US Pickup Truck Market Size 2025-2029

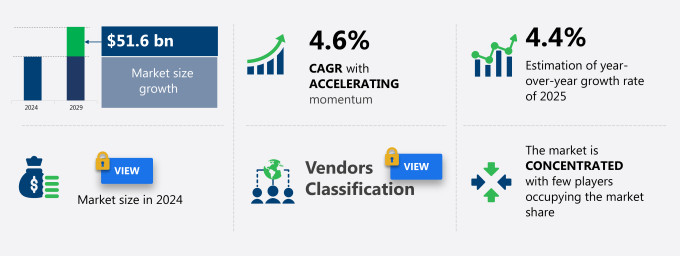

The US pickup truck market size is forecast to increase by USD 51.6 billion, at a CAGR of 4.6% between 2024 and 2029.

The market is experiencing significant growth, driven by the increased utility of pickup trucks for both personal and commercial use. Another key trend is the incorporation of lighter materials in pickup truck manufacturing, leading to improved fuel efficiency and reduced emissions. Additionally, the sales of used pickup trucks in the US continue to rise, offering an attractive option for budget-conscious consumers. These factors contribute to the market's steady expansion, making it an intriguing space for industry players to explore. However, the market has faced sluggish demand due to various factors, including supply chain disruptions caused by lockdowns and the shortage of auto parts, including semiconductor chips.

What will be the US Pickup Truck Market Size During the Forecast Period?

- The pickup truck market continues to be a significant player In the global automotive industry, driven by customers seeking vehicles with high torque, payload capacity, and towing ability. Fuel efficiency remains a key consideration for consumers, with a growing interest in alternative fuel types, including diesel and electric vehicles (EVs). The diesel segment, in particular, is expected to experience a rise in affordability, leading to increased growth in developing economies.

- The recovery of the market is anticipated, with fuel type insights indicating a shift towards more fuel-efficient options. The cargo area and general utility of pickup trucks make them a versatile choice for consumers, with applications ranging from personal use to commercial purposes. Despite challenges, the pickup truck market is poised for continued growth, with production and sales expected to rebound In the coming years.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Full-size pickup truck

- Small-size and mid-size pickup truck

- Type

- Extended cab and crew cab

- Regular cab

- Geography

- US

By Product Insights

- The full-size pickup truck segment is estimated to witness significant growth during the forecast period.

Full-size pickup trucks, defined as vehicles with a gross vehicle weight rating (GVWR) between 6,000 lbs. And 14,000 lbs., dominate the US pickup truck market. Manufacturers prioritize these models due to their higher profit margins compared to smaller counterparts. Enhanced engine capacity and increased ground clearance characterize full-size pickups. Some variants, labeled as heavy-duty (3500 and 2500 series), offer superior load-hauling and towing capabilities, enabling them to tow fifth-wheel trailers. Fuel efficiency, payload capacity, towing capacity, and customization are key factors influencing customer preferences. Diesel engines and gasoline are the primary fuel types, with diesel offering greater torque and payload capacity but higher CO2 emissions.

Developing economies and recovery from lockdowns are expected to fuel growth In the pickup truck market. The industry faces challenges such as supply chain disruptions, labor shortages, and semiconductor chip shortages. The market encompasses various players, including Stellantis Group, and the growth rate is anticipated to increase In the coming years. Electric vehicles (EVs) are emerging as a potential threat, with light-duty pickup trucks undergoing electrification.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our US Pickup Truck Market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of US Pickup Truck Market?

Increased utility of pickup trucks is the key driver of the market.

- Pickup trucks have gained significant popularity In the US market due to their versatility and utility. These vehicles offer larger payload capacities and towing capabilities, making them ideal for both commercial and personal use. The increased cargo area allows for the transportation of larger loads, surpassing the capabilities of passenger cars, SUVs, crossovers, and hatchbacks. Pickup trucks come in various trims, such as extended cab models, which prioritize additional passenger seats without compromising cargo bed space. Torque, a critical factor in pickup trucks, is essential for hauling heavy loads and towing trailers. Fuel efficiency is another essential consideration for customers, with many opting for diesel fuel type due to its higher torque and payload capacity.

- However, the shift towards electric vehicles (EVs) and the rising affordability of these vehicles may impact the fuel type insights In the future. The pickup truck market has experienced some sluggish demand due to various factors, including supply chain disruptions caused by lockdowns, labor shortages, and the lack of availability of auto parts, including semiconductor chips. Despite these challenges, the market is expected to recover, with growth rates projected to increase In the coming years. CO2 emissions and fuel type are crucial factors influencing the market in developing economies. As consumers become more environmentally conscious, there may be a shift towards light-duty pickup trucks with lower emissions and higher fuel efficiency.

What are the market trends shaping the US Pickup Truck Market?

Increasing incorporation of lighter materials in pickup truck manufacturing is the upcoming trend In the market.

- In the market, there is a growing emphasis on enhancing fuel efficiency and reducing CO2 emissions, leading vehicle manufacturers to explore alternative materials for manufacturing these vehicles. The use of lighter materials, such as aluminum, in pickup trucks can result in significant fuel savings and increased towing capacity. For instance, Ford Motor's aluminum F-150 pickup truck weighs approximately 700 lbs. Less than its steel counterpart, allowing for improved mileage and superior towing capabilities with a V6 engine instead of a V8 engine. The shift towards lighter materials also enables more engine power to be allocated to pulling or towing, thereby increasing the overall utility of the pickup truck.

- With the increasing focus on fuel efficiency and the rising affordability of these vehicles, the growth rate of the light-duty pickup truck market is expected to remain strong, despite the recent sluggish demand due to various factors such as lockdowns and supply chain disruptions. Furthermore, the transition towards electric vehicles (EVs) is also gaining momentum, with companies like Stellantis Group investing In the development of electric pickup trucks. Fuel type insights suggest that diesel pickup trucks still dominate the market, but the shift towards cleaner fuel alternatives is expected to continue. The production and sales of passenger cars and passenger vehicles, including pickup trucks, are anticipated to recover In the coming years, driven by consumer reach and the availability of auto parts, including semiconductor chips and labor.

What challenges does the US Pickup Truck Market face during the growth?

Increasing sales of used vehicles in the US is a key challenge affecting the market growth.

- The market is influenced by several factors, including torque, payload capacity, fuel efficiency, and towing capacity. These vehicles are popular for their general utility and high cargo area, making them a preferred choice for both personal and commercial use. However, the demand for pickup trucks has been sluggish due to various reasons, such as increasing consumer reach for fuel-efficient passenger cars and the impact of lockdowns on the supply chain. Fuel type is another significant factor In the pickup truck market. Traditionally, diesel pickups have been popular due to their higher torque and towing capacity.

- However, with increasing CO2 emissions concerns, there is a growing trend towards fuel-efficient pickups, especially those running on gasoline. The production and sales of light-duty pickup trucks are expected to grow at a moderate rate, driven by rising affordability and the increasing popularity of electric vehicles (EVs) in developing economies. The growth rate of the pickup truck market is also influenced by factors such as the availability of auto parts, semiconductor chips, labor, and the recovery of various industries. Fuel type insights suggest that the demand for diesel pickups may decline further as consumers shift towards more eco-friendly options.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

Chevrolet - The company offers pickup truck such as Colorado, Silverado, and Silverado HD, known for their durability, towing capacity, and advanced features.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ford Motor Co.

- Honda Motor Co. Ltd.

- Hyundai Motor Co.

- Isuzu Motors Ltd.

- Mitsubishi Motors Corp.

- Nissan Motor Co. Ltd.

- Rivian Automotive LLC

- Stellantis NV

- Tesla Inc.

- Toyota Motor Corp.

- Volkswagen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to exhibit strong dynamics, driven by the demand for vehicles with high torque and payload capacity. These vehicles cater to a broad customer base, including businesses and individuals who require general utility and towing capabilities. Fuel efficiency remains a significant consideration for consumers, with both diesel and gasoline options available. Despite the sluggish demand in some sectors due to various external factors, the pickup truck market is poised for growth. Developing economies are increasingly becoming key consumer reaches for these vehicles, driven by rising affordability and the need for reliable transportation solutions. Fuel type insights reveal that the market is undergoing a shift towards more environmentally-friendly options. While diesel continues to dominate the market, the adoption of electric vehicles (EVs) is on the rise. Light-duty pickup trucks, in particular, are expected to witness significant growth in the EV segment.

Further, production and sales of pickup trucks have been impacted by various challenges, including supply chain disruptions, labor shortages, and the lack of availability of essential auto parts, such as semiconductor chips. These issues have led to production delays and increased prices, affecting the overall market recovery. The market for passenger cars and pickup trucks is interconnected, with the latter often serving as a key indicator of economic health. The impact of lockdowns and other restrictions on the automotive industry has led to a ripple effect, affecting both markets. As the market evolves, horsepower and towing capacity continue to be essential factors for customers. However, the focus on reducing CO2 emissions and improving fuel efficiency is becoming increasingly important.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

144 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 51.6 billion |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

4.4 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch