Nanocellulose Market Size 2024-2028

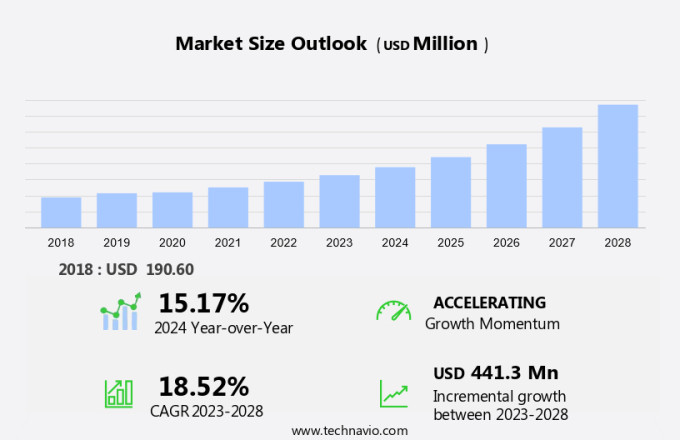

The nanocellulose market size is forecast to increase by USD 441.3 million at a CAGR of 18.52% between 2023 and 2028.

- Nanocellulose, a nanomaterial derived from cellulose, is witnessing significant growth in various industries due to its unique properties. The market for nanocellulose is driven by the increasing demand for this material in packaging applications, where it offers improved strength, flexibility, and sustainability. Additionally, the pharmaceutical industry is another major growth sector for nanocellulose, as it is used in drug delivery systems and as a replacement for synthetic polymers and high-performance polimers.

- However, the high cost of manufacturing nanocellulose remains a significant challenge for market growth. Despite this, the potential benefits of nanocellulose in areas such as lightweighting, biocompatibility, and renewability make it an attractive option for numerous applications.

- In summary, the market is poised for growth due to its expanding use cases in packaging and pharmaceuticals, but the high manufacturing costs present a significant challenge that must be addressed.

What will be the Size of the Nanocellulose Market During the Forecast Period?

To learn more about the market report, Request Free Sample

- The market is experiencing significant growth due to the increasing demand for sustainable and bio-based products in various industries. This material, derived from cellulose, offers unique properties such as increased strength, stiffness, and low weight, making it an attractive alternative to petroleum-based packaging materials. Nanocellulose comes in different forms, including micro fibrillated cellulose and nanofibrated cellulose, which can be derived from wood-based pulp through mechanical methods using high shear forces, high pressure homogenizers, ultrasonic homogenizers, grinders, and microfluidizers. The market is further propelled by the biodegradability and low toxicity of nanocellulose, which aligns with government initiatives promoting eco-friendly manufacturing processes.

- Applications of nanocellulose span from paperboard to cellulose derivatives, with bacterial nanocellulose gaining attention for its potential use in various industries. The market for nanocellulose is expected to continue growing as research and development efforts in material science advance, leading to new applications and improved production methods.

How is this Nanocellulose Industry segmented and which is the largest segment?

The nanocellulose industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2017-2022 for the following segments.

- Product

- Nano-fibrillated cellulose

- Nano-crystalline cellulose

- Bacterial nanocellulose

- Type

- Composites

- Paper processing

- Oil and gas

- Paints and coatings

- Others

- Geography

- Europe

- Germany

- UK

- North America

- Canada

- US

- APAC

- China

- South America

- Middle East and Africa

- Europe

By Product Insights

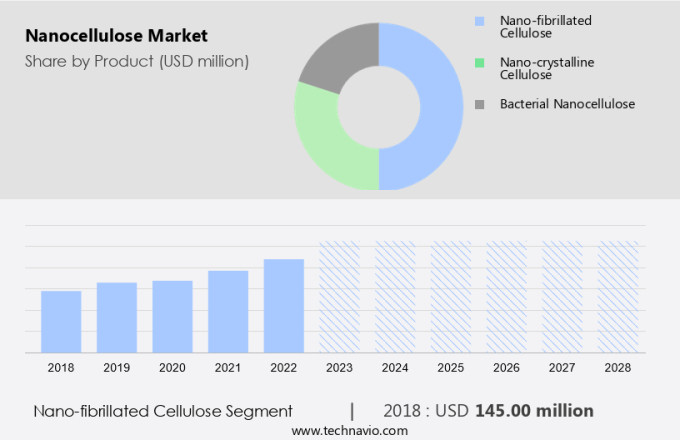

- The nano-fibrillated cellulose segment is estimated to witness significant growth during the forecast period.

The nanocellulose (NFC) market is projected to expand significantly due to NFC's unique properties, making it a preferred choice in various industries. NFC, derived from cellulose fibers through mechanical or enzymatic treatments, is renowned for its high aspect ratio and superior mechanical properties. These characteristics enhance the strength and stiffness of materials when integrated into polymers or coatings, resulting in lightweight and sustainable products with enhanced structural integrity. Moreover, NFC's exceptional barrier properties stem from its nano-sized fibrils, which form a densely packed network, providing excellent gas barrier performance. In the material science sector, NFC functions as a reinforcing agent in composites.

It is also utilized In the production of bullet-proof products, cement, oil and gas industries, masks, sanitation tissues, cosmetics manufacturing, and natural and chemical-based products. Containers and packaging are other potential applications for NFC due to its low density and hardness.

Get a glance at the Nanocellulose Industry report of share of various segments. Request Free Sample

The nano-fibrillated cellulose segment was valued at USD 145.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

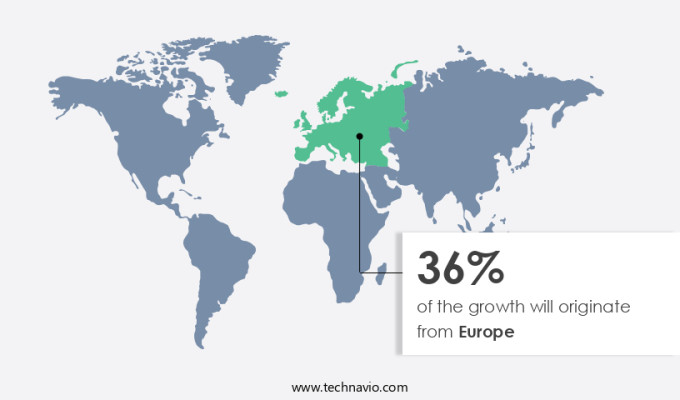

- Europe is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Nanocellulose, a material derived from renewable sources such as wood pulp, is gaining popularity in Europe due to its alignment with the region's sustainability goals. With stringent regulations and policies against non-renewable materials and high carbon footprint chemicals, nanocellulose offers a safer and more eco-friendly alternative. Its versatile properties make it suitable for various applications, including packaging, textiles, composites, coatings, and the medical field. The material's biodegradability, low toxicity, increased strength, stiffness, and low weight make it an attractive option for industries seeking to reduce their environmental impact. The versatility of nanocellulose has led to its adoption by various sectors, driving demand for this innovative material.

Nanocellulose Market Dynamics

Our nanocellulose market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Nanocellulose Industry?

Growing demand for nanocellulose in packaging applications is the key driver of the market.

- Nanocellulose, a nanoscale material derived from cellulose, is gaining significant attention In the material science industry due to its unique properties and potential applications in various sectors. Bio-based and sustainable, nanocellulose materials offer advantages such as increased strength, stiffness, and low weight, making them attractive alternatives to petroleum-based packaging and metallic components. The entangled nanoporous network of nanocellulose provides high yield, leading to the production of high-performance materials. MFC (Microfibrillated Cellulose) and NFC (Nanofibrillated Cellulose) are two common types of cellulose nanomaterials. They exhibit excellent surface properties and can be used in composites, paints and coatings, paper and boards, and other industries.

- Nanocellulose materials offer benefits such as biodegradability, low toxicity, and high aspect ratio, making them suitable for use in a wide range of applications. In the packaging industry, nanocellulose materials can replace non-renewable materials like steel structures, reinforced polymers, and containers and packaging made from fossil fuels. These materials offer advantages such as lightweight, super strength, electrical conductivity, and microbial contamination resistance. Nanocellulose materials are also used in cement and composites, textiles and nonwovens, food products, cosmetics and toiletries, filter materials, and more. The use of nanocellulose materials in various industries is expected to grow due to their renewable, naturally abundant, high strength, and chemical inertness properties.

- The potential applications of nanocellulose materials are vast, from bulletproof products and lightweight structures to additives in paper and pulp manufacturing, and from paints and coatings to active packaging and nanocomposites. The versatility and unique properties of nanocellulose materials make them a promising alternative to traditional materials in various industries.

What are the market trends shaping the Nanocellulose Industry?

Increasing use of nanocellulose in pharmaceutical industry is the upcoming market trend.

- Nanocellulose, a bio-based nanomaterial derived from cellulose, is gaining significant attention in material science due to its unique properties such as biodegradability, low toxicity, increased strength, stiffness, and low weight. These nanomaterials offer a sustainable alternative to petroleum-based packaging and metallic components, making them increasingly popular in various industries. Nanocellulose materials, including microfibrillated cellulose (MFC) and nanofibrillated cellulose (NFC), have nanoscale dimensions and an entangled nanoporous network, providing high yield and excellent surface properties. The applications of nanocellulose are vast and include reinforcements for steel structures, polymers, and composites, as well as additives for papermaking, paints and coatings, and manufacturing hubs.

- Nanocellulose is also used In the production of paper and boards, filters, and in the food industry as a thickener and stabilizer. In the pharmaceutical sector, nanocellulose is used for tablet coating, sustained drug delivery, and as additives. It is also used In the production of bulletproof products, lightweight and super strong nanocomposites, and electrically conductive materials. Government initiatives and growing consumer demand for sustainable and renewable products are driving the growth of the market. The versatility and high aspect ratio of nanocellulose make it an ideal replacement for non-renewable materials such as cement, oil and gas, and plastics.

- Additionally, nanocellulose offers improved mechanical and chemical resistance, making it an excellent choice for applications requiring hardness and durability. In summary, nanocellulose is a versatile and sustainable nanomaterial with a wide range of applications in various industries. Its unique properties, including biodegradability, low toxicity, increased strength, and ability to conduct electricity, make it an attractive alternative to traditional materials. The market for nanocellulose is expected to grow significantly due to increasing demand for sustainable and renewable materials and government initiatives to reduce the use of non-renewable materials.

What challenges does the Nanocellulose Industry face during its growth?

High cost of manufacturing nanocellulose is a key challenge affecting the industry growth.

- The market encompasses the production and application of nanoscale cellulose materials derived from renewable, naturally abundant resources, such as wood and bacterial cellulose. These nanomaterials, including micro fibrillated cellulose (MFC) and nanocellulose fibers (NFC), offer unique properties, such as increased strength, stiffness, and low weight, making them attractive for various industries. However, their production involves high capital investments and increased product costs, which can be a challenge for manufacturers. Nanocellulose materials are utilized in a range of applications, including composites and foams for automotive, aerospace, and building construction, as well as in high-end products In the oil and gas, automotive, and aerospace industries.

- In paper and packaging, nanocellulose enhances porosity, printing quality, and microbial contamination resistance. It also finds use in paints and coatings, textiles and nonwovens, and filter materials. Despite their benefits, the high cost of nanocellulose materials can be a deterrent for manufacturers in price-sensitive industries, such as plastics and municipal solid waste. To address this challenge, research focuses on improving production methods, such as mechanical processing and chemical processing, and the development of additives to enhance the yield and reduce costs. Nanocellulose materials offer numerous advantages, including biodegradability, low toxicity, and chemical inertness, making them a more sustainable alternative to petroleum-based packaging and metallic components.

- Their high aspect ratio, hardness, and electrical conductivity also make them suitable for applications in cement, oil and gas, masks, sanitation tissues, cosmetics manufacturing, and nanocomposites. In summary, the market is driven by the demand for sustainable, high-performance materials in various industries. Despite the initial high investment and production costs, the potential benefits and unique properties of nanocellulose materials make them a promising area for future research and development.

Customer Landscape

The nanocellulose market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the nanocellulose market growth analysis report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, nanocellulose market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

American Process International LLC - The company specializes in nanocellulose technology, providing innovative solutions through products like BioPlus. This proprietary technology utilizes a patented AVAP process for the production of high-quality nanocellulose material. It offers a range of downstream applications that leverage the unique properties of nanocellulose, including but not limited to, enhanced filtration, biocomposites, and energy storage.

The nanocellulose market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Process International LLC

- Asahi Kasei Corp.

- Axcelon Biopolymers Corp.

- Blue Goose Biorefineries Inc.

- Borregaard ASA

- CelluComp Ltd.

- CelluForce Inc.

- Daio Paper Corp.

- FiberLean Technologies Ltd.

- GranBio Investimentos SA

- GS Alliance Co. Ltd.

- Kruger Inc.

- Nature Costech Co. Ltd.

- Nippon Paper Industries Co. Ltd.

- Oji Holdings Corp.

- RISE Research Institutes of Sweden

- Sappi Ltd.

- Stora Enso Oyj

- UPM Kymmene Corp.

- Weidmann Holding AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Latest Market Developments and News

-

In December 2024, a major nanocellulose producer, CelluComp, launched a new line of products aimed at the food and beverage industry. The product is a sustainable alternative to traditional thickeners and stabilizers, capitalizing on the growing demand for eco-friendly ingredients.

-

In October 2024, the collaboration between American nanomaterials company, UPM-Kymmene, and Finnish startup, Enval, resulted in the creation of a new manufacturing technique that enhances the scalability of nanocellulose production, aiming to reduce costs and increase sustainability.

-

In September 2024, the merger of two key players in the nanocellulose space, Stora Enso and Nanocellulose Solutions, formed a new entity aimed at expanding the use of nanocellulose in construction materials. The merger is expected to accelerate research into high-performance, eco-friendly building materials.

-

In August 2024, a significant acquisition took place when Norwegian company, NORSKE Skog, acquired the nanocellulose division of a leading packaging company, reinforcing their commitment to developing lightweight, biodegradable packaging solutions for the consumer goods market.

Research Analyst Overview

Nanocellulose, a revolutionary material derived from the natural and abundant cellulose found in plants, is gaining significant attention In the realm of material science due to its unique properties and potential applications. This bio-based material offers several advantages over traditional, non-renewable materials, making it an attractive alternative for various industries. The inherent biodegradability and low toxicity of nanocellulose make it an eco-friendly choice for the production of sustainable products. Its nanoscale dimensions, which consist of microfibrillated cellulose (MFC) and nanofibrillated cellulose (NFC), result in an entangled nanoporous network that boasts increased strength, stiffness, and low weight. Nanocellulose materials can replace petroleum-based packaging and metallic components in various applications, contributing to the reduction of non-renewable materials in manufacturing processes.

In the construction sector, nanocellulose can be used as reinforcement in polymers, steel structures, and cement, leading to lighter, stronger, and more durable materials. The surface properties of nanocellulose can be tailored through chemical and mechanical processing, making it suitable for use in composites, paints and coatings, and paper and boards. The high porosity and improved printing quality of nanocellulose-based paper and pulp offer enhanced performance and sustainability. Nanocellulose materials have a wide range of applications, including In the production of composites, which can be used in automotive, aerospace, and other industries. They also find use In the manufacturing of nanocomposites, which exhibit enhanced electrical conductivity and can be used In the production of bulletproof products and energy storage devices.

The versatility of nanocellulose extends to various industries, such as oil and gas, where it can be used as a drilling additive, and In the production of masks, sanitation tissues, cosmetics manufacturing, and natural products. In the field of active packaging, nanocellulose materials offer microbial contamination resistance, preserving the quality and freshness of food products. The renewable and naturally abundant nature of nanocellulose, combined with its high strength, chemical inertness, and surface chemistry, make it an attractive alternative to traditional materials. As research and development in this area continue to advance, the potential applications for nanocellulose are expected to expand, offering significant opportunities for innovation and sustainability in various industries.

|

Nanocellulose Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

182 |

|

Base year |

2023 |

|

Historic period |

2017-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.52% |

|

Market growth 2024-2028 |

USD 441.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

15.17 |

|

Key countries |

Germany, US, UK, Canada, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Nanocellulose Market Research and Growth Report?

- CAGR of the Nanocellulose industry during the forecast period

- Detailed information on factors that will drive the Nanocellulose growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the nanocellulose market growth of industry companies

We can help! Our analysts can customize this nanocellulose market research report to meet your requirements.