Ophthalmology Surgical Devices Market Size 2024-2028

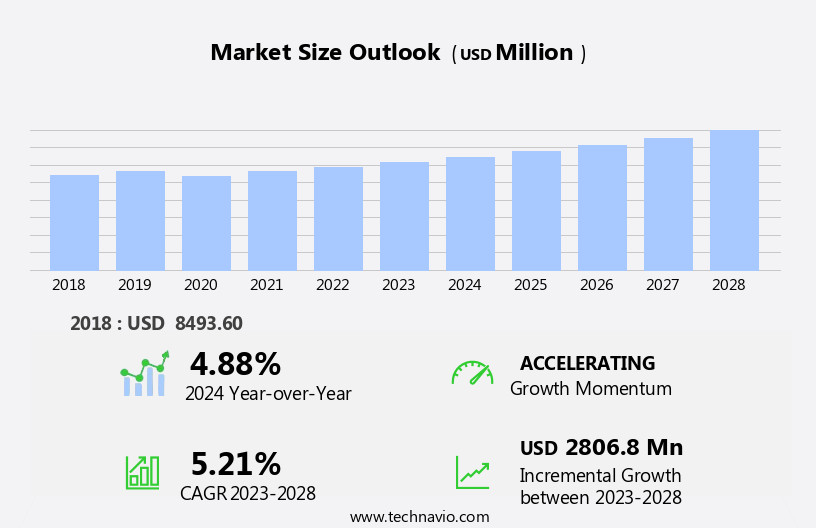

The ophthalmology surgical devices market size is forecast to increase by USD 2.81 billion at a CAGR of 5.21% between 2023 and 2028.

What will be the Size of the Ophthalmology Surgical Devices Market During the Forecast Period?

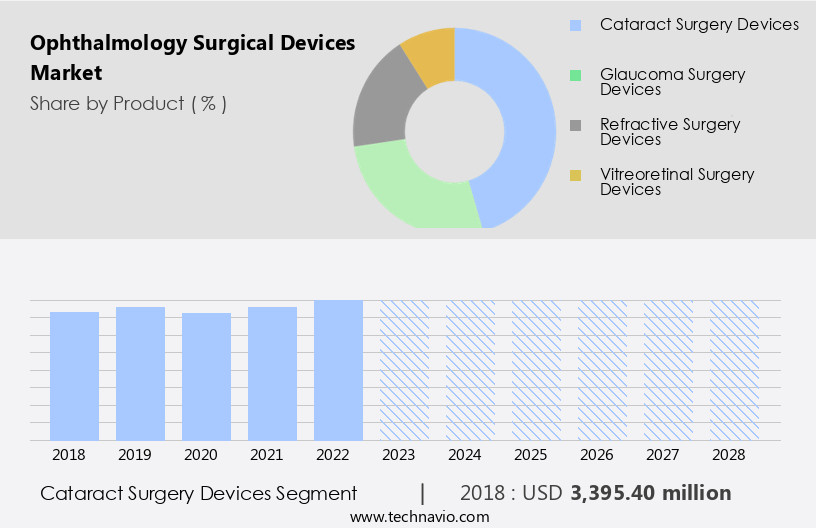

How is this Ophthalmology Surgical Devices Industry segmented and which is the largest segment?

The ophthalmology surgical devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Cataract surgery devices

- Glaucoma surgery devices

- Refractive surgery devices

- Vitreoretinal surgery devices

- Geography

- North America

- US

- Europe

- Germany

- UK

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

By Product Insights

- The cataract surgery devices segment is estimated to witness significant growth during the forecast period.

Ophthalmology surgical devices play a crucial role in addressing various eye disorders, including cataracts and glaucoma. Cataracts, a leading cause of vision impairment, affect individuals due to aging or eye injuries, and are associated with symptoms such as blurred vision, difficulty reading, and visual changes. According to the National Eye Institute, over 24.4 million Americans aged 40 and above have cataracts. Glaucoma, another prevalent ophthalmic disorder, affects over 3 million Americans and results in severe visual impairment or blindness if left untreated. Advanced technologies like microscopes, robotic technologies, and laser technology are transforming ophthalmic surgeries, including cataract surgeries utilizing phacoemulsification systems and intraocular lenses.

Technological advancements, such as SmartCataract solutions and the Hydrus Microstent for glaucoma, offer innovative alternatives for managing ophthalmic disorders. The geriatric population, with its increasing prevalence of cataracts and glaucoma, drives the demand for these surgical devices. The ophthalmic equipment market encompasses a wide range of surgical products, including vitreoretinal surgery devices, ophthalmology drugs, and glaucoma surgical devices. The aging population and the increasing prevalence of eye disorders, such as cataract, diabetic retinopathy, and macular degeneration, necessitate advancements in ophthalmic equipment.

Get a glance at the Ophthalmology Surgical Devices Industry report of share of various segments Request Free Sample

The Cataract surgery devices segment was valued at USD 3.4 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 43% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American the market is experiencing significant growth due to increasing healthcare expenditure on eye diseases and the approval of innovative ophthalmic surgical devices. The market's expansion is driven by the high prevalence of eye disorders, including cataracts, glaucoma, diabetic retinopathy, age-related macular degeneration (AMD), and refractive diseases. The aging population and the rising incidence of chronic diseases, such as diabetes, contribute to the increasing prevalence of ophthalmic diseases. In North America, cataract surgeries are common, with advanced cataract patients undergoing phacoemulsification (phaco) procedures using sophisticated phacoemulsification systems and smart cataract solutions. Glaucoma, another prevalent eye condition, is managed with microscopes, laser technology, and glaucoma surgical devices like the Hydrus Microstent.

Ophthalmic surgical devices, including vitreoretinal surgery devices and ophthalmic viscoelastic devices, are essential consumables in ophthalmology clinics and hospitals. The market's growth is also influenced by technological advancements in refractive surgeries, such as laser surgery (LASIK), and the increasing prevalence of severe visual impairment. The National Ophthalmology Database and other healthcare infrastructure improvements facilitate the implementation of these advanced surgical products. The prevalence of cataract and glaucoma In the region is high, with an estimated 3 million cataract surgeries and 3 million glaucoma cases annually. The market's growth is expected to continue as the demand for correcting vision impairment and treating eye disorders increases.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Ophthalmology Surgical Devices Industry?

Increasing prevalence of ophthalmic diseases is the key driver of the market.

What are the market trends shaping the Ophthalmology Surgical Devices Industry?

Strategic collaborations and M and A among vendors is the upcoming market trend.

What challenges does the Ophthalmology Surgical Devices Industry face during its growth?

High cost and limited reimbursements is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The ophthalmology surgical devices market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ophthalmology surgical devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, ophthalmology surgical devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AbbVie Inc. - The market encompasses advanced technologies utilized in various eye surgeries. One notable solution is the LensX laser system, a widely adopted tool in cataract surgery procedures. This system leverages precision laser technology to facilitate efficient and effective cataract removal, contributing significantly to the overall success of the surgery. By enhancing surgical accuracy and reducing complications, such devices play a crucial role in improving patient outcomes and advancing the field of ophthalmology.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AbbVie Inc.

- Alcon Inc.

- Bausch Health Companies Inc.

- Carl Zeiss AG

- Ellex Medical Lasers Ltd.

- EssilorLuxottica

- FCI Ophthalmics

- Glaukos Corp.

- Gulden Ophthalmics

- HOYA Corp.

- IRIDEX Corp.

- Johnson and Johnson Services Inc.

- Katena Products Inc.

- LENSAR Inc.

- Lumenis Be Ltd.

- Metall Zug AG

- NIDEK Co. Ltd.

- Nova Eye Medical Ltd.

- STAAR Surgical Co.

- Sterimedix Ltd.

- Topcon Corp.

- Ziemer Ophthalmic Systems AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The ophthalmic surgical devices market encompasses a range of advanced tools and technologies utilized In the diagnosis and treatment of various ophthalmic disorders. These devices play a crucial role in addressing conditions such as cataracts, glaucoma, and other eye disorders that can lead to severe visual impairment or blindness. Cataracts, a leading cause of vision loss, are characterized by clouding of the natural lens In the eye. Microscopes and advanced imaging systems enable ophthalmologists to diagnose and monitor the progression of cataracts. Robotic technologies and phacoemulsification (phaco) systems facilitate precise and efficient cataract surgeries, allowing for the implantation of artificial lenses to correct refractive errors and improve vision.

Glaucoma, another prevalent ophthalmic condition, is characterized by increased pressure withIn the eye, which can damage the optic nerve and lead to vision loss. Glaucoma surgical devices, such as the Hydrus microstent and Cypass micro-stent, are designed to improve the drainage of aqueous humor and reduce intraocular pressure. Technological advancements continue to shape the ophthalmic surgical devices market, with virtual reality options and portable VR tools providing enhanced training opportunities for cataract surgeons-in-training. Laser technology, including LASIK and femtosecond lasers, is used in refractive surgeries to correct vision impairment caused by various eye disorders. The aging population and the increasing prevalence of conditions like diabetes contribute to the growing demand for ophthalmic surgical devices.

According to data from the Macular Disease Foundation, an estimated 1.1 million Americans aged 40 and older have age-related macular degeneration. Ophthalmology surgery devices, including vitreoretinal surgery devices and ophthalmic viscoelastic devices, are essential for the treatment of these conditions. The ophthalmic surgical devices market is influenced by several factors, including the backlog of patients seeking consultations for various eye disorders, unfavorable reimbursement policies, and the prevalence of conditions like cataract and glaucoma. The National Ophthalmology Database reports that over 3 million cataract surgeries are performed annually In the United States alone. Ophthalmic equipment, including surgical products and consumables, are essential for the successful implementation of ophthalmic surgical procedures.

Hospitals and clinics rely on these devices to provide comprehensive eye care services to their patients. In conclusion, the ophthalmic surgical devices market represents a dynamic and evolving sector withIn the healthcare industry. With a growing aging population, increasing prevalence of eye disorders, and ongoing technological advancements, the demand for these devices is expected to continue growing. Ophthalmologists and healthcare providers must stay informed of the latest developments in this field to provide the best possible care for their patients.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

150 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.21% |

|

Market growth 2024-2028 |

USD 2806.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.88 |

|

Key countries |

US, Germany, UK, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Ophthalmology Surgical Devices Market Research and Growth Report?

- CAGR of the Ophthalmology Surgical Devices industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the ophthalmology surgical devices market growth of industry companies

We can help! Our analysts can customize this ophthalmology surgical devices market research report to meet your requirements.