Microarray Biochips Market Size 2024-2028

The microarray biochips market size is forecast to increase by USD 17.28 billion, at a CAGR of 22.2% between 2023 and 2028.

- The market is characterized by a growing number of collaborations among key players, which is expanding market presence and driving innovation. This strategic approach is essential in the capital-intensive market, where significant investments are required for research and development. A notable trend in the market is the emergence of Label-One-Component (LOC) technology, offering advantages such as improved sensitivity and specificity. However, the high cost of microarray biochips remains a significant challenge for market growth. Companies seeking to capitalize on opportunities must navigate this obstacle by focusing on cost reduction through economies of scale and process optimization.

- Additionally, collaborations and partnerships can help share research and development costs and accelerate time-to-market for innovative products. The strategic landscape of the market is dynamic, with ongoing advancements in technology and a growing demand for personalized medicine, creating opportunities for companies to differentiate themselves and gain a competitive edge.

What will be the Size of the Microarray Biochips Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and expanding applications across various sectors. Protein microarray technology, a crucial component, enables high-throughput analysis of protein-protein interactions and antibody discovery. Reproducibility metrics and spot morphology analysis ensure consistency and accuracy in data generation. Label incorporation methods, such as biotinylated target cDNA and reverse transcription PCR, facilitate efficient probe attachment. Gene ontology enrichment and pathway analysis tools provide insights into biological functions and molecular interactions. Data mining algorithms, including clustering algorithms and fold change calculations, facilitate pattern recognition and discovery. Microarray data normalization techniques, such as CDNA microarray platforms and genomic DNA extraction, ensure data consistency.

Microarray experimental design, hybridization kinetics, and high-throughput screening are essential for optimizing data generation and analysis. Single nucleotide polymorphism (SNP) detection and comparative genomic hybridization offer valuable insights into genetic variations. Data quality assessment, signal-to-noise ratios, and background correction methods ensure data accuracy and reliability. In situ hybridization and fluorescence detection methods facilitate visualization and analysis of gene expression at the cellular level. Differential gene expression analysis provides insights into disease mechanisms and therapeutic targets. Microarray scanner systems and image analysis software facilitate efficient and accurate data analysis. DNA microarray technology continues to evolve, offering exciting possibilities for research and diagnostic applications.

How is this Microarray Biochips Industry segmented?

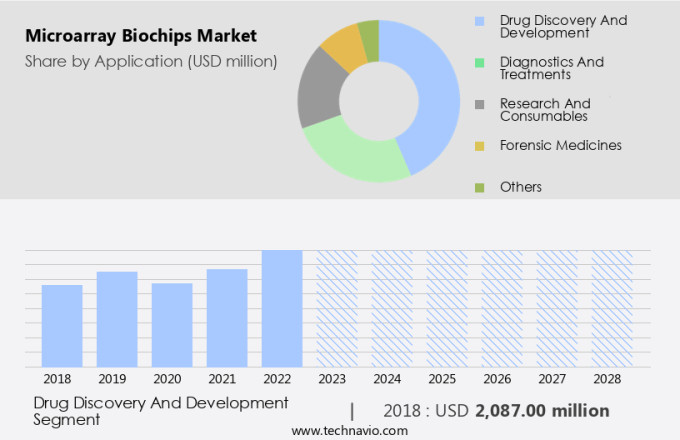

The microarray biochips industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Drug discovery and development

- Diagnostics and treatments

- Research and consumables

- Forensic medicines

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Application Insights

The drug discovery and development segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth due to its increasing application in drug discovery, driven by the rising preference for personalized medicines. With the global population aging, the demand for better healthcare solutions is escalating, leading manufacturers to continually innovate and improve microarray technology. In genomics and proteomics, microarray biochips are increasingly utilized, further fueling market growth. Advancements in protein microarray technology ensure greater reproducibility and accuracy, while spot morphology analysis and label incorporation enhance data reliability. Gene ontology enrichment and pathway analysis tools enable deeper insights into biological processes, and clustering algorithms facilitate the identification of complex relationships between genes.

Genomic DNA extraction and microarray data normalization are crucial steps in ensuring data quality, while high-throughput screening and single nucleotide polymorphism analysis accelerate research. Image analysis software, biotinylated target cDNA, reverse transcription PCR, and comparative genomic hybridization are essential techniques used in microarray experiments. Stringency washing conditions, RNA extraction methods, and microarray experimental design all contribute to optimizing hybridization kinetics. Data quality assessment, signal-to-noise ratios, and background correction methods ensure accurate data interpretation. In situ hybridization, fluorescence detection, and differential gene expression analysis provide valuable insights into gene function and regulation. Microarray scanner systems and DNA microarray technology facilitate gene expression profiling, offering a comprehensive understanding of gene expression patterns.

The market's evolution is characterized by continuous innovation in technology, ensuring its relevance and growth in the rapidly advancing field of life sciences.

The Drug discovery and development segment was valued at USD 2.09 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, particularly in North America, which currently leads in terms of both value and volume. This region's dominance is attributed to its advanced infrastructure for medical research, focusing on genomics and proteomics. North America's healthcare sector has been at the forefront of innovation, with rapid advancements in robotics, drug formulations, and microarray technology applications. Gene identification, DNA sequencing, and COVID-19 drug development activities are major contributors to this market's growth in the region. Technologically, North America is making strides, especially in areas like robotics and pharmaceuticals, where microarray technology is extensively used.

Protein microarray technology, a crucial aspect of this market, enables high-throughput screening, differential gene expression analysis, and single nucleotide polymorphism detection. Reproducibility metrics, spot morphology analysis, label incorporation, gene ontology enrichment, data mining algorithms, fold change calculations, pathway analysis tools, clustering algorithms, genomic DNA extraction, microarray data normalization, and RNA extraction methods are essential components of microarray technology. Data quality assessment is crucial, with signal-to-noise ratios and background correction methods ensuring accurate results. Image analysis software, biotinylated target cDNA, reverse transcription PCR, comparative genomic hybridization, and in situ hybridization are integral to microarray experiments. Fluorescence detection and microarray scanner systems are used for data acquisition.

DNA microarray technology and gene expression profiling are essential for understanding biological processes and disease mechanisms. In summary, the market is thriving, with North America being a significant contributor due to its robust healthcare sector and technological advancements. Microarray technology's applications, including protein microarray technology, are crucial for gene identification, DNA sequencing, and drug development. The market's growth is underpinned by advancements in technology, such as data mining algorithms, pathway analysis tools, and clustering algorithms, which ensure accurate and reliable results.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Microarray Biochips Industry?

- A collaboration strategy that enhances market presence is the primary catalyst driving market growth.

- The market is characterized by intense competition due to the large number of players. Companies compete based on technology and pricing, but market presence is another significant differentiator. Research indicates that collaborations between companies can lead to improved results, enhancing profit margins. These collaborations often involve research and development, financial resources, and intellectual properties. Both manufacturers and end-users form alliances to expand their reach in this market. With the increasing importance of gene expression profiling, in situ hybridization, background correction methods, fluorescence detection, and DNA microarray technology, the demand for microarray biochips continues to grow.

- Differential gene expression analysis is a crucial application of microarray technology, providing valuable insights into various biological processes. Microarray scanner systems play a vital role in the detection and quantification of gene expression levels. These advancements in technology continue to drive innovation and growth in the market.

What are the market trends shaping the Microarray Biochips Industry?

- The emergence of Location-Based Services (LOBs) technology is currently a significant market trend. This cutting-edge technology is poised to revolutionize various industries, offering enhanced user experiences and improved efficiency through location data utilization.

- Microarray biochips, specifically protein microarray technology, are experiencing significant growth in various research applications. This technology enables the simultaneous analysis of thousands of proteins, providing valuable insights into biological processes and disease mechanisms. Reproducibility metrics and spot morphology analysis are crucial in ensuring the accuracy and reliability of protein microarray data. Label incorporation methods, such as covalent bonding and biotin-avidin interaction, have improved the sensitivity and specificity of protein microarray assays. Advanced data mining algorithms and fold change calculations facilitate the identification of differentially expressed proteins and the discovery of new biomarkers.

- Furthermore, gene ontology enrichment and pathway analysis tools enable the functional characterization of these proteins, providing a deeper understanding of their roles in biological pathways. Protein microarray technology continues to advance, offering new opportunities for research and development in various fields, including diagnostics, drug discovery, and biomarker identification.

What challenges does the Microarray Biochips Industry face during its growth?

- A capital-intensive market poses a significant challenge to the industry's growth trajectory.

- The market is an expensive endeavor for companies due to its capital-intensive nature. This high cost is a significant barrier to adoption in various application markets. Skepticism among investors and end-users regarding potential returns on investment is also prevalent. Despite continuous innovation, the microarray technology's accuracy can be affected due to its limited dynamic range. In the medical science field, microarray technology has proven successful, enabling researchers to gain insights into disease mechanisms at a molecular level. Clustering algorithms, genomic DNA extraction, RNA extraction methods, and microarray data normalization are essential processes in microarray experimental design.

- CDNA microarray platforms and gene chip fabrication involve the use of oligonucleotide probes. Stringency washing conditions are crucial to ensure specificity and accuracy in microarray data analysis. Microarray technology's potential is vast, and ongoing research and development efforts aim to address the challenges and improve its performance.

Exclusive Customer Landscape

The microarray biochips market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the microarray biochips market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, microarray biochips market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Agilent Technologies Inc. - Agilent's microarray biochips are engineered to interrogate CpG islands and related sites for methylated DNA analysis. These chips, utilized in affinity-based isolation techniques like methylated DNA immunoprecipitation, facilitate comprehensive DNA methylation profiling.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agilent Technologies Inc.

- Applied Microarrays Inc.

- Arrayit Corp.

- BioChain Institute Inc.

- Bio Rad Laboratories Inc.

- BioIVT LLC

- Biometrix Technology Inc.

- Danaher Corp.

- F. Hoffmann La Roche Ltd.

- Fluidigm Corp.

- General Electric Co.

- Illumina Inc.

- Merck KGaA

- Pantomics Inc.

- Perkin Elmer Inc.

- Protein Biotechnologies Inc.

- RayBiotech Life Inc.

- Sengenics Corp. LLC

- Super BioChips Laboratories

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Microarray Biochips Market

- In January 2024, Thermo Fisher Scientific, a leading life sciences solutions provider, announced the launch of a new line of Oncomine Microarray Kits, expanding its cancer research offerings (Thermo Fisher Scientific Press Release). In March 2024, Illumina, a global leader in genomic sequencing and array-based solutions, entered into a strategic partnership with Merck KGaA to develop and commercialize integrated solutions for translational and clinical research (Illumina Press Release).

- In April 2024, NanoString Technologies, a pioneer in the field of digital molecular diagnostics, raised USD100 million in a public offering to support the commercialization of its GeoMx Digital Spatial Profiler technology (NanoString Technologies SEC Filing). In May 2025, the European Commission approved the marketing authorization for Agilent Technologies' SurePrint G3 Human CNV 4x180K Microarray, enabling the company to expand its diagnostic offerings in Europe (Agilent Technologies Press Release). These developments underscore the ongoing innovation and expansion within the market, driven by new product launches, strategic partnerships, and regulatory approvals.

Research Analyst Overview

- The market encompasses various applications, including cancer research studies, bacterial identification, viral detection, forensic science, pharmaceutical research, and toxicology assessments. Quality control metrics and data preprocessing steps are crucial in ensuring accurate results in these applications. Probe design software and data visualization tools facilitate efficient microarray analysis. In agricultural biotechnology, microarray biochips are utilized for genotyping applications and disease diagnostics. Gene expression levels are monitored to identify biomarkers for personalized medicine and drug target identification. Environmental monitoring applications include pathogen detection and microbial community analysis. Laser scanning systems enable high-throughput analysis in clinical diagnostics and toxicology assessments.

- Trends in the market include the integration of microarray technology with next-generation sequencing and the development of advanced probe design software and data visualization tools. Microarray printing techniques are essential for producing high-quality biochips for various applications. In food safety testing, microarray biochips are used to detect contaminants and ensure product safety. Overall, the market continues to evolve, driven by advancements in technology and increasing demand for accurate, efficient, and cost-effective diagnostic and research solutions.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Microarray Biochips Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 22.2% |

|

Market growth 2024-2028 |

USD 17275.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

17.9 |

|

Key countries |

US, UK, Germany, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Microarray Biochips Market Research and Growth Report?

- CAGR of the Microarray Biochips industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the microarray biochips market growth of industry companies

We can help! Our analysts can customize this microarray biochips market research report to meet your requirements.