Polyethylene Foam Market Size 2024-2028

The polyethylene (PE) foam market size is forecast to increase by USD 2.3 billion at a CAGR of 5.44% between 2023 and 2028.

- The market is experiencing significant growth, driven by various trends and factors. One key trend is the increasing demand from emerging economies, particularly in Asia Pacific, as the middle class population expands and disposable income rises, leading to an increase in demand for furniture and insulation applications. Another trend is the growth in the furniture industry, which is a major consumer of PE foam. However, the market faces challenges, including the volatility of raw material prices, particularly polyethylene resin, which can impact the cost structure of PE foam manufacturers. Additionally, stringent regulations regarding the use of certain types of PE foam, such as those containing chlorofluorocarbons (CFCs), are driving the shift towards alternative, eco-friendly materials. Overall, the PE foam market is expected to continue its growth trajectory, driven by these trends and challenges, with a focus on innovation and sustainability.

What will be the Size of the Market During the Forecast Period?

- Polyethylene Foam, a type of lightweight material derived from petroleum-based raw materials, plays a significant role in various industries such as consumer goods and e-commerce. The market for Polyethylene Foam is driven by its excellent insulation properties, making it an ideal choice for thermal insulation and protective packaging applications. The manufacturing processes of Polyethylene Foam involve the expansion of polyethylene resin using blowing agents, resulting in a foam with excellent cushioning solutions for various industries. The global Polyethylene Foam market is influenced by several factors including consumer spending, raw material pricing, and the availability of recycling infrastructure. Polyethylene Foam is widely used in vibration damping, insulation, and protective packaging applications due to its ability to provide strong packing options for online delivery.

- However, unfavorable conditions, such as moisture, can negatively impact the quality and performance of the foam. The market for Polyethylene Foam is expected to witness significant growth due to the increasing demand for lightweight materials in various industries. Moreover, the development of bio-based polyols is a promising trend in the market, offering sustainable alternatives to petroleum-based raw materials.

How is this Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Packaging

- Automotive

- Building and construction

- Footwear

- Others

- Type

- XLPE foam

- Non-XLPE foam

- Geography

- APAC

- China

- India

- Europe

- Germany

- North America

- US

- Middle East and Africa

- South America

- APAC

By Application Insights

- The packaging segment is estimated to witness significant growth during the forecast period.

The market is primarily driven by the consumer goods sector, particularly in protective packaging. PE foams, derived from petroleum-based raw materials, offer numerous advantages such as lightweight, vibration-dampening, insulating capabilities, and resistance to moisture and chemicals. These properties make PE foam an ideal choice for cushioning solutions in various industries, including automotive, electronics, and furniture. The protective packaging industry is the largest segment of the market and is expected to remain so during the forecast period. PE foams are used extensively for protective packaging due to their soft feel, flexibility, durability, and closed-cell structure. They are shock-sensitive, waterproof, and chemically resistant, making them suitable for packaging delicate and sensitive items.

Get a glance at the market report of share of various segments Request Free Sample

The packaging segment was valued at USD 1.89 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

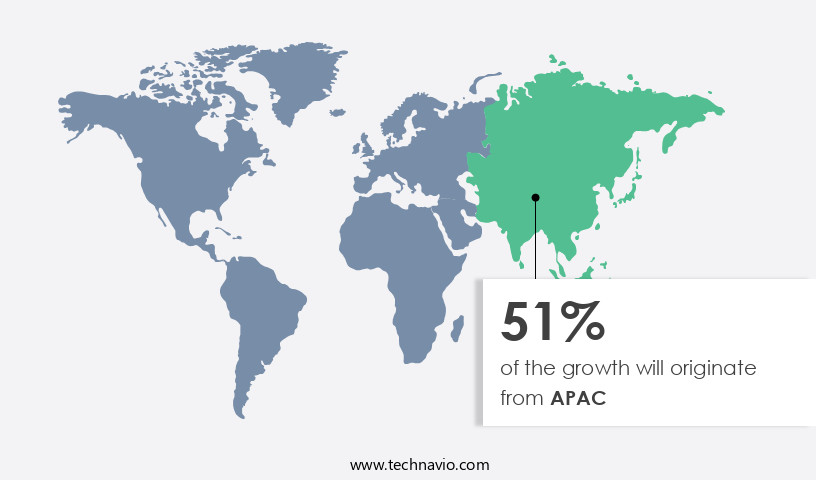

- APAC is estimated to contribute 51% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Polyethylene (PE) foam, renowned for its unique properties, finds extensive applications in various industries. Its distinctive feature of incorporating air pockets offers excellent insulation, making it ideal for pipe-in-pipe systems, doors, roofing sheets, and slabs. PE foam's oil resistance is a significant advantage in the manufacturing of furniture exports, medical supplies, and medical equipment. The material's resistance to frost ensures its usage in colder climates for insulation purposes. PE foam's pliability makes it suitable for creating armrests, backs, and padding for mattress pads, pillowcases, and furniture. Its applications extend beyond consumer goods, with uses in industrial processes and construction industries.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Industry?

Growing demand from emerging economies is the key driver of the market.

- The market is experiencing significant growth, particularly in emerging economies such as Brazil, China, Russia, Turkey, Indonesia, South Korea, Mexico, and India. Factors driving this expansion include the availability of affordable land, inexpensive labor, and reduced transportation costs. Moreover, less stringent government regulations in these countries are attracting Original Equipment Manufacturers (OEMs), including automotive manufacturers, to establish manufacturing bases. APAC is currently the fastest-growing region in the global market. The region's industrialization and economic development, led by China, India, and Japan, are the primary growth drivers. Macroeconomic policies in APAC aim to foster comprehensive growth, generate decent employment opportunities, ensure economic stability, and promote economic transformation.

- These initiatives include efforts to boost revenues in commodity-exporting countries. PE foam is widely used in various industries, including consumer goods, automotive, and construction. Lightweight and insulating, PE foam offers excellent vibration-dampening capabilities and insulating properties. PE foam comes in various densities, including Low-Density PE (LDPE) foam and High-Density PE (HDPE) foam. Non-XLPE foam and XLPE foam are also popular choices due to their unique properties. In the consumer goods sector, PE foam is used for protective packaging, while in the automotive industry, it is used for thermal insulation and cushioning solutions. In the construction sector, PE foam is used for insulation and frost protection.

What are the market trends shaping the Industry?

Growth in furniture industry driven by expanding population is the upcoming market trend.

- The global demand for Polyethylene (PE) foam is on the rise due to its extensive usage in various industries, including consumer goods and construction. PE foam is primarily manufactured using petroleum-based raw materials, such as LDPE (Low-Density Polyethylene) and HDPE (High-Density Polyethylene), which are transformed through manufacturing processes to create lightweight, insulating materials. PE foam is widely used for its vibration-dampening and insulating capabilities, making it an essential component in protective packaging for e-commerce and online delivery. Two main types of PE foam exist: Non-XLPE (Cross-Linked Polyethylene) and XLPE (Cross-Linked Polyethylene). Non-XLPE foam offers excellent cushioning solutions, while XLPE foam is known for its superior insulation properties.

- PE foam's lightweight nature makes it an attractive alternative to heavier materials, contributing to fuel efficiency in various applications. In the consumer goods sector, PE foam is used for insulation in refrigerators, freezers, and coolers. In construction, it is used for thermal insulation in residential and commercial buildings, particularly in urbanization projects. The protective packaging industry also benefits from PE foam's ability to protect delicate items during transportation. However, the recycling infrastructure for PE foam is still underdeveloped, which poses a challenge to the market's growth. Additionally, the price of petroleum-based raw materials can significantly impact the expenditure on PE foam production.

What challenges does the Industry face during its growth?

Volatility in raw material prices is a key challenge affecting the industry growth.

- The market relies heavily on petroleum-based raw materials, including benzene and toluene, sourced from the oil and gas industry for its manufacturing processes. The price volatility of these raw materials, influenced by crude oil pricing, significantly impacts the cost of PE foams. The market's performance is subject to economic conditions, with uncertain economic activities leading to fluctuating demands. PE foam is utilized extensively in various industries, including consumer goods, due to its lightweight nature, insulating capabilities, and vibration-dampening properties. PE foam comes in different densities, such as LDPE foam and HDPE foam, catering to diverse applications, including protective packaging, thermal insulation, and cushioning solutions.

- In the protective packaging industry, PE foam plays a crucial role in providing strong packing options for online delivery and ensuring favorable conditions for fragile goods during unfavorable conditions. PE foams are also used in residential and commercial construction for insulation purposes, contributing to urbanization efforts. The market's expansion is driven by factors like trade regulations, geographical expansions, and the growing demand for fuel efficiency. The use of PE foam in vibration control and moisture protection further broadens its applications. The market's growth is also influenced by the development of bio-based polyols and CO2-based polyols, offering sustainable alternatives to traditional PE foams.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the polyethylene (pe) foam market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, polyethylene (pe) foam market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- All Foam Products Co.

- Armacell International SA

- Clark Foam Products Corp.

- Dafa AS

- FoamPartner Switzerland AG

- Hira Industries LLC

- INOAC Corp.

- Johnson Foam Industry

- Mitsubishi Gas Chemical Co. Inc.

- Mitsui Chemicals Inc.

- Orlando Products Inc.

- Palziv Inc.

- PAR Group Ltd.

- Pregis LLC

- PTI Rubber and Gaskets Inc.

- Rogers Foam Corp.

- Sanwa Kako Co. Ltd.

- Sealed Air Corp.

- Wisconsin Foam Products

- Zotefoams plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Polyethylene (PE) foam, a type of plastic foam made from petroleum-based raw materials, plays a significant role in various industries due to its lightweight nature, insulating capabilities, and vibration-dampening properties. PE foam is widely used in consumer goods, particularly in protective packaging, cushioning solutions, and thermal insulation for e-commerce and online delivery. The manufacturing processes of PE foam include both Non-XLPE and XLPE types, with different densities such as LDPE and HDPE foams. The PE foam market is influenced by several factors, including consumer spending, raw material pricing, and trade regulations. The industry is expanding in response to the growing demand for fuel efficiency and the need for strong packing options in various sectors, such as residential and commercial construction, urbanization, and protective packaging.

In addition, the use of PE foam in insulation and vibration control is also essential in various applications, including automotive, aerospace, and industrial sectors. However, challenges such as chemicals, moisture, and unfavorable conditions can impact the PE foam market's growth. To address these challenges, research and development efforts are underway to explore alternatives to petroleum-based raw materials, such as bio-based polyols and CO2-based polyols. Geographical expansions and technological advancements are also expected to drive the market's growth in the coming years.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.44% |

|

Market growth 2024-2028 |

USD 2.30 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.06 |

|

Key countries |

China, US, Germany, India, and UAE |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.