Oil And Gas Digital Rock Analysis Market Size 2024-2028

The oil and gas digital rock analysis market size is forecast to increase by USD 119.4 million, at a CAGR of 3.27% between 2023 and 2028.

- The market is experiencing significant growth, driven by several key factors. The increasing consumption of oil and gas globally is a major growth driver, as traditional fossil fuels continue to dominate the energy sector. Additionally, the rise in unconventional oil and gas resources, such as shale and tight formations, necessitates advanced digital rock analysis techniques to optimize extraction and improve efficiency. Volatility in global crude oil prices also underscores the need for cost-effective and accurate digital rock analysis solutions to help companies make informed decisions and mitigate risks. Market trends include the adoption of artificial intelligence and machine learning technologies, increasing collaboration between oil and gas companies and technology providers, and the growing importance of data-driven insights In the industry. Challenges include data security and privacy concerns, the need for standardization and interoperability, and the high cost of implementation and maintenance of digital rock analysis solutions.

What will be the Size of the Oil And Gas Digital Rock Analysis Market During the Forecast Period?

- The market is witnessing significant growth due to the increasing adoption of advanced imaging techniques in the exploration and production of both conventional and unconventional reservoirs. Logging activities are a crucial part of oil and gas operations, and the integration of digital imaging and advanced microscopy in these processes is revolutionizing the industry. Geologists, geochemists, petrophysicists, and petroleum engineers utilize various techniques such as CT Scanning, Micro CT Scanning, Scanning Electron Microscope, and other advanced analysis tools to study reservoir rocks at the pore scale.

- These techniques provide precise and realistic simulations, enabling optimal resource extraction from unconventional resources. Physics plays a vital role in digital rock analysis, with fluid dynamics being a significant area of focus. The market is driven by the computational capabilities of these techniques, which allow for the simulation of complex reservoir behavior and enhanced oil recovery processes. Skilled workers are essential in the implementation and interpretation of these advanced analysis tools.

How is this Oil And Gas Digital Rock Analysis Industry segmented and which is the largest segment?

The oil and gas digital rock analysis industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Conventional

- Unconventional

- Geography

- North America

- Canada

- US

- APAC

- China

- Europe

- France

- Middle East and Africa

- South America

- North America

By Type Insights

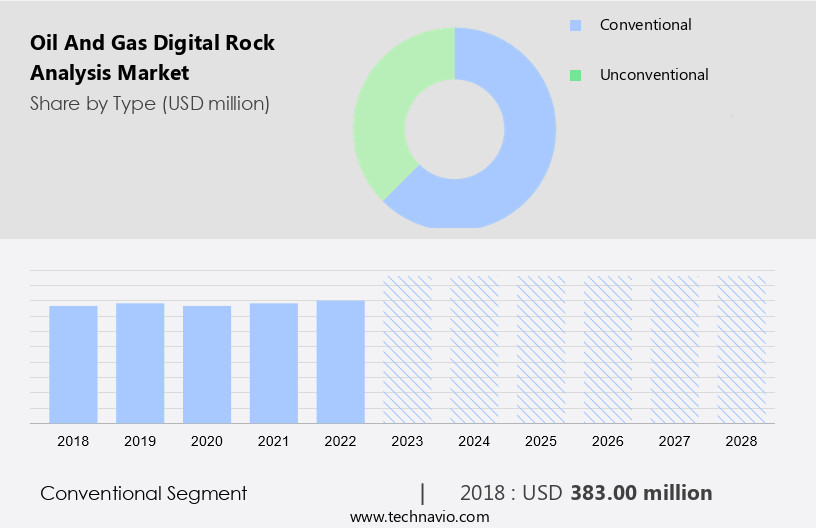

- The conventional segment is estimated to witness significant growth during the forecast period.

The market primarily focuses on the examination of reservoir rocks using advanced imaging techniques and data analysis to optimize hydrocarbon production from both conventional and unconventional resources. Conventional reservoirs, including mature and depleting fields, continue to dominate the market due to the extensive use of digital rock analysis in enhancing well recovery and crude oil production. This approach combines the expertise of various disciplines, such as geology, geochemistry, petrophysics, petroleum engineering, and physics, to investigate the pore structures and fluid behavior in rock formations. Advanced microscopy techniques, CT scanning, and modeling methods are employed to acquire high-resolution images of rock pores and mineral grains, enabling a better understanding of the reservoir's physical and fluid flow properties.

This data is then analyzed to develop reservoir characterization models, reservoir simulation models, and production optimization workflows. Research institutions and universities are also contributing significantly to the market by advancing imaging technologies and modeling methods for digital rock analysis. The shale revolution and the development of tight oil resources have led to a growing interest in digital rock analysis for unconventional reservoirs. The ability to characterize the complex pore structures and fluid flow properties of these formations is crucial for maximizing hydrocarbon production and improving well recovery. Digital rock analysis plays a vital role in understanding the unique properties of unconventional reservoirs, contributing to the growth of the market.

Get a glance at the market report of the share of various segments Request Free Sample

The conventional segment was valued at USD 383.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

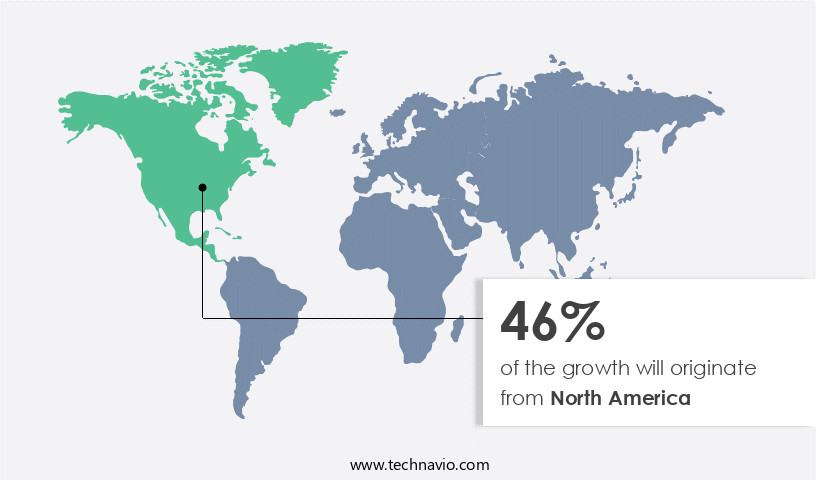

- North America is estimated to contribute 46% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Oil And Gas Digital Rock Analysis Industry?

Growing consumption of oil and gas is the key driver of the market.

- The oil and gas industry is experiencing a technological revolution, driven by the increasing demand for hydrocarbons and the need to optimally extract resources from unconventional reservoirs. Digital rock analysis is at the forefront of this transformation, with advanced analysis tools such as Micro CT Scanning and Scanning Electron Microscope playing a pivotal role. These techniques enable precise digital imaging, computational capabilities, and simulation techniques to deliver realistic simulations of fluid dynamics and Enhanced Oil Recovery (EOR) processes. Moreover, data-driven decision-making processes are gaining traction, with Big Data and machine learning enabling real-time analysis, monitoring capabilities, and digital twins for 3D visualization techniques.

- Cloud-based solutions offer the added advantage of accessibility and scalability, making these technologies indispensable for the industry. The conventional segment of the oil and gas industry is also embracing digital transformation, with scientific disciplines such as geology, geophysics, and engineering leveraging these tools to optimize production strategies and improve recovery rates. The ecological footprint of the industry is also a concern, and digital rock analysis offers a way to minimize it by providing data-driven insights for optimal resource extraction. Technology providers are at the heart of this transformation, offering a range of solutions to help companies navigate the complexities of the oil and gas industry.

What are the market trends shaping the Oil And Gas Digital Rock Analysis Industry?

Rise in unconventional oil and gas resources is the upcoming market trend.

- The oil and gas industry's reliance on crude oil prices and global supply-demand equilibrium is significant, with political and macroeconomic factors also playing a role. Unconventional resources, including shale formations, oil sands, and coalbed methane found in coal seams or deposits, have emerged as a crucial focus in recent years. These resources, which differ from conventional sources due to their lower permeability, have gained prominence as traditional oil sources approached depletion. Advanced analysis tools, such as Micro CT Scanning and Scanning Electron Microscope, have revolutionized the exploration and production process of unconventional reservoirs. Digital imaging, computational capabilities, and simulation techniques enable precise, realistic simulations for optimal resource extraction.

- Fluid dynamics and Enhanced Oil Recovery (EOR) techniques are essential for maximizing recovery rates in mature fields. Big data and data-driven decision-making processes have become crucial In the industry. Artificial intelligence and machine learning algorithms facilitate real-time analysis and monitoring capabilities, enabling data-driven insights. Digital twins and 3D visualization techniques offer a more comprehensive understanding of reservoirs, while cloud-based solutions provide accessibility and scalability. Several scientific disciplines, including geology, petroleum engineering, and geophysics, contribute to the development of production strategies. The integration of these disciplines with advanced analysis tools and technology providers is essential for achieving high recovery rates and minimizing the ecological footprint In the oil and gas sector.

What challenges does the Oil and Gas Digital Rock Analysis Industry face during its growth?

Volatility in global crude oil prices is a key challenge affecting the industry growth.

- The oil and gas industry's digital transformation is revolutionizing exploration and production (E&P) processes, particularly in the analysis of unconventional reservoirs. Advanced analysis tools, such as Micro CT Scanning and Scanning Electron Microscope, are used to study rock properties at a microscopic level, enhancing precision and providing realistic simulations for optimal resource extraction. Digital imaging and computational capabilities enable simulation techniques to model fluid dynamics and Enhanced Oil Recovery (EOR) processes, reducing ecological footprint and improving production strategies.

- Big data and data-driven decision-making processes provide insights into recovery rates and monitoring capabilities, enabling real-time analysis and digital twins for mature fields. Cloud-based solutions and 3D visualization techniques facilitate collaboration among scientific disciplines and technology providers, ensuring efficient and effective drilling in both conventional and unconventional segments. The integration of artificial intelligence and machine learning further enhances the industry's capabilities, enabling real-time monitoring and predictive maintenance.

Exclusive Customer Landscape

The oil and gas digital rock analysis market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the oil and gas digital rock analysis market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, oil and gas digital rock analysis market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Baker Hughes Co.

- CGG SA

- Core Laboratories NV

- Dassault Systemes SE

- Halliburton Co.

- iRock Technologies Co. Ltd.

- Math2Market GmbH

- Schlumberger Ltd.

- Thermo Fisher Scientific Inc.

- Weatherford International Plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the use of advanced imaging techniques and technologies to study the properties of reservoir rocks at the pore scale. This analysis is crucial for understanding hydrocarbon production from conventional and unconventional reservoirs, including mature and remaining reserves. The process involves logging activities, physics, geology, geochemistry, petrophysics, and petroleum engineering. Advanced microscopy and imaging techniques, such as CT Scanning, play a significant role in this market. These methods provide detailed information about pore structures, fluid behavior, and rock formations. This data is essential for reservoir characterization, modeling workflows, and production optimization workflows. Research institutions and universities are also contributing to the development of new imaging technologies and modeling methods.

In addition, the shale revolution and the exploration of tight oil resources have further boosted the demand for digital rock analysis. The market for this technology is expected to grow significantly due to the increasing importance of understanding the complexities of reservoir rocks and optimizing hydrocarbon production. The analysis of rock samples using digital imaging techniques and modeling methods helps in understanding the fluid flow properties and pore structures of reservoir rocks. This information is vital for reservoir simulation models and can lead to improved well recovery and crude oil production. Overall, the market is an essential component of the oil and gas industry, providing valuable insights into the behavior of reservoir rocks and optimizing hydrocarbon production.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

136 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.27% |

|

Market growth 2024-2028 |

USD 119.4 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

3.13 |

|

Key countries |

US, Canada, China, Russia, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Oil And Gas Digital Rock Analysis Market Research and Growth Report?

- CAGR of the Oil And Gas Digital Rock Analysis industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the oil and gas digital rock analysis market growth of industry companies

We can help! Our analysts can customize this oil and gas digital rock analysis market research report to meet your requirements.