Non-Ionic Surfactants Market Size 2024-2028

The non-ionic surfactants market size is forecast to increase by USD 4.82 billion at a CAGR of 6.1% between 2023 and 2028.

- The market is experiencing significant growth due to increasing demand for personal care products and bio-based alternatives. The personal care industry's expansion, driven by consumer preferences for gentle and effective cleansing agents, is boosting market growth. Additionally, the rising demand for eco-friendly and biodegradable products is fueling the adoption of bio-based non-ionic surfactants. Market trends include the development of green surfactants and bio-based products, driven by environmental concerns and the demand for sustainable technologies. However, market growth is challenged by the volatility in raw material prices, which can impact the profitability of manufacturers. Producers must navigate these price fluctuations and find ways to maintain cost competitiveness while meeting consumer demand for sustainable and effective non-ionic surfactant solutions. Additionally, multifunctional materials and the integration of biotechnology are also key areas of innovation. Raw material prices and competition from anionic, cationic, and amphoteric surfactants remain key challenges. The home care segment dominates the market, with industrial cleaning and food additives also significant contributors. Antimicrobial properties are a growing area of focus, particularly in cleaning applications.

What will be the Size of the Non-Ionic Surfactants Market During the Forecast Period?

- The market In the United States is experiencing significant growth due to their versatility and effectiveness in various applications. These chemical compounds, which reduce the surface tension between two liquids or a liquid and a solid, are extensively used in the home care and personal care industries. In home care, they are integral to the formulation of detergents, cleaners, and disinfectants, while in personal care, they serve as emulsifiers and enhancers in personal hygiene products. Non-ionic surfactants offer advantages over their ionic counterparts, including greater compatibility with hard water and improved biodegradability.

How is this Non-Ionic Surfactants Industry segmented and which is the largest segment?

The non-ionic surfactants industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Alcohol ethoxylates

- Fatty alkanolamide

- Amine derivatives

- Glycerol derivatives

- Others

- Application

- Industrial

- Cosmetics and personal care

- Agriculture

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

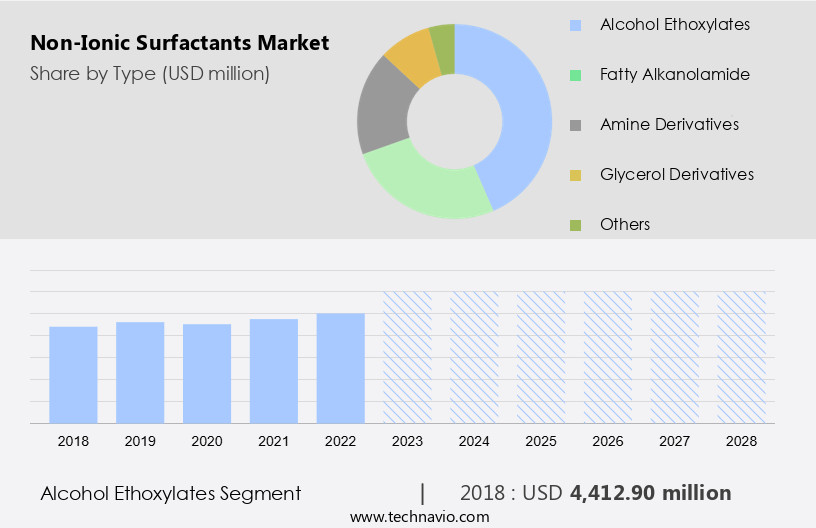

By Type Insights

- The alcohol ethoxylates segment is estimated to witness significant growth during the forecast period.

Non-ionic surfactants, specifically alcohol ethoxylates, are derived from natural fats and oils through ethoxylation. These compounds are essential for reducing surface tension in liquids, making them indispensable for various applications, including cleaning, emulsifying, and dispersing. Alcohol ethoxylates are extensively used in personal hygiene products and cleaner applications, such as detergents, dishwashing liquids, and all-purpose cleaners, due to their excellent cleaning properties and mildness to the skin. In the realm of sustainable technologies, green surfactants and bio-based products have gained significant traction. Alcohol ethoxylates align with this trend, as they are eco-friendly and versatile, making them a popular choice for manufacturers. This report explores the applications and market growth of alcohol ethoxylates, highlighting their importance In the personal hygiene, cleaner, and disinfectant industries.

Get a glance at the Non-Ionic Surfactants Industry report of share of various segments Request Free Sample

The alcohol ethoxylates segment was valued at USD 4.41 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 44% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market In the APAC region is projected to experience significant growth during the forecast period. Key drivers include the increasing demand from various applications such as detergents, personal care products, food processing, and industrial cleaning. Countries like China, India, Indonesia, Thailand, Australia, Japan, the Philippines, Malaysia, and South Korea are expected to fuel this demand due to their large populations and rising disposable incomes. In the detergents and personal care industries, China is a major consumer of non-ionic surfactants. These factors contribute to the expanding market, making it a significant area of focus for manufacturers and investors. The market caters to various industries, including cosmetics, agrochemicals, petroleum, and eco-friendly technologies. Online sales are also gaining popularity, further expanding the market reach. Non-ionic surfactants' eco-friendly properties and versatility make them an essential ingredient in numerous applications, ensuring their continued demand.

Market Dynamics

Our non-ionic surfactants market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Non-Ionic Surfactants Industry?

Increasing demand for personal care products is the key driver of the market.

- The market In the US is witnessing notable growth, primarily due to the escalating demand for home care and personal care products featuring mild and effective ingredients. Non-ionic surfactants, which are free of charged ions, are increasingly preferred for their gentle properties in various applications, including cleaning agents, lubricants, personal hygiene products, disinfectants, and emulsifiers. Environmental concerns have instigated the development of green surfactants and bio-based products, which are sustainable alternatives to traditional petroleum-derived surfactants. Technological advancements, such as emulsion polymerization and biosurfactant production, are driving the market's growth in this sector. Key players In the industry, like Nouryon, are introducing eco-friendly technologies, such as Structure M3 co-surfactant, to cater to the increasing consumer preference for gentle and natural ingredients.

- Additionally, the home care segment, which includes household products and food processing, accounts for a significant portion of the market's growth. Government support for environmental safety and hygiene awareness, coupled with customer demand for sustainable and bio-based products, is further fueling the market's expansion. The market's growth is also influenced by the increasing use of non-ionic surfactants in industrial cleaning applications, cosmetics, agrochemicals, oilfield chemicals, and various other industries. Despite the market's positive outlook, raw material prices and environmental safety concerns remain challenges for market growth. However, the increasing availability of renewable raw materials and ongoing research and development efforts are expected to mitigate these challenges. Overall, the US market is poised for significant growth, driven by consumer preferences, technological advancements, and government regulations.

What are the market trends shaping the Non-Ionic Surfactants Industry?

Growing demand for bio-based non-ionic surfactants is the upcoming market trend.

- The market is experiencing a notable transition towards bio-based alternatives, driven by escalating environmental concerns and regulatory pressures. Bio-based non-ionic surfactants, or biosurfactants, are chemical compounds derived from microorganisms or plants, which exhibit both hydrophobic and hydrophilic properties. These surfactants reduce surface tension between different phases, enabling effective aggregation and stabilization of interfaces in various media. The growing demand for eco-friendly alternatives to traditionally synthesized, chemically derived surfactants is a significant driver for the bio-based the market. Biosurfactants are produced under mild conditions and exhibit lower toxicity compared to their synthetic counterparts. They are gaining popularity in various industries, including home care, personal care, cleaning applications, and industrial cleaning, due to their multifunctional properties as detergents, lubricants, personal hygiene products, cleaner products, disinfectants, and emulsifiers.

- Furthermore, the increasing awareness of hygiene and the shift towards sustainable technologies, such as biotechnology and renewable raw materials, are expected to fuel the market growth. However, raw material prices and environmental safety concerns may pose challenges for market expansion. Technological advancements and government support for the development of eco-friendly technologies are expected to create opportunities for market growth In the future. The market for non-ionic surfactants is also expanding into new applications, such as food additives, cosmetics, agrochemicals, oilfield chemicals, and emulsion polymerization.

What challenges does the Non-Ionic Surfactants Industry face during its growth?

Volatility in raw material prices is a key challenge affecting the industry growth.

- The market is driven by the increasing demand for low surface tension agents in various applications, including home care, personal care, cleaning, and industrial cleaning. These chemical compounds function as surface-active agents, emulsifiers, dispersants, wetting agents, and stabilizers in numerous industries. Non-ionic surfactants are used In the production of detergents, lubricants, personal hygiene products, cleaner products, disinfectants, and eco-friendly technologies. The market's growth is influenced by factors such as increasing hygiene awareness, customer preference for green and bio-based products, and government support for sustainable technologies. However, the industry faces challenges due to the volatility in raw material prices, particularly for key inputs like fatty alcohol ethoxylate, alkyl phenol ethoxylate, and fatty acid alkoxylate, which are derived from petroleum.

- Additionally, the recent growth in oil prices, driven by production cuts and rising demand, has resulted in a significant increase in raw material costs. This trend poses a challenge to market growth, particularly for manufacturers relying on petroleum-based raw materials. Moreover, the market is witnessing technological advancements, such as the use of renewable raw materials, biosurfactants, and emulsion polymerization, to address environmental concerns and reduce dependency on petroleum-based inputs. The increasing popularity of eco-friendly technologies, bio-based products, and sustainable practices is expected to create new opportunities for market growth. Additionally, the growing online sales channel and increasing demand for multifunctional materials in various industries are expected to drive market expansion.

Exclusive Customer Landscape

The non-ionic surfactants market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the non-ionic surfactants market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, non-ionic surfactants market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acuro Organics Ltd.

- Akzo Nobel NV

- Arkema SA

- Associated British Foods Plc

- BASF SE

- Clariant AG

- Dow Inc.

- Elementis Plc

- Evonik Industries AG

- Geocon Products

- Growtech Agri Science and Research Pvt. Ltd.

- Hebei Sancolo Chemicals Co., Ltd.

- Kao Corp.

- Matangi Industries

- Nouryon

- Rimpro India

- Saudi Basic Industries Corp.

- Starco Arochem Pvt. Ltd.

- Stockmeier Holding GmbH

- Unicrop Biochem

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Non-ionic surfactants have gained significant attention in various industries due to their unique properties and versatility. These chemical compounds, which reduce the surface tension between two liquids or between a liquid and a solid, play a crucial role in numerous applications. In the realm of home care and personal care, non-ionic surfactants are extensively used in cleaning applications, including detergents and cleaner products. They offer several advantages over their ionic counterparts, such as better compatibility with hard water, milder effects on skin, and improved performance in certain applications. The personal hygiene sector also benefits from non-ionic surfactants in various forms, such as In the production of foaming agents for bath products and shampoos. These surfactants contribute to the creation of rich, long-lasting foam, enhancing the user experience. Beyond home and personal care, non-ionic surfactants find applications in industries like lubricants, food additives, and emulsifiers. In the industrial cleaning sector, they are used to create effective cleaning solutions for various surfaces. In food processing, they help improve the texture and stability of food products.

Additionally, the market for non-ionic surfactants is driven by several factors. Growing awareness of hygiene and cleanliness, particularly In the wake of the global health crisis, has led to increased demand for cleaning and personal care products. Additionally, the shift towards eco-friendly and sustainable technologies has fueled the growth of the market. Environmental concerns have also influenced the market dynamics. The production of non-ionic surfactants from renewable raw materials has gained traction, as it reduces the dependence on petroleum-based feedstocks and addresses concerns related to environmental safety. Technological advancements In the production of non-ionic surfactants have led to more efficient and cost-effective methods, further boosting market growth. The market is diverse and dynamic, with various segments catering to different industries and applications. The home care segment, which includes household products, is a significant contributor to the market's growth. Industrial cleaning applications, such as oilfield chemicals and agricultural chemicals, also represent substantial opportunities.

Furthermore, the market for non-ionic surfactants is influenced by several factors, including raw material prices, customer awareness, and government support. The price fluctuations of raw materials, such as ethylene oxide and propylene oxide, can significantly impact the production costs of non-ionic surfactants. In the realm of cosmetics, non-ionic surfactants are used as surface-active agents in various formulations. They help improve the spreadability and wetting properties of cosmetic products, contributing to their overall performance. In the production of dyes and pigments, non-ionic surfactants act as dispersants, ensuring even distribution and preventing settling. The market for non-ionic surfactants is expected to continue growing, driven by the increasing demand for eco-friendly and sustainable products, technological advancements, and expanding applications in various industries. The future of this market is promising, as it offers numerous opportunities for innovation and growth.

|

Non-Ionic Surfactants Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

222 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.1% |

|

Market growth 2024-2028 |

USD 4.82 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.3 |

|

Key countries |

US, China, India, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Non-Ionic Surfactants Market Research and Growth Report?

- CAGR of the Non-Ionic Surfactants industry during the forecast period

- Detailed information on factors that will drive the Non-Ionic Surfactants growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the non-ionic surfactants market growth of industry companies

We can help! Our analysts can customize this non-ionic surfactants market research report to meet your requirements.