Point Of Care Blood Gas And Electrolyte Market Size 2024-2028

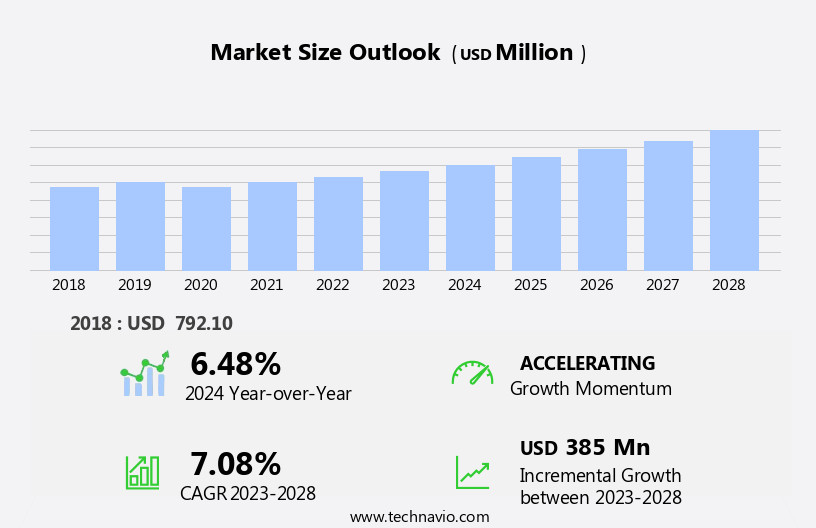

The point of care (POC) blood gas and electrolyte market size is forecast to increase by USD 385 million at a CAGR of 7.08% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. The aging population in North America is driving market demand, as this demographic is more prone to chronic diseases requiring frequent monitoring of blood gases and electrolyte levels. Another trend influencing market growth is the shift from benchtop to portable POC devices, which offer convenience and mobility for healthcare professionals and patients. Strict government regulations aimed at ensuring accuracy and safety also contribute to market expansion. These factors collectively create a favorable environment for market growth In the coming years.

- The market encompasses the production and sale of devices and consumables used for measuring electrolytes and metabolites, such as lactate, at the point of care. These measurements are essential for diagnosing and monitoring various conditions, including diabetes, chronic bronchitis, and other chronic diseases. The analyzers, which determine the pH level and the presence of respiratory acidosis or alkalosis, are a significant component of this market. Electronic medical records and critical care units in healthcare facilities drive the demand and electrolyte testing. The increasing use of ventilators in pulmonary units, neonatal intensive care, and emergency room care further boosts market growth.

What will be the Size of the Point Of Care (POC) Blood Gas And Electrolyte Market During the Forecast Period?

- Co-oximetry, a technique used to measure the oxygen-binding capacity of hemoglobin, is also a crucial aspect of this market. Portable and benchtop devices are popular due to their convenience and ease of use. Advancements in technology, such as photoluminescent biosensors, have led to more accurate and efficient testing. The market is also influenced by the growing prevalence of infectious diseases, which necessitate frequent monitoring. Overall, the electrolyte market is expected to grow significantly due to its importance in diagnosing and managing various medical conditions.

How is this Point Of Care (POC) Blood Gas And Electrolyte Industry segmented and which is the largest segment?

The point of care (POC) blood gas and electrolyte industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Consumables

- Instruments

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

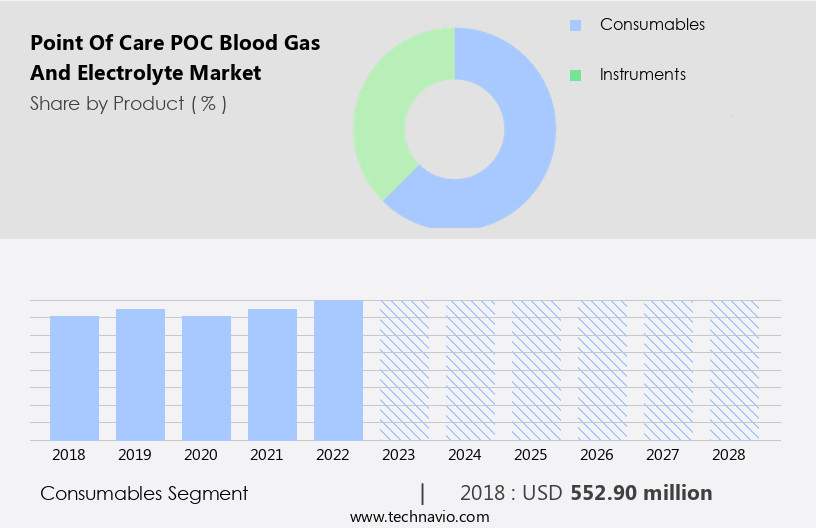

By Product Insights

- The consumables segment is estimated to witness significant growth during the forecast period.

The market encompasses instruments, consumables, and blood samples for analyzing blood gases, pH levels, electrolytes, metabolites, and biochemical markers. The consumables segment dominates the market due to the increasing prevalence of chronic diseases like diabetes and cardiovascular diseases (CVDs), which necessitate frequent electrolyte tests. This, in turn, fuels demand for consumables such as cartridges, test strips, electrodes, and controls. Additionally, the adoption of POC testing in various healthcare settings, including ICUs, emergency departments, hospitals, and clinics, contributes to the growth of the consumables segment. Electrolyte imbalances, blood pressure, heart rate, rhythm, and respiration rate measurements are essential in critical care units, ICUs, burn units, trauma units, chest pain units, stroke units, operating rooms, ambulances, and other healthcare facilities.

Portable and benchtop devices, CO-oximetry, and wireless point-of-care devices are instrumental in facilitating quick and accurate electrolyte assessments.

Get a glance at the Point Of Care (POC) Blood Gas And Electrolyte Industry report of share of various segments Request Free Sample

The Consumables segment was valued at USD 552.90 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- Europe is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market holds a significant share In the global Point of Care (POC) blood gas and electrolyte industry. The US and Canada are the major contributors to the region's revenue growth. Factors driving the market expansion include the rising prevalence of chronic diseases such as diabetes, chronic bronchitis, and chronic illnesses. Additionally, the US Food and Drug Administration (FDA) has approved several new analyzers and electrolyte analyzers for commercialization.

These companies cater to various healthcare facilities, including intensive care units (ICUs), emergency departments, hospitals, and clinics, by providing analyzers, electrolyte measurement systems, and consumables such as cartridges, electrodes, and test strips. The market encompasses various segments, including instruments and consumables, which are used in blood samples assessment for pH, electrolytes, metabolites, and biochemical markers. POC testing is crucial in diagnosing electrolyte imbalances and monitoring therapeutic outcomes in adult ICUs, burn units, trauma units, chest pain units, stroke units, operating rooms, ambulances, and other healthcare facilities. Wireless POC devices and portable devices have gained popularity due to their convenience and ease of use.

The market also caters to research institutions and home care services. Key diseases treated with POC blood gas and electrolyte analysis include infectious diseases, kidney disease, liver disease, and cancer. POC testing plays a vital role in ventilator management, ICU patient management, and critical care units.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Point Of Care (POC) Blood Gas And Electrolyte Industry?

Rising geriatric population is the key driver of the market.

- The market is experiencing significant growth due to the increasing prevalence of chronic diseases such as diabetes, chronic bronchitis, and cancer. This market caters to the demand for quick and accurate analysis and electrolyte measurement in various healthcare settings, including intensive care units (ICUs), emergency departments, and hospitals and clinics. The market comprises two major segments: instruments and consumables. Blood gas analyzers, electronic medical records, and critical care units are instrumental In the instruments segment. The consumables segment includes cartridges, electrodes, test strips, batteries, and other accessories. The rising number of elderly individuals globally is a significant factor driving the market's growth, as POC devices become increasingly popular in home care settings.

- POC blood gas and electrolyte testing is crucial for monitoring various biochemical markers, including pH, electrolytes, metabolites, blood pressure, heart rate, rhythm, respiration rate, and electrolyte imbalances. These tests are essential for therapeutic therapy and electrolyte measurement in adult ICUs, burn units, trauma units, chest pain units, stroke units, operating rooms, and ambulances. Additionally, POC devices are increasingly used for infectious diseases, emergency room care, and kidney and liver disease management. The market is witnessing the emergence of wireless point-of-care devices, making it more accessible and convenient for healthcare professionals.

- The increasing adoption of these devices in various healthcare settings, such as mobile C-arms, hybrid operating rooms, angiography systems, and ultrasound systems, is expected to further fuel market growth. The testing systems segment is also expected to witness significant growth due to the increasing demand for rapid and accurate testing. The POC blood gas and electrolyte market is experiencing substantial growth due to the increasing prevalence of chronic diseases, an aging population, and the need for quick and accurate testing in various healthcare settings. The market comprises instruments and consumables segments, with blood gas analyzers, electronic medical records, and critical care units being key drivers In the instruments segment.

What are the market trends shaping the Point Of Care (POC) Blood Gas And Electrolyte Industry?

Paradigm shift from benchtop to portable POC blood gas and electrolyte devices is the upcoming market trend.

- The market is experiencing significant growth due to the increasing prevalence of chronic diseases such as diabetes, chronic bronchitis, and cancer, which require frequent monitoring of blood gases and electrolyte levels. Intensive Care Units (ICUs), emergency departments, and critical care units in hospitals and clinics are major consumers of these devices. POC blood gas analysis enables quick assessment of pH, electrolytes, metabolites, and biochemical markers like blood pressure, heart rate, rhythm, respiration rate, and electrolyte imbalances. Portable and benchtop devices, including blood gas analyzers and CO-oximetry systems, are increasingly being adopted for their convenience, cost-effectiveness, and rapid turnaround times.

- The market consists of two main segments: Instruments and Consumables. Instruments include blood gas analyzers, ventilators, and wireless point-of-care devices, while Consumables comprise cartridges, electrodes, test strips, batteries, and other accessories. The use of POC blood gas and electrolyte devices in adult ICUs, burn units, trauma units, chest pain units, stroke units, operating rooms, and ambulances facilitates timely therapeutic interventions and improved patient management. The adoption of electronic medical records and integration with other healthcare technologies, such as ventilators and therapeutic therapy systems, further enhances their utility. In addition to hospitals and clinics, research institutions and home care settings are also adopting these devices for electrolyte measurement and assessment.

- The market is witnessing the development of advanced technologies, such as wireless point-of-care devices, which offer increased mobility and convenience. The growing prevalence of lifestyle disorders, including obesity, and the increasing incidence of infectious diseases necessitate the need for regular blood gas and electrolyte testing. The market is expected to continue its growth trajectory, driven by the increasing demand for accurate, rapid, and cost-effective testing solutions.

What challenges does the Point Of Care (POC) Blood Gas And Electrolyte Industry face during its growth?

Stringent government regulations is a key challenge affecting the industry growth.

- The market encompasses the production and distribution of devices and consumables used for the analysis of blood gases, pH levels, electrolytes, and metabolites at the point of care. These tests are crucial for diagnosing and managing various chronic diseases such as diabetes, chronic bronchitis, and cancer, as well as acute conditions in Intensive Care Units (ICUs), emergency departments, and critical care units in hospitals and clinics. Blood gas analysis plays a vital role in assessing the acid-base balance and oxygenation status of patients, while electrolyte measurement is essential for monitoring electrolyte imbalances. The market comprises two main segments: Instruments and Consumables.

- Instruments include blood gas analyzers, ventilators, and wireless point-of-care devices, while consumables consist of cartridges, electrodes, test strips, and batteries. Regulatory oversight is stringent due to concerns regarding testing variability, inaccuracy, and infection risk associated with the multiple use of POC blood gas and electrolyte test products. In the US, the Food and Drug Administration (FDA) grants market approval through 501(k) clearance. Compliance with these regulations can be challenging for manufacturers engaging in cross-border trade due to varying product standards from country to country. Applications of POC blood gas and electrolyte testing extend to various healthcare facilities, including ICUs, burn units, trauma units, chest pain units, stroke units, operating rooms, ambulances, and research institutions.

- Biochemical markers, blood pressure, heart rate, rhythm, respiration rate, and electrolyte imbalances are essential parameters for therapeutic outcomes In these settings. The market also caters to home care, with portable and benchtop devices enabling convenient and efficient testing for patients with chronic illnesses or lifestyle disorders such as obesity. Infectious diseases, kidney disease, liver disease, and neonatal intensive care are other areas where POC blood gas and electrolyte testing plays a significant role. CO-oximetry, a technique used to measure the percentage saturation of oxygen in blood, is a critical component of POC blood gas analysis. Portable devices and benchtop devices offer flexibility and convenience for healthcare professionals and patients alike.

Exclusive Customer Landscape

The point of care (POC) blood gas and electrolyte market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the point of care (POC) blood gas and electrolyte market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, point of care (POC) blood gas and electrolyte market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Bayer AG

- Biobase Biodusty Shandong Co. Ltd.

- Convergent Technologies GmbH and Co. KG

- Danaher Corp.

- EDAN Instruments Inc.

- F. Hoffmann La Roche Ltd.

- Fortress Diagnostics

- Guangzhou MeCan Medical Ltd.

- Guangzhou Yueshen Medical Equipment Co. Ltd.

- IDEXX LABORATORIES INC.

- JOKOH CO. LTD.

- LIFEHEALTH LLC

- Medica Corpo.

- Nova Biomedical Corp.

- Radiometer Medical ApS

- Shinova Medical Co. Ltd.

- Siemens Healthineers AG

- TECOM Analytical Systems

- Werfenlife SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the diagnostic and monitoring devices used to assess the pH levels and electrolyte concentrations in blood samples. These measurements play a crucial role in evaluating metabolic and respiratory conditions, particularly in intensive care units (ICUs), emergency departments, and critical care units. Blood gas analysis is a vital aspect of patient management in various healthcare facilities. In chronic diseases such as diabetes, chronic bronchitis, and cancer, regular monitoring of blood gases and electrolytes helps In therapeutic outcomes assessment and adjusting treatment plans accordingly. The consumption of blood gas analyzers and related consumables, including terminals, pump tubes, and valves, is significant in this context.

The POC blood gas and electrolyte market is segmented into two primary categories: instruments and consumables. Instruments include blood gas analyzers, which can be further classified into benchtop and portable devices. The increasing demand for wireless point-of-care devices, driven by their convenience and portability, is a notable trend in this segment. Consumables, on the other hand, include cartridges, electrodes, test strips, and batteries. The continuous need for regular testing and replacement of these items ensures a steady demand for consumables In the market. The healthcare industry's shift towards electronic medical document systems and digitalization has led to the integration of POC blood gas and electrolyte analyzers into various healthcare facilities.

This integration enhances patient care by enabling real-time monitoring and quick decision-making, especially in ICUs, burn units, trauma units, chest pain units, stroke units, and operating rooms. Moreover, the growing prevalence of chronic illnesses and lifestyle disorders, such as obesity, diabetes, and respiratory acidosis, necessitates the use of POC blood gas and electrolyte testing systems. These conditions can lead to electrolyte imbalances, which can be effectively managed through timely and accurate assessment using these devices. The market for POC blood gas and electrolyte testing systems is expected to grow significantly due to the increasing demand for rapid and accurate diagnostic tools.

Furthermore, the integration of these systems into ambulance services and research institutions expands their reach and applicability, contributing to market growth. In summary, the POC blood gas and electrolyte market is a critical segment of the diagnostic and monitoring devices industry. Its significance lies in its ability to provide real-time assessment of pH levels and electrolyte concentrations, contributing to improved patient care and therapeutic outcomes in various healthcare settings. The market's growth is driven by factors such as the increasing prevalence of chronic diseases, the shift toward digitalization, and the integration of these systems into diverse healthcare applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

139 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.08% |

|

Market growth 2024-2028 |

USD 385 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.48 |

|

Key countries |

US, Germany, UK, Canada, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Point Of Care (POC) Blood Gas And Electrolyte Market Research and Growth Report?

- CAGR of the Point Of Care (POC) Blood Gas And Electrolyte industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the point of care (POC) blood gas and electrolyte market growth of industry companies

We can help! Our analysts can customize this point of care (POC) blood gas and electrolyte market research report to meet your requirements.