Metal Packaging Market Size 2024-2028

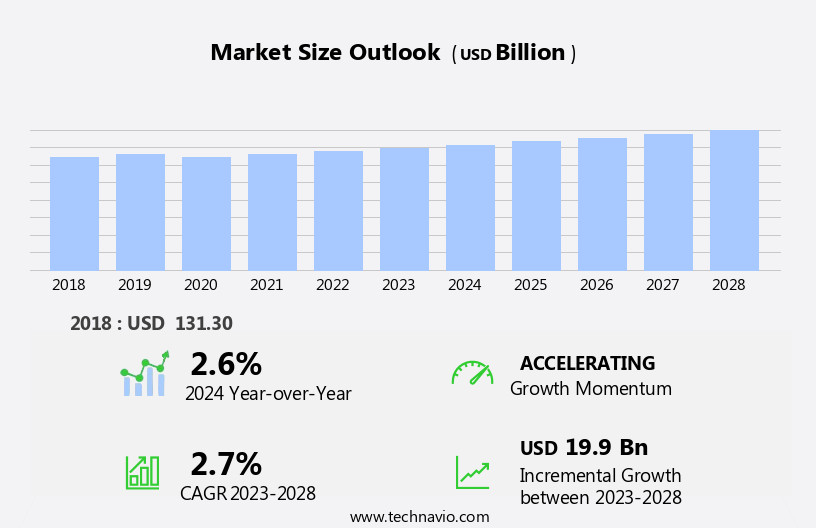

The metal packaging market size is forecast to increase by USD 19.9 billion, at a CAGR of 2.7% between 2023 and 2028.

- The market witnesses significant growth, driven by the increasing demand in the pharmaceutical sector. The sector's reliance on metal packaging for its durability, barrier properties, and ability to protect sensitive contents from external factors is a key growth driver. Furthermore, the trend towards convenient and ready-to-eat consumer products adds to the market's momentum. However, the market faces challenges due to the volatility in raw material prices. Metal packaging's production relies heavily on metals like aluminum and steel, whose prices can fluctuate significantly.

- Companies must navigate this price volatility to maintain profitability and competitiveness. To capitalize on market opportunities and mitigate challenges effectively, strategic business decisions and operational planning are essential. Companies can explore price hedging strategies, optimize supply chains, and invest in research and development to innovate and differentiate their offerings.

What will be the Size of the Metal Packaging Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the dynamic interplay of various factors. Beverage packaging, a significant segment, benefits from the superior barrier properties of metal containers, including light and moisture. Can closing technologies, such as ring-pull and twist-off designs, enhance user experience. Printing techniques, including flexographic and offset, offer versatility in decoration. Barrier properties, essential for product protection, are crucial in various sectors. Steel and aluminum cans, with their oxygen and moisture resistance, dominate the beverage industry. Industrial packaging also relies on these properties for long shelf life. Resealable cans extend product freshness in personal care applications.

Decoration techniques, like lacquering and lithography, add value to metal cans. Epoxy coatings and varnish coatings ensure product protection and enhance aesthetics. Can bodies, with their strength and durability, are integral to the circular economy, enabling metal recycling. Supplier relationships, quality control, and material sourcing are key considerations in can manufacturing. The ongoing evolution of can design, from electroplated to coated, impacts the market. Can filling technologies, such as seaming machines, streamline production processes. Environmental impact, including carbon footprint and waste management, is a growing concern. Can disposal and recycling, including metal and steel recycling, are crucial aspects of the circular economy.

The supply chain, from raw materials to finished products, is a complex web of interconnected activities. Inventory management, tamper-evident seals, and can ends are essential components of the market. Aerosol cans, food packaging, pharmaceutical packaging, and chemical packaging all rely on metal containers for their unique properties. The market's continuous dynamism underscores the importance of staying informed and adaptive.

How is this Metal Packaging Industry segmented?

The metal packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Food packaging

- Beverage packaging

- Personal care packaging

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

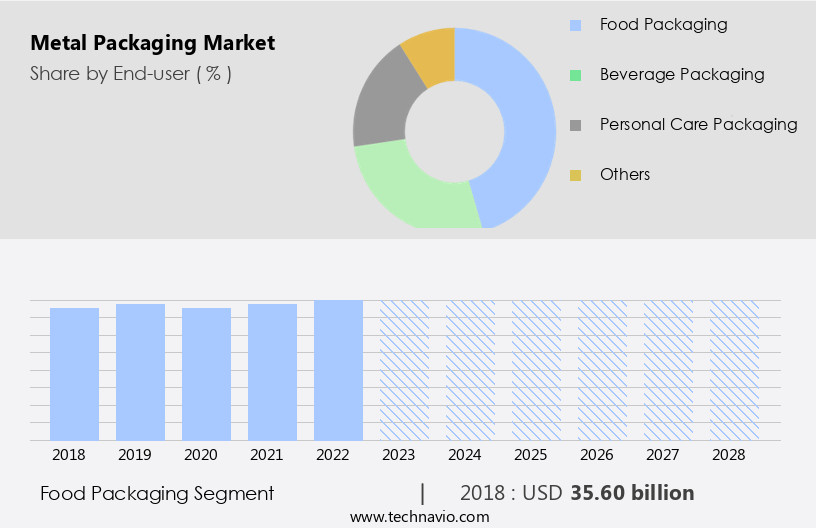

The food packaging segment is estimated to witness significant growth during the forecast period.

Metal packaging plays a crucial role in the food industry by safeguarding products from external influences and damage. The versatility of metal as a packaging material is evident in its combination of barrier properties, physical protection, recyclability, and consumer acceptance. In response to the increasing demand for convenient food options, metal packaging companies are innovating to cater to consumers. For instance, Crown Holdings, an American company specializing in metal food and beverage cans, metal closures, aerosol containers, and specialty packaging, offers advanced food can designs such as Peelfit, CrownSecure, PeelSeam peelable ends, and Easylift easy-open ends. These innovations enhance the consumer experience while maintaining product protection and sustainability.

Printing technologies, including flexographic and offset, contribute significantly to the design and decoration of metal packaging. Epoxy coatings and enamel coatings further improve the barrier properties of metal cans, ensuring extended shelf life for food products. Waste management and recycling are essential aspects of metal packaging, with metal recycling, steel recycling, and aluminum recycling playing a significant role in reducing environmental impact. In the beverage sector, steel and aluminum cans are the preferred choices due to their lightweight, moisture barrier, and oxygen barrier properties. Resealable cans and aerosol cans cater to specific consumer needs, while industrial packaging ensures product protection during transportation.

Quality control and material sourcing are essential elements of the metal packaging supply chain, with supplier relationships and inventory management playing a significant role in maintaining consistency and efficiency. Personal care packaging and pharmaceutical packaging also benefit from metal's barrier properties and recyclability. Coated cans, can manufacturing, can ends, and can filling technologies ensure product protection and ease of use. The circular economy and the focus on reducing carbon footprint have led to advancements in metal can manufacturing and the use of tin-free steel and coated cans. Tamper-evident seals and seaming machines further enhance the safety and security of metal packaging.

Digital printing and varnish coatings offer new possibilities for customization and branding in metal packaging. Chemical packaging and can filling technologies ensure the safe and efficient transfer of contents into metal containers. The integration of these technologies and processes in metal packaging production and design continues to drive innovation and growth in the market.

The Food packaging segment was valued at USD 35.60 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 56% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American the market is a substantial segment of the global packaging industry, fueled by factors such as sustainability, convenience, and the rising demand for packaged food and beverages. Aluminum and steel are the dominant materials utilized in this market, with aluminum cans being extensively used in the beverage sector for soft drinks, beer, and energy drinks. Sustainability is a significant driver in this market, as consumers and businesses increasingly prioritize environmental impact. Metal packaging, being highly recyclable, aligns with these eco-conscious trends. Innovative printing technologies, including flexographic and offset printing, are employed to enhance the decorative appeal of metal packaging.

Barrier properties, such as moisture and oxygen barriers, are crucial for food and personal care packaging to maintain product quality and extend shelf life. Can bodies are engineered with advanced technologies, such as epoxy coatings and electroplating, to improve product protection and can recycling. Can closing systems, including tamper-evident seals, ensure product safety and integrity. The circular economy is a growing focus, with metal recycling, steel recycling, and aluminum recycling playing essential roles in reducing waste and minimizing the carbon footprint. Supplier relationships and quality control are vital aspects of the metal packaging supply chain, ensuring consistent product delivery and maintaining the highest standards.

Can manufacturing processes, including can filling, seaming, and can ends production, are continually evolving to improve efficiency and reduce costs. Coated cans, such as lacquered and enamel-coated cans, offer additional benefits, including improved product protection and enhanced visual appeal. The market is also witnessing the emergence of new product categories, such as aerosol cans and resealable cans, catering to diverse consumer needs. Inventory management and supply chain optimization are essential for metal packaging manufacturers to remain competitive. The market is also embracing digital printing and advanced technologies to cater to the growing demand for customized and personalized packaging designs.

Overall, the North American the market is a dynamic and evolving industry, driven by consumer preferences, technological advancements, and a focus on sustainability.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Metal Packaging Industry?

- The pharmaceutical sector's increasing demand for metal packaging is the primary market driver. Metal packaging's robustness, preservation capabilities, and regulatory compliance make it the preferred choice for housing sensitive pharmaceutical products, thereby fueling market growth.

- The market experiences growth due to its increasing adoption in the pharmaceutical sector. Metals like aluminum and steel are favored for pharmaceutical packaging due to their protective properties, ensuring product safety and integrity. These metals create an impermeable barrier against moisture, light, and air, which can degrade pharmaceutical products. Consequently, metal packaging extends product shelf life and maintains efficacy, delivering optimal consumer experience. Furthermore, the emphasis on patient safety, product authenticity, and tamper-evident packaging fuels market demand. Varnish coatings and enamel coatings are commonly used in metal packaging to enhance product protection and shelf life.

- Seaming machines facilitate the production of metal cans, while offset printing and digital printing techniques ensure high-quality printed labels. Sustainability is a significant consideration, with metal packaging offering a lower carbon footprint compared to other packaging options. The supply chain involves various stages, from raw material sourcing to manufacturing, distribution, and disposal, all of which impact the environmental impact of metal packaging. Overall, the market is driven by the need for effective and safe packaging solutions in various industries, particularly pharmaceuticals.

What are the market trends shaping the Metal Packaging Industry?

- The increasing demand for convenient and ready-to-eat products represents a significant market trend. Consumers are increasingly seeking out time-saving solutions for their meals, leading to the growing popularity of these products.

- The market is experiencing growth due to the rising consumer demand for convenient and ready-to-consume food and beverage products. Metal packaging, such as cans, trays, and jars, offers several advantages, including durability, extended shelf life, and ease of use. These benefits make metal containers an ideal choice for time-saving, ready-to-eat meals, snacks, and beverages. The trend is particularly prominent among busy professionals, young adults, and urban dwellers who prioritize convenience. Metal packaging's barrier properties, including light and moisture resistance, are essential for maintaining product quality and freshness. Advanced printing technologies and decoration techniques enable customization and branding, further increasing consumer appeal.

- Industrial packaging applications, such as resealable cans and electroplated cans, offer additional functionality and convenience. Oxygen barrier properties are crucial for preserving the freshness of beverage packaging, making metal containers a popular choice for this sector. Overall, the market is poised for continued growth as consumer preferences shift towards convenient and long-lasting food and beverage options.

What challenges does the Metal Packaging Industry face during its growth?

- The metal packaging industry faces significant growth challenges due to the volatile pricing of raw materials.

- The market encompasses various applications, including personal care packaging, food and beverage, and industrial packaging. The design of metal packaging plays a crucial role in product protection and shelf life. Two primary coatings used in metal packaging are epoxy and lacquered. Epoxy coatings provide superior resistance to chemicals, while lacquered cans offer excellent protection against moisture and light. Raw material sourcing is a significant aspect of the metal packaging industry, with steel, aluminum, and tinplate being the primary materials used. The cost of these raw materials significantly influences the price of the end product. Fluctuations in raw material prices, driven by economic conditions, currency fluctuations, commodity price volatility, transportation costs, and resource availability, pose a challenge to market participants.

- Effective waste management and can disposal are essential for the sustainability of the market. Recycling is a key focus area, with can recycling rates continuing to increase. Supplier relationships and quality control are essential for maintaining consistent product quality and ensuring customer satisfaction. Aerosol cans are another popular application in the market, offering convenience and product preservation. In conclusion, the market is influenced by various factors, including raw material prices, waste management, and product protection. The ability to navigate these challenges and maintain strong supplier relationships and quality control will be crucial for market success.

Exclusive Customer Landscape

The metal packaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the metal packaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, metal packaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amcor Plc - This company specializes in metal packaging innovations, featuring AmLite Heat Flex and AmLite Ultra as prominent solutions. AmLite Heat Flex offers flexibility for temperature-sensitive products, while AmLite Ultra ensures durability and protection. These advanced packaging options cater to diverse industries, enhancing product preservation and presentation.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amcor Plc

- Ardagh Group SA

- Ball Corp.

- BWAY Corp.

- CANPACK SA

- CCL Container

- COFCO Corp.

- Crown Holdings Inc.

- DS Containers

- Greif Inc.

- Herenco AB

- Kaira Can Co. Ltd.

- Kian Joo Can Factory Bhd

- Silgan Holdings Inc.

- Sonoco Products Co.

- Tata Steel Ltd.

- Ton YI Industrial Corp.

- Toyo Seikan Group Holdings Ltd.

- Tubex GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Metal Packaging Market

- In January 2024, Ball Corporation, a leading metal packaging solutions provider, announced the launch of its innovative new product, the Ball QuadPack, a 100% aluminum, infinitely recyclable, and lightweight beverage can designed to reduce carbon emissions by up to 33% in the beverage industry (Ball Corporation Press Release).

- In March 2024, Ardagh Metal Packaging, a global metal packaging producer, entered into a strategic partnership with Nestlé, the world's largest food and beverage company, to develop and produce aluminum beverage cans for Nestlé's Nesquik brand, expanding Ardagh's reach in the food and beverage sector (Ardagh Metal Packaging Press Release).

- In May 2024, Novelis, the world's largest aluminum rolling and recycling company, completed the acquisition of Aleris Corporation, a leading global supplier of rolled aluminum products, for approximately USD2.6 billion, enhancing Novelis's position in the aluminum packaging market (Novelis Press Release).

- In April 2025, the European Union's Circular Economy Action Plan was officially adopted, including a commitment to increase the recycling of aluminum beverage cans to 90% by 2025, providing a significant boost to the market in Europe (European Commission Press Release).

Research Analyst Overview

- The market is characterized by continuous material science advancements and product innovation, leading to enhanced corrosion resistance and improved product safety. Raw material procurement strategies play a pivotal role in ensuring supply chain optimization and cost analysis. Metal decoration techniques, such as can coatings, offer enhanced shelf appeal and brand loyalty. Safety standards are a critical consideration, with a focus on consumer interaction, water usage, energy efficiency, and emission reduction. Waste reduction is another key trend, with recycling technologies and process optimization gaining traction. Product lifecycle management and regulatory compliance are essential for maintaining quality assurance and consumer preferences.

- The market also prioritizes regulatory compliance and sustainability, with a focus on emission reduction and recycling technologies. Moreover, the industry is exploring innovative ways to enhance ease of handling and reduce material usage, while maintaining the necessary safety and performance standards. The integration of technology in metal packaging, such as smart labels and QR codes, offers opportunities for consumer engagement and product traceability. Overall, the market is dynamic, with a focus on material innovation, process optimization, and sustainability. Companies must navigate the complex supply chain, regulatory landscape, and consumer preferences to remain competitive.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Metal Packaging Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

178 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.7% |

|

Market growth 2024-2028 |

USD 19.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.6 |

|

Key countries |

China, US, Germany, Japan, Canada, UK, South Korea, India, France, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Metal Packaging Market Research and Growth Report?

- CAGR of the Metal Packaging industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the metal packaging market growth of industry companies

We can help! Our analysts can customize this metal packaging market research report to meet your requirements.