Mountain Biking Equipment Market Size 2024-2028

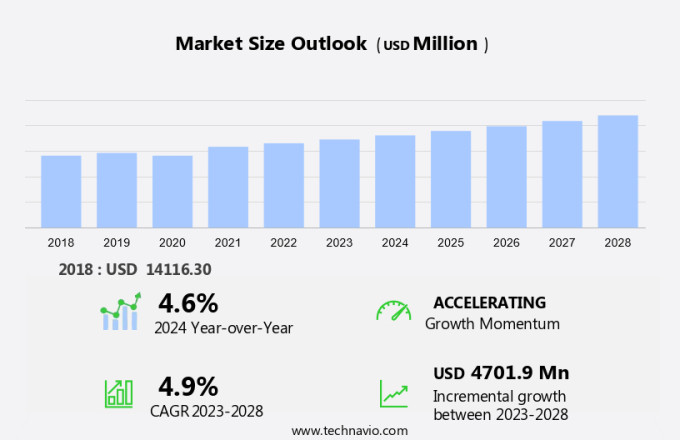

The mountain biking equipment market size is forecast to increase by USD 4.7 billion at a CAGR of 4.9% between 2023 and 2028.

- The market is experiencing significant growth due to several key drivers. The increasing popularity of mountain biking as a recreational activity, with the formation of numerous groups and clubs, is a major factor. Additionally, the rise of online sales channels makes it more convenient for consumers to purchase equipment. Risk management is another crucial driver, as riders seek to improve their performance and build confidence on the trails. However, challenges such as poor riding skills leading to accidents and high maintenance costs can hinder market growth. The industry is also focusing on becoming more eco-friendly, with initiatives like the Breeze initiative promoting non-polluting practices.

- Furthermore, there is a growing demand for comfortable and body-shape specific equipment among women mountain bikers, as well as women-only rides and races. Steep slopes, loose dirt, and grassy tracks present unique challenges for motorcycle riders, requiring specialized equipment. The market is expected to continue growing, with trends including the increasing importance of comfort and eco-friendliness. Protective gear, such as helmets, gloves, goggles, body armor, and elbow and knee pads, are essential for safety during these adventures.

What will be the Size of the Market During the Forecast Period?

- The market in the United States has witnessed significant growth due to the increasing popularity of mountain biking as a form of healthy recreation and off-road adventure. Mountain biking offers an opportunity to conquer various terrains, from muddy tracks to rocky trails, and provides a sense of community and culture among enthusiasts. Mountain biking is not just about riding the bike, but also about maintaining it. Proper maintenance ensures the durability of the bike and enhances safety. Mountain bike maintenance includes regular checks of components such as brakes, gears, and suspension.

- As the sport gains momentum, there has been an increasing demand for mountain bike accessories. These include protective gear, such as helmets and pads, as well as tools for bike repairs and upgrades. Thick tires are a popular accessory for mountain biking, providing better traction and stability on various terrains. Mountain biking is also becoming more accessible with the introduction of electric mountain bikes, or e-mountain bikes. These bikes offer the same off-road experience but with the added benefit of an electric motor, making it easier for riders with physical limitations or those looking for an endurance cycling challenge.

- Additionally, gravel cycling is another segment of the mountain biking market that is gaining traction. Gravel cycling involves riding on unpaved roads and trails, often in remote areas, providing a unique off-road experience. Sustainable tourism is another driving factor for the market. Mountain biking is a non-polluting form of transport, making it an eco-friendly option for exploring natural landscapes. Bikepacking, or carrying camping gear on a mountain bike, is a popular activity among mountain bikers, allowing for self-sufficient off-road adventures. Mountain bike safety is a top priority for riders, and there are various resources available to help ensure safety. The market offers a wide range of equipment, from mountain bikes and motorcycle accessories to safety gear and training resources, catering to the diverse needs of mountain bikers.

- Bike safety tips can be found online and in mountain biking publications. Mountain bike videos and training programs offer instruction on mountain bike skills and techniques. The mountain biking community is a diverse and passionate group of individuals, with a rich history and culture. Mountain bike racing is a popular activity, with various events and competitions held throughout the year. Women's cycling community is also an integral part of the mountain biking scene, with women-specific bikes and events catering to their needs. In conclusion, the market in the United States is thriving, driven by the increasing popularity of mountain biking as a form of healthy recreation and off-road adventure. The market offers a wide range of equipment, from mountain bikes and accessories to safety gear and training resources, catering to the diverse needs of mountain bikers.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Protective gears

- Mountain biking tools

- Geography

- North America

- Canada

- Mexico

- US

- Europe

- UK

- France

- Norway

- APAC

- China

- South America

- Brazil

- Middle East and Africa

- North America

By Product Insights

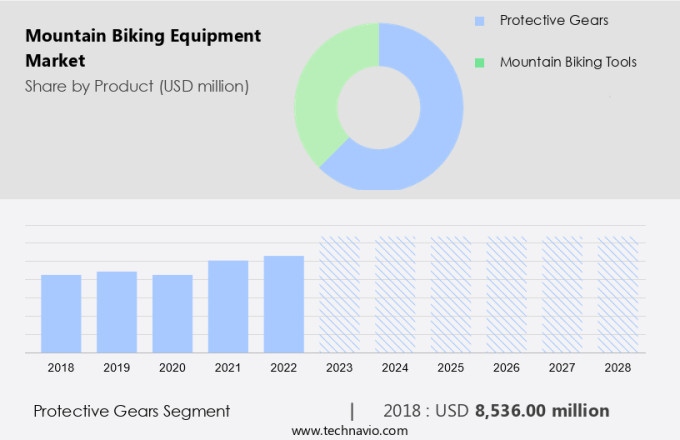

- The protective gears segment is estimated to witness significant growth during the forecast period.

Mountain biking is an exhilarating performance-based extreme sport that allows participants to traverse irregular terrains, including narrow tracks, fire roads, and rugged mountainous terrain. As leisure activities gain popularity, the demand for mountain biking equipment is projected to increase. Protective gear, such as helmets, gloves, goggles, body armor, and elbow and knee pads, are essential for safety during these adventures. The global market for mountain biking equipment is expected to expand significantly due to the increasing participation rates in this sport. Innovative product offerings, including ergonomic handle grips, advanced braking systems, and high-performance saddles, are driving the growth of this market.

Moreover, the advent of e-mountain bikes, which provide pedal-assistance, is attracting a younger generation to this sport. The European adventure tourism industry's growth is fueling the market. Consumers seek equipment that caters to their unique needs, leading companies to introduce innovative designs, colors, shapes, and weights. Shock absorbers and sturdy rims are crucial components of mountain biking equipment, ensuring a smooth ride on uneven terrain. Safety concerns are a top priority, making protective gear a significant segment of the market.

Get a glance at the market report of share of various segments Request Free Sample

The protective gears segment was valued at USD 8.54 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

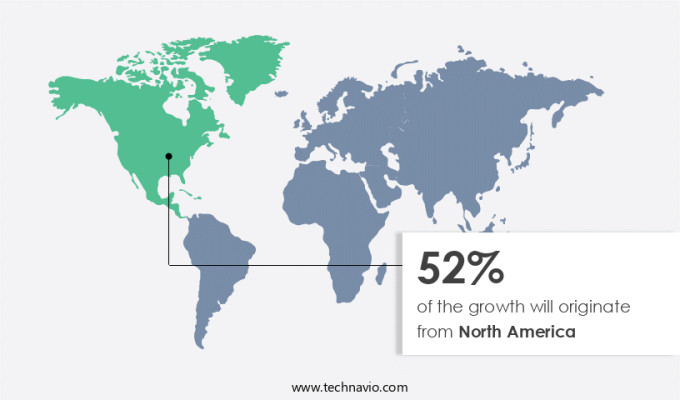

- North America is estimated to contribute 52% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The League of American Bicyclists and the Bicycle Federation of America, along with state-level bicycling organizations, facilitate numerous cycling events and instructional courses. These initiatives have significantly boosted cycling participation rates in North America, particularly in mountain biking, making it the global region with the highest participation and the US the largest revenue contributor. The rising popularity of outdoor recreational activities among the younger demographic, specifically those aged 15-24 years, and the increasing consumer preference for mountain biking have fueled the demand for mountain biking equipment in recent years.

Mountain biking, an activity suited for rough terrain, has gained substantial traction in North America. With the US leading the market, the region's growth is driven by the increasing interest in outdoor recreation and the preference for mountain biking equipment. The youth demographic, aged 15-24 years, is a significant contributor to this trend. As a result, the market for mountain biking equipment in North America has experienced steady growth in the last few years.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Mountain Biking Equipment Market?

The rising number of mountain bicycle clubs and events is the key driver of the market.

- Mountain biking, an exhilarating recreational activity known for its cardiovascular benefits and adventure, continues to gain popularity among skilled cyclists worldwide. With the increasing number of mountain biking clubs and groups, the market for mountain bikes is experiencing significant growth. In the US alone, there are numerous clubs and meetups, such as the Hudson Valley Cyclists in New York and Chicago Hiking Outdoors in Chicago, fostering a community of intermediate riders. These groups provide opportunities for cyclists to challenge themselves on tough trails, hone their finesse, and experience the thrill of risky actions. Mountain bikes, renowned for their durability and engine support, are essential equipment for mountain biking.

- Advanced suspension systems ensure optimal pedaling power, enabling riders to achieve great speeds. As the demand for mountain bikes grows, manufacturers continue to innovate, offering a wide range of options for enthusiasts. Mountain biking offers a unique blend of physical challenge and mental satisfaction, making it an appealing choice for those seeking a break from their daily routine. Whether you're an experienced rider or just starting out, there's a mountain biking group or club that's right for you. Joining one not only provides access to a supportive community but also opens up a world of new experiences and adventures.

What are the market trends shaping the Mountain Biking Equipment Market?

The rising prominence of online sales is the upcoming trend in the market.

- Mountain biking, an eco-friendly industry, continues to gain popularity in the US, attracting various groups of riders seeking improved performance and confidence on non-polluting bikes. However, accidents can occur due to poor riding skills or challenging terrains, including steep slopes and loose dirt. To address these concerns, initiatives like the Breeze initiative offer women-only rides and group sessions to enhance riders' skills and ensure a safe and enjoyable experience. Online buying platforms have emerged as a preferred choice for many mountain bikers, offering convenience and cost savings.

- Additionally, retailers are adapting to this trend by expanding their online presence, providing extensive customer reviews, simple return policies, door-to-door delivery, and customer-informed fit guidelines using videos. These features aim to help customers choose the right bike based on their body shape and confidence levels. Despite the advantages of online shopping, high maintenance costs and the importance of a proper bike fit remain concerns for mountain bikers. Host communities also play a significant role in fostering a positive riding experience, as they provide access to grassy tracks and races. As the industry continues to evolve, companies and retailers must prioritize customer satisfaction and safety to maintain a loyal customer base.

What challenges does Mountain Biking Equipment Market face during the growth?

Risk management is a key challenge affecting market growth.

- The market caters to the needs of advanced riders seeking an immersive experience in uphill riding on various terrains. Nature plays a significant role in mountain biking, making it essential to ensure the safety and efficiency of mountain biking trails. However, managing risks and maintaining trails presents challenges in this market. The absence of international standards for mountain biking trail design necessitates the involvement of experts in trail planning and construction. Organizations such as the US Forest Service, the International Mountain Bicycling Association (IMBA), and the Forest Commission of Great Britain provide valuable resources for trail design and construction requirements.

- Additionally, effective management and maintenance of mountain biking trails are crucial to minimize threats and losses from lawsuits. Proper trail maintenance ensures a healthy and enjoyable riding experience for athletes participating in mountain biking tours, bike riding contests, and mountain biking tourism. Uneven terrains, dirt roads, and off-road cycling on hard rocks and choppy terrains require robust technology and continuous upkeep. Regular workshops and training sessions for trail maintenance personnel can help address these challenges.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accell Group NV

- Active Brands AS

- Dorel Industries Inc.

- Endura Ltd.

- EssilorLuxottica

- F.I.V.E. Bianchi Spa

- FOX Head Inc.

- Giant Manufacturing Co. Ltd.

- Hoco Online GmbH

- R.C. Jenson Inc.

- Safilo Group S.p.A

- SCOTT Sports SA

- SELLE ROYAL spa

- SHIMANO INC.

- Specialized Bicycle Components Inc.

- Trek Bicycle Corp.

- Troy Lee Designs Inc.

- Vista Outdoor Inc.

- WELLGO PEDALS Corp.

- Why Cycles Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Mountain biking is an exhilarating adventure sport that appeals to skilled cyclists seeking finesse and thrill on uneven terrains. The market for mountain bikes caters to the needs of intermediate riders and advanced athletes, offering sturdy bikes with suspension systems that ensure comfort and performance on tough trails. These bikes are designed to provide great speeds and pedaling power, enabling riders to conquer steep slopes, rocky terrain, and irregular topography. Mountain biking is not just about cardiovascular fitness and risky actions; it's also about connecting with nature and experiencing the satisfaction of overcoming challenges. Mountain biking tours and bike riding contests have gained popularity as recreational activities, contributing to the economic development of local communities.

Additionally, robust technology, such as shock absorbers, strong alloys, and durable rims, ensures the bikes can handle the rigors of off-road cycling on choppy terrains and fire roads. E-mountain bikes with pedal assistance and electric motors cater to a younger generation seeking a more sustainable transport option. Safety concerns are addressed through handlebar grips, braking systems, and progressive suspension systems. Mountain bike engineering continues to evolve, offering multiple gear systems, narrow tracks, and handlebars for a more personalized riding experience. Mountain biking is an eco-friendly industry that offers a range of recreational activities for all, from cross-country races to downhill courses, hiking, and women-only rides. The sport fosters a sense of community and confidence, allowing riders to push their limits and explore the great outdoors.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.9% |

|

Market growth 2024-2028 |

USD 4.70 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.6 |

|

Key countries |

US, Canada, China, UK, Australia, France, Norway, Mexico, Brazil, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch