Orthopedic Splints Market Size 2024-2028

The orthopedic splints market size is forecast to increase by USD 1.24 billion, at a CAGR of 10.3% between 2023 and 2028.

- The market is driven by the increasing incidence of osteoporotic fractures and the utilization of splints for the treatment of tetraplegic patients. The growing aging population and the subsequent rise in bone-related conditions are significant factors fueling market growth, particularly in the elderly population as a result of osteoporosis. Moreover, advancements in materials science and technology have led to the development of lightweight, customizable, and effective splints, enhancing patient comfort and compliance. However, the market faces challenges, primarily in the form of complications associated with splint usage. These complications include skin irritation, pressure ulcers, and the potential for infection. Additionally, improper fitting and application of splints can lead to decreased patient mobility and discomfort.

- Addressing these challenges through continuous research and development of innovative splint designs and materials will be crucial for market participants to capitalize on the growth opportunities and maintain a competitive edge. Companies must focus on improving patient comfort, ensuring accurate fitting, and addressing potential complications to meet the evolving needs of the patient population and healthcare providers.

What will be the Size of the Orthopedic Splints Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in materials, design, and application. Joint stability is a primary focus, with padding materials such as thermoplastic and carbon fiber composites offering improved comfort and support. Bone healing acceleration is another key area of development, with lightweight designs and adjustable straps enabling better patient compliance. Pressure relief padding and pain management techniques are essential for patient comfort, while skin irritation prevention is crucial for long-term use. Fracture immobilization and spinal immobilization are common applications, with soft tissue support and ligament stabilization also gaining prominence. Biomechanical assessment plays a vital role in splint design, ensuring proper alignment and function.

Dynamic splinting and ventilation properties are also important, enabling edema reduction and weight-bearing capacity. Orthotics design principles guide the development of upper extremity supports, with aluminum splints and functional bracing popular choices. Muscle atrophy prevention and gait analysis are also key considerations. Sterilization methods and splint fitting techniques are essential for patient safety and comfort. Custom splint fabrication and durability testing are ongoing priorities to ensure the highest quality products. The market's continuous dynamism reflects the ongoing need for innovation and improvement.

How is this Orthopedic Splints Industry segmented?

The orthopedic splints industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Lower extremity

- Upper extremity

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- Iran

- South Africa

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Application Insights

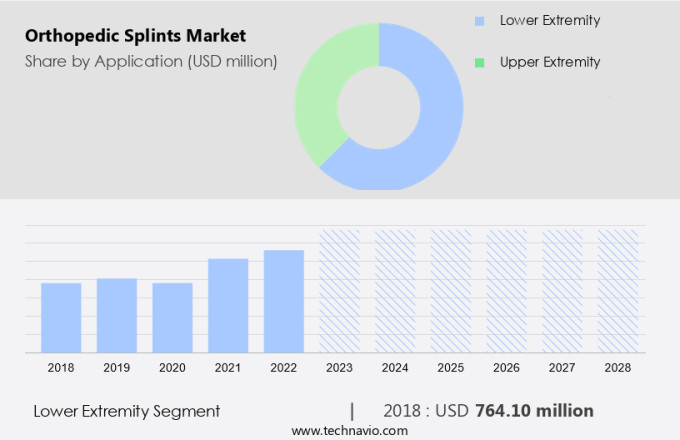

The lower extremity segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of devices designed to provide support and stability to various joints in the body. These splints play a crucial role in the treatment of injuries, including fractures, sprains, and dislocations, as well as conditions requiring soft tissue support or spinal immobilization. Lower extremity splints, specifically designed for the lower part of the body, cater to the hip, knee, thigh bones, leg, foot, and ankle joints. Fiberglass and plaster are common materials used in their construction, with fiberglass splints gaining popularity due to their durability and ease of use. They are available in various sizes and offer stronger and more versatile support compared to traditional plaster splints.

Thermoplastic materials are another material type used in the production of orthopedic splints. These materials offer the advantage of adjustability, ensuring a custom fit for patients. Patient compliance is a significant concern in orthopedic care, and adjustable straps and padding materials, such as pressure relief padding, contribute to improved compliance and patient comfort. Sterilization methods and compliance improvement strategies are essential considerations in the design and fabrication of orthopedic splints. Pain management techniques and skin irritation prevention are also crucial factors, as prolonged use of splints can lead to discomfort and potential complications. Fracture immobilization is a primary application of orthopedic splints.

They are also used for ligament stabilization, muscle atrophy prevention, and post-surgical rehabilitation. Lightweight designs, incorporating materials like carbon fiber composites and aluminum splints, enhance patient mobility and comfort. Biomechanical assessment and gait analysis are essential components of orthotics design principles, ensuring the optimal fit and functionality of splints. Custom splint fabrication and durability testing are crucial aspects of the manufacturing process, ensuring the highest quality and safety standards. Incorporating ventilation properties and edema reduction into splint design can significantly improve patient comfort and overall treatment outcomes. Weight-bearing capacity, static and functional bracing, and dynamic splinting are additional features that cater to various patient needs.

Polyurethane foam and splint fitting techniques are essential in ensuring a proper fit and effective treatment. Post-surgical rehabilitation and spinal immobilization are significant applications of orthopedic splints, with the market witnessing continuous growth and innovation.

The Lower extremity segment was valued at USD 764.10 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

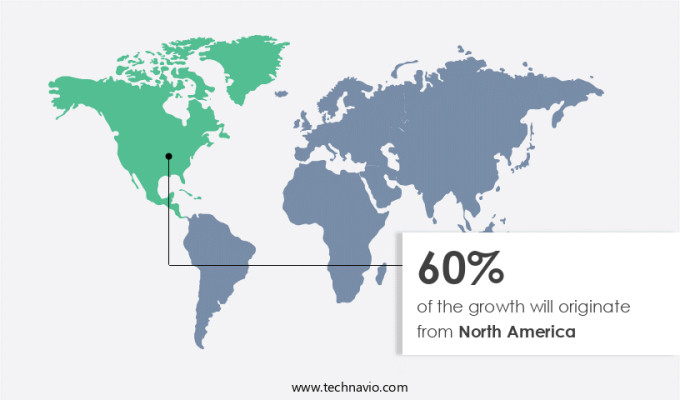

North America is estimated to contribute 60% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America experienced significant growth in 2023, accounting for the largest revenue share due to advanced healthcare infrastructure, a high incidence of non-fatal road injuries and sports injuries in the US, and the strong market presence of leading companies. Factors driving market expansion include the use of thermoplastic materials for custom splint fabrication, adjustable straps for patient compliance, and sterilization methods ensuring hygiene and infection prevention. Lightweight designs, pressure relief padding, and pain management techniques cater to patient comfort, while carbon fiber composites and fiberglass casting offer ligament stabilization and fracture immobilization. Biomechanical assessment and gait analysis enable proper splint fitting, and post-surgical rehabilitation and muscle atrophy prevention strategies ensure effective recovery.

Durability testing and ventilation properties are essential considerations for ensuring weight-bearing capacity and edema reduction. Orthotics design principles, including aluminum splints and functional bracing, cater to both lower and upper extremity support, as well as spinal immobilization. Polyurethane foam splints offer soft tissue support, and dynamic splinting facilitates range of motion. In conclusion, the North American market's evolution reflects the importance of patient comfort, advanced materials, and effective rehabilitation strategies in the orthopedic splints industry.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Orthopedic splints are essential medical devices used in the management of various injuries and conditions affecting the musculoskeletal system. The selection of appropriate materials for orthopedic splint fabrication plays a crucial role in ensuring effective support, comfort, and patient compliance. This guide provides an overview of key considerations for orthopedic splint design and application. When it comes to material selection, understanding the properties of various materials is essential. For instance, thermoplastic splints offer flexibility and adjustability, while fiberglass splints provide rigidity and durability. Aluminum splints have high weight-bearing capacity, making them suitable for supporting lower extremities. Carbon fiber composite splints offer superior strength and are commonly used for upper extremity applications. Custom splint fabrication techniques are essential for optimal patient comfort and functionality. Lower extremity splints require careful design considerations to accommodate various foot and ankle conditions. Upper extremity splints, on the other hand, require precise application methods to ensure proper alignment and function of the affected limb. Post-surgical rehabilitation splint protocols are critical in the recovery process. Properly designed splints can help maintain joint alignment, reduce pain, and promote healing. Pressure relief padding and effective fitting techniques are essential for patient comfort and compliance. Dynamic splinting principles and applications offer improved outcomes for certain conditions. These splints allow for controlled movement and can help prevent muscle atrophy and joint stiffness. Static splints, on the other hand, provide rigid support and are commonly used for immobilization. Sterilization methods and efficacy are essential for maintaining the hygiene and safety of orthopedic splints. Adjustable splint strap designs offer improved functionality and patient comfort. Lightweight orthopedic splint designs are also gaining popularity due to their ease of use and portability. Market research reports indicate that the market is expected to grow significantly in the coming years. Durability testing of orthopedic splint materials is essential to ensure long-term effectiveness and patient safety. Functional bracing design is also a key focus area for improving outcomes and patient satisfaction. Overall, the selection of appropriate materials, fabrication techniques, and application methods are critical factors in the design and success of orthopedic splints.

What are the key market drivers leading to the rise in the adoption of Orthopedic Splints Industry?

- The rising prevalence of osteoporosis-related fractures serves as the primary growth factor for the market.

- Osteoporosis, a condition characterized by bone density loss, affects millions globally, with an estimated 1.5 million vertebral compression fractures occurring annually in the US alone. These fractures, more common than hip or wrist fractures, can be debilitating and increase the risk of further complications. According to the International Osteoporosis Foundation, osteoporosis results in over 8.9 million fractures annually, equating to one fracture every 3 seconds. The fragility of affected bones can lead to significant structural damage, necessitating the use of orthopedic splints for immobilization and support during the healing process.

- The market for these medical devices is driven by the increasing prevalence of osteoporosis, advancements in material science for improved durability, and the growing need for non-invasive treatment options. The emphasis on harmonious design and patient comfort further propels market growth, as these factors contribute to a more immersive and effective healing experience for patients.

What are the market trends shaping the Orthopedic Splints Industry?

- Trends in tetraplegia treatment include the increasing use of splints. Splints are becoming more common in the market for managing the symptoms of tetraplegic patients.

- Orthopedic splints play a crucial role in providing support and promoting joint stability for individuals with various orthopedic conditions, including spinal cord injuries. According to the National Spinal Cord Injury Statistical Center, there are approximately 296,000 individuals living with spinal cord injuries in the US, with around 18,000 new cases reported each year. For patients with cervical spinal cord injuries, hand assessments and the use of static hand splints are essential components of occupational therapy. These splints help maintain proper hand positioning and prevent deformities. Orthopedic splints come in various materials, such as thermoplastic and padding materials, which provide comfort and support.

- Thermoplastic materials allow for customization and adjustability through heating, while padding materials offer cushioning and protection. Some splints also facilitate bone healing acceleration and range of motion. Patient compliance is a significant factor in the effectiveness of orthopedic splints. Adjustable straps and easy-to-clean materials contribute to better patient compliance. Sterilization methods, such as autoclaving and chemical sterilization, ensure the splints remain hygienic and safe for multiple uses. In summary, orthopedic splints are essential tools in the treatment and management of various orthopedic conditions, including spinal cord injuries. They offer joint stability, support, and promote functional positions, while materials like thermoplastic and padding cater to patient comfort and compliance.

- Proper sterilization methods ensure the continued effectiveness and safety of these devices.

What challenges does the Orthopedic Splints Industry face during its growth?

- The usage of splints in the industry is accompanied by significant complications, posing a substantial challenge to its growth.

- Orthopedic splints are essential medical devices used for fracture immobilization, spinal and upper extremity support, and soft tissue injury treatment. However, their usage comes with potential complications, primarily related to pressure build-up and skin irritation. Compartment syndrome is a significant concern, as it occurs when increased pressure within a muscle space restricts blood flow, leading to tissue damage. This condition can manifest as tingling, worsening pain, numbness, or signs of vascular compromise such as delayed capillary refill, severe swelling, or a dusky appearance of the affected area. To mitigate these risks, healthcare professionals employ various compliance improvement strategies. These include regular assessments, proper fitting, and adjustment of the splint, as well as the use of pressure relief padding and pain management techniques.

- Skin irritation prevention is another crucial aspect, achieved through the application of protective coverings and frequent splint checks to ensure proper alignment and circulation. Biomechanical assessment plays a vital role in selecting the appropriate splint design and application to minimize complications. By adhering to these best practices, healthcare providers can optimize the benefits of orthopedic splints while minimizing potential risks.

Exclusive Customer Landscape

The orthopedic splints market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the orthopedic splints market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, orthopedic splints market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company specializes in orthopedic support solutions, including the 3M Coban Self Adherent Wrap.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Alimed Inc.

- Breg Inc.

- Corflex Global

- DARCO International Inc.

- DeRoyal Industries Inc.

- DJO Global Inc.

- Dynatronics Corp.

- Essity AB

- KineMedics

- Lohmann and Rauscher GmbH and Co. KG

- medi GmbH and Co. KG

- Mika Medical Co.

- Orfit Industries NV

- Ossur hf

- Ottobock SE and Co. KGaA

- Performance Health Holding Inc.

- Prime Medical Inc.

- Stryker Corp.

- Zimmer Biomet Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Orthopedic Splints Market

- In January 2024, Wright Medical Group N.V. announced the FDA clearance of its REFlex Point⢠Ankle-Foot Orthosis (AFO), expanding its orthopedic product portfolio (Wright Medical Group N.V. Press release). This advanced AFO is designed for the treatment of ankle instability and foot drop.

- In March 2024, 3D Systems and Stryker collaborated to develop and commercialize 3D-printed orthopedic implants and surgical instruments, aiming to improve patient outcomes and reduce manufacturing costs (3D Systems press release). This strategic partnership combines 3D Systems' additive manufacturing expertise with Stryker's orthopedic market knowledge.

- In April 2024, DJO Global completed the acquisition of Breg, a leading provider of orthopedic and rehabilitation products, significantly expanding its product offerings and market presence (DJO Global press release). This transaction created a global orthopedic solutions company with combined revenues of approximately USD 1.7 billion.

- In May 2025, Medtronic received CE mark approval for its new Active Brace System, an advanced, wireless-enabled orthopedic brace for knee osteoarthritis patients (Medtronic press release). This system uses sensors to monitor patient activity and provides personalized treatment recommendations, marking a significant technological advancement in the market.

Research Analyst Overview

- The orthopedic appliances market encompasses a range of immobilization devices, including prefabricated and custom-fit splints. Comfort features, such as skin protection and adjustable designs, are essential considerations for patient comfort during both short- and long-term use. Occupational therapy integration and physical therapy are key application techniques to optimize recovery time reduction. Manufacturing processes and material properties play a significant role in producing functional outcomes for therapeutic splints. Material selection criteria are influenced by specific injury types, infection control, and patient comfort. Injury prevention and patient education are integral to the effective use of orthopedic appliances. Custom-fit splints offer superior comfort and fit compared to prefabricated options.

- Design considerations include ease of use, removal techniques, and infection control. Home care instructions are crucial for patients to ensure proper application and maintenance. Functional outcomes are enhanced through the integration of physical therapy and adjustable designs. Infection control and patient comfort are essential factors in the selection of materials for manufacturing processes. Fracture types and wound healing are critical considerations for the design and application of therapeutic splints.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Orthopedic Splints Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

156 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.3% |

|

Market growth 2024-2028 |

USD 1240.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.1 |

|

Key countries |

US, Germany, UK, China, Japan, France, Canada, India, South Africa, and Iran |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Orthopedic Splints Market Research and Growth Report?

- CAGR of the Orthopedic Splints industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the orthopedic splints market growth of industry companies

We can help! Our analysts can customize this orthopedic splints market research report to meet your requirements.