Personal Loans Market Size 2025-2029

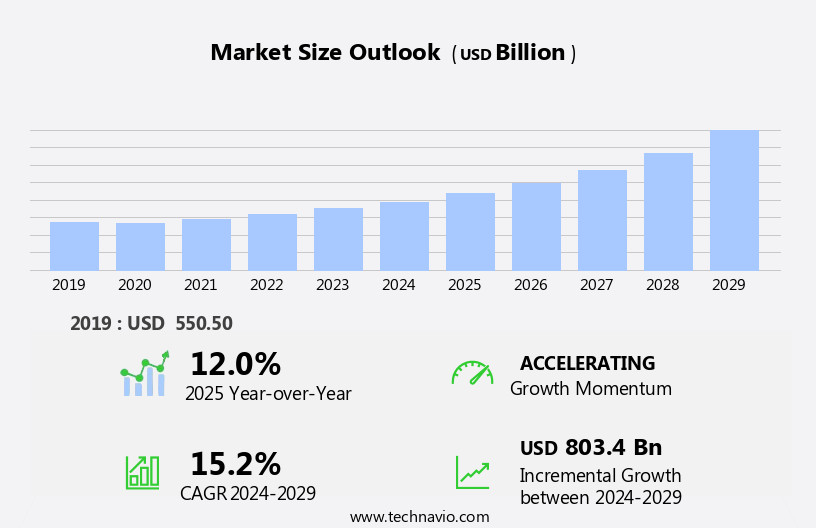

The personal loans market size is forecast to increase by USD 803.4 billion, at a CAGR of 15.2% between 2024 and 2029.

- The market is witnessing significant advancements, driven by the increasing adoption of technology in loan processing. Innovations such as artificial intelligence and machine learning are streamlining application processes, enhancing underwriting capabilities, and improving customer experiences. Moreover, the shift towards cloud-based personal loan servicing software is gaining momentum, offering flexibility, scalability, and cost savings for lenders. However, the market is not without challenges. Compliance and regulatory hurdles pose significant obstacles, with stringent regulations governing data privacy, consumer protection, and fair lending practices. Lenders must invest in robust compliance frameworks and stay updated with regulatory changes to mitigate risks and maintain a competitive edge.

- Additionally, managing the increasing volume and complexity of loan applications while ensuring accuracy and efficiency remains a pressing concern. Addressing these challenges through technological innovations and strategic partnerships will be crucial for companies seeking to capitalize on the market's growth potential and navigate the competitive landscape effectively.

What will be the Size of the Personal Loans Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and shifting consumer preferences. Digital lending platforms enable online applications, automated underwriting, and instant loan disbursement. APIs integrate various financial planning tools, such as FICO score analysis and retirement planning, ensuring a comprehensive borrowing experience. Unsecured loans, including personal installment loans and lines of credit, dominate the market. Credit history, interest rates, and borrower eligibility are critical factors in determining loan terms. Predictive modeling and machine learning algorithms enhance risk assessment and fraud detection. Consumer protection remains a priority, with regulations addressing identity theft and fintech literacy.

Credit utilization and debt management are essential components of loan origination and debt consolidation. Repayment schedules and debt management plans help borrowers navigate their financial obligations. Market dynamics extend to sectors like student loans, auto loans, and mortgage loans. Loan servicing, collection agencies, and loan application processes ensure efficient loan administration. Open banking and data analytics facilitate seamless financial transactions and improve loan approval processes. Small business loans and secured loans also contribute to the market's growth. Continuous innovation in digital lending, credit scoring, and loan origination shapes the future of the market.

How is this Personal Loans Industry segmented?

The personal loans industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Short term loans

- Medium term loans

- Long term loans

- Type

- P2P marketplace lending

- Balance sheet lending

- Channel

- Banks

- Credit union

- Online lenders

- Purpose

- Debt Consolidation

- Home Improvement

- Medical Expenses

- Education

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

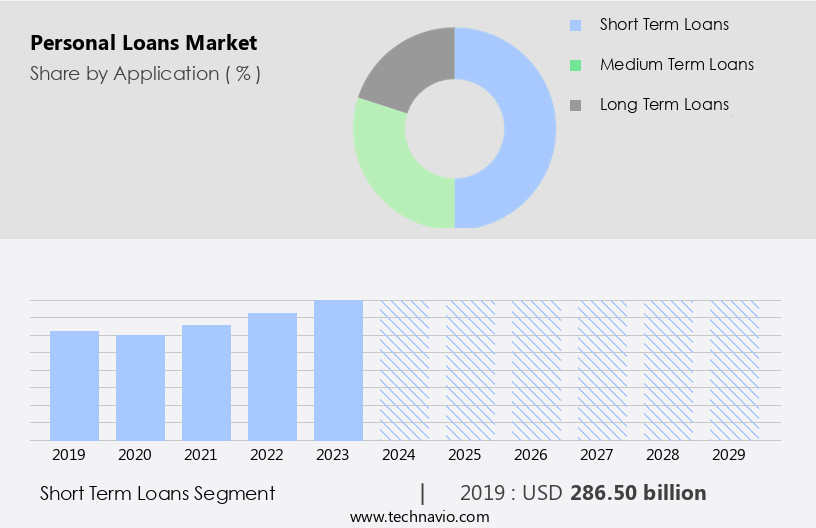

By Application Insights

The short term loans segment is estimated to witness significant growth during the forecast period.

Personal loans continue to gain traction in the US market, driven by the convenience of online applications and the increasing adoption of digital lending. Unsecured loans, such as personal installment loans and lines of credit, allow borrowers to access funds quickly for various personal expenses, including debt consolidation and unexpected expenses. Short-term loans, including payday loans and auto title loans, provide immediate financial relief with quick approval and flexible repayment schedules. Predictive modeling and machine learning enable automated underwriting, streamlining the loan origination process and improving borrower eligibility assessment. Credit scoring, FICO scores, and debt-to-income ratios (DTIs) are essential components of the credit evaluation process, ensuring responsible lending practices.

Digital lending platforms offer customer service through various channels, including mobile banking and open banking, enhancing the borrower experience. Financial literacy and education are vital in managing personal debt, and digital lending platforms offer tools and resources to help borrowers make informed decisions. Fraud detection and identity theft protection are crucial aspects of digital lending, ensuring secure transactions and maintaining consumer trust. Risk assessment and credit repair services help borrowers improve their creditworthiness and access better loan terms. Small business loans and student loans are other growing segments within personal loans, catering to unique borrowing needs. Loan servicing, loan disbursement, and collection agencies manage the loan life cycle, ensuring efficient and effective loan management.

Data analytics and API integration enable seamless loan application processes and improve overall efficiency. The personal loan market is evolving, with a focus on improving the borrower experience, ensuring consumer protection, and promoting financial literacy and education. The future of personal loans lies in leveraging advanced technologies, such as artificial intelligence and machine learning, to provide customized solutions and enhance the overall borrowing experience.

The Short term loans segment was valued at USD 286.50 billion in 2019 and showed a gradual increase during the forecast period.

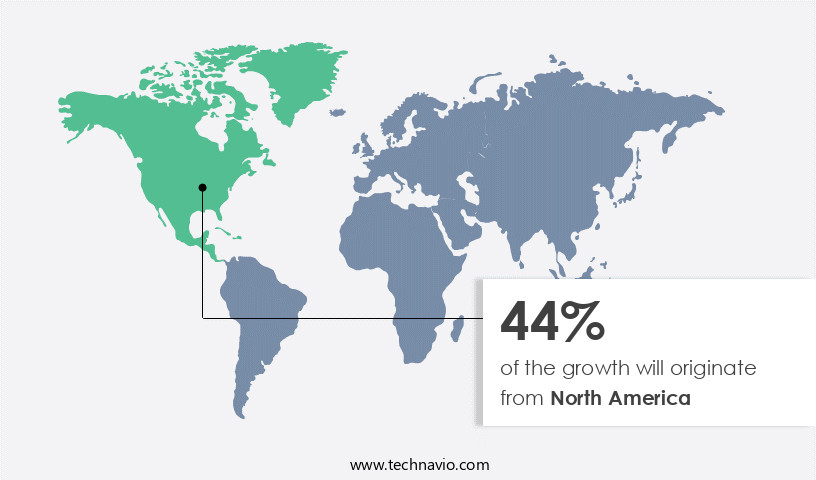

Regional Analysis

North America is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American the market is experiencing growth due to the region's technological advancements and adoption of innovative technologies such as artificial intelligence (AI) and the Internet of Things (IoT). Leading commercial lending institutions, including Goldman Sachs, American Express, and Bank of America Corp., are investing in these technologies to enhance their offerings and improve customer service. Digital lending platforms, online applications, and automated underwriting are becoming increasingly popular, enabling quicker loan approval processes and better credit risk assessment. Consumer protection measures, such as identity theft protection and fraud detection, are also prioritized in the market.

Credit utilization, debt consolidation, and debt management are key areas of focus for borrowers, leading to an increased demand for personal loans with flexible repayment schedules and debt management tools. Predictive modeling and machine learning are utilized to assess borrower eligibility and determine loan terms, while data analytics and credit scoring help lenders make informed decisions. The market caters to various loan types, including unsecured loans, auto loans, student loans, and small business loans. Credit history, FICO score, and debt-to-income ratio (DTI) are essential factors in loan origination and approval processes. Credit repair services and loan servicing companies play a crucial role in helping borrowers manage their debt and improve their creditworthiness.

Despite the growth, challenges such as default rates, delinquency rates, and debt settlement remain, necessitating effective debt management strategies and risk assessment techniques. In summary, the North American the market is witnessing significant growth due to technological advancements, increased adoption of digital lending platforms, and a focus on consumer protection and financial education. Key players in the market are investing in AI, IoT, and data analytics to streamline processes, enhance customer service, and make informed lending decisions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and competitive the market, borrowers seek flexible financing solutions tailored to their unique financial needs. These loans, which do not require collateral, offer quick approval and funding for various personal expenses, including medical emergencies, home improvements, or debt consolidation. Personal loan providers employ rigorous underwriting processes to assess creditworthiness, ensuring responsible lending practices. Interest rates, repayment terms, and loan amounts vary, enabling applicants to find a suitable fit. Online applications streamline the process, allowing for convenient access to personal loans. Credit scores, income, debt-to-income ratio, and employment history are crucial factors influencing loan approval. Borrowers must consider these aspects when selecting a personal loan, ensuring they secure the best possible terms. Personal loans provide a valuable financial safety net, empowering individuals to manage unexpected expenses and improve their financial situation.

What are the key market drivers leading to the rise in the adoption of Personal Loans Industry?

- The implementation of advanced technologies significantly drives the loan market by streamlining processes and enhancing efficiency.

- The market is experiencing significant transformation in the banking and financial sector, driven by technological advancements. Cloud-based payment platforms enable financial institutions to streamline payment collection and offer swift services with updated functions. This innovation has encouraged institutions to explore new marketing strategies to attract customers. Additionally, the adoption of digital platforms for document storage, such as in-memory and columnar databases, minimizes the use of paper. Credit scoring is a crucial aspect of personal loans, and financial organizations employ advanced techniques to assess borrower eligibility.

- Identity theft protection and fraud detection systems are essential to ensure security. Financial literacy programs and debt management tools help customers understand repayment schedules and debt consolidation options. The industry's focus on customer service, debt management, and financial education contributes to a lower default rate. Artificial intelligence and machine learning algorithms enhance the borrowing experience by providing personalized services and improving overall efficiency.

What are the market trends shaping the Personal Loans Industry?

- The adoption of cloud-based personal loan servicing software is gaining momentum in the market. This trend signifies a shift towards more efficient and flexible solutions for managing personal loans.

- In the financial services sector, the shift towards cloud-based solutions, including loan servicing, is gaining momentum due to their cost-effective and efficient nature. With the increasing focus on financial planning and retirement planning, the demand for streamlined loan processes is on the rise. Cloud-based loan servicing offers quick implementation, enabling lenders to reduce time-to-market and enhance customer experience. Credit history plays a crucial role in loan disbursement, and cloud-based servicing solutions can seamlessly integrate with APIs to access FICO scores and other credit data. Moreover, these solutions can cater to various loan types, such as auto loans, student loans, and lines of credit, ensuring a unified approach to loan management.

- Interest rate calculations and loan servicing are critical components of the loan application process. Cloud-based offerings can efficiently handle these tasks, reducing the risk of errors and ensuring regulatory compliance. In the event of loan defaults, these solutions can effectively manage the collection process, minimizing the need for external collection agencies. In summary, cloud-based loan servicing offers numerous benefits, including quick implementation, seamless integration with credit data, efficient handling of various loan types, and effective collection management. By adopting these solutions, financial institutions can optimize their loan servicing operations and enhance their overall customer experience.

What challenges does the Personal Loans Industry face during its growth?

- Compliance and regulatory challenges, particularly those related to loans, significantly hinder the growth of the industry. These challenges necessitate adherence to various laws and regulations, adding complexity and cost to business operations.

- The market is characterized by stringent regulatory requirements that financial institutions must adhere to, ensuring the financial system's stability. One such regulation is Basel III, a global banking regulation developed by the Bank for International Settlements. This standard sets out a framework for banks to manage their risks effectively and maintain sufficient liquidity. In the context of personal loans, lenders use various methods to assess risk, including data analytics and credit repair. Open banking, which allows secure access to financial data, facilitates a more efficient loan approval process. Small business loans and personal installment loans are popular loan products, with lenders evaluating borrowers' debt-to-income ratios (DTIs) to determine their ability to repay.

- Delinquency rates and debt settlement are essential considerations for lenders, as they impact the risk profile of potential borrowers. Mortgage loans and secured loans also play a significant role in the market, with risk assessment a critical factor in determining eligibility. Despite these challenges, the market continues to evolve, with technology and data analytics playing increasingly important roles in the loan approval process.

Exclusive Customer Landscape

The personal loans market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the personal loans market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, personal loans market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Axis Bank Ltd. - This company provides access to personal loans ranging from USD1,000 to USD44,000 with flexible repayment terms up to 60 months, enabling individuals to manage their financial needs effectively. Our lending solutions prioritize originality, ensuring enhanced search engine visibility while maintaining a clear, informative message from a research analyst's perspective. No specific geographic area or key players are referenced.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Axis Bank Ltd.

- Bajaj Finserv Ltd.

- Canara Bank

- Cholamandalam Investment and Finance Co. Ltd.

- Citigroup Inc.

- Finbud Financial Services Pvt Ltd

- HDFC Bank Ltd.

- HSBC Holdings Plc

- ICICI Bank Ltd.

- IDBI Bank Ltd.

- Indian Overseas Bank

- Mahindra and Mahindra Financial Services Ltd.

- PPF Group

- Punjab National Bank

- State Bank of India

- Tata Sons Pvt. Ltd.

- UCO BANK

- Union Bank of India

- Whizdm Innovations Pvt. Ltd.

- Yes Bank Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Personal Loans Market

- In January 2024, PayPal Holdings, Inc. Announced the expansion of its PayPal Credit offering to include personal loans in addition to credit lines, marking a significant product development for the digital payments giant (PayPal Press Release, 2024). In March 2024, Marlette Funding, LLC, a leading online consumer lending platform, entered into a strategic partnership with Capital One to offer personal loans through Capital One's online marketplace (Capital One Press Release, 2024).

- In April 2025, Prosper Marketplace, Inc., an online marketplace lender, secured a USD400 million investment from a consortium of investors, including BlackRock Inc. And Blackstone Group Inc., to fuel its growth and expand its personal loan offerings (Prosper Press Release, 2025). In May 2025, the U.S. Small Business Administration (SBA) introduced the Personal Name Loan Program, allowing small businesses to use their personal credit to secure SBA-backed loans, signaling a key regulatory initiative to support small businesses during economic uncertainty (SBA Press Release, 2025).

Research Analyst Overview

- The market exhibits dynamic interplay between various factors, including the yield curve, consumer confidence, compliance regulations, and economic indicators. The shape of the yield curve influences interest rate sensitivity and interest rate risk for lenders, impacting prime and subprime lending spreads. Consumer confidence levels affect demand for personal loans, while compliance regulations shape credit risk management and loan modification practices. Default modeling and credit counseling are crucial components of risk mitigation strategies in alternative lending, including peer-to-peer platforms. Financial inclusion initiatives expand access to credit, but legal compliance and loan insurance remain essential for balanced risk management.

- Balance transfer offers and debt refinancing provide borrowers with opportunities to optimize their debt portfolios, while capital adequacy and liquidity risk management are vital for lenders' long-term sustainability.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Personal Loans Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.2% |

|

Market growth 2025-2029 |

USD 803.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.0 |

|

Key countries |

US, Canada, UK, India, Germany, China, France, Japan, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Personal Loans Market Research and Growth Report?

- CAGR of the Personal Loans industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the personal loans market growth of industry companies

We can help! Our analysts can customize this personal loans market research report to meet your requirements.