Micro Lending Market Size 2025-2029

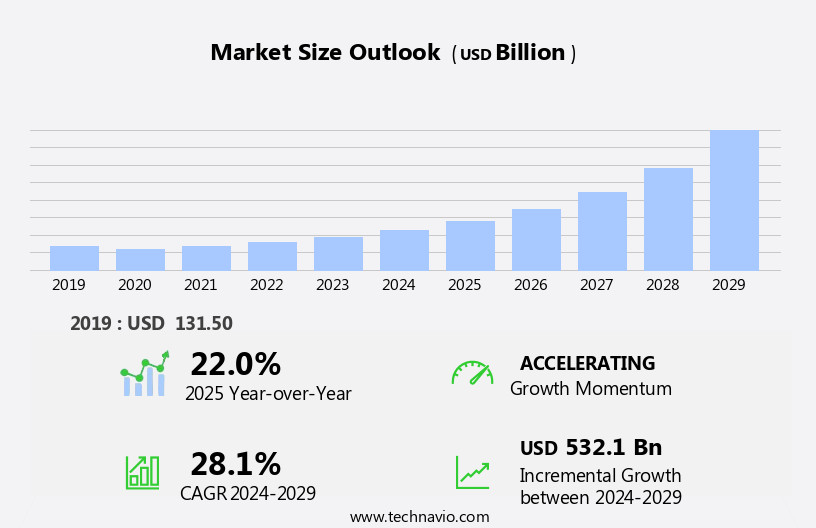

The micro lending market size is forecast to increase by USD 532.1 billion at a CAGR of 28.1% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of advanced technology in microfinancing. This technological evolution is enabling financial institutions to expand their reach and provide more accessible and efficient services to a larger population, particularly in developing nations. However, despite this progress, there remains a substantial untapped market due to the lack of awareness about financial services in certain regions. This presents both opportunities and challenges for market participants. On the one hand, there is a vast potential customer base waiting to be served, offering significant growth prospects. On the other hand, there are complexities in reaching and serving these customers effectively, requiring innovative solutions and strategic partnerships.

- One major trend is the adoption of advanced technology in microfinancing, enabling faster and more efficient loan processing and underwriting. This technology includes mobile applications, biometric identification, and artificial intelligence. Another trend is the increasing adoption of micro lending in developing nations, where access to traditional banking services is limited. Companies seeking to capitalize on this market opportunity must navigate these challenges with agility and a deep knowledge of local market dynamics. By leveraging technology, building strong partnerships, and addressing the unique needs of the market, businesses can effectively serve this growing customer base and differentiate themselves in a competitive landscape.

What will be the Size of the Micro Lending Market during the forecast period?

- The market continues to gain momentum as a critical component of global financial inclusion efforts. This market encompasses various financial inclusion strategies, including digital financial inclusion, loan disbursement through fintech platforms, and microfinance trends that prioritize responsible lending and sustainable finance. Financial inclusion policies have driven market growth, enabling greater financial resilience and empowerment for individuals and communities. Despite the market's progress, challenges persist, such as loan default, financial literacy programs, and debt management. Impact measurement, social impact reporting, and financial inclusion metrics are essential for assessing the market's success and addressing these challenges. Regulations and best practices play a crucial role in ensuring microfinance remains an effective solution for inclusive finance.

- Borrowers, often from economically disadvantaged backgrounds, use these loans for various purposes, including starting small businesses in retail, food services, handicrafts, livestock rearing, transportation, recycling, and health services. Micro lending plays a crucial role in addressing income inequality by providing access to financial services for those excluded from the formal banking sector. Collateral is usually not required for these loans, making them more accessible than traditional loans. Financial inclusion initiatives have seen significant investment opportunities, with fintech startups and alternative data sources driving innovation. The market's future direction lies in data-driven lending, financial inclusion frameworks, and inclusive finance that caters to the unique needs of microenterprises and their development. Overall, the market's continued growth and evolution reflect its vital role in fostering financial inclusion and promoting economic prosperity.

How is this Micro Lending Industry segmented?

The micro lending industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Source

- Banks

- NBFCs

- MFIs

- End-user

- Small enterprises

- Solo entrepreneurs

- Micro-entrepreneurs

- Geography

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- North America

- US

- Middle East and Africa

- South America

- Brazil

- APAC

By Source Insights

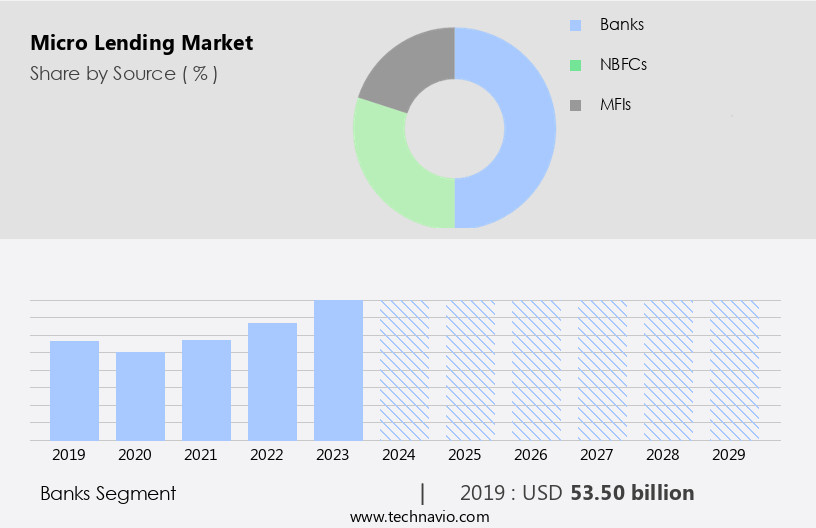

The banks segment is estimated to witness significant growth during the forecast period. Micro lending banks provide financial services, such as loans, savings accounts, and insurances, to individuals with limited income. Established by various entities, including individuals, community organizations, private corporations, and foreign investors, these banks focus on economically disadvantaged clients, low-income households, and unbanked populations, including marginalized groups like women, youth, disabled individuals, and informal sector operators, such as micro-entrepreneurs and subsistence farmers. In developing countries, like India and Nigeria, micro lending banks play a significant role in financial inclusion. For instance, the establishment of the first Regional Rural Bank (RRB), Prathama Grameen Bank, in Moradabad, Uttar Pradesh, India, was sponsored by Syndicate Bank following the RRBs Act legislation.

Digital identity and financial access are crucial aspects of micro lending. Digital financial services, including digital lending, mobile lending, and peer-to-peer lending, are increasingly popular due to their convenience and accessibility. Data analytics, machine learning, and alternative credit scoring are essential tools for loan origination and risk assessment. Financial inclusion programs, open banking, social impact investing, and financial technology (FinTech) are driving innovation in micro lending. Digital wallets, loan repayment, and loan terms are essential components of micro lending strategies. Financial education and financial literacy are crucial for sustainable development and poverty alleviation. Social responsibility and interest rates are significant considerations in micro lending.

Microfinance institutions (MFIs) play a vital role in providing financial services to the underserved population. The use of artificial intelligence (AI) in micro lending enhances efficiency and accuracy in loan processing and risk assessment. Mobile payments and loan origination are transforming the micro lending landscape.

Get a glance at the market report of share of various segments Request Free Sample

The Banks segment was valued at USD 53.50 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

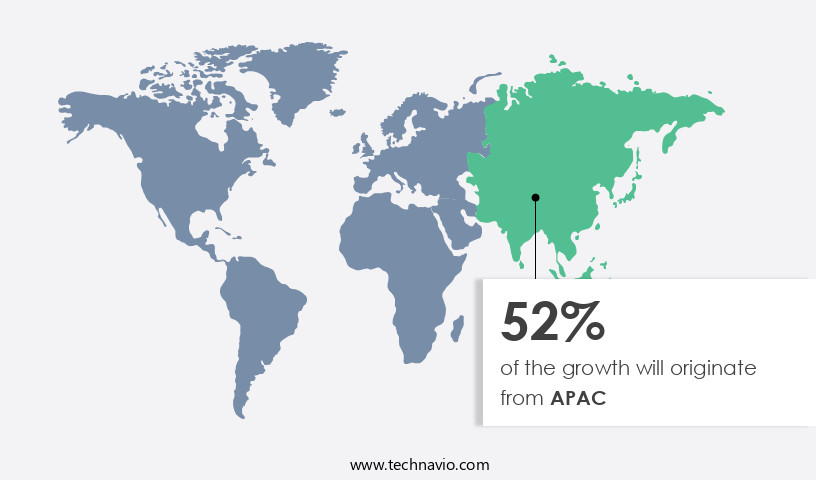

APAC is estimated to contribute 52% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in Asia Pacific (APAC) holds the largest revenue share and is expected to continue its dominance during the forecast period. Favorable government regulations, such as credit guarantee schemes (CGSs), particularly for rural populations, foster a conducive environment for micro lending in the region. The wave in digital financial services and digital lending has led to increased financial access for individuals and small businesses in developing countries. Digital identity, data analytics, and machine learning are transforming the micro lending landscape. Financial inclusion programs, open banking, social impact investing, and financial services innovation are driving the market growth.

Digital wallets, loan origination platforms, and alternative credit scoring are revolutionizing the loan application process. Artificial intelligence (AI) and mobile lending are becoming increasingly popular, enabling quicker risk assessment and loan repayment tracking. Peer-to-peer lending and microfinance institutions (MFIs) are key players in the market, providing financial services to the underbanked and unbanked populations. Financial literacy and sustainable development are essential components of financial inclusion strategies. Interest rates and loan terms are critical factors influencing borrower decisions. Financial technology (FinTech) companies are leveraging mobile payments and digital wallets to expand their reach and offer convenient loan repayment options.

Social responsibility and financial education are essential aspects of micro lending, ensuring borrowers make informed decisions and repay their loans on time. The market's continued growth is crucial for poverty alleviation and economic empowerment in developing countries.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Micro Lending Industry?

-

Adoption of advanced technology in micro financing is the key driver of the market. The market is experiencing significant growth due to the integration of digital technologies and increasing urbanization. This market plays a pivotal role in creating job opportunities, particularly in developing countries, where it empowers women and small business owners. Natural disasters and rising income inequality have further prioritized the importance of micro lending in providing financial assistance. Fintech companies are leveraging advanced technologies such as big data, machine learning, blockchain, and mobile technology to streamline loan disbursal processes and improve creditworthiness assessment. Regulatory reforms are also facilitating the expansion of this market, enabling the use of credit scoring systems and risk management tools for underwriting.

-

In addition, these advancements are transforming the micro lending landscape, making it more accessible and efficient for self-employed individuals and small enterprises. The widespread use of smartphones and internet connectivity is further enhancing the market's reach and impact, contributing to social good and social impact investment.

What are the market trends shaping the Micro Lending Industry?

- Rise in adoption of micro lending in developing nations is the upcoming market trend.

- Micro lending is transforming the lives of numerous individuals in Asia Pacific, South America, and the Middle East by providing them with essential financial assistance. Government initiatives promoting micro lending in various nations fuel the expansion of the market. Moreover, the proliferation of micro lenders enables emerging economies to alleviate poverty and enhance the living standards of underprivileged populations. In Africa, farmers are increasingly turning to micro lending to purchase crops, thereby contributing to the market's growth.

- Furthermore, people in rural areas are securing loans from micro lenders to establish businesses and improve their livelihoods, ensuring the market's continued growth throughout the forecast period.

What challenges does the Micro Lending Industry face during its growth?

- Lack of awareness about financial services is a key challenge affecting the industry's growth. Microfinance Institutions (MFIs) play a crucial role in providing financial services to underbanked populations, particularly in low-income and developing countries. However, they encounter significant challenges due to limited financial literacy among their customer base. Many individuals lack a comprehensive knowledge of micro lending and the loan process, leading to poor repayment rates and increased risk of defaults for MFIs. Furthermore, MFI representatives at the field level may not be well-versed in the regulations, such as pricing guidelines. The absence of financial literacy is a major hurdle, as it hinders effective communication between MFIs and their clients.

- This issue necessitates increased efforts to educate both MFI representatives and their customers about financial services and the importance of repaying loans on time. Enhancing financial literacy will not only benefit MFIs by reducing defaults but also empower individuals to make informed financial decisions and improve their overall economic well-being.

Exclusive Customer Landscape

The micro lending market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the micro lending market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, micro lending market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accion International - The company offers solutions for micro lending where low-interest loans are provided to low-income individuals and groups.

- Accion International

- Bajaj Finserv Ltd.

- Bluevine Inc.

- ESAF Small Finance Bank

- Fincare Small Finance Bank Ltd.

- Fusion Micro Finance Ltd.

- HDB Financial Services Ltd.

- ICICI Bank Ltd.

- Larsen and Toubro Ltd.

- LendingClub Corp.

- Lendio Inc.

- Lendr.Online LLC

- Oakam Ltd.

- On Deck Capital Inc.

- Panamax Inc.

- Small Industries Development Bank of India

- Ujjivan Small Finance Bank Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of digital financial services aimed at expanding financial access to individuals and small businesses. This sector is characterized by its focus on economic empowerment and financial inclusion, leveraging digital identity and data analytics to assess creditworthiness and streamline loan origination. Digital identity plays a crucial role in the market, enabling financial institutions to verify applicant information and assess risk more effectively. Machine learning algorithms and data analytics are increasingly being employed to analyze applicant data, providing alternative credit scoring models that go beyond traditional credit history. Digital lending platforms offer a range of loan terms and repayment structures, catering to the diverse needs of borrowers.

Peer-to-peer lending and mobile lending have gained popularity in recent years, providing greater access to financing for those who may not have access to traditional banking services. Open banking and digital financial services have also played a significant role in expanding financial inclusion, allowing users to access a range of financial services through digital wallets and mobile payments. Social impact investing and financial literacy programs have further bolstered the sector's social responsibility and sustainability efforts. Financial services innovation continues to drive growth in the market, with artificial intelligence (AI) and machine learning being increasingly utilized to improve risk assessment and loan origination processes.

Impact investing and financial inclusion strategies have also gained traction, with investors seeking to generate social and environmental returns alongside financial returns. Despite these advancements, challenges remain in the market. Risk assessment and loan repayment remain key concerns, with lenders seeking to balance the need for accessibility with the need for sustainable lending practices. Interest rates and financial technology (fintech) regulations also continue to evolve, shaping the competitive landscape and impacting market growth. The market is a dynamic and evolving sector, driven by a focus on financial inclusion, digital identity, and data analytics. With continued innovation and investment in digital financial services, the sector is poised to expand access to financing for individuals and small businesses around the world.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

191 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 28.1% |

|

Market growth 2025-2029 |

USD 532.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

22.0 |

|

Key countries |

China, US, India, South Korea, Germany, Japan, UK, Saudi Arabia, Brazil, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Micro Lending Market Research and Growth Report?

- CAGR of the Micro Lending industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the micro lending market growth and forecasting

We can help! Our analysts can customize this micro lending market research report to meet your requirements.