Point Of Care Glucose Testing Market Size 2024-2028

The point of care glucose testing market size is forecast to increase by USD 874.6 million at a CAGR of 4.91% between 2023 and 2028.

- The market is experiencing significant growth due to the rise in diabetes cases and increasing awareness about the importance of diabetes management. According to the Centers for Disease Control and Prevention, approximately 34.2 million Americans have diabetes, making it a major public health concern. This trend is driving the demand for convenient and affordable glucose testing solutions, particularly point-of-care (POC) devices. Moreover, the focus on introducing low-cost test strips is expected to further boost market growth. However, challenges such as the need for continuous calibration and the requirement for proper training to use POC devices effectively remain.

- Despite these challenges, the market is poised for continued expansion as the need for timely and accurate glucose monitoring solutions becomes increasingly crucial for effective diabetes management.

What will be the Size of the Point Of Care Glucose Testing Market During the Forecast Period?

- The Point of Care (PoC) Glucose Testing market is characterized by stringent performance standards and continuous advancements in technology. Blood sample preparation plays a crucial role in ensuring accurate results, with disposable test strips and sensor drift being key considerations. Manufacturers prioritize biocompatibility testing, shelf life, and precision and repeatability to meet patient needs. Dry reagent technology, data logging capabilities, and user-friendly interfaces are trends that enhance device ergonomics and error detection systems. Reimbursement policies and device reliability are significant market drivers, with clinical trial results demonstrating the effectiveness of optical glucose sensing. Healthcare provider training and storage conditions are essential for proper use and maintaining the quality of PoC glucose testing devices.

- Cloud data storage, cost-effectiveness metrics, and proficiency testing are crucial for efficient data management and maintaining regulatory compliance. Packaging requirements, response time, and wireless connectivity are other factors influencing market dynamics. Amperometric detection and automated calibration contribute to improved accuracy and ease of use, while mobile app integration and wireless connectivity enable remote monitoring and data sharing.

How is this Point Of Care Glucose Testing Industry segmented and which is the largest segment?

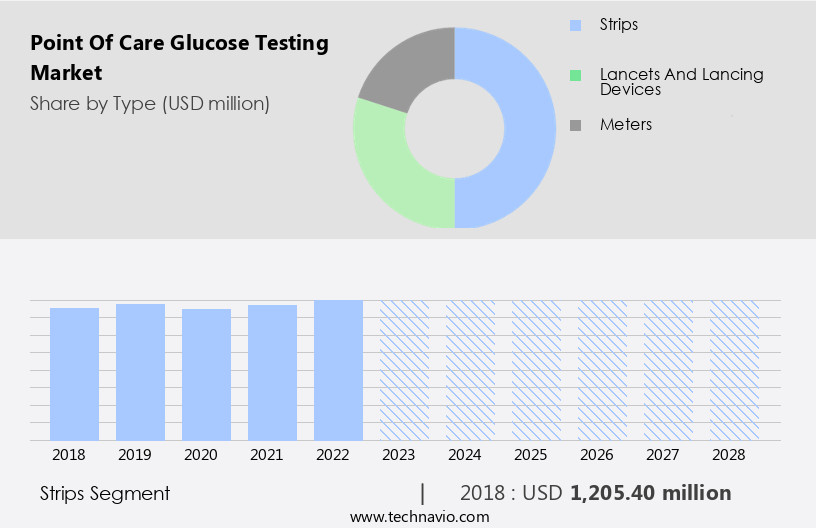

The point of care glucose testing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Strips

- Lancets and lancing devices

- Meters

- Geography

- North America

- US

- Canada

- Europe

- UK

- APAC

- China

- India

- Rest of World (ROW)

- North America

By Type Insights

The strips segment is estimated to witness significant growth during the forecast period.

Point-of-care glucose testing plays a crucial role in managing diabetes through the use of blood glucose meters and associated strips. These strips, made of thin plastic or paper, contain reactive enzymes like glucose oxidase that react with glucose in the blood, providing an accurate measurement. Hospitals, particularly large and medium-sized facilities, are significant users due to their advanced medical infrastructure and increased patient visits. Regulatory compliance is essential in this market, ensuring the accuracy and reliability of these devices. Interference substances, such as hematocrit levels and temperature, can impact test results, necessitating calibration procedures and quality control measures.

Advancements in sensor technology have led to the emergence of flash glucose monitoring systems and continuous glucose monitoring, enabling real-time, non-invasive monitoring. Self-monitoring devices have become popular, enabling patients to test their glucose levels at home. Data management systems facilitate the storage and interpretation of test results, while clinical validation studies ensure diagnostic accuracy and glucometer accuracy. Lancet devices and sample volume requirements are also critical considerations. Remote patient monitoring and data transmission protocols have expanded the reach of point-of-care glucose testing, enabling healthcare professionals to monitor patients from a distance. Hypoglycemia and hyperglycemia detection are essential features, with electrochemical sensors playing a significant role in result interpretation.

Temperature effects and hematocrit influence are factors that must be accounted for in the testing process. Point-of-care diagnostics, including whole blood analysis, are increasingly being adopted for glucose testing due to their convenience and speed. Continuous glucose monitoring systems provide real-time, continuous data, allowing for more effective diabetes management. Regular testing frequency and glucose meter maintenance are essential for accurate and reliable results. The market for point-of-care glucose testing is dynamic, with ongoing advancements in technology and regulatory requirements shaping its evolution.

Get a glance at the market report of share of various segments Request Free Sample

The Strips segment was valued at USD 1,205.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

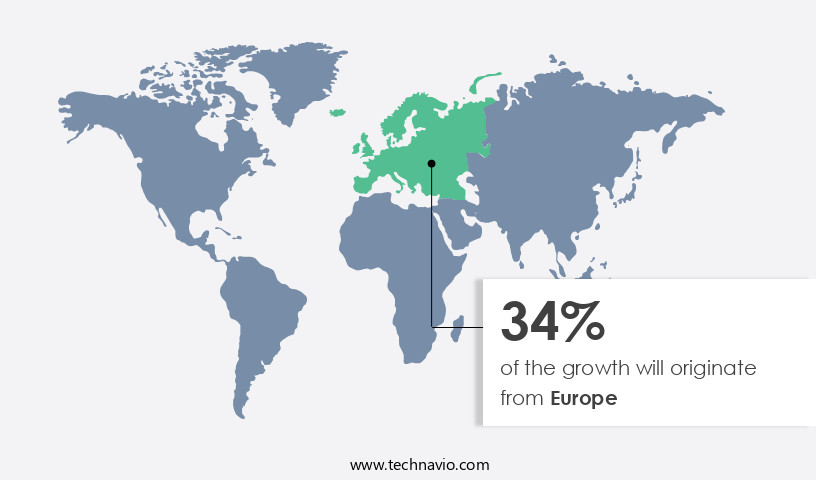

Europe is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The point-of-care (POC) glucose testing market in the US is experiencing significant growth due to the rising prevalence of diabetes and technological advancements in this field. POC glucose testing offers immediate results, enabling better patient care and management. This demand is further fueled by increasing awareness about diabetes and the need for continuous monitoring to ensure effective disease management. Regulatory compliance is a crucial aspect of the POC glucose testing market, ensuring the accuracy and reliability of blood glucose meters, test strips, and sensors. Calibration procedures and quality control measures are essential for maintaining diagnostic accuracy and glucometer accuracy.

Remote patient monitoring and data management systems facilitate seamless data transmission and analysis, allowing for more effective diabetes management. Flash glucose monitoring and self-monitoring devices with sensor technology have gained popularity due to their convenience and continuous glucose monitoring capabilities. Home glucose monitoring and capillary blood sampling are common methods for POC testing, while electrochemical sensors and the glucose oxidase method are widely used for result interpretation. Hypoglycemia and hyperglycemia detection are vital functions of POC glucose testing, with temperature effects and hematocrit influence being critical factors affecting test results. Continuous glucose monitoring systems provide whole blood analysis, ensuring more accurate and reliable results.

Proper maintenance of glucose meters and lancet devices, along with adherence to sample volume requirements, is essential for optimal performance. Clinical validation studies play a crucial role in ensuring the diagnostic accuracy and reliability of POC glucose testing systems. Point-of-care diagnostics have become an integral part of diabetes management, improving patient outcomes and reducing healthcare costs.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Point Of Care Glucose Testing Industry?

Increase in the number of diabetes cases and rising awareness about diabetes is the key driver of the market.

- Point-of-care glucose testing devices have gained significant importance in diabetes management due to their convenience and accuracy. The glucose oxidase method, the most common technique used in these devices, enables quick and reliable hyperglycemia detection through capillary blood sampling. The increasing prevalence of diabetes and pre-diabetes, with approximately 34.2 million people in the US diagnosed with diabetes in 2020 (CDC), fuels the demand for these devices. Diagnostic accuracy and glucometer accuracy are crucial factors driving the market's growth. Lancet devices, used for capillary blood sampling, ensure minimal invasiveness and pain. Data transmission protocols facilitate seamless communication between the devices and healthcare providers, contributing to effective diabetes management.

- The long device lifespan ensures cost-effectiveness and reduces the need for frequent replacements.

What are the market trends shaping the Point Of Care Glucose Testing Industry?

Focus on introducing low-cost test strips is the upcoming market trend.

- Point-of-care glucose testing is a critical area in healthcare, with a growing focus on early detection of hypoglycemia and regulatory compliance. Companies are developing advanced blood glucose meters to cater to this need. However, interference substances in blood samples can affect the accuracy of the test results. To mitigate this issue, companies are investing in research and development to enhance the sensitivity and specificity of their products. Patient self-testing is a popular trend, and remote patient monitoring is gaining traction. Calibration procedures and quality control measures are essential to ensure the accuracy and reliability of these devices. Plastic and paper blood glucose test strips, which are widely used, involve expensive devices for embedding electrodes to conduct electrical currents.

- In contrast, silk strips offer a cost-effective alternative, as they can conduct electrochemical signals directly, eliminating the need for expensive devices. However, the use of silk strips comes with challenges, such as interference from certain substances. Companies are addressing this issue by improving the manufacturing process and developing new technologies to enhance the performance of silk strips. Ensuring regulatory compliance and maintaining the highest quality standards are crucial to gain market acceptance and customer trust.

What challenges does the Point Of Care Glucose Testing Industry face during its growth?

Lower diagnosis and treatment rate is a key challenge affecting the industry growth.

- Point-of-care glucose testing faces challenges in emerging economies due to a significant number of undiagnosed diabetes cases. According to International Diabetes Federation data from 2021, over 55% of diabetic patients in the Asia-Pacific region remain undiagnosed, with India, China, and Indonesia having the highest numbers. Limited public awareness and access to advanced healthcare infrastructure hinder market expansion. These factors may impede the growth of the point-of-care glucose testing market, particularly in countries where chronic diseases like diabetes mellitus are not well-recognized.

Exclusive Customer Landscape

The point of care glucose testing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the point of care glucose testing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, point of care glucose testing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - The CHOLESTECH LDX ANALYZER is a leading point-of-care glucose testing solution, delivering accurate and timely results for healthcare professionals.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- ACON Laboratories Inc.

- Bayer AG

- Becton Dickinson and Co.

- Danaher Corp.

- EKF Diagnostics Holdings Plc

- F. Hoffmann La Roche Ltd.

- Johnson and Johnson Services Inc.

- LifeScan IP Holdings LLC

- Nipro Corp.

- Nova Biomedical Corp.

- PHC Holdings Corp.

- Prodigy Diabetes Care LL

- PTS Diagnostics

- Sekisui Medical Co. Ltd.

- Siemens Healthineers AG

- Trinity Biotech Plc

- Trivida Health Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to evolve, driven by advancements in technology and increasing demand for efficient and accurate diabetes management solutions. Entities in this sector offer a range of products, including blood glucose meters, self-monitoring devices, and flash glucose monitoring systems. These entities employ sensor technology, test strip technology, and home glucose monitoring systems to provide real-time glucose level data. Regulatory compliance plays a crucial role in market dynamics, with entities implementing rigorous calibration procedures and quality control measures to ensure diagnostic accuracy. Data management systems enable seamless data transmission and analysis, facilitating remote patient monitoring and clinical validation studies.

Continuous glucose monitoring systems, which utilize electrochemical sensors for whole blood analysis, provide valuable insights into glucose trends and patterns. However, factors such as interference substances, hematocrit influence, temperature effects, and result interpretation require ongoing attention to maintain diagnostic accuracy. Entities in this market prioritize glucometer accuracy and device lifespan, with lancet devices and sample volume requirements optimized for user convenience. Temperature effects and calibration procedures continue to be areas of focus for ongoing research and development. In the ever-evolving landscape of point-of-care diagnostics, entities must remain agile and adapt to emerging trends, ensuring their offerings remain competitive and effective in meeting the diverse needs of healthcare providers and patients.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

134 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.91% |

|

Market growth 2024-2028 |

USD 874.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.41 |

|

Key countries |

US, UK, China, Canada, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Point Of Care Glucose Testing Market Research and Growth Report?

- CAGR of the Point Of Care Glucose Testing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the point of care glucose testing market growth of industry companies

We can help! Our analysts can customize this point of care glucose testing market research report to meet your requirements.