Neuropathy Pain Treatment Market Size 2024-2028

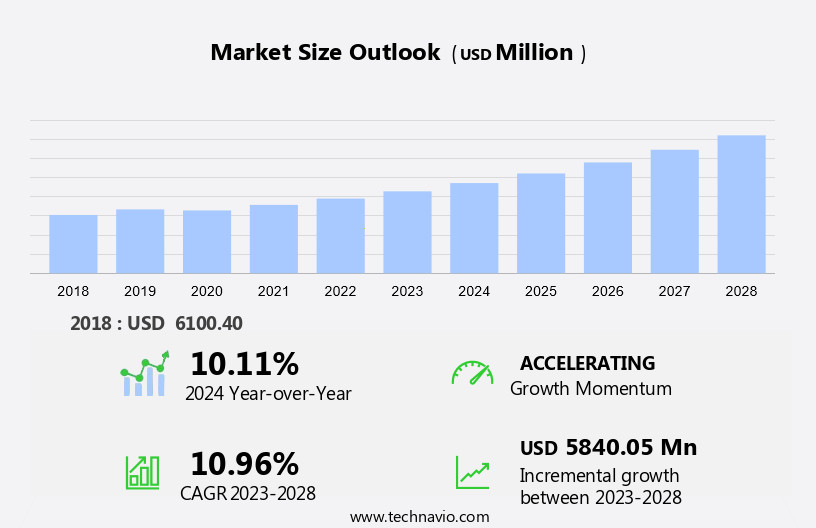

The neuropathy pain treatment market size is forecast to increase by USD 5.84 billion at a CAGR of 10.96% between 2023 and 2028.

- The market is experiencing significant growth due to the presence of a large patient pool suffering from neuropathy pain. Neuropathy, a condition characterized by nerve damage, affects millions worldwide, leading to chronic pain, numbness, and weakness. A key trend influencing market growth is the development of topical patches for neuropathy pain treatment, offering patients a non-invasive alternative to traditional methods, alongside the increasing availability of generic drugs and the rise of e-pharmacies, providing convenient access to affordable treatment options. However, the high cost of neuropathy pain treatment remains a major challenge, limiting access to care for many patients. Despite this, ongoing research and development efforts are expected to yield new and more affordable treatment options, driving market expansion.

What will be the Size of the Neuropathy Pain Treatment Market During the Forecast Period?

- Neuropathy pain, characterized by algiax pharmaceuticals' definition as "damage or dysfunction of the somatosensory nervous system," causes significant discomfort and symptoms such as hyperalgesia. The market is projected to grow, driven by the increasing prevalence of diabetes leading to the diabetic neuropathy segment. Phase studies are underway for investigational drugs like Vertex Pharmaceuticals Incorporated's Vixotrigine, an anticonvulsant In the drug class.

- The pain management market covers retail pharmacies and drug stores. Tricyclic antidepressants are currently used, but new treatments are needed due to the aetiology and anatomic localization of neuropathy. The National Institutes of Health (NIH) and World Health Organization (WHO) are conducting research, as published in PubMed and Springer. Biogen, Baxter Healthcare, and Senzer Pharmaceuticals are also involved in developing new treatments. Data monitoring committees ensure the safety and efficacy of these projects In the in-depth report coverage of the pain management market.

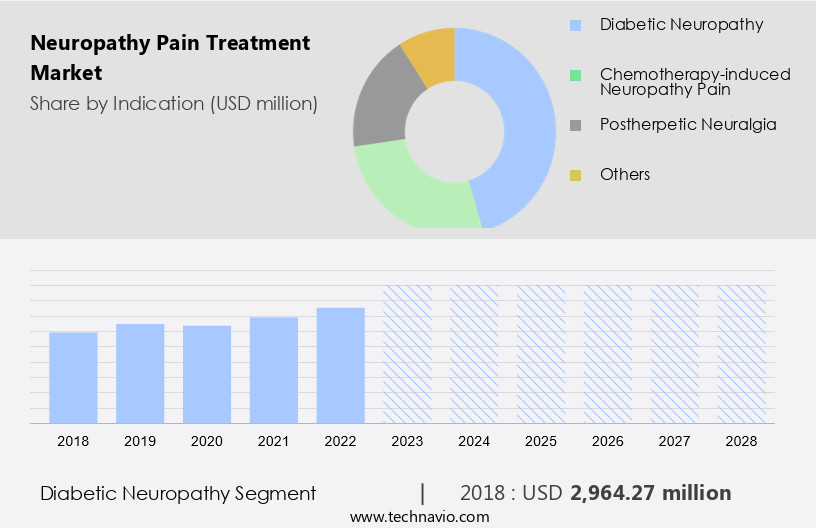

How is this Neuropathy Pain Treatment Industry segmented and which is the largest segment?

The neuropathy pain treatment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Indication

- Diabetic neuropathy

- Chemotherapy-induced neuropathy pain

- Postherpetic neuralgia

- Others

- Distribution Channel

- Retail pharmacies

- Hospital pharmacies

- Online pharmacies

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By Indication Insights

- The diabetic neuropathy segment is estimated to witness significant growth during the forecast period.

Neuropathic pain, a type of chronic pain caused by damage or dysfunction to the somatosensory nervous system, affects an estimated 10 million people worldwide, with a significant number being diabetic patients. Diabetic neuropathy, a common complication of diabetes, is characterized by aetiologies such as axonal damage, hyperalgesia, allodynia, and anatomic localization. Neuropathic pain can be caused by various conditions, including autoimmune diseases, virally-induced neuropathy, and oncology medications like chemotherapy. The pain management market for neuropathic pain is projected to experience significant growth due to the rising prevalence of diabetes and the increasing number of approved drugs for its treatment.

Furthermore, neuropathic pain medications include tricyclic anti-depressants, anticonvulsants such as Lyrica, Topamax, and Lamotrigine, and prescription opioids. However, these medications come with severe adverse effects and high costs, limiting their widespread use. The pain management market covers both pharmaceutical companies and pain management centres. Leading pharmaceutical companies are investing in research and development to bring new treatments to market. Guidelines recommend early diagnosis and treatment of neuropathic pain to prevent further nerve damage and provide symptomatic relief. Despite advancements in treatment, challenges remain, including the need for more effective and affordable options for the general population.

Get a glance at the Neuropathy Pain Treatment Industry report of share of various segments Request Free Sample

The diabetic neuropathy segment was valued at USD 2.96 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 33% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Neuropathic Pain, a debilitating condition affecting the somatosensory nervous system, is projected to witness significant growth In the global market. The aetiology of Neuropathic Pain can be attributed to various factors, including autoimmune diseases, virally-induced neuropathy, and chemotherapy. The International Diabetes Federation reports that approximately 10 million people In the US alone suffer from Diabetic Neuropathy, a common complication of diabetes. Diabetic patients, particularly those with type 2 diabetes, are at an increased risk due to the rising prevalence of diabetes. The pain management market is witnessing a shift towards Neuropathic Pain medications such as Tricyclic anti-depressants, Anticonvulsants like Lyrica, Topamax, and Lamotrigine, and prescription opioids.

Furthermore, the sales analysis reveals that leading pharmaceutical companies like GSK have gained approval for these drugs, leading to a rise in prescriptions. However, the high cost and severe adverse effects of prescription opioids limit their widespread use. Hyperalgesia and Allodynia, symptoms of Neuropathic Pain, can cause significant discomfort, leading to a need for effective treatment. The growing older population and the increasing adoption of these approved drugs will further fuel market growth. The market is expected to expand, with pain management centres playing a crucial role in providing specialized care for Neuropathic Pain patients.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Neuropathy Pain Treatment Industry?

The presence of a large patient pool of neuropathy pain is the key driver of the market.

- The market is poised for significant growth due to the expanding patient population afflicted with neuropathy. Neuropathy pain is a symptom of various disorders, including diabetic neuropathy, chemotherapy-induced pain, shingles, and herniated disks. The prevalence of these conditions is increasing, with an estimated 30.30 million Americans diagnosed with diabetes in 2021, and 84.10 million having prediabetes.

- Approximately 50% of diabetes patients develop nerve damage, and up to 60%-70% of those with diabetes experience diabetic neuropathy. Neuropathy pain can manifest as symptoms such as nausea, skin rashes, diarrhea, and daytime sleepiness. Both branded medications and generic medicines are utilized for managing neuropathy pain, offering treatment options for patients.

What are the market trends shaping the Neuropathy Pain Treatment Industry?

The development of topical patches for neuropathy pain treatment changing market dynamics is the upcoming market trend.

- Neuropathy pain, a debilitating condition characterized by nerve damage, often results in symptoms such as numbness, tingling, and severe pain. Traditional treatment methods, including branded medications, have been associated with complications like nausea, skin rashes, diarrhea, and daytime sleepiness, leading to poor patient compliance.

- In response, companies are focusing on the development of new routes of administration (ROAs), particularly topical patches, to address the unmet medical needs In the neuropathy pain market. These treatments offer a multimodal approach to chronic pain management with limited absorption and an improved safety profile compared to systemic options. Researchers have explored various medications for topical use, including anti-inflammatory drugs, capsaicin, local anesthetics, tricyclic antidepressants, ketamine, and gabapentin, which can be used alone or in combination.

What challenges does the Neuropathy Pain Treatment Industry face during its growth?

The high cost of neuropathy pain treatment is a key challenge affecting the industry growth.

- Diabetic neuropathy, a complication of diabetes, can lead to debilitating symptoms such as pain, numbness, nausea, skin rashes, diarrhea, and daytime sleepiness. The economic burden of diabetic peripheral neuropathy and its complications

- Currently, only symptomatic treatment options are available for diabetic neuropathy, with a limited number of approved drugs on the market. These include branded medications such as Pregabalin (LYRICA), gabapentin (NEURONTIN), and duloxetine (CYMBALTA), which are used for the first-line treatment of painful diabetic peripheral neuropathy. The high cost of these branded drugs, coupled with the difficulty of securing drug reimbursement or insurance coverage, poses a significant challenge for patients in managing their conditions effectively.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, neuropathy pain treatment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Alfasigma Spa

- Astellas Pharma Inc.

- AstraZeneca Plc

- Baxter International Inc.

- Biogen Inc.

- Bristol Myers Squibb Co.

- Daiichi Sankyo Co. Ltd.

- Dr Reddys Laboratories Ltd.

- Eli Lilly and Co.

- Endo International Plc

- GlaxoSmithKline Plc

- Johnson and Johnson

- Mallinckrodt Plc

- Neuracle Lifesciences Pvt. Ltd.

- Pfizer Inc.

- Sanofi

- Sun Pharmaceutical Industries Ltd.

- Vertex Pharmaceuticals Inc.

- VistaGen Therapeutics Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing prevalence of various conditions causing neuropathic pain, such as diabetic neuropathy, spinal stenosis, HIV, cancer, and Alzheimer's disease. Algiax Pharmaceuticals is currently conducting a phase study for a new drug In the anticonvulsant segment for the indication of neuropathic pain. The study is being monitored by a Data Monitoring Committee. The market is segmented into the anticonvulsant, antidepressant, and opioid drug classes. The antidepressant segment, which includes tricyclic antidepressants and selective serotonin and norepinephrine reuptake inhibitors, holds a significant market share. Neuropathic pain drugs are available in various channels such as drug stores, retail pharmacies, hospital pharmacies, and online platforms.

Moreover, the symptoms of neuropathic pain include burning, pricking, shooting pain, numbness, and sensitivity to touch. Investigational drugs target various mechanisms such as synaptotagmin and are in different stages of clinical trials and product approval. The neuropathy pain market is affected by factors such as the geriatric population's growing prevalence, the recession's impact on healthcare spending, and the World Health Organization's efforts to increase awareness and access to therapeutic drugs.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.96% |

|

Market Growth 2024-2028 |

USD 5.84 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.11 |

|

Key countries |

US, Canada, Germany, UK, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Neuropathy Pain Treatment Market Research and Growth Report?

- CAGR of the Neuropathy Pain Treatment industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the neuropathy pain treatment market growth of industry companies

We can help! Our analysts can customize this neuropathy pain treatment market research report to meet your requirements.