Parsley Market Size 2025-2029

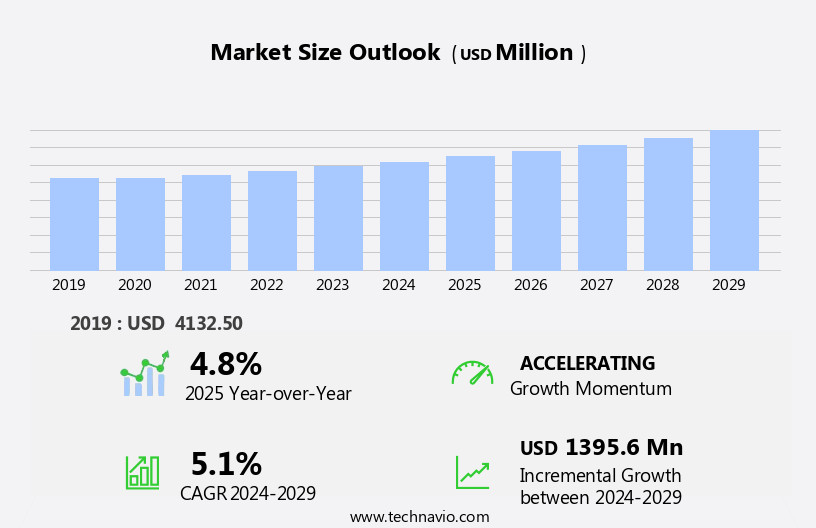

The parsley market size is forecast to increase by USD 1.4 billion, at a CAGR of 5.1% between 2024 and 2029.

- The market is experiencing significant growth driven by the increasing popularity of private-label brands and the rising demand for organic parsley. Consumers are increasingly seeking out healthier and more natural food options, leading to a rise in demand for organic parsley. However, challenges persist in the market due to the issue of spoilage, which is often caused by the overuse of fertilizers and pesticides in conventional farming practices.

- This trend is pushing producers to explore sustainable and smart farming methods and innovative preservation techniques to maintain the freshness and quality of the product. Companies looking to capitalize on this market opportunity should focus on developing organic and sustainably grown parsley offerings, while also investing in research and development to address the challenge of spoilage and extend the product's shelf life. By doing so, they will be well-positioned to meet the evolving needs of health-conscious consumers and capitalize on the growing demand for organic and sustainable food options.

What will be the Size of the Parsley Market during the forecast period?

- The market encompasses various applications of Petroselinum crispum, including fresh leaves, seeds, and essential oils. This market experiences strong growth due to parsley's versatility in diverse sectors. In the food industry, parsley's use as a garnish and ingredient in various cuisines remains prevalent. The pharmaceutical industry leverages parsley for its medicinal benefits, particularly in addressing menstrual difficulties, digestive complaints, and skin conditions such as broken capillaries.

- Parsley seeds find demand In the organic ingredients segment, while parsley oil is increasingly used in beauty treatments, lice elimination, and hair growth products. Convenience stores and supermarkets cater to the consumer trend of readily available, fresh parsley for home cooking. Overall, the market is poised for continued expansion, driven by its wide-ranging applications and growing consumer awareness of its health benefits.

How is this Parsley Industry segmented?

The parsley industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Fresh parsley

- Dry parsley

- Distribution Channel

- Offline

- Online

- Geography

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- North America

- US

- Canada

- Middle East and Africa

- South America

- Europe

By Product Insights

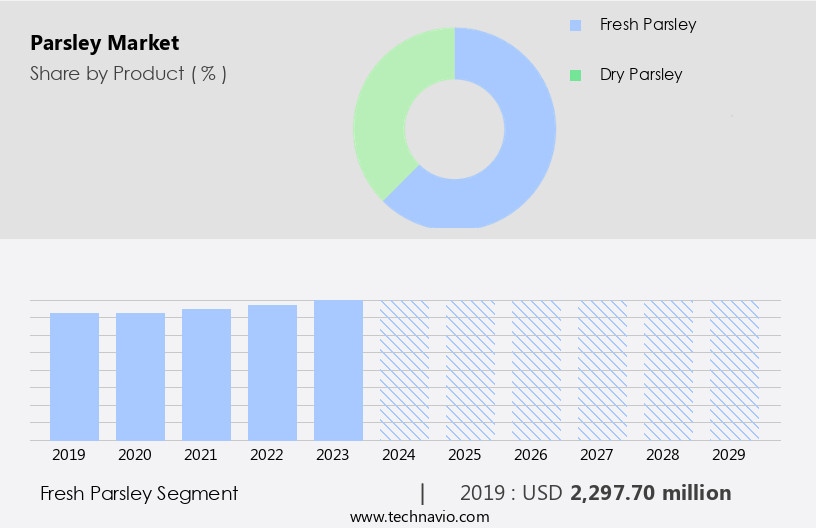

The fresh parsley segment is estimated to witness significant growth during the forecast period. Parsley, a member of the Apiaceae family and specifically Petroselinum crispum, is a widely used herb In the food industry and beyond. Its fresh leaves, often referred to as flat-leaf parsley or French curly parsley, are prized for their culinary applications due to their ability to add flavor and serve as a garnish in various dishes. Beyond its role In the food sector, parsley holds medicinal benefits. For instance, it may aid in digestion and contribute to heart health, making it a valuable ingredient In the pharmaceuticals industry for treating chronic diseases. Parsley seeds and oil, derived from the plant, possess antimicrobial and anti-inflammatory properties.

These natural ingredients have potential applications in beauty treatments, such as lice elimination and hair growth, as well as in addressing conditions like menstrual difficulties, broken capillaries, and varicose veins. To ensure the highest quality, sustainable farming practices are essential. Fresh farming methods are employed to maintain the herb's natural nutrients and flavor. Organic parsley is increasingly popular, and various industry verticals, including food companies, convenience stores, and the food service sector, are incorporating it into their offerings. Private-label brands are also capitalizing on the demand for organic and natural ingredients, while home gardens continue to be a source for fresh parsley.

Get a glance at the market report of share of various segments Request Free Sample

The fresh parsley segment was valued at USD 2.3 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

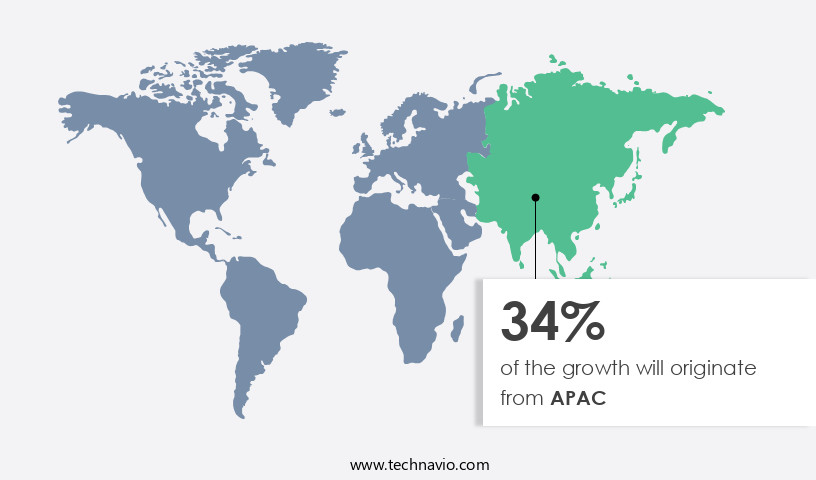

APAC is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in Europe is experiencing steady growth, driven by its diverse applications in various industries. This herb, a member of the Apiaceae family and specifically Petroselinum crispum, is widely used In the food industry for its distinctive flavor and nutritional benefits. In culinary applications, parsley is incorporated into dishes such as persillade in France, salsa verde in Italy, and roux-based sauces In the UK. Beyond food, parsley's medicinal properties are valued In the pharmaceuticals industry for treating menstrual difficulties, digestive complaints, and even hair growth.

Sustainable farming practices and fresh farming techniques ensure the availability of high-quality parsley seeds and both fresh and dry parsley for private-label brands and foodservice sector. Parsley oil, rich in anti-inflammatory and antimicrobial properties, is another valuable product derived from parsley seeds. Overall, the market's growth is underpinned by its versatility, health benefits, and wide-ranging applications in domestic spices, food companies, convenience stores, and industry verticals.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Parsley Industry?

- The increasing prominence of private-label brands is the key driver of the market. The market is witnessing significant growth due to the increasing focus of retailers on private-label brands. Retailers are capitalizing on the trend by selling various types of parsley, including organic, under their own labels to boost profitability.

- In the past decade, the private-label product segment has expanded significantly, with major retailers introducing their brands of parsley. This strategic move is in response to the growing consumer demand for fresh and high-quality parsley. The private-label the market is expected to continue its growth trajectory In the coming years, offering opportunities for retailers to differentiate themselves and increase market share.

What are the market trends shaping the Parsley Industry?

- Growing demand for organic parsley is the upcoming market trend. Organic parsley products represent a segment of the market that caters to consumers seeking natural and health-conscious options. These products are derived from parsley plants grown without synthetic herbicides, fertilizers, and pesticides. The cultivation process prioritizes biodiversity, ecological processes, and local climate adaptation. Regulatory bodies, such as the USDA and the non-GMO Project, oversee the production and certification of organic parsley.

- Consumers value organic parsley for its absence of synthetic additives and perceived health benefits, making it a preferred choice for regular consumption. Several companies In the market offer organic parsley, including Geo Fresh Organic and Morton and Bassett, among others. These companies ensure their organic parsley adheres to stringent production standards and regulatory requirements.

What challenges does the Parsley Industry face during its growth?

- Spoilage due to overuse of fertilizers and pesticides is a key challenge affecting the industry growth. Parsley, a widely used herb In the food and beverage industry, faces challenges due to the extensive use of chemicals during production. These chemicals, absorbed In the parsley leaves, cannot be removed even through washing. The scarcity of organic pesticides and the use of inorganic fertilizers contribute to this issue. Moreover, unhealthy soil conditions can negatively impact the final product.

- To ensure food safety, it's crucial to wash parsley thoroughly and discard old or bruised leaves with excessive pesticide residue. The potential health risks associated with the use of chemically treated parsley may lead to a decline in its consumption in various food and beverage applications. Producers and processors must prioritize safe handling practices and explore sustainable farming methods to maintain the quality and safety of parsley In the market.

Exclusive Customer Landscape

The parsley market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the parsley market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, parsley market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AgriFutures Australia - The company offers parsley products such as parsley oil, which is extracted from several parts of the parsley plant.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aum Agri Freeze Foods

- B and G Foods Inc.

- Badia Spices Inc.

- Camstar Herbs Ltd.

- Frontier Co op.

- Geo Fresh Organic

- GreenDNA India Pvt. Ltd.

- Litehouse Inc.

- McCormick and Co. Inc.

- Morton and Bassett

- Naturevibe Botanicals

- NOMU Brands Pty Ltd.

- OIJA

- Pereg Gourmet Spices

- Swanson Health Products Inc.

- The Kroger Co.

- The Pahari Life

- The Watkins Co.

- Universal Parsley Indonesia

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The Apiaceae family, encompassing the herb Petroselinum crispum, is renowned for its versatile member, parsley. This vibrant herb, with its distinctive taste and aroma, offers a myriad of benefits, extending beyond the realm of culinary applications. Parsley seeds, a crucial component of this plant, have gained significant attention due to their organic ingredients and potential medicinal properties. The seeds, rich in volatile oils and flavonoids, exhibit anti-inflammatory and antimicrobial properties. These properties make parsley seeds a valuable addition to various industry verticals, including pharmaceuticals and food. Sustainable farming practices have become increasingly important In the production of parsley and its seeds.

Further, fresh farming practices ensure the preservation of the herb's nutritional value and contribute to its overall quality. The domestic spices market, comprising food companies and convenience stores, heavily relies on a consistent supply of high-quality parsley and parsley oil. The pharmaceuticals industry has recognized the potential of parsley and its seeds for addressing various chronic diseases, such as heart disease. The anti-inflammatory and antimicrobial properties of parsley make it a promising candidate for the development of innovative products. Parsley's medicinal benefits extend to menstrual difficulties and digestive complaints. Its use in beauty treatments, including hair growth and lice elimination, has also gained popularity.

Additionally, parsley is known to help alleviate broken capillaries, varicose veins, and menstruation regulation, contributing to uterine health. Home gardens have become a popular source for growing parsley, allowing for the production of fresh parsley and the collection of organic parsley seeds. The cultivation of parsley using sustainable farming practices, such as permaculture, further enhances its appeal. Private-label brands have capitalized on the growing demand for natural ingredients and the health benefits of parsley. Both fresh parsley and dry parsley are used extensively in the foodservice sector, with the former preferred for its superior flavor and texture. The market continues to evolve, with cutting edge research and development focusing on the potential applications of parsley seed oil and its various uses in the food, pharmaceutical, and cosmetic industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

195 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market Growth 2025-2029 |

USD 1.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.8 |

|

Key countries |

US, China, UK, Japan, Germany, India, Italy, France, South Korea, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Parsley Market Research and Growth Report?

- CAGR of the Parsley industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the parsley market growth of industry companies

We can help! Our analysts can customize this parsley market research report to meet your requirements.