Metering Pumps Market Size 2024-2028

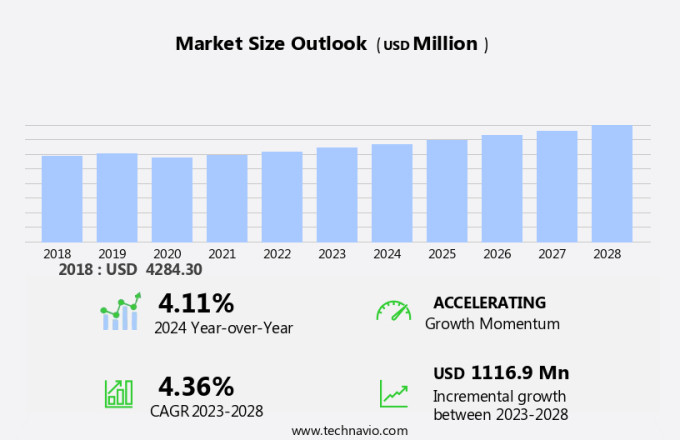

The metering pumps market size is forecast to increase by USD 1.12 billion at a CAGR of 4.36% between 2023 and 2028. The market is experiencing significant growth due to the increasing focus on water conservation and treatment, particularly in the areas of wastewater management and freshwater consumption. Precise chemical dosing is essential in wastewater treatment facilities to meet environmental standards and ensure effective water purification processes. The adoption of intelligent metering pumps and Coriolis mass flowmeters is on the rise, enabling more accurate and efficient dosing. Freshwater resources are under threat from pollution, making the need for advanced water treatment technologies more pressing. Materials of construction for metering pumps are also a key consideration, with corrosion-resistant materials gaining popularity to ensure longevity and reliability.

The metering pumps market plays a crucial role across various industries, including petrochemical industries, oil and gas exploration, and specialty chemicals. These positive displacement devices offer precise chemical injection for fluid control systems, ensuring optimal performance in applications such as diagnostic equipment, personal care, and the food and beverage sector. Metering pumps are vital for accurate dosing and maintaining consistent flow rates in fluid handling, which is essential in the efficient operation of these industries. With the continuous rise in crude oil production and economic activities, the demand for high-quality water for various industrial processes is escalating. In petrochemical and oil and gas exploration, they are used for injecting chemicals that enhance production processes. In the personal care and cosmetic sector, metering pumps ensure the safe and consistent formulation of products. Their versatility continues to drive demand across diverse sectors.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Diaphragm

- Plunger

- Others

- End-user

- Water and wastewater industry

- Oil and gas industry

- Chemical and petrochemical industry

- Food and beverage industry

- Others

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- UK

- North America

- US

- Middle East and Africa

- South America

- APAC

By Product Insights

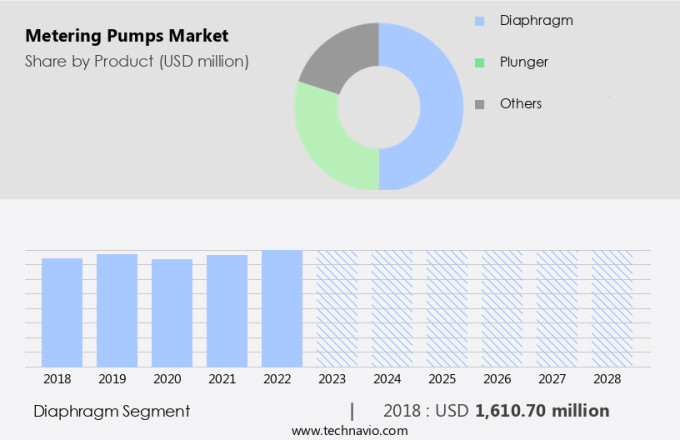

The diaphragm segment is estimated to witness significant growth during the forecast period. Diaphragm metering pumps are widely utilized in various industries for dosing and chemical injection applications due to their ability to handle fluids containing solid materials without corrosion or damage. These pumps are preferred over other types due to their safety, precision, and operational efficiency. Unlike other pump types, diaphragm pumps do not have moving parts that come into direct contact with the fluid, except for the valves. This design feature allows for their operation through mechanical or hydraulic means. Maintaining a diaphragm metering pump in good condition can lead to significant cost savings over time. The market for diaphragm metering pumps is thriving due to the demand for digital pumping solutions and production capacity expansion.

Further, advanced features such as diagnostic capabilities, variable speed drives, and customization are increasingly being integrated into these pumps to meet the evolving needs of industries. Metals, polymers, and alloys are commonly used materials in the manufacturing of diaphragm metering pumps. The choice of material depends on the specific application requirements, such as corrosion resistance, temperature tolerance, and pressure resistance. The market for diaphragm metering pumps is expected to grow further due to the increasing demand for reliable and efficient pumping solutions. In summary, diaphragm metering pumps are a preferred choice for dosing and chemical injection applications due to their safety, precision, and operational efficiency.

Get a glance at the market share of various segments Request Free Sample

The diaphragm segment accounted for USD 1.61 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

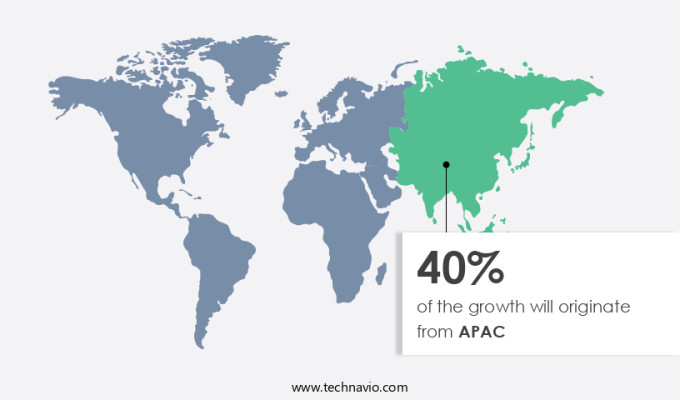

APAC is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in Asia Pacific is projected to experience significant growth during the forecast period, primarily driven by the increasing demand from the oil and gas and water and wastewater industries. The region's abundant natural resources and affordable labor costs are major factors contributing to this growth. In developing countries such as India and Singapore, the need for clean drinking water is escalating due to population growth and urbanization. This has led to increased investments in water treatment plants and upgrades to existing water supply systems. The petrochemical and chemical processing industries in the APAC region also rely heavily on metering pumps for precise measurement and delivery of chemicals and oil products. Overall, the market in Asia Pacific is poised for substantial expansion in the coming years.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Growing demand for water conservation and treatment is the key driver of the market. In the industrial sector, metering pumps play a crucial role in ensuring accurate measurement and delivery of fluid, particularly in applications such as Refinery Throughput, Water Treatment Plants, and Chemical Additives. The market is experiencing significant growth due to the increasing focus on sustainable development goals, including water conservation and environmental preservation. Governments and organizations are investing heavily in water and wastewater treatment plants to address the severe shortage of potable water and comply with stringent regulations.

Moreover, the increasing number of these plants is driving the demand for metering pumps, as they are essential for the precise dosing of chemicals and other additives. The market is expected to continue its growth trajectory, driven by the need for efficient and accurate fluid measurement and delivery solutions.

Market Trends

The adoption of intelligent metering pumps is the upcoming trend in the market. Intelligent and programmable metering pumps have revolutionized the market for standard metering pumps, particularly in industries such as medical, laboratory, and pharmaceutical. These advanced pumps offer precise chemical dosing, ensuring compliance with environmental standards and water purification processes. Wastewater management and freshwater consumption are crucial aspects of various industries, and the use of metering pumps in wastewater treatment facilities is essential for effective water pollution control. Intelligent metering pumps are programmable, allowing for automated fluid handling and reducing the risk of human error. In the medical industry, these pumps are utilized for dispensing solvents, lubricants, and adhesives in medical component assembly and reagents in diagnostic test kit packaging.

Additionally, laboratories rely on metering pumps for automated fluid and sample handling in analytical instrumentation. In the pharmaceutical sector, these pumps are employed for low and micro-volume production, dispensing chemicals into vials, ampules, and syringes, sterilizing chemical metering, and dissolving system chemical additions. Materials of construction for metering pumps are selected based on the specific application and chemical compatibility to ensure longevity and efficiency. The use of metering pumps contributes to the conservation of freshwater resources and the reduction of water pollution, making them an essential component in various industries' water management systems.

Market Challenge

Growing adoption of Coriolis mass flowmeters is a key challenge affecting the market growth. In various industries, including water and wastewater, metals and minerals, mining, power, paper and pulp, petroleum, and chemical and petrochemical sectors, Coriolis mass flowmeters have gained significant traction as an alternative to metering pumps for precise flow measurement. These flowmeters are particularly effective in handling corrosive fluids, such as acids and bases, and challenging applications involving slurries and viscous liquids.

Moreover, coriolis mass flowmeters utilize advanced technology to detect the mass flow rate of liquids and dense gases, offering high precision, ease of handling in sanitary applications, and low maintenance. The versatility of Coriolis mass flowmeters allows them to cater to a broad range of applications, ensuring process efficiency and product quality. By providing accurate and consistent flow measurement, these instruments contribute to cost savings, improved productivity, and enhanced safety in various industries.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Swelore Engineering Pvt. Ltd.: The company offers metering pumps such as Bran Luebbe metering pumps.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alltech dosing systems GmbH

- Atlas Copco AB

- Blue-White Industries Ltd.

- Dover Corp.

- Fluid Metering Inc.

- Grundfos Holding AS

- IDEX Corp.

- Ingersoll Rand Inc.

- Iwaki Co. Ltd.

- KNF DAC GmbH

- Lutz-Jesco GmbH

- March May Ltd.

- Nikkiso Co. Ltd.

- NOV Inc.

- ProMinent GmbH

- Schlumberger Ltd.

- SEKO SpA

- Spirax Sarco Engineering Plc

- SPX FLOW Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Metering pumps play a crucial role in various industries such as oil and gas, water treatment, and chemical processing. These pumps are essential for precise chemical dosing in different applications, including refinery throughput, water treatment plants, and desalination plants. Metering pumps are used to handle a wide range of fluids, including corrosives, acids, bases, slurries, and viscous liquids. The water treatment segment is a significant market for metering pumps due to the growing demand for clean drinking water and wastewater treatment. The industrial sector, particularly chemical processing industries, also relies heavily on metering pumps for precise fluid control in their processes. Metering pumps are available in different types, such as diaphragm pumps and piston or plunger pumps, each with its unique advantages. Diaphragm pumps are ideal for low-pressure applications, while piston pumps are suitable for handling high-pressure fluids.

Further, the metering pump market is driven by the need for sustainable development goals, such as freshwater consumption and wastewater management. Environmental standards and water purification processes are also key factors driving the market's growth. Materials of construction, such as metals, polymers, and alloys, play a significant role in the metering pump market. Digital pumping solutions, variable speed drives, diagnostic capabilities, customization, engineering, and automation are some of the advanced features that are increasingly being adopted in metering pumps to enhance their performance and efficiency. The energy industry is another significant market for metering pumps, particularly in the context of production capacity expansion and the need for monitoring and controlling fluid flow in various processes. Overall, the metering pump market is expected to grow significantly in the coming years due to its critical role in various industries and the ongoing demand for precise fluid control and sustainable solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

187 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 1.12 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Regional analysis |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 40% |

|

Key countries |

China, US, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Alltech dosing systems GmbH, Atlas Copco AB, Blue-White Industries Ltd., Dover Corp., Fluid Metering Inc., Grundfos Holding AS, IDEX Corp., Ingersoll Rand Inc., Iwaki Co. Ltd., KNF DAC GmbH, Lutz-Jesco GmbH, March May Ltd., Nikkiso Co. Ltd., NOV Inc., ProMinent GmbH, Schlumberger Ltd., SEKO SpA, Spirax Sarco Engineering Plc, SPX FLOW Inc., and Swelore Engineering Pvt. Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch