Online Streaming Services Market Size 2025-2029

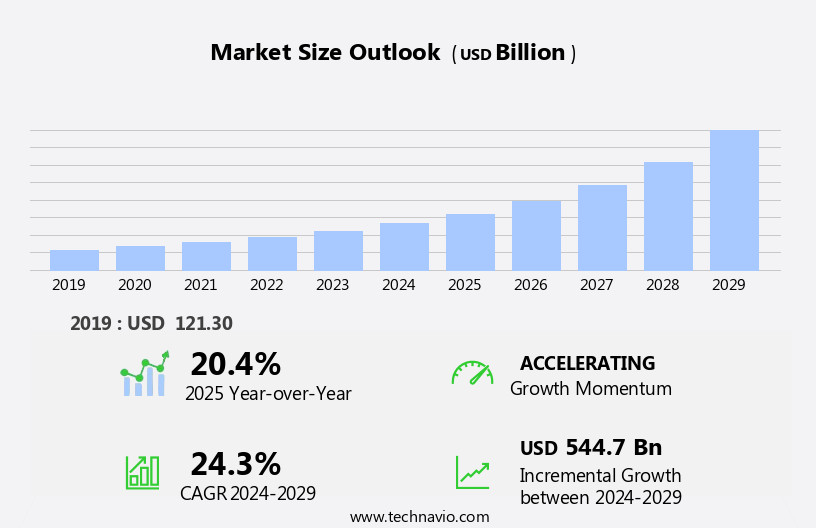

The online streaming services market size is forecast to increase by USD 544.7 billion, at a CAGR of 24.3% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing penetration of smartphones and widespread access to the internet. This digital shift has led to a surge in consumer demand for on-demand video content, making online streaming a preferred choice for entertainment consumption. Furthermore, the integration of advanced technologies, such as artificial intelligence and machine learning, enhances user experience by providing personalized recommendations and content adaptability. However, challenges persist, with video piracy being a major concern. As the market continues to evolve, companies must navigate these challenges effectively to capitalize on the growing opportunities and maintain a competitive edge.

- Strategic partnerships, robust security measures, and continuous innovation are essential to addressing piracy concerns and ensuring consumer trust. By focusing on these key drivers and challenges, companies can effectively position themselves in the dynamic the market.

What will be the Size of the Online Streaming Services Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- In the dynamic the market, subscription revenue continues to dominate, driven by the proliferation of Ott platforms and content aggregation. Interactive storytelling and immersive experiences are key differentiators, with machine learning and artificial intelligence powering personalized recommendations and user behavior modeling. Content monetization strategies expand beyond subscriptions, incorporating advertising revenue and loyalty programs. Cultural sensitivity and search engine optimization are essential for reaching global audiences. Data security and privacy are paramount, with metadata management and blockchain technology playing crucial roles in securing content. The Internet of Things and 5G networks enable adaptive bitrate streaming and dynamic content delivery, enhancing user experiences.

- Business model innovation, including data mining and predictive analytics, fuels future growth. Disruptive technologies, such as content encoding and video transcoding, ensure optimal streaming quality. Content promotion and tagging are essential for user engagement, driving search engine optimization and user behavior modeling. Overall, the future of streaming is characterized by innovative technologies, cultural sensitivity, and user-centric strategies.

How is this Online Streaming Services Industry segmented?

The online streaming services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Revenue

- Subscription

- Advertising

- Rental

- Type

- Online video streaming

- Online music streaming

- Content Types

- Movies and TV Shows

- Music and Podcasts

- Sports

- News

- User-Generated Content

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Revenue Insights

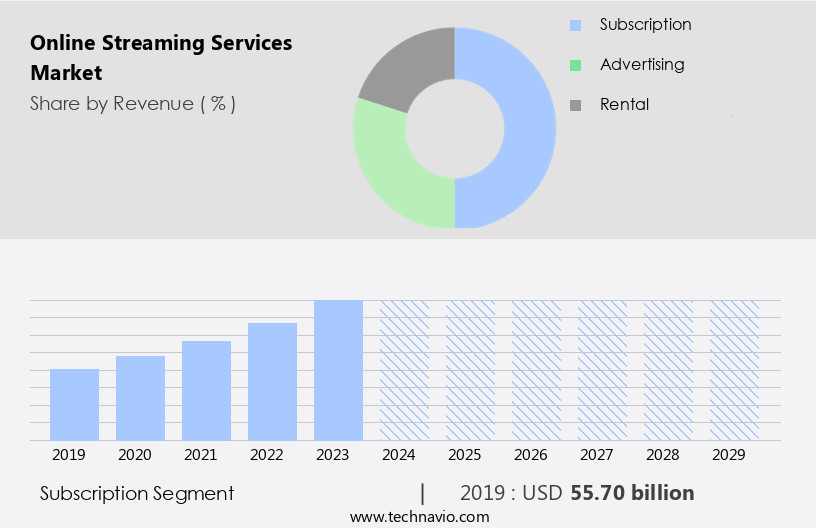

The subscription segment is estimated to witness significant growth during the forecast period.

Subscription video-on-demand (SVOD) services have gained significant traction in the media landscape, offering customers unlimited access to a vast library of high-quality content for a fixed monthly fee. The popularity of SVOD platforms, including Netflix, Amazon Prime Video, Hulu, HBO, and Disney+, can be attributed to their innovative pricing strategies, original premium content, and the convenience of on-demand viewing. Usage patterns reveal that users in India, particularly those in Tier I cities and major metros, account for a substantial portion of OTT platform users. Server capacity and content delivery networks ensure seamless streaming, while content moderation and anti-piracy measures protect intellectual property.

Emerging trends include augmented reality content, virtual reality, and interactive programming. Audio quality and multi-language support enhance user experience, and social media integration facilitates content discovery and sharing. Content production costs and bandwidth management are essential considerations for streaming services, which also employ targeted advertising, marketing campaigns, and subscription models to monetize their offerings. Content analytics and recommendation algorithms help personalize user experiences and improve customer retention. Security measures, digital rights management, and user reviews ensure content protection and maintain industry standards. Live streaming and multi-screen viewing cater to diverse user preferences. Subtitles and captions, original programming, and user interface design further engage users and differentiate services.

Competition analysis is crucial for streaming services to stay competitive, with constant innovation in content, technology, and user experience being key drivers. Cloud computing and streaming infrastructure investments support the delivery of high-quality content to a growing user base.

The Subscription segment was valued at USD 55.70 billion in 2019 and showed a gradual increase during the forecast period.

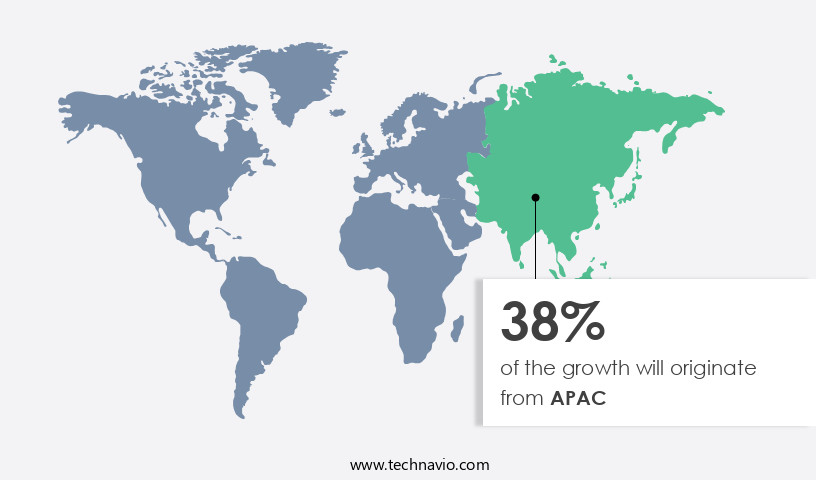

Regional Analysis

APAC is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the expanding on-demand video market and the decline of traditional live TV broadcasting. This region's mature and technologically advanced entertainment industry is driving innovation in streaming services, which now offer more than just movies and television shows. For instance, Twitch Prime/Prime Gaming is anticipated to provide free games, game content, and a free Twitch channel subscription as part of its standard Prime membership, catering to the increasing demand for new content. Usage patterns indicate a shift towards multi-screen viewing, with viewers consuming content on various devices, including smart TVs and mobile devices.

Augmented reality and virtual reality content are emerging trends, enhancing user engagement and experience. Server capacity and bandwidth management are crucial considerations for streaming infrastructure, ensuring seamless content delivery to subscribers. Content production costs continue to rise, leading streaming services to adopt various pricing strategies, such as tiered pricing and advertising-supported models. Targeted advertising and marketing campaigns are essential tools for customer acquisition and retention, with content analytics and recommendation algorithms playing a significant role in user engagement. Security measures, including digital rights management and anti-piracy technologies, are essential to protect intellectual property and maintain industry standards. Content localization and multi-language support cater to diverse audiences, while user reviews and ratings influence content licensing decisions.

Subscription models and cloud computing enable on-demand access to vast content libraries, offering value to consumers. Live streaming and interactive content further enrich the user experience, with high video resolution and user interface design playing a critical role in viewer satisfaction. Competition analysis is essential for streaming services to stay competitive, with innovation pipelines and original programming being key differentiators. Operating expenses and investment opportunities are significant factors in the market's growth and sustainability.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Online Streaming Services market drivers leading to the rise in the adoption of Industry?

- The significant increase in smartphone adoption and widespread internet access serves as the primary catalyst for market growth.

- Online streaming services have gained significant traction in today's digital landscape, driven by the widespread use of high-end smartphones and improved Internet accessibility. The increasing penetration of mobile devices with high-resolution displays offers users an immersive viewing experience. In emerging markets, the availability of affordable smartphones and the expansion of 4G and 5G technologies have fueled the demand for online streaming services. Customer retention is a critical concern for streaming service providers, and content discovery plays a pivotal role in achieving this goal. Augmented reality (AR) content and personalized recommendations are emerging trends that help users discover new content and enhance their viewing experience.

- Usage patterns indicate that users watch content on multiple devices, necessitating server capacity expansion and bandwidth management. Content moderation and anti-piracy measures are essential to maintain the integrity of the streaming services. Content localization is another important aspect, as providing content in local languages and cultures can increase user engagement and retention. The production costs of high-quality content continue to rise, making it essential for streaming services to invest in efficient content production and delivery systems. Audio quality is another key factor influencing user satisfaction. Smart TV integration allows users to access streaming services directly from their TVs, providing a more convenient and enjoyable viewing experience.

- Streaming services are continually innovating to meet evolving user needs and expectations.

What are the Online Streaming Services market trends shaping the Industry?

- Advanced technologies are increasingly being integrated into online streaming services, representing a significant market trend. This fusion of technology and streaming is transforming the way we consume media.

- Online streaming services have experienced significant growth, driven by advanced technologies and consumer preferences. Artificial intelligence (AI), deep learning, natural language processing, and blockchain technology are transformative forces in the industry, improving video quality and streaming experiences. AI aids various aspects of video production, from cinematography and editing to voice-overs and scriptwriting. Providers like Hulu and YouTube leverage AI to enhance content quality and meet consumer demands. Pricing strategies, such as subscription models, remain crucial for customer acquisition and retention. Targeted advertising and marketing campaigns based on user data and preferences contribute to revenue generation. Virtual reality content and live streaming further boost user engagement.

- A robust streaming infrastructure, powered by cloud computing and a content delivery network, ensures seamless content delivery. Content analytics offers valuable insights into consumer behavior and preferences, enabling providers to tailor their offerings. The integration of AI and advanced technologies, along with strategic pricing and targeted marketing, positions online streaming services for continued growth and success.

How does Online Streaming Services market faces challenges during its growth?

- Video piracy poses a significant challenge to the industry's growth, as concerns regarding intellectual property theft continue to mount. This issue undermines revenue streams and damages the reputation of content creators and distributors alike. It is imperative that effective measures are taken to mitigate the impact of video piracy and safeguard the interests of industry stakeholders.

- The market faces challenges due to the prevalence of web video piracy and illegal streaming. Torrent sites, which allow users to download copyrighted content for free using software like BitTorrent and uTorrent, pose a significant threat. While the use of such software is not illegal, the sharing of copyrighted material is. This trend undermines the need for users to subscribe to online streaming services. To combat these issues, industry standards prioritize security measures such as digital rights management and copyright protection. A content management system ensures secure distribution and access to licensed content. Interactive content and high video resolution are key differentiators for streaming services, driving investment opportunities.

- The innovation pipeline remains robust, with ongoing advancements in streaming quality. User reviews provide valuable insights for consumers, helping them make informed decisions. The market faces challenges from piracy and illegal streaming. However, industry standards, security measures, and ongoing innovation ensure a professional and engaging user experience. Investment opportunities exist for companies that can effectively manage content and provide high-quality streaming services.

Exclusive Customer Landscape

The online streaming services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the online streaming services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, online streaming services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Access Industries Inc. - This global streaming platform provides access to music and audio content in over 180 countries, boasting a vast library of 56 million tracks. Our service caters to a diverse audience, delivering high-quality streaming experiences to users worldwide. By leveraging advanced technology, we ensure uninterrupted access to a broad range of genres and artists, enhancing the entertainment experience for our subscribers. Our commitment to innovation and customer satisfaction sets US apart in the digital media landscape.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Access Industries Inc.

- Alibaba Group Holding Ltd.

- Amazon.com Inc.

- Apple Inc.

- AT and T Inc.

- Baidu Inc.

- Balaji Telefilms Ltd.

- Brightcove Inc.

- British Broadcasting Corp.

- Eros International Media Ltd.

- Fox Corp.

- fuboTV Inc.

- Google LLC

- Hulu LLC

- Netflix Inc.

- Spotify Technology SA

- Tencent Holdings Ltd.

- The Walt Disney Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Online Streaming Services Market

- In February 2023, Disney+ announced the launch of its ad-supported subscription tier, making it more accessible to budget-conscious consumers. This strategic move aimed to expand its customer base and compete more effectively with other streaming services offering lower-priced ad-supported plans (Disney Press Release).

- In May 2024, Amazon Prime Video and MGM Studios entered into a strategic partnership. This collaboration allowed Amazon to acquire MGM's vast film and TV library, enhancing its content offering and strengthening its position in the competitive streaming market (Variety).

- Netflix made a significant investment of USD500 million in Indian streaming services in March 2025, marking a major geographic expansion and commitment to producing local content for the growing market (Netflix Investor Relations).

- In August 2025, Apple TV+ and Disney+ reached a multi-year deal to bring Disney content back to Apple's platform. This partnership demonstrated the importance of content licensing agreements in the streaming market and allowed Apple to regain a portion of Disney's popular content (Deadline).

Research Analyst Overview

The market continues to evolve, with dynamic market dynamics shaping its applications across various sectors. Usage patterns are a critical focus, as customer retention hinges on delivering a seamless user experience. Server capacity and content moderation are essential components, ensuring uninterrupted streaming and maintaining content quality. Augmented reality content and virtual reality experiences are emerging trends, enhancing user engagement and offering new revenue streams. Pricing strategies and targeted advertising are essential tools for customer acquisition and retention. Streaming services invest in marketing campaigns to expand their reach and differentiate themselves from competitors. Cloud computing and content delivery networks optimize streaming infrastructure, enabling high-quality content delivery and reducing operating expenses.

Subscription models and customer analytics provide valuable insights into viewership data and churn rates, informing content production costs and innovation pipelines. Live streaming and interactive content cater to evolving audience preferences, while content localization and multi-language support expand reach. Security measures, digital rights management, and copyright protection are crucial for maintaining industry standards and mitigating risks. Social media integration and user reviews contribute to content discovery and word-of-mouth marketing. Bandwidth management and device compatibility ensure a consistent user experience across platforms. The ongoing unfolding of market activities reveals a competitive landscape, with streaming services continually innovating to meet evolving consumer demands and expectations.

The future of the market lies in delivering high-quality, personalized content across multiple screens, while managing costs and maintaining a strong value proposition.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Online Streaming Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

200 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 24.3% |

|

Market growth 2025-2029 |

USD 544.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

20.4 |

|

Key countries |

US, Canada, China, UK, Germany, Japan, France, India, Brazil, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Online Streaming Services Market Research and Growth Report?

- CAGR of the Online Streaming Services industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the online streaming services market growth of industry companies

We can help! Our analysts can customize this online streaming services market research report to meet your requirements.