Next-Generation Data Storage Market Size 2024-2028

The next-generation data storage market size is forecast to increase by USD 29.2 billion, at a CAGR of 8.08% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for data compliance in various sectors, particularly in data centers and mobile payments. The trend toward cloud computing is also driving market growth as businesses seek to store and process large amounts of data more efficiently. Big data, artificial intelligence (AI), machine learning, social media, and the Internet of Things (IoT) are generating massive amounts of data, necessitating advanced storage solutions.

However, challenges such as cyber threats, including distributed denial-of-service attacks, ransomware, viruses, worms, and malware, pose significant risks to data security and privacy. Compliance with data protection regulations and ensuring data security are becoming critical factors for companies in this market. High operating expenses for companies are also a challenge, as they must invest in research and development to stay competitive and offer innovative solutions to meet the evolving needs of businesses.

The market is experiencing significant growth due to the increasing data production from mobile devices, smart wearables, and connected devices. With the advent of 5G technology, the volume of data generated is expected to increase exponentially. E-commerce, smart technologies, automated systems, and mobile payments are driving the demand for cloud storage and data centers. Big data, data analytics, AI, and machine learning are transforming industries such as healthcare, finance, and retail. Security breaches, cyber threats, and distributed denial-of-service attacks are major concerns for organizations, leading to the adoption of advanced security measures. Flash memory and HDDs from non-volatile manufacturers are the preferred choices for low-latency data storage in smartphones, tablets, and laptops. The integration of AI and machine learning algorithms in data storage systems is enabling faster data processing and analysis. Social media platforms are generating massive amounts of data, further fueling the growth of the market.

Market Segmentation

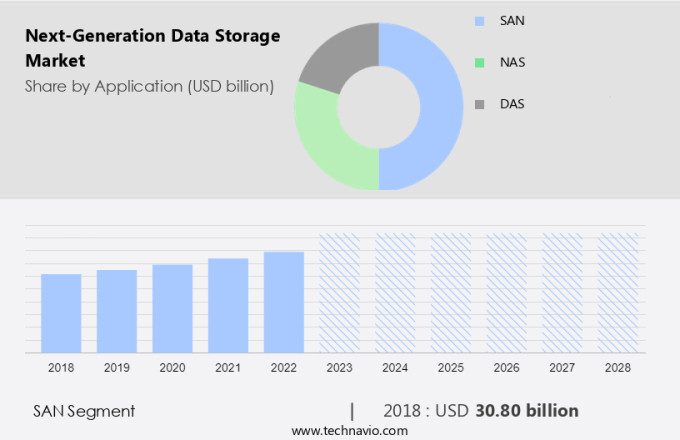

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- SAN

- NAS

- DAS

- Deployment

- On-premise

- Cloud

- Geography

- North America

- US

- Europe

- UK

- France

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Application Insights

The SAN segment is estimated to witness significant growth during the forecast period. The market is witnessing significant expansion due to the exponential growth of digital data in large-scale industries such as corporate information, healthcare with patient information, banking and financial services, online shopping, video, and pictures. To address the increasing demand for higher storage capacity and scalability, next-generation storage solutions like Storage Area Networks (SAN) have emerged. A SAN is a dedicated high-speed network that interconnects storage devices to multiple servers, providing each server with direct access to the storage. This setup allows for better flexibility, availability, and performance compared to Direct Attached Storage (DAS) or Network Attached Storage (NAS) systems.

In a collected environment, a backup server controls the primary server by connecting to the storage volume in case of system failure. Enterprise adoption of SAN storage devices is on the rise due to these advantages. Automatic cloud backups and the integration of the Internet of Things (IoT) further enhance the utility of next-generation data storage solutions.

Get a glance at the market share of various segments Request Free Sample

The SAN segment accounted for USD 30.80 billion in 2018 and showed a gradual increase during the forecast period.

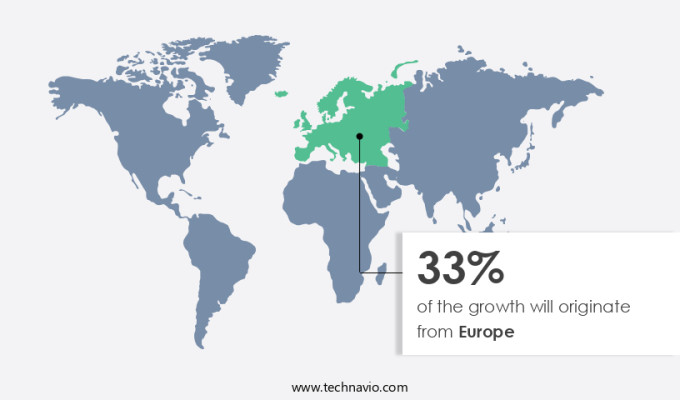

Regional Insights

Europe is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is experiencing significant expansion due to the exponential growth of digital data in various industries, including corporate information, healthcare with patient data, banking and financial services, online shopping, video, and pictures. This trend is particularly pronounced in large-scale industries, where the need for higher storage capacity and scalable solutions is paramount. The market's growth is driven by the benefits of next-generation data storage, such as energy efficiency and faster write speeds, which are increasingly important for businesses seeking to gain a competitive edge. In the coming years, automatic cloud backups and the integration of the Internet of Things (IoT) are expected to further fuel market growth. The market, with SMEs being a significant contributor to this growth. These businesses have dynamic needs but limited resources, making next-generation data storage solutions an attractive option for them. Furthermore, the imminent launch of 5G is expected to augment the demand for cloud storage solutions, as telecommunication service providers make efforts to launch commercial 5G services.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Growing demand for IoT and big data operations is the key driver of the market. The market is poised for substantial growth due to the increasing number of Internet-connected devices, estimated to reach approximately 40 billion worldwide by 2022. IoT trends like connected cars, homes, and cities are driving this growth, with sectors such as manufacturing, utilities, retail, automotive, and social media adopting IoT technology. These devices require energy-efficient networks of interconnected smart nodes, leading to an increased demand for next-generation data storage solutions. Structured and unstructured data are generated in vast quantities from both business and consumer applications.

The proliferation of mobile devices, smart wearables, and connected devices, coupled with the advent of 5G technology, e-commerce, and smart technologies, necessitates automated systems to manage and secure this data. However, next-generation data storage also poses challenges such as data security issues, configuration errors, and poor user rights, making it essential for providers to address these concerns to ensure the market's continued growth.

Market Trends

Software-defined storage is the upcoming trend in the market. The market: Trends and Opportunities Next-Generation Software-Defined Storage (SDS) is revolutionizing the data storage landscape by separating software services from hardware services. This separation enables increased flexibility, scalability, and automation capabilities for enterprise data storage infrastructures. SDS offers resource pooling, abstraction, and automated management while providing support for legacy applications, big data analytics, and cloud-based data applications. The proliferation of data production from mobile devices, smart wearables, connected devices, and e-commerce platforms, coupled with the adoption of 5G technology and smart technologies, is driving the demand for next-generation data storage solutions. SDS addresses the challenges of managing less structured data, data security issues, configuration errors, and poor user rights.

Cloud storage and server services are also contributing to the growth of the market. However, security breaches and concerns regarding data privacy remain significant challenges. Next-generation data storage solutions must offer data security features to address these concerns and meet the evolving demands of businesses. Overall, the market is poised for significant growth, offering opportunities for technology providers and enterprises alike.

Market Challenge

High operating expenses for companies are a key challenge affecting market growth. The market caters to the increasing demand for advanced storage solutions from various end-users, including mobile devices, smart wearables, connected devices, and e-commerce platforms. The market is driven by the adoption of 5G technology, smart technologies, and automated systems, which generate vast amounts of less structured data.

However, the market faces challenges such as data security issues, configuration errors, and poor user rights. companies must design and develop specifications tailored to end-user needs, which is an expensive process due to the high level of research and development investment required. Cloud storage and server services are popular solutions, but their demand patterns are cyclical, leading to a mismatch between supply and demand. Unexpected changes in end-user demand can result in oversupply or shortage situations, impacting manufacturing costs for storage solutions.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Cloudian Inc. - The company offers next generation data storage such as Cloudian HyperStore.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Cloudian Inc.

- DataDirect Networks Inc.

- Dell Technologies Inc.

- Drobo Inc.

- Furukawa Electric Co. Ltd.

- Hewlett Packard Enterprise Co.

- Hitachi Ltd.

- Inspur Group

- International Business Machines Corp.

- Micron Technology Inc.

- NetApp Inc.

- Netgear Inc.

- Nutanix Inc.

- Oracle Corp.

- Pure Storage Inc.

- Quantum Corp.

- Samsung Electronics Co. Ltd.

- Scality Inc.

- Toshiba Corp.

- Western Digital Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing exponential growth due to the increasing production of digital data from mobile devices, smart wearables, connected devices, and the implementation of 5G technology. The expansion of industries such as e-commerce, smart technologies, and automated systems is leading to higher storage capacity demands. However, data security issues, including security breaches, configuration errors, and poor user rights, remain significant challenges. Cloud storage and server services are popular solutions for managing large-scale industries' corporate information. The healthcare sector, banking services, and financial services generate vast amounts of less structured data, requiring scalable and flexible storage solutions. The retail industry also benefits from automatic cloud backups and faster data access for data-driven applications and analytics.

Further, the Internet of Things (IoT) and smartphones generate massive amounts of data, necessitating high-speed data storage with low latency and faster processing capabilities. Cloud services offer scalable storage solutions, while on-premises, hybrid, and distributed storage solutions cater to specific industry needs. Data protection and backup are crucial in the face of cyber threats, including ransomware attacks, malware, viruses, worms, botnets, spam, spoofing, phishing, hacktivism, and state-sanctioned cyberwarfare. Non-volatile manufacturers produce flash memory and HDDs to meet the demands for various storage solutions, including direct-attached storage, network-attached storage, and storage area networks. IT specialists are responsible for installation structures, databases, and compliance in various sectors, including telecom companies, healthcare, and the BFSI sector. The manufacturing sector and consumer goods sector also rely on storage solutions for their operations. The integration of AI, machine learning, and social media generates additional data, further increasing the importance of secure and efficient storage solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

173 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.08% |

|

Market Growth 2024-2028 |

USD 29.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

Europe at 33% |

|

Key countries |

US, China, UK, France, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Cloudian Inc., DataDirect Networks Inc., Dell Technologies Inc., Drobo Inc., Furukawa Electric Co. Ltd., Hewlett Packard Enterprise Co., Hitachi Ltd., Inspur Group, International Business Machines Corp., Micron Technology Inc., NetApp Inc., Netgear Inc., Nutanix Inc., Oracle Corp., Pure Storage Inc., Quantum Corp., Samsung Electronics Co. Ltd., Scality Inc., Toshiba Corp., and Western Digital Corp. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.