Payment Gateways Market Size 2024-2028

The payment gateways market size is forecast to increase by USD 11.23 billion at a CAGR of 13.42% between 2023 and 2028.

What will be the Size of the Payment Gateways Market During the Forecast Period?

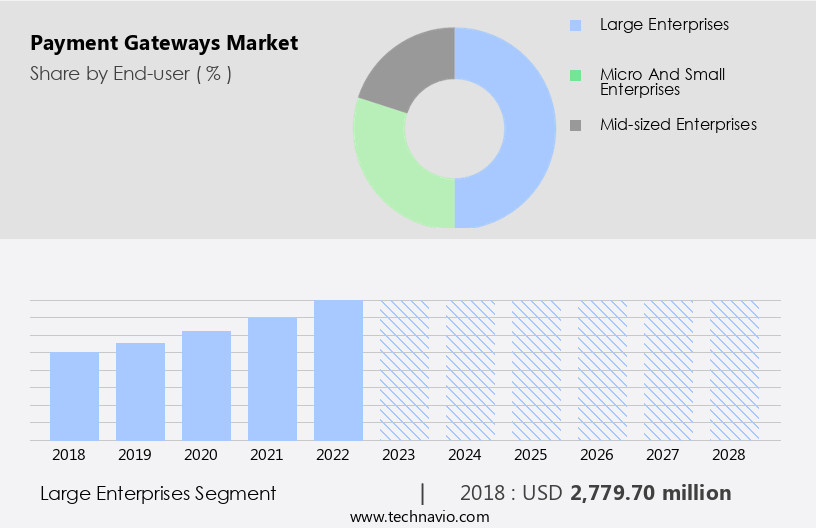

How is this Payment Gateways Industry segmented and which is the largest segment?

The payment gateways industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Large enterprises

- Micro and small enterprises

- Mid-sized enterprises

- Type

- Hosted

- Non-hosted

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By End-user Insights

- The large enterprises segment is estimated to witness significant growth during the forecast period.

Payment gateways have experienced significant adoption among large enterprises due to the increasing number of transactions, particularly in sectors such as banking, financial services and insurance (BSFI), IT, and manufacturing. Cross-border banking activities and the integration of modern vending machines with contactless and card-based payments are further driving market growth. Large enterprises are more inclined towards advanced payment solutions like payment gateways and digital wallets, contributing the majority of market revenue. The coronavirus pandemic has accelerated the shift towards contactless payments and digitalization in various sectors, including e-commerce, leading to record highs in online transactions. Payment gateways facilitate faster transactions, improve customer relationships, and enable digital channels such as mobile-based apps, internet banking, and e-commerce transactions.

Security concerns, including phishing, denial of services, and cyberattacks, necessitate robust digital infrastructure to ensure consumer data protection and prevent financial losses and business interruptions. The increasing consumer inclination towards online services and the coronavirus outbreak have propelled the e-commerce sector to new heights, further fueling the demand for payment gateways. Payment gateways support various payment methods, including cards, bank apps, and digital wallets, and enable bulk transactions, onsite payments, and payment processing. In conclusion, the market for payment gateways is poised for growth due to the increasing need for secure and efficient payment processing solutions In the digital economy.

Get a glance at the Payment Gateways Industry report of share of various segments Request Free Sample

The Large enterprises segment was valued at USD 2.78 billion in 2018 and showed a gradual increase during the forecast period.

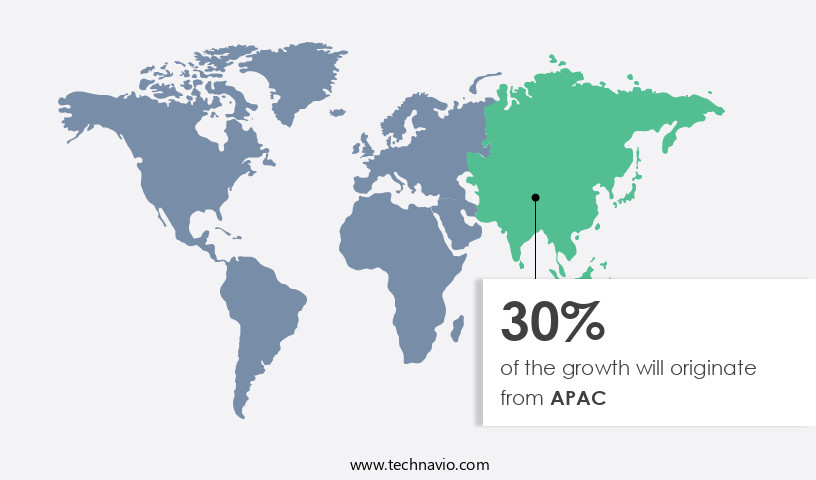

Regional Analysis

- APAC is estimated to contribute 30% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC is poised for significant expansion due to the increasing adoption of digital payment solutions. Sectors in India and China are integrating payment gateways with online platforms and hardware devices, such as smartphones and PoS systems, to enhance transaction security. E-commerce and BFSI sectors are particularly adopting online payment gateways to streamline payment processes and improve customer satisfaction. India and Japan lead the UPI industry, driving market growth In the region. Internet penetration and the coronavirus pandemic have accelerated the shift towards contactless, digital payments. Payment gateways facilitate faster transactions, digital wallets, and contactless services, fostering stronger customer relationships.

Security concerns, including phishing, denial of services, and cyberattacks, necessitate robust digital infrastructure. Payment gateways process bulk transactions, onsite payments, and e-commerce transactions, enabling businesses to operate efficiently and securely In the digital economy.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Payment Gateways Industry?

High adoption of contactless payment solutions is the key driver of the market.

What are the market trends shaping the Payment Gateways Industry?

Emergence of NFC-based payment technology is the upcoming market trend.

What challenges does the Payment Gateways Industry face during its growth?

High operating and maintenance costs of PoS terminals is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The payment gateways market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the payment gateways market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, payment gateways market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Adyen NV - Payment gateways facilitate secure and efficient online transactions for businesses, enabling them to accept various payment methods from customers worldwide. These systems process authorization and verification of transactions in real-time, ensuring seamless commerce experiences. Key features include fraud prevention tools, encryption technology, and compatibility with multiple currencies and payment types. The market for payment gateways continues to grow, driven by the increasing shift towards e-commerce and digital payments. Companies specializing in this sector offer customizable solutions to cater to diverse business needs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adyen NV

- Amazon.com Inc.

- B2Broker Ltd.

- BitPay Inc.

- Block Inc.

- CCBill LLC

- Fidelity National Information Services Inc.

- Global Payments Inc.

- Infibeam Avenues Ltd.

- Ingenico Group SA

- JPMorgan Chase and Co.

- Mastercard Inc.

- MIH PayU BV

- One97 Communications Ltd.

- Payoneer Global Inc.

- PayPal Holdings Inc.

- Razorpay Software Pvt. Ltd.

- Stripe Inc.

- VeriFone Inc.

- Visa Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Payment systems have evolved significantly in recent years, with the shift towards digital transactions becoming increasingly prevalent. The convenience and accessibility of making payments online have led to a surge in consumer adoption, particularly in areas with high internet penetration. This trend is not limited to developed economies but is also gaining traction in emerging markets. Consumers' increasing inclination towards cashless transactions has led to the proliferation of various digital payment methods. These include digital wallets, bank apps, and merchant acquiring solutions. Merchants, particularly small ones, are increasingly turning to cost-effective and unified payments solutions to facilitate online transactions.

The digitalization of payments has brought about numerous benefits, including faster transactions, improved customer relationships, and the ability to process bulk transactions. However, it also presents new challenges, particularly In the areas of security and compliance. Sensitive data transmitted during online transactions is a prime target for cyberattacks, including phishing, denial of service attacks, and data breaches. Payment gateways play a crucial role in facilitating secure and efficient online transactions. These systems enable merchants to accept payments through various digital channels, including e-commerce transactions, mobile-based payments, and internet banking. They offer a range of features, including hosted payment pages, escrow accounts, and interest calculations, to ensure a seamless payment experience for both merchants and consumers.

The coronavirus pandemic has accelerated the shift towards digital payments, with consumers increasingly relying on contactless services for their day-to-day transactions. The e-commerce sector has seen record highs in sales, with digital wallets and mobile-based apps becoming the preferred mode of payment for many consumers. Despite the benefits of digital payments, there are still concerns around security and consumer trust. Merchants and payment processors must ensure that their digital infrastructure is robust and secure to prevent financial losses and business interruptions. Payment gateways must prioritize security measures, such as encryption and tokenization, to protect sensitive data and mitigate the risk of cyberattacks.

In conclusion, the market is dynamic and constantly evolving, driven by the increasing adoption of digital payments and the need for secure and efficient transaction processing. Merchants and consumers alike are benefiting from the convenience and accessibility of digital channels, but it is essential that payment processors prioritize security and compliance to build trust and confidence In the digital payments ecosystem.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.42% |

|

Market growth 2024-2028 |

USD 11231.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

11.57 |

|

Key countries |

China, US, Japan, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Payment Gateways Market Research and Growth Report?

- CAGR of the Payment Gateways industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the payment gateways market growth of industry companies

We can help! Our analysts can customize this payment gateways market research report to meet your requirements.