North America Piping And Fittings Market Size 2025-2029

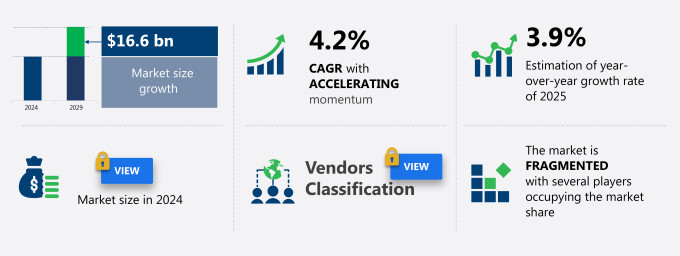

The North America piping and fittings market size is forecast to increase by USD 16.6 billion at a CAGR of 4.2% between 2024 and 2029.

- The piping and fittings market is experiencing significant growth due to the rise in exploration and production (E&P) activities, particularly in the oil and gas sector. This trend is driven by advances in material usage and technology, which have led to the development of more efficient and cost-effective piping systems. This trend is further fueled by advances in material use and technology, such as the adoption of high-performance alloys, and plastic and non-metallic piping systems. However, the market is also facing challenges from volatile input costs, which can impact the profitability of manufacturers and end-users alike. Despite these challenges, the market is expected to continue growing, driven by the increasing demand for reliable and efficient piping systems in various industries, including oil and gas, power generation, and water and wastewater treatment. The market analysis report provides a comprehensive assessment of these trends and challenges, offering insights into the key drivers and growth opportunities in the piping and fittings market.

What will be the Size of the Market During the Forecast Period?

- The piping and fittings market is driven by the demand for reliable and durable plumbing systems in various applications. Key materials in this market include polyvinyl chloride (PVC), high-density polyethylene (HDPE), chlorinated polyvinyl chloride (CPVC), acrylonitrile butadiene styrene (ABS), brass, cast iron, aluminum, and galvanized steel. The strength and resilience against corrosion of these materials make them ideal for use in sewage systems and heavy irrigation applications, where longevity is crucial.

- The increasing reliance on piping and fittings for crop production and clean-drinking water supply systems further boosts market growth. Bending and movements in piping systems require high durability and flexibility, which is driving the demand for advanced piping and fitting solutions. The market is expected to continue growing due to the increasing number of residential structures and the need for efficient water supply and sewage systems. Overall, the piping and fittings market is a dynamic and evolving industry, with ongoing innovation and development to meet the diverse needs of various applications.

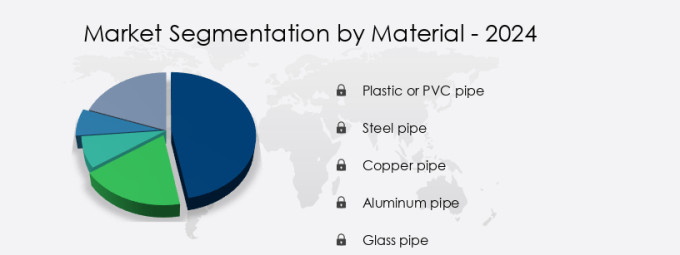

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Material

- Plastic or PVC pipe

- Steel pipe

- Copper pipe

- Aluminum pipe

- Glass pipe

- Geography

- North America

- Canada

- Mexico

- US

- North America

By Material Insights

- The plastic or PVC pipe segment is estimated to witness significant growth during the forecast period.

The Piping and Fittings Market, encompassing segments such as Galvanized Steel, Plumbing, Water Distribution, Drainage and Sewage, Irrigation, and HVAC, is experiencing significant growth, particularly in the PVC pipe segment. This expansion is attributed to the increasing investment in infrastructure projects, including new construction and drainage, in the region. PVC pipes are preferred due to their durability, flexibility, and lower maintenance costs compared to traditional iron or steel pipes. Their versatility makes them suitable for various applications, including plumbing, drainage, agriculture, and oil and gas production. The superior properties of PVC pipes, such as resistance to corrosion and chemical attack, contribute to their widespread adoption.

Additionally, environmental sustainability and technological advancements are driving the market's growth, as these materials offer eco-friendly alternatives and improved efficiency.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our North America Piping And Fittings Market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the North America Piping And Fittings Market?

The rise in E and P activities is the key driver of the market.

- The Piping and Fittings Market encompasses a wide range of products used in various applications, including plumbing systems for water distribution, drainage and sewage, irrigation, HVAC, and industrial processes. Key materials in this market include Polyvinyl Chloride (PVC), High-Density Polyethylene (HDPE), Copper, Concrete Pipes, Chlorinated Polyvinyl Chloride (CPVC), Acrylonitrile Butadiene Styrene (ABS), Brass Pipes, Cast Iron Pipes, Aluminum Pipes, and Galvanized Steel. In the context of plumbing, these piping materials offer strength, resilience against corrosion, longevity, and flexibility. For instance, PVC and CPVC pipes are widely used in residential and commercial structures due to their ease of installation, durability, and resistance to chemical degradation.

- HDPE pipes are preferred for heavy irrigation reliance in agriculture, while aluminum and copper pipes are popular choices for their strength and resistance to corrosion in industrial applications. Technological advancements have led to the development of thermoplastic piping, automation, and pipeline replacement solutions, enhancing the overall efficiency and sustainability of water supply and wastewater management systems. With increasing applications in various sectors, the market for piping and fittings is expected to grow significantly, driven by increasing urbanization, government regulation, and investments in construction in developing areas. In the oil and gas sector, piping and fittings play a crucial role in the extraction, transportation, and processing of crude oil and natural gas.

What are the market trends shaping the North America Piping And Fittings Market?

Advances in material use and technology is the upcoming trend in the market.

- The Piping and Fittings Market encompasses a wide range of products used in various applications within the plumbing systems sector. These include but are not limited to, Polyvinyl Chloride (PVC), High-Density Polyethylene (HDPE), Copper, Concrete Pipes, Chlorinated Polyvinyl Chloride (CPVC), Acrylonitrile Butadiene Styrene (ABS), Brass Pipes, Cast Iron Pipes, Aluminum Pipes, and Galvanized Steel. These piping solutions cater to diverse requirements in water distribution, drainage and sewage, irrigation, HVAC, and other industries. Technological advancements have significantly impacted the piping industry, leading to the development of thermoplastic piping and automation. The strength and resilience against corrosion of these non-metallic pipes have made them increasingly popular in heavy irrigation reliance areas, such as agriculture, for crop production.

- Additionally, the focus on environmental sustainability has led to the growing use of these pipes in water supply, sewage, and clean-drinking water systems. Investments in construction and developing areas, particularly in residential and commercial structures, have driven the demand for piping and fittings. Government regulation plays a crucial role in ensuring the quality and safety standards of these products. Piping industries are continually innovating to address the challenges of pipeline replacement, wastewater management, and building construction. In the energy sector, piping and fittings are essential components of oil and gas infrastructure. The market's growth is influenced by various factors, including increasing applications, water supply, sewage, and the need for clean-drinking water.

What challenges does the North America Piping And Fittings Market face during the growth?

Volatile input cost is a key challenge affecting market growth.

- The Piping and Fittings Market encompasses various types of materials, including Polyvinyl Chloride (PVC), High-Density Polyethylene (HDPE), Copper, Concrete Pipes, Chlorinated Polyvinyl Chloride (CPVC), Acrylonitrile Butadiene Styrene (ABS), Brass Pipes, Cast Iron Pipes, Aluminum Pipes, and Galvanized Steel. These materials are essential components of plumbing systems for Water Distribution, Drainage and Sewage, Irrigation, HVAC, and other applications in agriculture, environmental sustainability, and technological advancements. Raw material prices' instability significantly impacts the cost of production for piping and fitting providers. Stainless steel, iron, steel, and plastic are the primary raw materials, and their prices' volatility influences contracts for companies and overall fabrication costs.

- Inflation, supply and demand, and availability are the primary factors affecting raw material prices. For instance, the benchmark steel prices underwent substantial volatility in 2024, with prices dropping by approximately 15% in mid-year but surging back to over USD700 per ton by the end of the year. The Piping and Fittings Market's growth is influenced by increasing applications in various sectors, including residential and commercial structures, growing urbanization, government regulation, and investments in construction in developing areas. The market's expansion is also driven by the need for water supply, sewage, clean-drinking water, and wastewater management in both rural and urban settings.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Aliaxis Holdings SA - The company provides specialized piping and fitting solutions for various sectors in the US market. These include Healthcare and Hospitals where they ensure the delivery of clean and safe water and medical gases.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aliaxis Holdings SA

- Allied Group

- ArcelorMittal

- BASF SE

- BK Products Ltd.

- Canadoil Group

- Charlotte Pipe and Foundry Co.

- Compagnie de Saint-Gobain SA

- Hitachi Ltd.

- ISCO Industries

- JSW Group

- Kohler Co.

- Nippon Steel Corp.

- Orbia Advance Corp. S.A.B. de C.V.

- Pestan North America

- Swagelok Co.

- The Lubrizol Corp.

- Uponor Corp.

- Victaulic Co.

- Westlake Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The piping and fittings market encompasses a wide range of products used in various applications, including water distribution, drainage and sewage, irrigation, HVAC, and plumbing systems. These systems are essential for supplying clean-drinking water, ensuring adequate sewage disposal, and facilitating agricultural production. The market consists of several types of pipes, each with unique characteristics that cater to specific application requirements. Polyvinyl chloride (PVC) and high-density polyethylene (HDPE) pipes are popular choices due to their strength and resilience against corrosion. PVC pipes are widely used in residential structures and commercial applications, while HDPE pipes are favored for their durability and flexibility, making them suitable for heavy irrigation reliance and crop production in agriculture.

Furthermore, chlorinated polyvinyl chloride (CPVC) and acrylonitrile butadiene styrene (ABS) pipes are also significant contributors to the market. CPVC pipes are often used in plumbing applications due to their resistance to chemical degradation, while ABS pipes are preferred for their strength and versatility in various industries. Traditional materials like brass, cast iron, aluminum, and galvanized steel pipes continue to hold a considerable market share. Brass pipes are known for their resistance to corrosion and excellent flow characteristics, making them suitable for water distribution and HVAC applications. Cast iron pipes offer high strength and durability, making them ideal for sewage systems and heavy-duty applications.

Moreover, aluminum and galvanized steel pipes are popular choices for their resistance to corrosion and high strength-to-weight ratio, making them suitable for various industrial applications. Technological advancements have led to the emergence of thermoplastic piping, which offers increased flexibility, ease of installation, and improved performance. Automation and digitalization have also transformed the piping and fittings industry, leading to increased efficiency and cost savings. Environmental sustainability is a growing concern in the piping and fittings market. The demand for eco-friendly materials and sustainable manufacturing processes is driving innovation in the sector. The use of recycled materials and energy-efficient manufacturing processes is becoming increasingly common, as is the adoption of renewable energy sources in the production of piping and fittings.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

157 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.2% |

|

Market Growth 2025-2029 |

USD 16.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.9 |

|

Key countries |

US, Canada, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch