Medical Foods Market Size 2024-2028

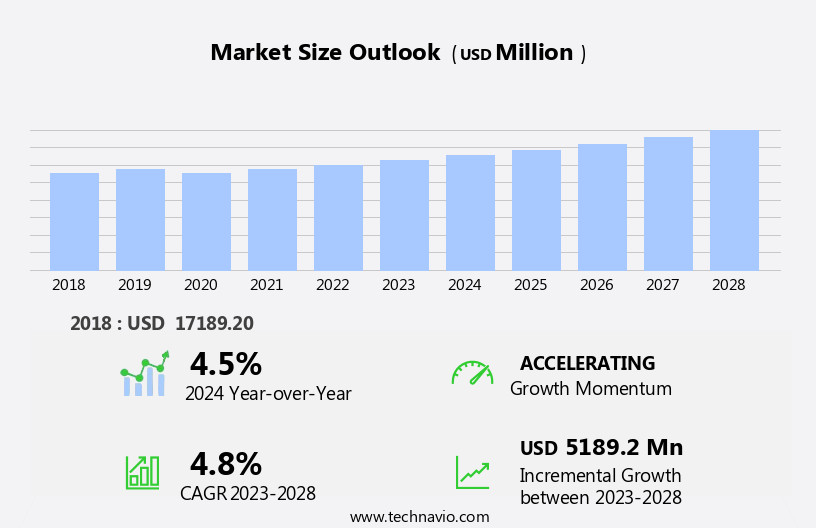

The medical foods market size is forecast to increase by USD 5.19 billion, at a CAGR of 4.8% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing geriatric population and rising prevalence of conditions such as malnutrition and diabetes. The elderly demographic, with their unique nutritional needs, presents a substantial market opportunity for medical food manufacturers. Additionally, the growing number of individuals diagnosed with chronic conditions necessitates specialized nutritional solutions, further fueling market expansion. However, the market faces challenges in the form of discrepancies in the categorization of medical foods. The lack of a standardized definition and regulatory framework complicates market entry and product development for companies.

- Navigating these complexities requires a deep understanding of the regulatory landscape and strategic partnerships with regulatory bodies. To capitalize on market opportunities and effectively address challenges, companies must remain agile and innovative, focusing on developing targeted, evidence-based medical food solutions for specific conditions.

What will be the Size of the Medical Foods Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the increasing demand for specialized nutritional solutions across various sectors. Infant nutrition remains a significant focus, with ongoing research and development in ingredient sourcing to ensure optimal nutrition for growing infants. Specialized diets, including those for toddlers, patients with food allergies, and those requiring metabolic support, are also gaining traction. Patient compliance is a critical factor in the success of medical food products, with a focus on extended shelf life and convenient packaging requirements. Elderly nutrition and hepatic support are emerging areas of interest, as the global population ages and nutritional needs shift.

Regulatory compliance, including protein supplementation and vitamin fortification, plays a crucial role in the development of medical foods. The importance of nutrient absorption, calorie density, mineral balance, and weight management is also a key consideration. Formula development for enteral nutrition and clinical nutrition continues to advance, with a focus on disease management, glucose control, appetite stimulation, and renal support. The gut microbiome and immune function are also areas of increasing interest, with omega-3 fatty acids and dietary fiber playing essential roles. The market is characterized by continuous innovation, with ongoing research and development in nutritional deficiencies, nutrient absorption, and regulatory compliance.

The market's dynamism is reflected in the evolving patterns of ingredient sourcing, product formulation, and quality control.

How is this Medical Foods Industry segmented?

The medical foods industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Powder

- Pill

- Others

- Type

- Oral Nutrition

- Enteral Nutrition

- Metabolic Disorder Formulas

- Application

- Diabetes

- Cancer

- Neurological Disorders

- Inborn Errors of Metabolism

- Distribution Channel

- Pharmacies

- Hospitals & Clinics

- Online Retail

- Specialty Stores

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

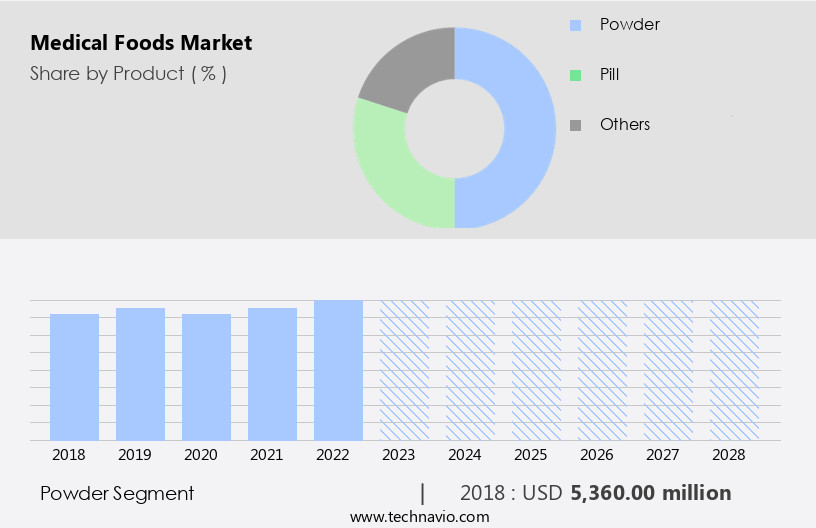

By Product Insights

The powder segment is estimated to witness significant growth during the forecast period.

In the market, companies provide powder medical foods tailored to address the unique nutritional requirements of diverse patient populations. Developed through collaborative efforts between registered dieticians, food scientists, and nutritionists, these powders cater to adults, geriatric consumers, infants, children, and new mothers. They support disease management for conditions such as chronic kidney disease, minimal hepatic encephalopathy, chemotherapy-induced diarrhea, pathogen-related infections, diabetic neuropathy, attention deficit hyperactivity disorder (ADHD), depression, Alzheimer's disease, nutritional deficiencies, and various orphan diseases like phenylketonuria and eosinophilic esophagitis. These medical foods are formulated to meet specific dietary needs, including specialized diets for food allergies, gut microbiome management, and metabolic support.

They offer enteral nutrition, hepatic support, and omega-3 fatty acid supplementation. companies prioritize regulatory compliance, ensuring product formulation aligns with medical food regulations. Quality control and packaging requirements are stringently adhered to, while vitamin fortification enhances nutrient absorption. Calorie density and mineral balance are crucial considerations, with some products designed for weight management and renal support. Glucose control and appetite stimulation are essential features for certain patient populations. Dietary fiber and clinical nutrition support digestive health and immune function. companies prioritize shelf life, ensuring patients receive effective and safe medical foods.

The Powder segment was valued at USD 5.36 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In North America, there is a significant increase in the consumption of medical foods, dietary supplements, and prescription drugs due to the rising prevalence of obesity and chronic diseases, including cardiovascular conditions. This trend is driven by the deficiency of essential nutrients in diets and the inclusion of synthetic products. According to the Centers for Disease Control and Prevention (CDC), in 2023, approximately 8.9% of the US population had diabetes, with this number growing by 5% annually. Medical foods play a crucial role in addressing nutritional deficiencies and supporting various health conditions, such as metabolic disorders, enteral feeding, hepatic support, and immune function.

These foods cater to specialized diets, including infant and toddler nutrition, and address food allergies and gut microbiome imbalances. Regulatory compliance is essential in the production of medical foods, ensuring quality control, vitamin fortification, and mineral balance. Shelf life, calorie density, and appetite stimulation are also critical factors in their formulation. Renal support, clinical nutrition, and digestive health are other areas where medical foods offer significant benefits. In the development of medical foods, ingredient sourcing, product formulation, and regulatory compliance are key considerations. Packaging requirements and nutrient absorption are also essential aspects of medical food production. Omega-3 fatty acids, protein supplementation, and disease management are some of the other areas where medical foods provide essential support.

Market Dynamics

The Global Medical Foods Market is experiencing significant medical foods market growth, largely due to the increasing focus on dietary management of disease and the rising prevalence of medical foods for chronic diseases. A growing aging population (medical foods) further fuels demand for specialized nutritional support. Products like medical food powders and liquid medical foods are crucial for malnutrition (medical foods) prevention and treatment, often used in clinical nutrition settings and for hospital nutrition. The Global medical foods market size continues to expand, driven by robust new product development medical foods and evolving medical foods industry trends. Specialized formulas, such as medical foods for metabolic disorders and medical foods for gastrointestinal disorders, are vital for specific patient groups. The convenience of e-commerce medical foods is enhancing accessibility, offering nutritionally complete medical foods for home use through programs like home enteral nutrition (HEN). The future of this market is also being shaped by personalized nutrition and the complex regulatory landscape medical foods.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Medical Foods Industry?

- The geriatric population's growing adoption of medical foods serves as the primary market driver.

- Medical foods, formulated to address specific nutritional needs for various health conditions, are gaining traction among the geriatric population. Factors contributing to this trend include the aging process, which can lead to decreased appetite and nutrient absorption, affecting around 20-30% of older adults. This condition, known as anorexia of aging, can worsen chronic conditions like frailty and sarcopenia. Additionally, over 81% of those aged 65 and above manage at least one chronic condition, driving demand for specialized medical foods. Product formulation in medical foods focuses on vitamin fortification, renal support, and immune function, among others.

- Vitamin fortification addresses common deficiencies, while renal support caters to individuals with kidney issues. Digestive health and immune function are crucial for overall well-being, especially in the elderly population. Clinical nutrition plays a significant role in medical foods, ensuring they meet specific nutritional requirements and health conditions. This targeted approach to nutrition is essential for addressing the unique needs of the geriatric population, making medical foods an appealing option for supplementation.

What are the market trends shaping the Medical Foods Industry?

- The prevalence of conditions such as malnutrition and diabetes is on the rise, representing a significant market trend. This increasing demand for solutions to manage and prevent these health issues is expected to drive market growth in the healthcare industry.

- The market is experiencing notable expansion due to the increasing prevalence of chronic conditions, such as malnutrition and diabetes, and advancements in healthcare awareness. Chronic diseases, including diabetes, cancer, and cardiovascular issues, are becoming more common, necessitating specialized nutritional interventions. For instance, diabetes management often requires specific dietary adjustments that medical foods can provide to optimize patient outcomes. Malnutrition, particularly among cancer patients, is a significant concern, with estimates suggesting that 40-80% may experience nutritional deficiencies due to their condition and treatment side effects. Medical foods play a crucial role in restoring nutritional balance, emphasizing their importance in the healthcare landscape.

- Specialized diets for toddlers, elderly nutrition, and metabolic support, including enteral nutrition, are additional areas driving market growth. Ingredient sourcing and ensuring an acceptable shelf life are critical factors influencing market dynamics. In summary, the market is gaining traction due to the rising demand for tailored nutrition solutions to address the nutritional needs of various patient populations.

What challenges does the Medical Foods Industry face during its growth?

- The inconsistent classification of medical foods poses a significant challenge to the industry's growth trajectory. This issue, which requires the attention of industry professionals and regulatory bodies alike, can hinder market expansion and potentially limit access to essential nutritional solutions for various patient populations.

- In the US and other parts of the world, regulatory bodies play a crucial role in producing and regulating medical foods. The Food and Drug Administration (FDA) in the US, for instance, has defined medical foods as FDA-regulated products under the 1988 Orphan Drugs Act Amendments. These foods are designed to affect the body's function, making them distinct from conventional foods. In Europe, the European Food Safety Authority (EFSA) recognizes medical foods as foods for special medical purposes. However, the regulatory process for medical foods in developing nations, such as Brazil and South Africa, is still in its infancy. Medical foods cater to various health conditions, including protein supplementation for individuals with food allergies, gut microbiome support for disease management, hepatic support, and omega-3 fatty acid supplementation for nutrient deficiencies and nutrient absorption.

- As the understanding of the role of nutrition in disease management continues to evolve, the demand for medical foods is expected to grow. Regulatory compliance is a critical aspect of producing and marketing medical foods, ensuring their safety and efficacy for consumers.

Exclusive Customer Landscape

The medical foods market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the medical foods market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, medical foods market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - This company specializes in the provision of a comprehensive selection of medical food brands, including Elecare and Ensure, catering to various nutritional needs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Alfasigma Spa

- Bausch Health Companies Inc.

- Danone SA

- Entera Health Inc.

- Fresenius Kabi AG

- Medtrition Inc.

- Meiji Holdings Co. Ltd.

- Metagenics LLC

- Nestle SA

- Physician Therapeutics LLC

- Primus Pharmaceuticals Inc.

- Proliant Inc.

- Reckitt Benckiser Group Plc

- Targeted Medical Pharma Inc.

- Upsher Smith Laboratories LLC

- Victus Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Medical Foods Market

- In January 2024, Danone Manifesto Ventures, a global investment organization focused on health and nutrition, announced the acquisition of a significant stake in Nutricia, a leading medical nutrition company. This strategic investment marked Danone's commitment to expanding its presence in the market (Danone Manifesto Ventures Press Release).

- In March 2024, Nestlé Health Science, a global leader in the field of nutritional science, launched a new line of medical foods, 'Peptamen 1.5', designed for patients with gastrointestinal disorders. This innovation expanded the company's medical food offerings and catered to the growing demand for specialized nutritional solutions (Nestlé Health Science Press Release).

- In May 2024, Abbott, a leading healthcare company, received FDA approval for its new medical food product, 'Glucerna RFA', specifically formulated for patients with diabetes. This approval marked a significant milestone for Abbott, as it expanded its portfolio of medical foods and further solidified its position in the diabetes care market (Abbott Press Release).

- In April 2025, Fresenius Kabi, a global healthcare company, announced a partnership with the University of California, San Francisco (UCSF) to develop new medical foods for patients with rare metabolic disorders. This collaboration aimed to leverage UCSF's expertise in metabolic research and Fresenius Kabi's capabilities in medical food production (Fresenius Kabi Press Release).

Research Analyst Overview

- The market caters to individuals with specific nutritional needs, including those with dietary restrictions. Manufacturers focus on enhancing nutrient bioavailability through optimal macronutrient balance and micronutrient delivery. Feeding tubes and oral supplements are essential forms of delivery for individuals unable to consume regular food. Allergen control is paramount to ensure patient safety, with stringent manufacturing processes in place. Probiotic strains, prebiotic fibers, and antioxidant capacity are crucial components, contributing to improved health outcomes. Physician recommendations guide the selection of medical foods based on patient monitoring data, such as glycemic index, gut health markers, product stability, liver function, kidney function, energy metabolism, inflammatory response, and amino acid profile.

- Ingredient selection is driven by the latest scientific research, ensuring optimal fiber types, food composition, and therapeutic nutrition for various conditions.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Medical Foods Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

136 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.8% |

|

Market growth 2024-2028 |

USD 5189.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.5 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Medical Foods Market Research and Growth Report?

- CAGR of the Medical Foods industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the medical foods market growth of industry companies

We can help! Our analysts can customize this medical foods market research report to meet your requirements.