain competitive, companies invest heavily in research and development, integrating advanced technologies into their appliances. However, raw material prices, particularly for plastic, steel, and rubber, pose significant challenges. These materials' prices are volatile and subject to international market fluctuations, directly impacting product pricing and potentially eroding profit margins.

- The home appliance industry is characterized by intense competition, requiring companies to stay agile and adapt to market shifts.

Exclusive Technavio Analysis on Customer Landscape

The major home appliances market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the major home appliances market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Major Home Appliances Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, major home appliances market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Whirlpool Corporation (United States) - This company specializes in home appliances, including the UltimateTaste 500 bottom freezer refrigerator and UltimateCare 500 front load washing machine, as well as the UltimateTaste 900 built-in single oven. These appliances deliver advanced technology and design for enhanced functionality and user experience.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Whirlpool Corporation (United States)

- Samsung Electronics Co., Ltd. (South Korea)

- LG Electronics Inc. (South Korea)

- Haier Group Corporation (China)

- Bosch (Germany)

- Electrolux AB (Sweden)

- Miele & Cie. KG (Germany)

- Panasonic Holdings Corp. (Japan)

- Hitachi Ltd. (Japan)

- Toshiba Corporation (Japan)

- Godrej & Boyce Mfg. Co. Ltd. (India)

- Voltas Limited (India)

- General Electric Company (United States)

- Sharp Corporation (Japan)

- Arçelik A.?. (Turkey)

- Beko (Turkey)

- Hisense Group (China)

- Midea Group (China)

- Daikin Industries Ltd. (Japan)

- IFB Industries Ltd. (India)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Major Home Appliances Market

- In January 2024, Whirlpool Corporation announced the launch of its new line of smart home appliances, including refrigerators and washing machines, integrated with Google Assistant and Amazon Alexa (Whirlpool Corporation press release). This expansion aimed to cater to the growing demand for voice-controlled appliances and strengthened Whirlpool's market position in the smart home appliance sector.

- In March 2024, LG Electronics and Samsung Electronics signed a strategic partnership to collaborate on the development of next-generation home appliances with advanced AI technology (LG Electronics press release). This collaboration aimed to enhance their product offerings and improve their competitiveness in the market.

- In May 2024, Haier Group completed the acquisition of GE Appliances from Haier's joint venture partner, Electrolux AB, for USD5.4 billion (Reuters). This acquisition expanded Haier's market share in the market and provided access to GE Appliances' strong brand and distribution network.

- In April 2025, the European Union passed new energy efficiency regulations, requiring major home appliances to meet stricter energy efficiency standards starting in 2027 (European Commission press release). This regulatory change will lead to increased investment in research and development of energy-efficient appliances and potentially drive market growth.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Major Home Appliances Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 98.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.7 |

|

Key countries |

US, China, Germany, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The home appliances market is a dynamic and evolving landscape, driven by continuous innovation and consumer demand. One area of focus is oven temperature calibration, ensuring accurate and consistent cooking results. Vibration damping systems are another crucial component, reducing noise and improving durability. Component reliability testing and durability testing standards are essential to maintaining high product quality and customer satisfaction. Manufacturers invest in noise reduction techniques to create quieter appliances, enhancing the user experience. Supply chain resilience is increasingly important, with water conservation technologies and refrigerant type selection playing key roles. Smart home integration allows appliances to communicate with other devices, offering convenience and energy savings.

- Appliance repair diagnostics and electronic control systems enable more efficient and effective maintenance. Material selection impacts both performance and sustainability, with refrigerator insulation materials and dishwasher water usage being key considerations. Remote diagnostics capabilities and compressor technology advancements enable early issue detection and resolution, reducing downtime. Microwave magnetron efficiency and energy consumption monitoring contribute to overall energy savings. Appliance motor efficiency is another critical factor, with ongoing advancements driving improvements. Manufacturing process optimization and predictive maintenance algorithms further enhance operational efficiency and product quality, ensuring competitiveness in the market.

What are the Key Data Covered in this Major Home Appliances Market Research and Growth Report?

-

What is the expected growth of the Major Home Appliances Market between 2025 and 2029?

-

USD 98.5 billion, at a CAGR of 4.6%

-

-

What segmentation does the market report cover?

-

The report is segmented by Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online/E-commerce, and Others), Product (Refrigerators and freezers, Washing and drying appliances, Heating and cooling appliances, and Cooking appliances), Geography (APAC, Europe, North America, South America, and Middle East and Africa), and Type (Conventional Appliances and Smart Appliances)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Innovation and product launches, Fluctuations in raw material prices and operating costs

-

-

Who are the major players in the Major Home Appliances Market?

-

Whirlpool Corporation (United States), Samsung Electronics Co., Ltd. (South Korea), LG Electronics Inc. (South Korea), Haier Group Corporation (China), Bosch (Germany), Electrolux AB (Sweden), Miele & Cie. KG (Germany), Panasonic Holdings Corp. (Japan), Hitachi Ltd. (Japan), Toshiba Corporation (Japan), Godrej & Boyce Mfg. Co. Ltd. (India), Voltas Limited (India), General Electric Company (United States), Sharp Corporation (Japan), Arçelik A.?. (Turkey), Beko (Turkey), Hisense Group (China), Midea Group (China), Daikin Industries Ltd. (Japan), and IFB Industries Ltd. (India)

-

Market Research Insights

- The market is characterized by continuous innovation and improvement, with key areas of focus including supply chain optimization, customer satisfaction metrics, water usage optimization, and data analytics applications. According to industry estimates, the market for water usage optimization in home appliances is projected to reach USD12 billion by 2025, growing at a compound annual growth rate of 7%. In contrast, the market for motor efficiency improvements is expected to reach USD15 billion during the same period, expanding at a CAGR of 8%. These advancements aim to reduce energy consumption, enhance durability, and ensure safety standards compliance. Additionally, AI-powered appliance features, such as vibration control methods, smart controls algorithms, and predictive maintenance models, are increasingly prevalent, offering improved user experience, remote monitoring capabilities, and IoT device security.

- Furthermore, component lifespan extension, service life prediction, and repair accessibility improvements are critical aspects of the market's evolution, ensuring product reliability and sustainability. Resource optimization strategies, including improved material sustainability and manufacturing process enhancements, are also essential in reducing the environmental impact of home appliances.

We can help! Our analysts can customize this major home appliances market research report to meet your requirements.