Marine Electronics Market Size 2025-2029

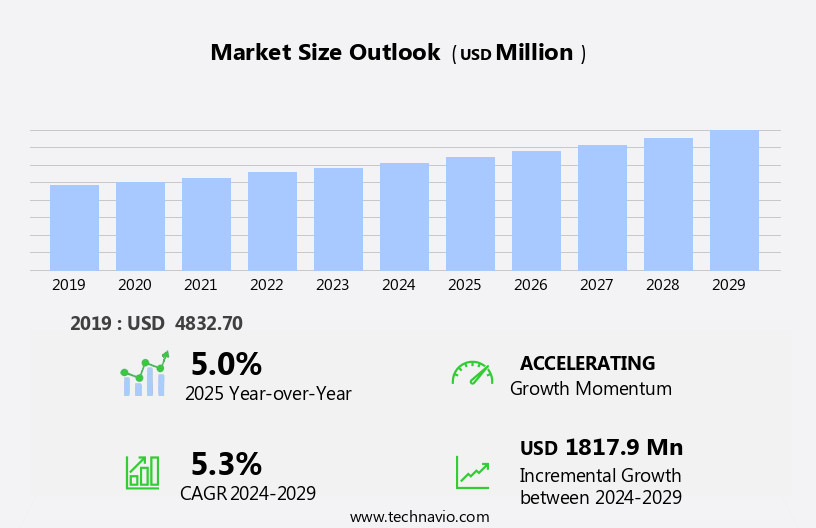

The marine electronics market size is forecast to increase by USD 1.82 billion at a CAGR of 5.3% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing adoption of Global Positioning System (GPS) technology in marine applications. GPS systems enable precise navigation, location tracking, and communication, making them essential for various marine industries, including fishing, shipping, and defense. Another key trend is the rising deployment of Unmanned Underwater Vehicles (UUVs) for deep-sea exploration and surveillance, which necessitates advanced marine electronics. However, the high cost associated with sophisticated sonar systems remains a challenge for market growth. To capitalize on the opportunities presented by this market, companies must focus on developing cost-effective solutions while maintaining high performance and reliability.

- Strategic partnerships, collaborations, and acquisitions can also help market players expand their product offerings and reach a broader customer base. In summary, the market is poised for growth, driven by the adoption of GPS technology and the increasing use of UUVs. Companies must navigate the high cost of advanced sonar systems to capitalize on this opportunity and maintain a competitive edge.

What will be the Size of the Marine Electronics Market during the forecast period?

- The market encompasses various applications, including ship tracking systems and routes for commercial shipping and naval forces. Electronic hardware, such as GPS systems and sonar technology, play essential roles in ensuring efficient operations and safety. Waterproofing is a crucial factor for electronics used in brackish and salty water environments. GPS systems enable real-time monitoring of ship locations, enhancing logistics and international trade. Military electronics, including sonar systems, are integral to naval vessels' operations, providing situational awareness and enabling effective rescue operations. Diesel engines power many commercial ships, necessitating the integration of marine electronics for optimal performance and fuel efficiency.

- Recreational water activities also benefit from advanced marine electronics, ensuring safety and enjoyment in irregular waves. Natural gas exploration and production rely on marine electronics, with video displays providing valuable insights into underwater terrain. Water corrosion resistance is a significant concern for marine electronics, with satellite transmission enabling communication and data transfer in remote locations. The market is influenced by the growing demand for efficient and safe shipping operations, expanding international trade, and the integration of technology into various maritime applications. Military applications, including naval forces and rescue operations, continue to drive innovation in marine electronics.

How is this Marine Electronics Industry segmented?

The marine electronics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Hardware

- Software

- Product

- Sonar systems

- Radars

- GPS tracking devices

- Geography

- North America

- US

- Canada

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- South America

- Brazil

- Middle East and Africa

- North America

By Component Insights

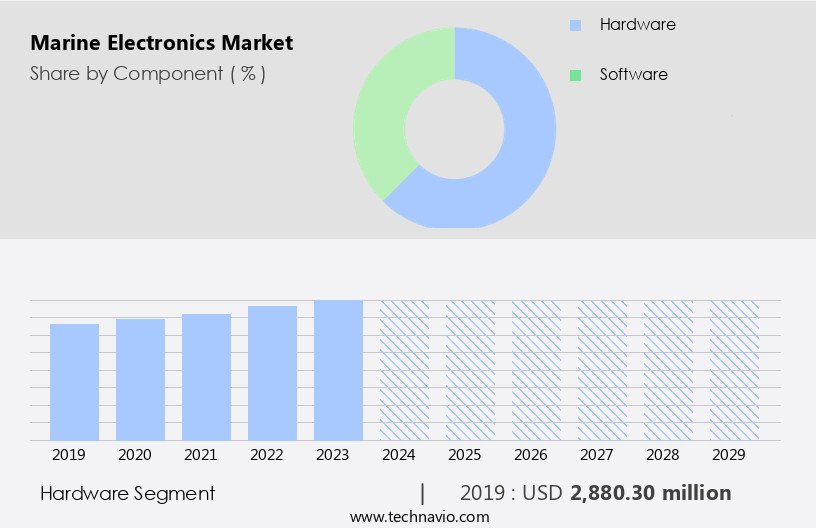

The hardware segment is estimated to witness significant growth during the forecast period.

Marine electronic hardware, including GPS systems, fish finders/SONAR modules, thermal and visible cameras, VHF communication devices, audio/video equipment, marine autopilots, autonomous identification systems, analog and digital communication displays, and satellite TVs, play a significant role in the marine ecosystem. The growing adoption of GPS systems by marine vessels and advanced electronic hardware applications are driving the demand for marine electronics. This trend is further fueled by the expansion of naval forces, resulting from the acquisition of new ships, submarines, and upgrades to existing naval vessels. Additionally, the need for real-time monitoring, ice management, and cybersecurity measures in commercial shipping, as well as the increasing popularity of recreational water activities, is contributing to the growth of the market.

Marine safety, vessel management systems, and underwater exploration technologies, such as sonar systems and underwater drones, are also gaining traction. The integration of energy-efficient tech, such as emission control systems and ice management systems, is further enhancing the market's potential. Overall, the market is experiencing steady growth due to the increasing demand for advanced technology solutions in various marine applications.

Get a glance at the market report of share of various segments Request Free Sample

The Hardware segment was valued at USD 2.88 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

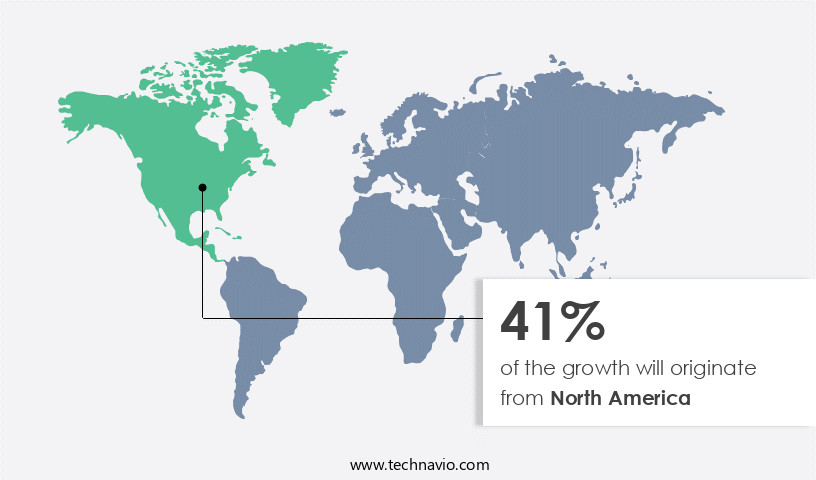

North America is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is experiencing growth due to increasing demand from commercial and military ships. Countries like Canada, Mexico, and the US are investing in sonar systems for securing coastal areas and enhancing naval capabilities. The presence of established marine electronics manufacturers and substantial defense spending by respective governments are major factors driving market expansion. The US, being the largest global spender on submarines and related components, has significantly invested in sonar systems for detecting underwater threats. Other applications of marine electronics, such as real-time monitoring, vessel management, and environmental monitoring, are also gaining traction.

Navigation software, satellite communication systems, and radar displays are essential components of modern naval vessels and commercial ships. Power consumption, water corrosion resistance, and energy-efficient tech are key considerations for marine electronics manufacturers. Additionally, cybersecurity measures and system integration are becoming increasingly important in the market. Overall, the North American the market is witnessing significant growth due to the increasing demand for advanced marine technology and defense applications.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Marine Electronics Industry?

- Increase in adoption of GPS systems is the key driver of the market.

- The maritime industry's reliance on advanced technology for navigation and safety is on the rise, with GPS systems playing a pivotal role. These systems determine the location of ships and facilitate immediate rescue efforts during emergencies. GPS technology, which operates on a satellite transmission basis, offers authentic and effective solutions. By providing accurate details and information, GPS systems enable seaborne vessels to make informed decisions regarding their routes and courses.

- Additionally, vessel tracking systems that integrate GPS functionality serve as transmission and receiving points using VHF radio channels. The adoption of these systems enhances the efficiency and safety of maritime operations. GPS technology's increasing use in vessel tracking is a testament to its significance in the maritime sector.

What are the market trends shaping the Marine Electronics Industry?

- Increasing deployment of UUVs is the upcoming market trend.

- Unmanned underwater vehicles (UUVs) are advanced underwater drones utilized for diverse applications, including naval mine detection, seabed mapping, seabed mining, underwater mine searches, and search and recovery missions. Equipped with sonar systems and oceanographic sensors, these vehicles play a crucial role in underwater surveillance for both military and non-military applications. With the rise of terrorist activities, the need to protect sensitive installations such as naval bases, offshore oil-and-gas production and transport facilities, and nuclear power plants has become increasingly important.

- Furthermore, concerns regarding the pollution of subsea environments necessitate monitoring and detection of pollutants in sensitive areas and larger basins. The demand for underwater surveillance systems is expected to grow significantly due to these factors. UUVs offer a cost-effective and efficient solution for monitoring water quality and detecting potential threats, making them an indispensable tool for various industries and governments.

What challenges does the Marine Electronics Industry face during its growth?

- High cost associated with sonar systems is a key challenge affecting the industry growth.

- Sonar systems are divided into two primary categories: commercial and defense applications. Commercial sonar systems are predominantly utilized by individuals for activities such as fishing, treasure hunting, and seabed surveys. These systems typically cost between USD100 and USD1,000 and involve minimal research and development investment. In contrast, defense sonar systems are characterized by significantly higher average selling prices due to their intricate requirements and the need for advanced technology.

- This high investment barrier can hinder the development of new sonar modules for defense applications. Sonar system manufacturers must customize these devices to meet the unique specifications of their clients, necessitating continuous upgrades to maintain acoustic superiority at a reasonable cost.

Exclusive Customer Landscape

The marine electronics market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the marine electronics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, marine electronics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adrie Marine Electronics Solutions Pvt. Ltd. - The company specializes in marine electronics, providing advanced automation and control systems to enhance vessel operations. These innovative solutions optimize performance, ensure safety, and improve overall efficiency for boat owners and operators. Our offerings include a range of integrated systems for navigation, communication, and monitoring, enabling seamless control and real-time data analysis. By leveraging cutting-edge technology, we cater to diverse marine applications, delivering customized, user-friendly solutions for a smarter and more connected maritime experience.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adrie Marine Electronics Solutions Pvt. Ltd.

- Elcome International LLC

- Furuno Electric Co. Ltd.

- Garmin Ltd.

- Icom America Inc.

- Japan Radio Co. Ltd.

- Johnson Outdoors Inc.

- Kongsberg Gruppen ASA

- Kraken Robotics Inc.

- Marine Electronics

- Navico

- Neptune Sonar Ltd.

- Northrop Grumman Corp.

- R2SONIC Inc.

- Raymarine

- Sound Metrics Corp.

- SRT Marine Systems Plc

- Teledyne Technologies Inc.

- thyssenkrupp AG

- Ultra Electronics Holdings Plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of technologies and applications, serving various industries and sectors. Navigation equipment plays a crucial role in ensuring safe and efficient navigation, particularly in oil exploration and ocean surveillance operations. Work boats and naval vessels rely heavily on advanced navigation systems to navigate through irregular waves and challenging environmental conditions. Sonar systems and underwater vehicles are essential tools for ocean mapping and bathymetric studies. These technologies enable the exploration of seabeds and the identification of underwater features, including oil and gas deposits and underwater mines. Power consumption is a significant concern in marine applications, with diesel engines and emission control systems being widely used to reduce fuel consumption and minimize environmental impact.

Tracking devices and software solutions are integral to vessel management systems, enabling real-time monitoring of ship routes, cargo, and crew. Ocean surveillance and defense applications require advanced radar systems and communication systems for effective monitoring and response to potential threats. Recreational boats and luxury yachts also utilize marine electronics for navigational systems, fish finders, and vessel control applications. Marine safety is a primary concern, with GPS devices, fire alarm systems, and ice navigation systems being essential components of safety equipment. Environmental monitoring systems are also gaining popularity, particularly in the context of increasing focus on sustainable practices in the maritime industry.

Hardware components, such as depth sounders and chart plotters, are essential for effective navigation and vessel management. The market is characterized by ongoing innovation and technological advancements. Multi-functional systems and energy-efficient tech are increasingly being adopted to enhance operational efficiency and reduce environmental impact. Real-time data and satellite communication systems enable effective vessel management and improve communication between vessels and shore-based operations. Naval modernization programs are driving demand for advanced marine electronics, including radar systems, naval forces communication systems, and ice management systems. The leisure boating sector is also witnessing significant growth, with recreational water activities and fancy lighting systems gaining popularity.

Environmental condensation and water corrosion resistance are critical considerations in marine electronics design. Vessel management systems and software applications are being integrated to optimize operational efficiency and reduce technical snags. Cybersecurity measures are also becoming increasingly important to safeguard against potential threats and ensure the integrity of data transmitted over satellite communication systems. In , the market is a dynamic and evolving industry, driven by technological innovation and the need for safe, efficient, and sustainable maritime operations. From oil exploration to recreational boating, marine electronics play a crucial role in enhancing operational efficiency, improving safety, and enabling effective communication and monitoring.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

199 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.3% |

|

Market growth 2025-2029 |

USD 1817.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.0 |

|

Key countries |

US, Canada, Japan, China, India, Brazil, South Korea, UK, Germany, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Marine Electronics Market Research and Growth Report?

- CAGR of the Marine Electronics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the marine electronics market growth of industry companies

We can help! Our analysts can customize this marine electronics market research report to meet your requirements.