Japan Patient Monitoring Equipment Market Size 2024-2028

The Japan patient monitoring equipment market size is forecast to increase by USD 271.6 million, at a CAGR of 3.6% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing preference for self-care monitoring devices. This trend is being fueled by an aging population and the rising incidence of chronic diseases, leading to a greater need for continuous health monitoring outside of hospital settings. Furthermore, the integration of advanced technologies, such as artificial intelligence and the Internet of Things, is revolutionizing patient monitoring, enabling real-time data analysis and improved healthcare outcomes. However, the market faces challenges, including data privacy issues, which must be addressed to ensure patient confidentiality and trust. As regulatory requirements continue to evolve, companies must prioritize data security and implement robust data protection measures to mitigate risks and maintain compliance.

- To capitalize on market opportunities and navigate challenges effectively, companies should focus on developing innovative solutions that prioritize user-friendly design, data security, and seamless integration with healthcare systems. By addressing these key market dynamics, players can position themselves for long-term success in the rapidly evolving market.

What will be the size of the Japan Patient Monitoring Equipment Market during the forecast period?

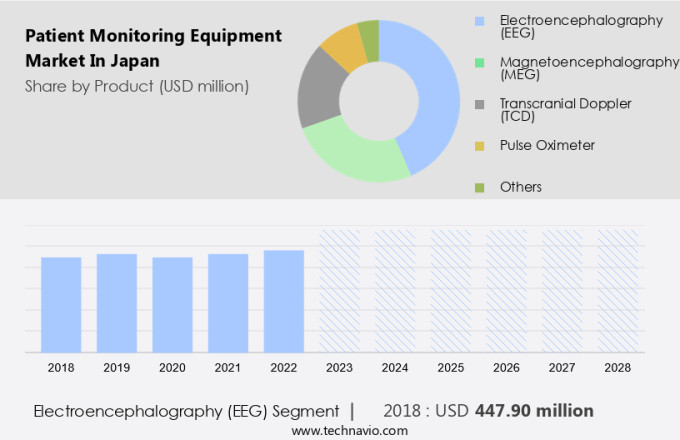

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

- The Japanese patient monitoring equipment market is characterized by a focus on device ergonomics and patient safety features, ensuring user-friendly designs that prioritize patient comfort and minimize risks. Data transmission protocols and wireless connectivity enable real-time monitoring and remote access control, while user interface designs simplify data analysis methods for medical professionals. Clinical trial data informs long-term monitoring solutions, with software updates and system integration testing ensuring regulatory compliance and maintaining device performance. Device power management, fault detection, and data storage capacity are critical considerations, balanced against network security and data privacy concerns.

- Medical grade sensors, hardware maintenance, calibration procedures, and signal processing algorithms contribute to sensor accuracy validation and reliable data transmission. Battery life expectancy and data visualization dashboards provide valuable insights for healthcare providers, enhancing overall patient care.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Electroencephalography (EEG)

- Magnetoencephalography (MEG)

- Transcranial doppler (TCD)

- Pulse oximeter

- Others

- End-user

- Hospitals

- Clinics

- Ambulatory care services

- Geography

- APAC

- Japan

- APAC

By Product Insights

The electroencephalography (eeg) segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, particularly in the electroencephalography (EEG) segment. Technological advancements and the increasing prevalence of neurological disorders are driving this growth. Innovative devices, such as the non-invasive EEG patch developed by Osaka University, are revolutionizing brainwave monitoring. This patch, which can be placed on the forehead for quick and easy brain scans, eliminates the need for traditional setups that require multiple electrodes and extensive setup time. Japan's aging population is a major factor in the growth of the EEG segment, as conditions like dementia and epilepsy become more common. Other areas of patient monitoring, such as continuous glucose monitoring, vital signs monitoring, remote diagnostics, fall detection systems, remote patient monitoring, home healthcare monitoring, ECG signal processing, temperature monitoring systems, blood pressure monitoring, wearable vital signs, central monitoring systems, non-invasive monitoring, pulse oximetry technology, respiratory rate sensors, multiparameter monitoring, wireless sensor networks, invasive blood pressure, patient data analytics, real-time patient data, clinical decision support, electronic health records, patient alert systems, SpO2 measurement accuracy, ambulatory ECG monitoring, heart rate variability, patient data acquisition, data encryption security, holter monitor technology, sleep apnea monitoring, telemedicine integration, and cardiac arrhythmia detection, are also experiencing growth due to the need for more efficient and accurate patient care.

These technologies enable healthcare providers to monitor patients in real-time, analyze data, and make informed decisions, leading to improved patient outcomes and reduced healthcare costs.

The Electroencephalography (EEG) segment was valued at USD 447.90 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Japan Patient Monitoring Equipment Market drivers leading to the rise in adoption of the Industry?

- The increasing demand for self-care monitoring devices is the primary market driver, as more individuals seek to prioritize their health and wellness through advanced technologies.

- Patient monitoring equipment plays a significant role in enabling individuals to accurately track their heart rate vitals and monitor their fitness levels and sleep patterns. Ambulatory ECG monitoring and heart rate variability assessment are essential features of these devices. The increasing focus on quality care and disease management drives the adoption of portable patient monitoring equipment, particularly in developed countries. Multi-parameter patient monitors, consisting of a core monitor box with slots for separate units or modules measuring various vital signs, are gaining popularity due to their ability to provide comprehensive health data.

- Telemedicine integration and advanced features like cardiac arrhythmia detection and sleep apnea monitoring further enhance the functionality of these devices. Data encryption security ensures the confidentiality of patient data. The market dynamics indicate a growing demand for self-care devices that offer multiple parameters, enabling users to take charge of their health while reducing healthcare expenditure.

What are the Japan Patient Monitoring Equipment Market trends shaping the Industry?

- The integration of technologies is an emerging market trend, with an increasing number of industries adopting advanced solutions to enhance their operations. This technological fusion is not only mandatory for businesses seeking competitiveness but also for those aiming to provide superior customer experiences.

- The market is experiencing significant growth due to the integration of advanced technologies. Providers are shifting their focus towards virtual platforms, enabling remote diagnoses and improving patient care. Medical devices, such as continuous glucose monitoring systems and vital signs monitoring devices, are becoming increasingly popular. These devices, when paired with mobile health applications, offer flexibility and portability, making them accessible to individuals and healthcare professionals. Moreover, the development of new monitoring technologies has led to improved disease diagnosis and treatment. ECG signal processing and remote diagnostics are becoming essential components of patient care. Fall detection systems are also gaining traction, ensuring the safety and well-being of elderly patients.

- The healthcare industry is undergoing a digital transformation, with the adoption of electronic health records and digital communication systems. Companies are responding by improving data connectivity for various management solutions, ensuring seamless interoperability between devices and healthcare systems. In conclusion, the market is witnessing a shift towards digital health solutions. The integration of advanced technologies, such as continuous glucose monitoring, vital signs monitoring, remote diagnostics, fall detection systems, and ECG signal processing, is revolutionizing the healthcare industry and improving patient outcomes.

How does Japan Patient Monitoring Equipment Market face challenges during its growth?

- Data privacy concerns represent a significant challenge to the expansion of various industries, as organizations must balance the collection and use of consumer information with the need to protect individual privacy and ensure compliance with applicable laws and regulations.

- Patient monitoring equipment in Japan incorporates advanced technologies such as temperature monitoring systems, blood pressure monitoring, wearable vital signs, central monitoring systems, non-invasive monitoring, pulse oximetry technology, respiratory rate sensors, and multiparameter monitoring. These devices are compact yet capable of storing vast amounts of data related to personal health and wellness. However, the small size increases the risk of data loss or misplacement. Some devices use the Global Positioning System (GPS) to retrieve location-based information, necessitating the sharing of this data with third parties for certain services.

- Advertisers and network operators, including mobile carriers and mobile content providers, can access and utilize this data.

Exclusive Japan Patient Monitoring Equipment Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Analog Devices Inc.

- BIOTRONIK SE and Co. KG

- Compumedics Ltd.

- Contec Medical Systems Co. Ltd.

- Dexcom Inc.

- Dragerwerk AG and Co. KGaA

- F. Hoffmann La Roche Ltd.

- Fortive Corp.

- General Electric Co.

- Johnson and Johnson Inc.

- Koninklijke Philips N.V.

- Masimo Corp.

- Medtronic Plc

- Natus Medical Inc.

- Nihon Kohden Corp.

- OMRON Corp.

- Shenzhen Mindray BioMedical Electronics Co. Ltd

- Siemens AG

- Smiths Group Plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Patient Monitoring Equipment Market In Japan

- In January 2024, Fujitsu and Canon announced a strategic partnership to develop advanced patient monitoring systems integrating Fujitsu's IT solutions and Canon's medical imaging technology (Fujitsu press release).

- In March 2024, Panasonic Healthcare secured regulatory approval for its new wireless vital sign monitoring system, expanding its product offerings in the Japanese market (Panasonic Healthcare press release).

- In April 2024, Omron Healthcare, a leading player in the Japanese patient monitoring equipment market, raised approximately JPY 20 billion through an equity offering, bolstering its financial resources for research and development (Nikkei Asia).

- In May 2025, the Japanese government announced a JPY 1 trillion investment in digital healthcare initiatives, including the expansion of telehealth services and the development of advanced patient monitoring systems (Japan Ministry of Health, Labor and Welfare press release).

Research Analyst Overview

The market continues to evolve, driven by advancements in technology and the expanding application across various sectors. Medical device interoperability enables seamless communication between different devices, enhancing the efficiency and accuracy of patient care. Continuous glucose monitoring and vital signs monitoring are essential tools in diabetes management and critical care, respectively. Remote diagnostics and fall detection systems enable early intervention and improved patient outcomes. Home healthcare monitoring and telemedicine integration facilitate access to healthcare services from the comfort of one's home. ECG signal processing, temperature monitoring systems, blood pressure monitoring, and pulse oximetry technology are integral components of comprehensive patient monitoring.

Non-invasive monitoring, wireless sensor networks, and real-time patient data acquisition are transforming patient care, offering clinical decision support and electronic health records. Patient alert systems ensure timely intervention, while data encryption security protects sensitive patient information. Ambulatory ECG monitoring, heart rate variability analysis, and sleep apnea monitoring offer valuable insights into patient health. The market dynamics remain fluid, with ongoing innovations in patient data analytics, invasive blood pressure monitoring, and cardiac arrhythmia detection.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Patient Monitoring Equipment Market in Japan insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

145 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.6% |

|

Market growth 2024-2028 |

USD 271.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.5 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Japan

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch