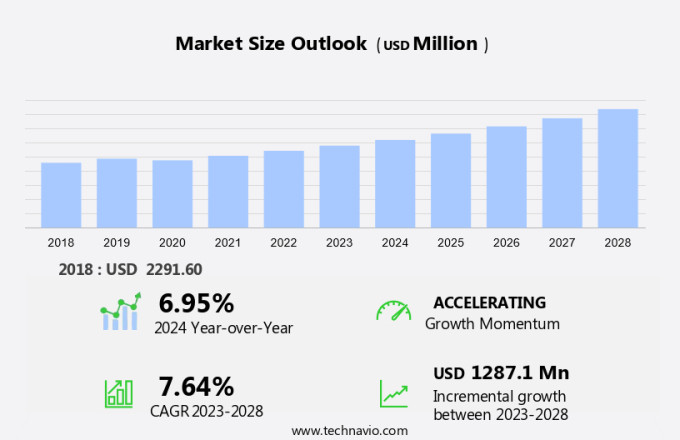

Organic And Natural Feminine Care Market Size 2024-2028

The organic and natural feminine care market size is projected to increase by USD 1.28 billion at a CAGR of 7.64% between 2023 and 2028. The market's growth depends on several factors, including heightened awareness of hygiene and associated products, escalating environmental concerns regarding the use and disposal of plastic feminine care products, and increased government initiatives to promote menstrual hygiene in developing regions. These factors collectively drive the market's expansion, reflecting a shift towards sustainable and environmentally friendly feminine care solutions. The growing awareness of hygiene underscores the importance of safe and effective menstrual products, driving demand for eco-friendly alternatives. Furthermore, government initiatives play a crucial role in promoting menstrual hygiene practices, particularly in regions with limited access to such products. As these trends gain momentum, the market is poised for substantial growth, driven by the shift toward sustainable menstrual care solutions.

What will be the Size of the Market During the Forecast Period?

For More Highlights About this Report, Request Free Sample

Market Dynamic and Customer Landscape

The Market is gaining significant attention due to increasing health awareness and concerns regarding synthetic chemicals in scents, dyes, and menstrual products. Environmental issues and sustainability are key factors driving the demand for sustainable manufacturing techniques and biodegradable components. Nature-friendly alternatives, such as organic cotton, are preferred by consumers, particularly those with sensitive skin and concerns for their vaginal area. Brand names that prioritize these initiatives are increasingly influencing consumer purchasing decisions. Plastic waste, a pressing environmental concern, is also a significant issue in the industry. Reusable products, such as menstrual cups and cloth pads, are gaining popularity as sustainable alternatives to disposable sanitary pads and tampons. Cancer and chronic diseases have brought attention to the importance of using natural and organic products. Initiatives by nations to reduce the taboo of menstruation and promote women's health are further propelling the market growth. The shift towards organic and natural feminine care is a positive step towards a healthier and more sustainable future.

Key Market Driver - Growing awareness about hygiene and related products

The market comprises products such as menstrual pads, tampons, menstrual cups, and panty liners. Despite their long existence, proper use and hygiene practices have been under-discussed. However, with increasing awareness through campaigns and advertisements, the importance of good menstrual hygiene management is gaining recognition. In India, for instance, numerous organizations, businesses, and individuals observed Menstrual Hygiene Day in 2020. Sensitive skin users prefer unscented menstrual products, while specialized health stores offer top-tier options free from synthetic chemicals and toxins. Sustainability is a growing concern, with manufacturers adopting sustainable manufacturing methods and techniques to minimize environmental impact. The taboo surrounding menstruation persists, but traceability and uniformity in product quality are essential for consumer wellbeing, particularly for working women. These factors will fuel the growth of the market during the forecast period.

Significant Market Trends - Increasing rate of cervical cancer

The prevalence of cervical cancer is high in undeveloped and developing countries. Menstrual pads contain harmful ingredients such as rayon and dioxin. One of the main causes of cervical cancer is poor menstrual hygiene. The lack of hygiene can lead to fungal infections and reproductive tract infections (RTI) and increase the chances of infertility. Cervical cancer is mainly prevalent in rural areas of countries such as South Africa, Nigeria, Kenya, and India due to the use of rags and old clothes during menstruation.

The increasing awareness about cervical cancer and its prevention is fueling the adoption of natural and organic and natural feminine care products. These are made of breathable natural materials and contain no perfumes, dyes, plastic, or chlorine. This helps in avoiding contact with synthetic materials and skin irritants, thereby reducing the rate of infections and cervical cancer. Therefore, the increasing rate of cervical cancer is fueling the adoption of these products. These factors will boost the market growth during the forecast period.

Major Market Challenge - Presence of counterfeit products

The growing market opportunities have encouraged the entry of manufacturers of counterfeit organic and natural feminine care products, especially in developing countries. These are made of low-quality raw materials and have low durability. The penetration of e-commerce further improves the reach, sales, and distribution of counterfeit products. Moreover, customers are unable to distinguish between real and counterfeit products as they look similar.

The low cost of these has a negative impact on the sales and pricing strategies of market companies. As a result, global companies are compelled to lower the prices of their products, which reduces their profit margins. In addition, they have to invest more in advertising and promotional campaigns to educate customers. Established global companies are looking to penetrate developing markets, such as India and China, which have a significant presence. Thus, the presence of these is expected to restrict the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Key offering - Aisle offers organic and natural feminine care products such as period underwear, reusable pads, and leakproof liners.

- Key offering - Corman SpA offers organic and natural feminine care products under its brands Lady Presteril, Organyc, and Cistiset.

- Key offering - COTTON HIGH TECH SL offers organic and natural feminine care products such as menstrual panties, underwear for small urine leaks, and washable cloth panty liner.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Edgewell Personal Care Co.

- Essity AB

- First Quality Enterprises Inc.

- Kimberly Clark Corp.

- Maxim Hygiene Products Inc.

- Natratouch

- Nutraceutical Corp.

- Ontex BV

- Organic Initiative Ltd.

- Saathi Eco Innovations India Pvt. Ltd.

- The Procter and Gamble Co.

- TZMO SA

- Unicharm Corp.

- Unilever PLC

- Urban Essentials India Pvt Ltd.

- Veeda

- Wet and Dry Personal Care Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

By Product

The market share growth by the menstrual pads segment will be significant during the forecast period. The market including pads, panty liners, and tampons, is driven by the health advantages they offer. Consumers are increasingly conscious of the health implications of using these with synthetic ingredients, such as parabens and phthalates.

Get a glance at the market share of various regions Download the PDF Sample

The menstrual pads segment was valued at USD 1.10 billion in 2018. This health awareness has led to a preference for organic and natural alternatives made from organic cotton, organic materials, and natural ingredients. Initiatives by nations and influencers to promote sustainability and reduce plastic waste have also influenced the market. However, limited distribution channels and logistical difficulties pose challenges. Premium Organic Brands and Luxury Organic Brands cater to price conscious consumers seeking high-quality, raw material sustainability, and regulatory supervision. Menstruation remains a taboo subject in some cultures, leading to Restricted Availability in certain regions. Internet users have increased access to information and options, enabling them to make informed choices. Odor control and nature-based solutions are key factors in the perception of effectiveness. Pharmacies and retail outlets offer a wider range of organic menstrual products, including organic pads, organic panty liners, organic tampons, organic menstrual cups, and panty liners & shields. Reusable by-products are gaining popularity as an eco-friendly alternative. Overall, the market is expected to grow as consumers prioritize health, quality, and promoting sustainability. These factors will contribute to the growth of this segment during the forecast period.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

Europe is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The European market is driven by a heightened focus on health and the advantages it offers. Health awareness and the perception of effectiveness are key influencers for consumers. Initiatives by nations to promote sustainability and reduce plastic waste have also contributed to the trend. Despite logistical difficulties and restricted availability, internet users increasingly turn to online shopping for these premium organic brands. Natural ingredients, such as organic cotton and organic materials, are preferred over synthetic alternatives. However, price consciousness remains a challenge for some consumers. Regulatory supervision ensures quality and raw material sustainability. Luxury organic brands offer odor control and reusable options, such as organic menstrual cups and organic pads, as alternatives to traditional, disposable menstrual products. Pharmacies and retail outlets continue to be important distribution channels, but the rise of online sales is changing the landscape. Consumers are increasingly concerned with the health implications of menstrual products, leading them to avoid parabens and phthalates. This will propel the growth of the market in the region during the forecast period.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Product Outlook

- Menstrual pads

- Tampons

- Pantyliners

-

Distribution Channel Outlook

- Offline

- Online

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Argentina

- Brazil

- Chile

- North America

You may also interested in below market reports:

1. Organic Sanitary Napkins Market Analysis North America, Europe, APAC, South America, Middle East and Africa - US, China, Germany, Canada, UK - Size and Forecast

2. Organic Tampons Market Analysis North America, Europe, APAC, South America, Middle East and Africa - US, China, Japan, UK, Germany - Size and Forecast

3. Womens Intimate Care Products Market Analysis North America, Europe, APAC, Middle East and Africa, South America - US, China, UK, Germany, France - Size and Forecast

Market Analyst Overview

The Market is experiencing significant growth due to increasing consumer awareness and preference for chemical-free personal care products. The market is driven by factors such as rising disposable income, changing demographics, and shifting consumer preferences toward natural and organic products. Key players in the market include companies that specialize in organic and natural feminine care products, such as Seventh Generation, Tampax, and Natracare. These companies focus on using natural and organic ingredients, sustainable production methods, and eco-friendly packaging to cater to the growing demand for such products. The market is segmented based on product type, distribution channel, and region.

Furthermore, product types include sanitary napkins, tampons, and menstrual cups. Distribution channels include supermarkets/hypermarkets, pharmacies, and online retailers. Regions include North America, Europe, Asia Pacific, and the Rest of the World. The market is expected to continue its growth trajectory due to increasing consumer awareness and demand for natural and organic personal care products. Companies are investing in research and development to innovate and launch new products to meet the evolving needs of consumers. Additionally, governments and regulatory bodies are implementing stringent regulations to ensure the safety and quality of feminine care products, further boosting market growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.64% |

|

Market growth 2024-2028 |

USD 1.28 Billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.95 |

|

Regional analysis |

Europe, North America, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

Europe at 34% |

|

Key countries |

US, China, Germany, Italy, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Aisle, Corman SpA, COTTON HIGH TECH SL, Edgewell Personal Care Co., Essity AB, First Quality Enterprises Inc., Kimberly Clark Corp., Maxim Hygiene Products Inc., Natratouch, Nutraceutical Corp., Ontex BV, Organic Initiative Ltd., Saathi Eco Innovations India Pvt. Ltd., The Procter and Gamble Co., TZMO SA, Unicharm Corp., Unilever PLC, Urban Essentials India Pvt Ltd., Veeda, and Wet and Dry Personal Care Pvt. Ltd. |

|

Market dynamics |

Parent market analysis, Market forecasting growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Forecast Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2024 and 2028

- Precise estimation of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies