Photo Editing Software Market Size 2025-2029

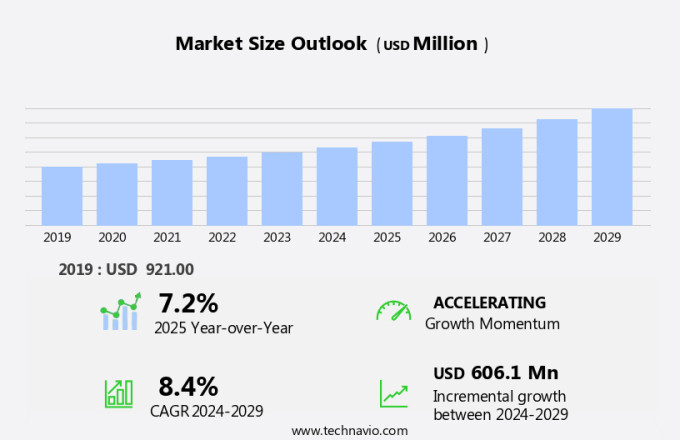

The photo editing software market size is forecast to increase by USD 606.1 million at a CAGR of 8.4% between 2024 and 2029.

- The market is witnessing significant growth due to several key trends. One of the primary factors driving market growth is the increasing use of photo editing software in the global event industry. With the rise in digital events and virtual meetings, the demand for high-quality, edited images and videos has increased. Another trend shaping the market is the increasing applications of artificial intelligence (AI) in the photo editing process. AI-powered tools enable automatic image enhancement, color correction, and object recognition, making photo editing more efficient and accessible to a wider audience. Additionally, the availability of open-source software for photo editing is fostering innovation and competition in the market. These trends are expected to continue driving market growth in the coming years.

What will be the Size of the Market During the Forecast Period?

- The market is witnessing significant growth due to the increasing demand for improving the quality of digital photographs. Old photos, in particular, require special attention as they often contain imperfections such as scratches, fading, and discoloration. Photo restoration software has emerged as a popular solution for restoring these precious memories to their former glory. Image cleanup is another essential function of photo editing tools that help enhance image quality by removing unwanted elements and blemishes. Photo retouching techniques, including facial recognition and artificial intelligence, are increasingly being adopted to automate the process of removing imperfections and enhancing color and tints.

- Moreover, product prices for photo editing software vary depending on the features and capabilities offered. Basic image editing tools are available for free, while advanced software with features such as layered editing, high-definition quality images, and digital picture recovery may come with a premium price tag. Photographers and social media users are the primary consumers of photo editing software. The market trend is towards more advanced computational algorithms, including artificial intelligence and virtual reality, to offer more sophisticated image enhancement capabilities. Special effects and 3D-imaging tools are also gaining popularity, allowing users to create unique and visually appealing images.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Commercial

- Personal

- Platform

- Windows

- Mac OS

- Android

- iOS

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- South America

- Brazil

- Middle East and Africa

- North America

By End-user Insights

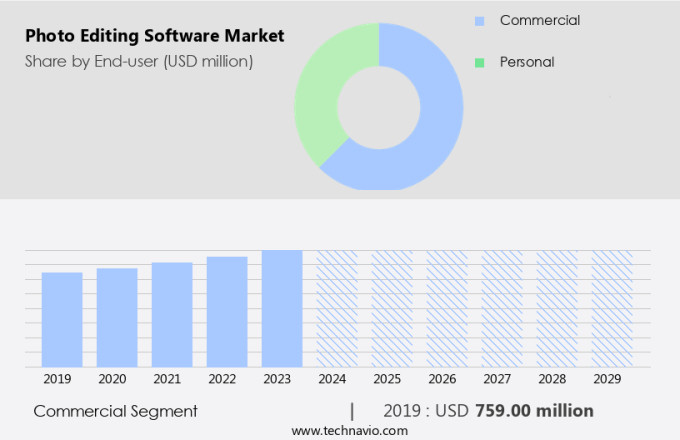

- The commercial segment is estimated to witness significant growth during the forecast period.

The market is experiencing substantial growth due to its widespread adoption in various industries. Commercial sectors, including marketing and advertising agencies, e-commerce businesses, and the media and entertainment industry, utilize these tools to produce visually appealing content. E-commerce platforms enhance product images to provide an engaging shopping experience for consumers. In the commercial segment, notable companies include Adobe Inc., GIMP, Lightricks Ltd., Afterlight Collective Inc., and PhotoUp Inc. The increasing penetration of smartphones and internet usage, as well as the rising sales of mobile phones, have expanded the market reach to non-professional users. Basic editing functions, such as color correction, effects, and background modifications, cater to this demographic. Overall, the market continues to grow, driven by the increasing demand for high-quality visuals across various industries.

Get a glance at the market report of share of various segments Request Free Sample

The commercial segment was valued at USD 759.00 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

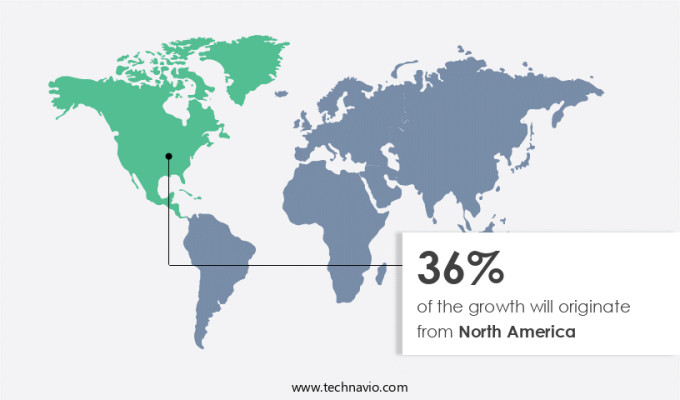

- North America is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is a significant contributor to the global photo editing software industry, driven by advanced technological infrastructure and a high adoption rate of digital devices. This region's vibrant ecosystem includes major market players, innovative startups, and a large community of photographers and content creators, fueling market growth and innovation. E-commerce platforms have become a popular and cost-effective sales channel for businesses. Effective website design, featuring high-quality, refurbished images, is crucial for attracting customers and increasing online traffic. Photo editing software plays a vital role in enhancing image quality, correcting imperfections, and providing advanced features such as 3D alignment and 3D smart vision. Artificial intelligence and non-raw editing software are also gaining popularity for their ability to streamline the editing process and cater to a wider audience. Overall, the North American market's dynamic landscape and strong demand for sophisticated photo editing tools position it as a key player in the global industry.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Photo Editing Software Market?

Increasing use of photo editing software in global event industry is the key driver of the market.

- The market is experiencing significant growth as the demand for enhancing digital images continues to rise. With advancements in technology, including 3D alignment, artificial intelligence, and 3D smart vision, photo editing software has evolved beyond basic color correction and format conversion. Old film photography and digital cameras have given way to high-definition quality images captured by modern smartphones and camera systems. Non-raw editing software caters to non-professional users seeking easy-to-use tools for refurbishing images. Meanwhile, raw editing software offers more advanced computational algorithms for professionals and enthusiasts. The commercial segment includes social media platforms, e-commerce, fashion industries, and fashion businesses, which rely on high-quality images for branding and marketing.

- In addition, the penetration of smartphones and the increase in internet usage and mobile phone sales have led to an influx of digital images. As a result, photo editor apps have become increasingly popular for quick edits and filters. Service providers offer a range of editing capabilities, from basic functions like image orientation and brightness adjustments to advanced tools like depth of field, time-lapse, and 3D-imaging. Artificial intelligence and facial recognition are key features in modern photo editing software, enabling users to enhance selfies and portraits with ease. Virtual reality and augmented reality capabilities add an extra layer of engagement, allowing users to experiment with different backgrounds and effects.

What are the market trends shaping the Photo Editing Software Market?

Increasing applications of AI in photo editing process is the upcoming trend in the market.

- Artificial intelligence (AI) is revolutionizing the market by automating the entire editing process. With advanced computational algorithms, AI identifies the type of photo and analyzes its quality, making improvements such as adjusting exposure, color correction, and enhancing details from shadows. It also optimizes brightness, contrast, color balance, sharpness, and noise level according to the photo type, be it objects, landscapes, selfies, or portraits. AI-powered photo editing software enables users to refurbish old film photography and digital images, enhancing their quality to high-definition. The market for this technology is growing, driven by the penetration of smartphones, increased internet usage, and the popularity of social media platforms like Instagram and Facebook.

- In addition, non-professional users benefit from basic editing functions, while commercial segments such as fashion industries and e-commerce rely on advanced 3D alignment, layered editing, and augmented reality for product promotion. AI-driven photo editing software is available on various platforms including Android/iOS, Windows, and Mac, with popular apps like VSCO, Lightroom, and Snapseed leading the trend. AI's ability to recognize facial features and apply facial recognition technology further enhances the user experience. The future of photo editing lies in the integration of AI, 3D imaging systems, and virtual reality, offering new possibilities for photographers and businesses alike.

What challenges does Photo Editing Software Market face during the growth?

Availability of open software for photo editing is a key challenge affecting the market growth.

- The market is witnessing significant shifts in pricing models, with an increasing trend toward subscription-based services. companies are moving away from perpetual licenses and offering monthly, quarterly, and annual subscriptions. While monthly subscriptions provide greater flexibility, they are more expensive than longer-term subscriptions. Non-professional users, who infrequently use photo editing software and do not require frequent upgrades, often opt for free software available through web browsers. These tools offer basic editing functions such as color correction, effects, background modifications, resizing, format conversion, and cropping. Advanced photo editing software, including raw editing software and 3D alignment tools, cater to the needs of professionals and businesses.

- Moreover, these tools offer high-quality images through artificial intelligence and 3D smart vision technology. They enable refurbishing images, improving quality, and adding special effects. The commercial segment, including fashion industries and e-commerce, is a major consumer of these advanced tools. Digital photography, driven by the penetration of digital cameras and smartphones, has led to an increase in the demand for photo editing software. Digital images require editing to enhance color, tints, brightness, contrast, sharpness, and color balance. The market for photo editing software is further fueled by the popularity of social media platforms, virtual reality, and augmented reality. Technology improvements in camera systems, digital photos, and image orientation have led to the development of advanced computational algorithms and 3D-imaging tools.

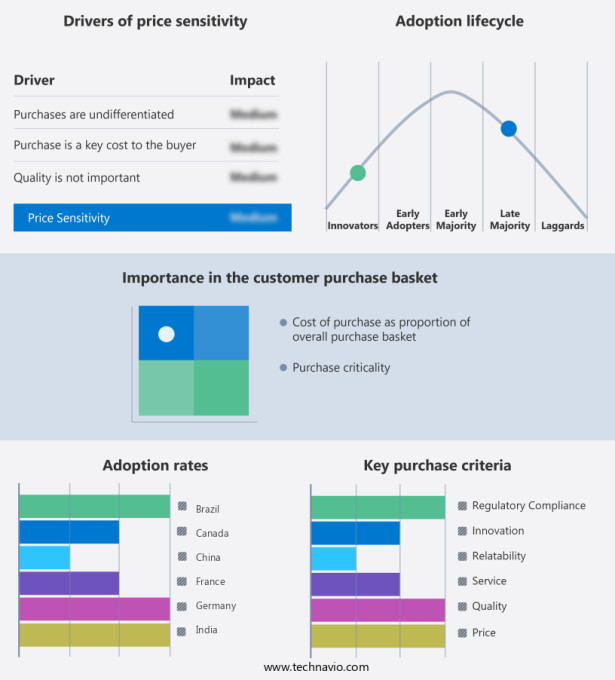

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ACD Systems International Inc. - The company offers photo editing software such as Photo Studio Ultimate 2024, Photo Studio Professional 2024, Photo Studio Home 2024, Photo Studio for Mac 10 and Gemstone Photo Editor 1.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adobe Inc.

- Afterlight Collective Inc.

- Alphabet Inc.

- Apple Inc.

- Capture One

- Corel Corp.

- CyberLink Corp.

- DxO Labs

- GIMP

- Inmagine Lab Pte. Ltd.

- Lightricks Ltd.

- MAGIX Software GmbH

- ON1

- PhotoUp Inc.

- PicsArt Inc.

- Polarr

- Samsung Electronics Co. Ltd.

- Serif Europe Ltd.

- Skylum Software USA Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market has witnessed significant growth in recent years, driven by the increasing popularity of digital photography, the proliferation of smartphones, and the rise of social media platforms. This content explores the market dynamics of photo editing software, focusing on the latest trends, technologies, and user preferences. Market Overview: the market caters to various segments, including professional photographers, non-professional users, and businesses. The market offers a wide range of solutions, from raw editing software to non-raw editing software, each designed to cater to different user needs and skill levels.

Furthermore, the market is witnessing rapid technological advancements, with the integration of artificial intelligence (AI) and 3D imaging systems becoming increasingly common. These technologies enable advanced computational algorithms to automatically enhance image quality, correct imperfections, and even apply 3D alignment and 3D smart vision effects. Quality and User Experience: Quality and user experience are key factors driving the growth of the market. Users seek high-definition quality images, with features such as image orientation correction, colour correction, contrast adjustment, and noise reduction. Additionally, the market offers various special effects and filters to help users create unique and visually appealing images.

Furthermore, the market is witnessing several trends, including the increasing popularity of 3D imaging, augmented reality, and virtual reality. These technologies enable users to create more enriching and interactive images, enhancing the overall user experience. Furthermore, the penetration of smartphones and the rise of internet usage have led to an increase in the number of users seeking easy-to-use, mobile-friendly photo editing apps. User Preferences: Non-professional users typically prefer basic editing functions, such as colour correction, effects, background modifications, resizing, and format conversion. In contrast, professional photographers and businesses require more advanced features, such as layered editing, depth of field control, time-lapse creation, and service providers for large-scale projects.

In addition, the market caters to various segments, including commercial, social media, e-commerce, fashion industries, and fashion businesses. Social media platforms, such as Instagram and Facebook, have significantly impacted the market, with users seeking to enhance their digital photos for online sharing. E-commerce and fashion industries rely on high-quality images to showcase their products, while businesses use photo editing software for branding and marketing purposes. Conclusion: the market is a dynamic and evolving industry, driven by technological advancements, user preferences, and market trends. The market offers a wide range of solutions, catering to various user segments and skill levels. As technology continues to advance, we can expect to see further innovations in photo editing software, enabling users to create even more visually appealing and engaging images.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.4% |

|

Market growth 2025-2029 |

USD 606.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.2 |

|

Key countries |

US, Japan, Germany, UK, China, India, Canada, France, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch