Military Logistics Market Size 2024-2028

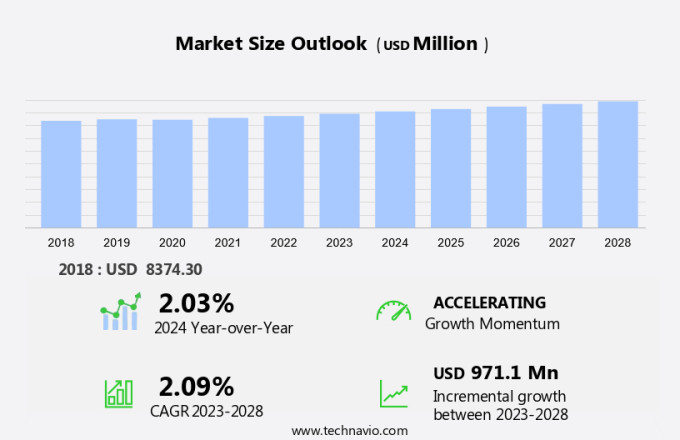

The military logistics market size is forecast to increase by USD 971.1 million, at a CAGR of 2.09% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for international peacekeeping operations and the globalization of military operations. With the rise in geopolitical instability and conflicts worldwide, the need for efficient and effective logistics support for military forces is becoming increasingly crucial. This trend is further amplified by the growing regulatory compliance related to military logistics, ensuring the secure and ethical transportation and handling of supplies. However, the market also faces several challenges. The complex and often unpredictable nature of military operations presents unique logistical challenges, such as the need for rapid deployment and the transportation of large quantities of supplies over long distances.

- Additionally, the security risks associated with military logistics, including the potential for theft, damage, or interception, require robust security measures to mitigate these risks. Furthermore, the need for interoperability between different military forces and logistics systems can be a significant challenge, requiring extensive coordination and collaboration. Companies seeking to capitalize on the opportunities in the market must be agile, innovative, and able to navigate these challenges effectively to provide value to their clients and stakeholders.

What will be the Size of the Military Logistics Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities shaping its landscape. Logistics planning plays a crucial role in ensuring the seamless integration of various sectors, including spare parts management, fleet management, and transportation management systems. Risk management and maintenance and repair are essential components, with predictive analytics and real-time tracking enabling proactive measures. Logistics software and warehouse management systems facilitate network security and cargo security, ensuring the protection of valuable assets. Air cargo carriers and cargo ships are integral to military transportation, with contingency planning and demand forecasting critical for efficient deployment operations. Military vehicles, from tactical vehicles to heavy-duty trucks, require logistical support for fuel efficiency and resource allocation.

Humanitarian aid and emergency response operations necessitate robust logistical planning and distribution networks. Data analytics and asset tracking are essential for optimizing transportation and enhancing supply chain resilience. The ongoing unfolding of market activities highlights the importance of logistical solutions in various military applications. From combat support to disaster relief efforts, logistics plays a pivotal role in ensuring mission success. The integration of data encryption, network security, and cargo security solutions further strengthens the market's capabilities. Logistical challenges continue to evolve, necessitating innovative solutions. The market's dynamism underscores the importance of adaptability and flexibility in logistical planning and execution.

As military operations become increasingly complex, logistics solutions must continue to evolve to meet the demands of the ever-changing landscape.

How is this Military Logistics Industry segmented?

The military logistics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Army

- Navy

- Airforce

- Type

- Logistics and distribution

- Facility management

- Services

- Geography

- North America

- US

- Europe

- France

- Russia

- APAC

- China

- India

- Rest of World (ROW)

- North America

By End-user Insights

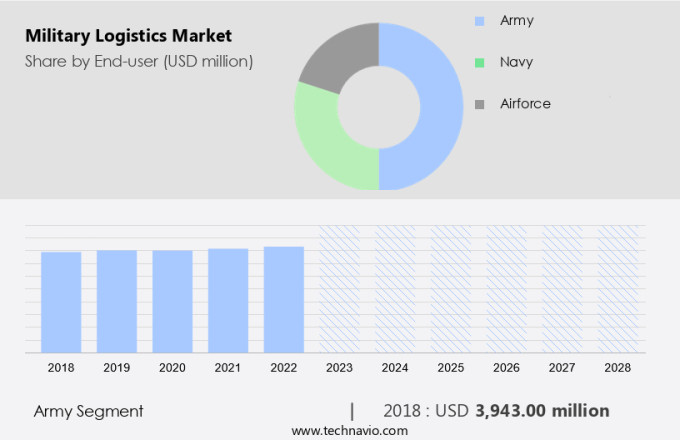

The army segment is estimated to witness significant growth during the forecast period.

In the military logistics sector, three distinct supply chains serve the army segment. The first chain focuses on the swift transportation of light commodities like food, medicine, and clothing. The second chain handles the movement of major weapon systems requiring prolonged repair and maintenance. Lastly, the deployment chain facilitates the rapid movement of large troops in a short timeframe. Enhancing supply chain efficiency involves digitizing inventories, employing technology for real-time monitoring of movement, repair, and maintenance, and outsourcing supply and repair services to capitalize on the market's growing strength. Over 85% of military materials are transported commercially. Logistics training plays a crucial role in ensuring the effective management of military supply chains.

Heavy-duty trucks and cargo ships are essential for the transportation of military supplies, while fleet management and transportation optimization ensure their efficient use. Spare parts management and maintenance and repair are integral to keeping military aircraft and vehicles operational. Risk management strategies mitigate potential threats to military logistics operations. Inventory control, demand forecasting, and warehousing solutions are essential components of military logistics. Predictive analytics and real-time tracking enable effective contingency planning and combat support. Deployment operations require robust transportation networks and distribution systems. Data analytics, asset tracking, and logistics planning are vital for optimizing military logistics operations. Data encryption and network security ensure the protection of sensitive information.

Military logistics also includes disaster relief efforts and humanitarian aid, which require efficient coordination and resource allocation. Emergency response and fuel efficiency are essential factors in military transportation. The market is witnessing a trend towards supply chain resilience and the integration of technology to streamline logistics operations. Military transport companies and air cargo carriers provide essential services in this sector. Field operations require effective pallet loading and unloading, while logistics software and warehouse management systems facilitate the smooth functioning of military logistics operations.

The Army segment was valued at USD 3943.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

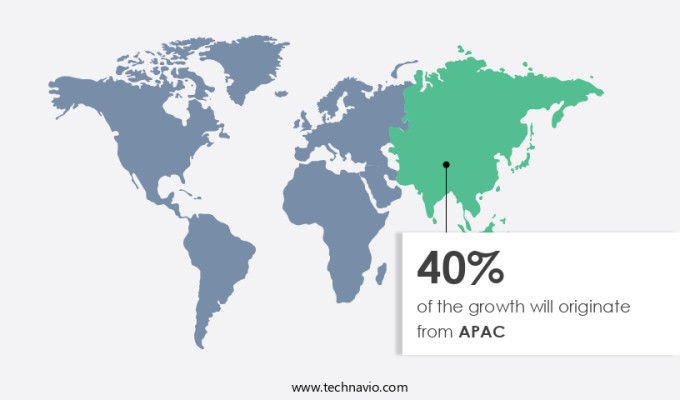

APAC is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In North America, the market is characterized by its size and complexity, driven by the significant military presence of countries like the US and Canada. Factors fueling market growth include escalating military budgets, the demand for advanced logistics technologies, and the requirement to support diverse military operations. Geopolitical tensions and the need to maintain a strong military presence in the region further influence the market. The US dominates the North American military logistics landscape, with a vast demand for logistics solutions encompassing heavy-duty trucks, military aircraft, fleet management, transportation management systems, risk management, maintenance and repair, transportation optimization, cargo ships, disaster relief logistics, inventory control, route planning, training simulations, tactical vehicles, supply chain resilience, contingency planning, warehousing solutions, demand forecasting, combat support, predictive analytics, deployment operations, real-time tracking, military vehicles, fuel efficiency, humanitarian aid, emergency response, resource allocation, military transport, distribution networks, data analytics, asset tracking, logistics planning, data encryption, logistics software, warehouse management systems, network security, cargo security, air cargo carriers, field operations, and pallet loading.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Military Logistics Industry?

- The increasing necessity for international peacekeeping operations serves as the primary catalyst for market growth in this sector.

- The market experiences significant growth due to the increasing demand for deployment operations in complex and diverse environments. Peacekeeping missions, which can span challenging terrains and regions affected by conflict or instability, require an extensive logistical infrastructure. This infrastructure includes transportation, supply chain management, and infrastructure development. Specialized equipment, such as armored vehicles and medical supplies, are essential for peacekeeping forces. Ensuring timely delivery and operational readiness is crucial. Real-time tracking and data analytics enable effective resource allocation and asset management during emergency response situations. Military transport and distribution networks play a vital role in supplying essential resources to military personnel.

- Fuel efficiency is another critical factor, as military vehicles often operate in remote locations with limited resources. Humanitarian aid missions also contribute to the market's growth. In emergency response situations, logistical support is essential for delivering aid to affected populations. Military logistics plays a crucial role in ensuring the efficient and effective distribution of resources. In conclusion, the market is driven by the need for comprehensive logistical support in peacekeeping and humanitarian aid operations. The market's growth is underpinned by the complexity and scope of these operations, which necessitate specialized equipment, transportation, and supply chain management solutions.

- Real-time tracking, data analytics, and fuel efficiency are essential considerations for military logistics providers.

What are the market trends shaping the Military Logistics Industry?

- Global military operations are increasingly being subjected to the trends of growing globalization. This market tendency signifies an expanding interconnectedness among military forces across the world.

- The market has experienced significant growth in response to the increasing globalization of military operations. Over the past decade, there has been a trend towards multinational military collaborations, with countries working together to address common security challenges. Military logistics has played a crucial role in supporting the deployment and withdrawal of troops and equipment in various parts of the world, such as Afghanistan and regions affected by terrorism and extremism. One key aspect of military logistics is ensuring the security of data and cargo. Advanced logistics software, warehouse management systems, and network security measures are essential for effective planning and execution of military operations.

- Data encryption and pallet loading techniques are used to secure supplies and maintain the integrity of military operations. Air cargo carriers play a vital role in transporting troops and equipment, and field operations require robust logistics planning to ensure the timely delivery of supplies. Network security and cargo security are critical concerns for military logistics, as the transportation of sensitive military equipment and supplies requires stringent security measures. The use of logistics software and warehouse management systems helps streamline operations and improve efficiency, while also ensuring the security of data and cargo. With the ongoing trend towards multinational military collaborations, the importance of effective military logistics planning and execution will continue to grow.

What challenges does the Military Logistics Industry face during its growth?

- The logistics industry faces significant growth challenges due to increasing regulatory compliance requirements. These regulations, which are mandatory for businesses in the sector, can be complex and time-consuming to implement, potentially hindering industry expansion.

- The market faces intricate regulatory challenges due to export control regulations that differ by country and region. These regulations limit the export of military equipment, technologies, and software to specific entities, carrying severe penalties for non-compliance, including hefty fines and damage to a logistics company's reputation. Customs regulations further complicate the movement of military equipment and supplies across international borders, necessitating extensive documentation and adherence to customs procedures. These requirements can impede logistics operations' speed and efficiency. Effective logistics training, fleet management, transportation management systems, risk management, maintenance and repair, and transportation optimization are crucial in navigating these complexities.

- Military logistics encompasses the movement of heavy-duty trucks, military aircraft, and cargo ships, necessitating a robust understanding of the unique challenges and regulations in this sector.

Exclusive Customer Landscape

The military logistics market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the military logistics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, military logistics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AECOM - This company specializes in providing comprehensive military logistics services, encompassing program management, design, acquisition, installation, and technical support for global telecommunications systems and interconnected command centers. Our expertise lies in ensuring seamless communication and information exchange between military forces through advanced technology solutions. We prioritize originality and innovation to elevate search engine exposure, while maintaining a clear and informative message reflecting a research analyst's perspective. Our services are not limited to any specific geographic location and cater to the needs of worldwide military operations.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AECOM

- Agility Public Warehousing Co. K.S.C.P

- Amentum Services Inc.

- Anham Fzco LLC

- BAE Systems Plc

- CACI International Inc.

- CLAXTON LOGISTICS SERVICES LLC

- CMA CGM SA Group

- Colak Group

- Crane Worldwide Logistics

- Crowley Maritime Corp.

- Fluor Corp.

- General Dynamics Corp.

- KBR Inc.

- Lockheed Martin Corp.

- ManTech International Corp.

- One Network Enterprises Inc.

- SEKO Logistics

- Thales Group

- Wincanton Plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Military Logistics Market

- In March 2024, Raytheon Technologies and L3Harris Technologies announced their merger, creating a leading defense technology company with a combined military logistics business worth over USD45 billion (Raytheon Technologies Press Release, 2024). This merger aims to enhance their logistics capabilities, including supply chain management, maintenance, repair, and overhaul services.

- In July 2024, Lockheed Martin and Amazon Web Services (AWS) signed a strategic partnership to modernize the U.S. Department of Defense's (DoD) logistics systems using cloud technologies (Lockheed Martin Press Release, 2024). This collaboration is expected to improve operational efficiency and data sharing between military branches, resulting in significant cost savings and increased agility.

- In October 2024, Boeing and Safran signed a joint venture agreement to manufacture and supply the U.S. Army with 1,000 next-generation T-7A Red Hawk trainer jets (Boeing Press Release, 2024). This deal includes the provision of logistics support and services for the entire fleet, further expanding Boeing's footprint in military logistics.

- In February 2025, the U.S. Department of Defense launched the Joint All Domain Logistics (JADL) initiative, aiming to create a unified logistics system for all military branches (DoD Press Release, 2025). This initiative focuses on improving interoperability, reducing redundancies, and increasing the speed and efficiency of logistics operations. The JADL is expected to save the DoD over USD1 billion annually (DoD Press Release, 2025).

Research Analyst Overview

- The market encompasses a complex web of global supply chains that serve forward operating bases with critical resources. Customs clearance and trade compliance are essential components of international logistics, ensuring seamless transportation of goods through various modes, including land, strategic airlift, and intermodal transportation. Drones in logistics and robotics are revolutionizing supply chain optimization, providing real-time data and enhancing efficiency in deployment zones. Sustainability in logistics, such as carbon footprint reduction and green logistics, is gaining traction, with logistics consulting firms advocating for logistics data standards and the adoption of autonomous vehicles, blockchain technology, and logistics analytics platforms.

- Logistics security standards remain paramount, safeguarding supply chain visibility and combating potential threats in both combat and non-combat zones. Multimodal transportation and logistics automation are key trends, enabling the military to respond swiftly and effectively to evolving mission requirements.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Military Logistics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

177 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.09% |

|

Market growth 2024-2028 |

USD 971.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.03 |

|

Key countries |

US, China, India, Russia, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Military Logistics Market Research and Growth Report?

- CAGR of the Military Logistics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the military logistics market growth of industry companies

We can help! Our analysts can customize this military logistics market research report to meet your requirements.