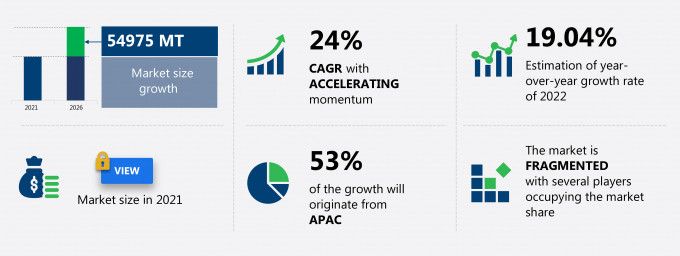

“The Offshore Wind Turbine Market is poised to grow by 54975 MT during 2022-2026, accelerating at a CAGR of 24% during the forecast period”

Technavio market report provides a holistic analysis, market size and forecast, trends, growth drivers, challenges, and vendor analysis covering around 15 vendors. Furthermore, this report extensively covers offshore wind turbine market segmentation by geography (EMEA, APAC, and Americas) and substructures (monopiles, gravity foundation, and others). The market report also offers information on several market vendors, including Eaton Corporation Plc, ENERCON GmbH, General Electric Co., Hitachi Ltd., Nordex SE, Senvion SA, Siemens AG, Suzlon Energy Ltd., Vestas Wind System AS, and Xinjiang Goldwind Science & Technology Co. Ltd. among others.

What will the Offshore Wind Turbine Market Size be During the Forecast Period?

Download Report Sample to Unlock the Offshore Wind Turbine Market Size for the Forecast Period and Other Important Statistics

Parent Market Analysis

Our Technavio Research categorizes the report belonging to Electrical Equipment Industry for the market. Technavio is based on four simple principles: easy-to-access reports, robust industry coverage, a focus on new and emerging technologies, and competitive pricing. We believe in helping companies and executives become better equipped to make faster, sounder, and more effective decisions.

Offshore Wind Turbine Market: Key Drivers, Trends, and Challenges

Technavio Research categorizes the global Offshore Wind Turbine Market belonging to the Capital Goods Industry. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic's impact on the industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the forecast year.

The market is extremely competitive with all sizes of businesses, including large, medium, and small-sized companies vying to monopolize the market. The tremendous development in various fields such as product innovations and new product launches by manufacturers operating in the market will drive the growth further.

Key Offshore Wind Turbine Market Driver

- The decline in LCOE for wind power generation is one of the major drivers impacting the offshore wind turbine market growth.

- Technological advances such as larger swept areas and higher hub height, along with the decline in the total installation costs, have encouraged the growth of wind power worldwide.

- The fall in wind turbine cost, low operation and maintenance cost, low cost of financing, and rising turbine supplies are contributing to the decline in the levelized cost of electricity (LCOE).

- The UK is a pioneer in wind power generation, where the cost of producing electricity from onshore wind turbines has declined dramatically due to innovative designs; the cost of producing electricity using wind energy in the country is now cheaper than that using fossil fuels. A decline in LCOE in wind power generation is expected to boost wind turbine installation worldwide, thereby propelling the global offshore wind turbine market.

Key Offshore Wind Turbine Market Trend

- R&D in direct drive generators is one of the major trends influencing the offshore wind turbine market growth. In a typical onshore wind turbine, a low rotational speed of around 14 rpm is converted into a high rotational speed of 560-1,500 rpm. However, the wind turbine industry is currently experimenting with direct drive generators.

- Direct train technology offers various advantages when compared with conventional turbines; for example, direct-drive generators will eliminate the need for a gearbox, and thus the turbine will involve fewer moving parts than geared drive trains. In the absence of gearboxes, direct-drive wind turbines run with the help of a rotor and a generator that rotate as an integrated unit.

- With no mechanism to step up the rotational speed, the size of the generator increases considerably. Moreover, with no gearbox present, direct drive wind turbines are lighter in weight.

- Many companies such as Siemens and GE are already experimenting with direct drive turbines, especially in offshore wind farms. As they require low maintenance, these systems are considered the future of offshore wind turbines. During the forecast period, these turbines are expected to undergo more R&D, which will also be influenced by the expected increase in offshore wind capacity.

Key Offshore Wind Turbine Market Challenge

- The high failure rate of wind turbine components is one of the major challenges impeding the offshore wind turbine market growth.

- The reliability of turbines is a prerequisite for the actual generation of power from wind energy. Any catastrophe of components will negatively distress the functioning of the entire system.

- A wind turbine is manufactured by integrating various components and technologies, ranging from hydraulics, aeronautics, automation, and others. Due to wind power's intermittency, these generators must endure recurrent load variations and mechanical stress, which can eventually lead to their breakdown.

- The high failure rate of wind turbines in offshore and onshore wind farms is leading to replacement and servicing costs.

- Offshore wind turbines incur more costs when compared with onshore wind turbines as replacement and servicing costs are higher in offshore wind turbines. Owing to high costs, offshore wind turbine installation is expected to decrease further in the future. This poses a major challenge to the offshore wind turbine industry.

Who are the Major Offshore Wind Turbine Market Vendors?

The vendor analysis is designed to help clients improve their market position, and in line with this, this report provides a detailed analysis of several leading market vendors such as

- Eaton Corporation Plc

- ENERCON GmbH

- General Electric Co.

- Hitachi Ltd.

- Nordex SE

- Senvion SA

- Siemens AG

- Suzlon Energy Ltd.

- Vestas Wind System AS

- Xinjiang Goldwind Science & Technology Co. Ltd.

Market Overview

The global heavy electrical equipment market is an important manufacturing market that caters to the needs of the energy sector and other industrial sectors such as power, mining, and oil and gas. The parent, global heavy electrical equipment market covers products and companies engaged in the manufacture of equipment for the generation, distribution, and transmission of power for fixed-use and large electrical systems. Technavio calculates the size of the global electrical equipment market based on the combined revenue generated by manufacturers of heavy electrical equipment such as electric cables, wires, and other components, and heavy electrical equipment.

Offshore Wind Turbine Market Value Chain Analysis

In this report, we provide extensive information on the value chain analysis for the market. Our data covers all key stages of a market flow and provides a complete understanding of all aspects of the market logistics value chain. This includes an end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies.

Which are the Key Regions for Offshore Wind Turbine Market?

53% of the market’s growth will originate from APAC during the forecast period. China is the key market for offshore wind turbines in APAC. Market growth in this region will be faster than the growth of the market in other regions.

The energy demand in APAC is rising because of the growing population and enhanced standard of living in the region. This has led to an increase in focus on renewable energy to increase power generation. China and India are anticipated to account for much of the wind energy installations in the region.For instance, in India, the government has plans to add approximately 10 GW of wind power capacity every year, at least for the next five years. However, India is also conducting assessments for the possibility of developing offshore wind farms over the next couple of years. China also has plans to increase its wind power capacity to 200 GW by 2020 and is targeting 30 GW of offshore wind installed capacity by 2020. Japan is exhibiting potential for wind power, driven by the expansion plans of wind companies such as Eurus and Hitachi. Initiatives taken by many countries in the region and the pace of their execution indicate an increased readiness to replace fossil fuels with renewables. Governments of these countries are promoting the large-scale installation of renewables to address the issue of environmental degradation and pollution caused by burning fossil fuels.

What are the Revenue-generating Geography Segments in the Offshore Wind Turbine Market?

To gain further insights on the market contribution of various segments Request a PDF Sample

The offshore wind turbine market share growth in the monopolies segment will be significant during the forecast period. The offshore wind turbine market is dominated by the monopiles substructure segment, mainly owing to its stability and higher number of lower-depth offshore projects running and lined up. The monopile support structure is a comparatively simple design by which the tower is maintained by monopiles either through a transition piece or directly. Monopiles are presently the most commonly used foundation in the offshore wind turbine market owing to their ease of setting up in shallow to medium water depths.

The report provides a near-term to long-term perspective on the trends and forecasts horizon for the market. It offers an overview of the key market drivers and restraints, enabling precise identification of key opportunities in each region over the coming years.

|

Offshore Wind Turbine Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 24% |

|

Market growth 2022-2026 |

54975 MT |

|

Market structure |

Fragmented |

|

YoY growth (%) |

19.04 |

|

Regional analysis |

EMEA, APAC, and Americas |

|

Performing market contribution |

APAC at 53% |

|

Key consumer countries |

UK, Germany, China, Denmark, and Belgium |

|

Competitive landscape |

Leading companies, Competitive Strategies, Consumer engagement scope |

|

Key companies profiled |

Eaton Corporation Plc, ENERCON GmbH, General Electric Co., Hitachi Ltd., Nordex SE, Senvion SA, Siemens AG, Suzlon Energy Ltd., Vestas Wind System AS, and Xinjiang Goldwind Science & Technology Co. Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Offshore Wind Turbine Market Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive the growth during the next five years

- Precise estimation of the size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the industry across EMEA, APAC, and Americas

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of offshore wind turbine market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch