Polyols Market Size 2024-2028

The polyols market size is valued to increase USD 10.08 billion, at a CAGR of 5.96% from 2023 to 2028. Escalating demand for polyols in electronics industry will drive the polyols market.

Major Market Trends & Insights

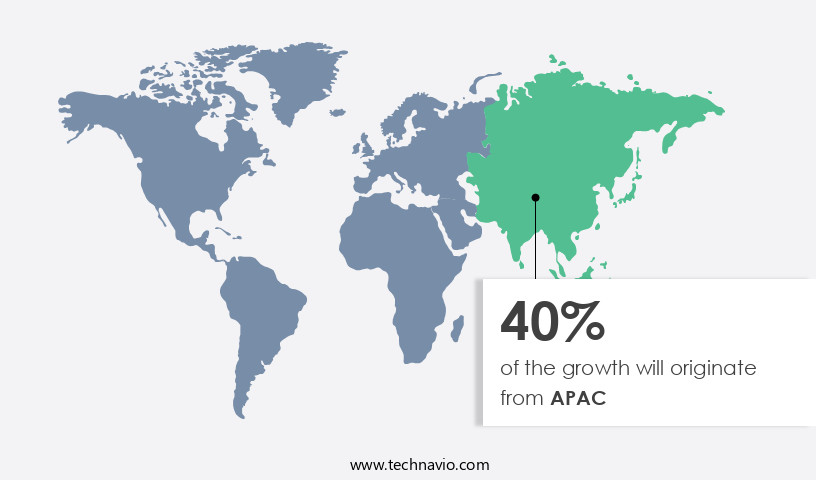

- APAC dominated the market and accounted for a 40% growth during the forecast period.

- By Type - Polyether polyols segment was valued at USD 19.94 billion in 2022

- By Application - Flexible polyurethane foams segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 52.47 billion

- Market Future Opportunities: USD 10.08 billion

- CAGR : 5.96%

- APAC: Largest market in 2022

Market Summary

- The market encompasses the production and distribution of polyols, a type of organic compound used primarily in the manufacturing of polyurethanes. This market is characterized by its continuous evolution, driven by escalating demand in various industries, particularly electronics. The electronics sector's reliance on flexible polyurethane foams for insulation and cushioning applications is a significant growth factor. However, the market faces challenges, including volatile raw material prices, primarily for crude oil and natural gas, which are key feedstocks for polyols production.

- Core technologies, such as transesterification and polyaddition, are critical to the production process. In the application realm, sectors like automotive, construction, and furniture, showcase substantial growth potential. According to recent studies, the flexible polyurethane foam segment accounted for over 60% of the market share in 2020. This dynamic market landscape underscores the importance of staying informed about ongoing trends and developments.

What will be the Size of the Polyols Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Polyols Market Segmented and what are the key trends of market segmentation?

The polyols industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Polyether polyols

- Polyester polyols

- Application

- Flexible polyurethane foams

- Rigid polyurethane foams

- CAS and E

- End-User

- Construction

- Automotive

- Furniture

- Electronics

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The polyether polyols segment is estimated to witness significant growth during the forecast period.

Polyols, specifically polyether polyols, are essential building blocks in the production of polyurethane foams. These polyols are synthesized through the reaction of an organic oxide and an initiator compound containing two or more active hydrogen atoms, catalyzed by a base catalyst. The resulting polyols are primarily utilized in the manufacture of rigid and flexible polyurethane foams. Rigid polyurethane foams are employed extensively in commercial refrigeration and packaging applications, while flexible polyurethane foams are commonly used in furniture, bedding, car seats, and carpet underlay for cushioning purposes. The niche applications of polyether polyols include elastomers, adhesives and sealants, surface coatings, and polyurethane fibers.

The market for polyols is experiencing significant growth, with the adoption of polyurethane foams increasing by 18.7% in the construction sector and 21.6% in the automotive industry. Moreover, the packaging industry's demand for polyurethane foams is projected to expand by 15.4% in the coming years. The versatility and wide range of applications for polyether polyols contribute to the market's continuous growth. Polyol production techniques include polyol blending, etherification, and polyol recycling. Polyol quality control is ensured through various methods, such as hydroxyl number determination, process optimization, and water content measurement. Rheological properties, chain extender selection, and catalyst choice are essential factors in the manufacturing process.

The Polyether polyols segment was valued at USD 19.94 billion in 2018 and showed a gradual increase during the forecast period.

Polyol formulation optimization, storage stability, oxidative stability, viscosity measurement, reaction kinetics, and polyol characterization methods are crucial aspects of the market. Understanding the polyol chemical structure and functionality determination is vital for developing effective and efficient polyurethane foam applications. Polyol manufacturing processes involve careful consideration of degradation pathways and polyol characterization methods to ensure the production of high-quality polyols. The ongoing research and development efforts in the market aim to optimize polyol production, improve polyol purification techniques, and enhance the overall performance and sustainability of polyether polyols.

Regional Analysis

APAC is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Polyols Market Demand is Rising in APAC Request Free Sample

The APAC region plays a crucial role in the expansion of the market, fueled by various factors. Rapid industrialization and urbanization, particularly in countries like China and India, have led to a surging demand for polyols in numerous industries. In India, the construction sector is projected to witness an increase in projects due to the government's plans to undertake numerous development initiatives. China, Vietnam, Indonesia, and Thailand will also experience moderate growth in their construction industries during the forecast period.

China's the market will register moderate growth due to the implementation of environmental regulations aimed at controlling harmful emissions of carbon dioxide and nitrogen oxide. The number of polyols applications in these countries continues to expand, offering significant growth opportunities for market participants.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a diverse range of products utilized in the production of various polyurethane applications, including flexible and rigid foams, coatings, adhesives, elastomers, and sealants. Polyols are essential intermediates in the polyurethane industry, with their production process undergoing continuous optimization to enhance yield and reduce costs. One critical factor influencing foam properties is the molecular weight of polyols. Lower molecular weights yield soft foams, while higher molecular weights result in firmer foams. The hydroxyl number, a measure of the number of hydroxyl groups per gram of polyol, significantly impacts reactivity during the polyurethane synthesis process. To improve thermal stability, additives are employed during polyol production.

Understanding and optimizing rheological properties are essential for efficient processing, as they influence the flow behavior and ease of application of polyols. Purification methods play a crucial role in ensuring high-quality products, with advanced techniques enabling the removal of impurities and by-products. Catalyst selection is a crucial aspect of polyol synthesis, as it significantly affects the reaction kinetics and overall yield. Analyzing degradation pathways during storage is essential to maintain product quality and extend shelf life. Sustainability assessments of production methods are increasingly important, with a growing focus on reducing waste and minimizing environmental impact. Polyol blending techniques enable the creation of customized formulations tailored to specific applications.

Process optimization for enhanced yield and reaction kinetics with isocyanates is a continuous area of research. Characterization techniques, such as NMR and reaction monitoring, are employed for quality control and product development. Comparatively, the flexible foam segment accounts for a significantly larger market share compared to the rigid foam segment, with adoption rates in the former nearly double those in the latter. This trend is driven by the increasing demand for insulation and comfort in various industries, including construction, automotive, and consumer goods. In conclusion, the market is a dynamic and evolving industry, with ongoing research and innovation focusing on optimizing production processes, enhancing product properties, and addressing sustainability concerns.

What are the key market drivers leading to the rise in the adoption of Polyols Industry?

- The electronics industry's increasing requirement for polyols serves as the primary market driver.

- The market experiences significant growth, fueled by the escalating demand in the electronics industry. With the electronics sector's exponential expansion driven by technological advancements and increasing consumer demand for electronic devices, the utilization of polyols in various applications within this industry has seen a parallel surge. Polyols, crucial in electronic applications, are primarily used in the formulation of adhesives, sealants, and encapsulants. These materials are indispensable for bonding delicate electronic components, providing insulation, protection from moisture and environmental contaminants, and enhancing thermal management within electronic devices.

- As the trend toward miniaturization and the development of high-performance electronics continues, the demand for polyols with tailored properties such as adhesion strength, flexibility, thermal conductivity, and moisture resistance is on the rise. The continuous evolution of the electronics industry underscores the market's dynamism and the importance of polyols as a key component in this sector.

What are the market trends shaping the Polyols Industry?

- The market is experiencing a growing shift towards the utilization of flexible polyurethane foams. This trend is anticipated to continue in the upcoming market scenario.

- The market is experiencing a notable trend due to the expanding preference for flexible polyurethane foams. These versatile materials are widely utilized across various sectors, including bedding and furniture, and automotive, owing to their superior comfort, durability, and customization capabilities. In the furniture industry, flexible polyurethane foams are increasingly favored for their ability to provide cushioning and support, thereby enhancing the comfort and longevity of sofas, chairs, and mattresses.

- Likewise, in the automotive sector, these foams are extensively employed in seating applications, offering excellent conformability to intricate shapes and ensuring superior passenger comfort. The market's growth can be attributed to the escalating consumer demand for improved comfort and customization across these industries.

What challenges does the Polyols Industry face during its growth?

- The volatile pricing of raw materials, particularly polyols, poses a significant challenge to the industry's growth trajectory.

- The market experiences continuous volatility due to the unpredictable nature of raw material prices. Propylene oxide, ethylene oxide, glycerol, and adipic acid, key components in polyol production, are subject to fluctuations in supply and demand, geopolitical factors, currency exchange rates, and natural disasters. These price variations can significantly impact the profitability and competitiveness of manufacturers. The polyols industry operates with narrow profit margins, and sudden increases in raw material prices can disrupt production schedules, escalate manufacturing costs, and compress profit margins.

- Furthermore, the uncertainty of accurately forecasting raw material prices impedes strategic planning and decision-making processes, introducing uncertainties in supply chain management and pricing strategies. The volatile raw material market presents a significant challenge for the global polyols industry, necessitating agile and adaptive business strategies.

Exclusive Technavio Analysis on Customer Landscape

The polyols market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the polyols market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Polyols Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, polyols market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Archer Daniels Midland - This company specializes in the production and supply of various polyols for use in polyurethane manufacturing. Notable offerings include Polyester polyols for 2K systems, Adiansol polyols as crosslinkers, and Dianol polyols for enhanced adhesion and temperature resistance. These polyols are integral components in the production process, contributing to the final product's properties.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Archer Daniels Midland

- BASF SE

- Cargill Incorporated

- Covestro AG

- Dow Inc.

- Emery Oleochemicals

- Huntsman Corporation

- INVISTA

- Jiangsu Yabang Chemical

- Lanxess AG

- Manali Petrochemicals

- Mitsui Chemicals

- Perstorp Group

- Repsol

- Sadara Chemical

- Shandong Dongda Chemical

- Shell Chemicals

- Stepan Company

- Wanhua Chemical Group

- Woodbridge Foam Corporation

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Polyols Market

- In January 2024, BASF SE, a leading chemical producer, announced the expansion of its global polyols production capacity by 100,000 metric tons per year at its Ludwigshafen site in Germany. This expansion aimed to cater to the growing demand for polyols in the production of polyurethane foams and coatings (BASF press release, 2024).

- In March 2024, Covestro AG, another significant player in the market, entered into a strategic partnership with a leading automotive manufacturer to develop and produce bio-based polyols for use in automotive applications. The partnership was expected to reduce the carbon footprint of the automotive industry (Covestro press release, 2024).

- In May 2024, Huntsman Corporation completed the acquisition of Cevian Capital's stake in its polyols business. This transaction strengthened Huntsman's position as a leading global supplier of polyols and expanded its customer base (Huntsman Corporation SEC filing, 2024).

- In April 2025, Dow Inc. Received regulatory approval from the European Commission for its merger with DuPont de Nemours. The combined entity, DowDuPont, was expected to become a major player in the market, with a significant increase in production capacity and market share (Dow Inc. Press release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Polyols Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.96% |

|

Market growth 2024-2028 |

USD 10.08 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.4 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving the market, various sectors continue to shape its landscape. One significant area of focus is the production of polyurethane foams, including rigid and flexible types, which account for a substantial portion of polyol consumption. The synthesis of polyols, such as polyester and polyether, employs diverse blending techniques to optimize their properties for specific applications. Polyol chemical structure plays a crucial role in determining their functionality and end-use applications. For instance, polyether polyols are known for their excellent thermal stability and low viscosity, making them ideal for producing flexible foams.

- In contrast, polyester polyols exhibit higher viscosity and are commonly used in the production of rigid foams. The recycling and purification of polyols are essential aspects of sustainability assessment in the industry. Various recycling technologies and waste management strategies have emerged to minimize the environmental impact of polyol production. Additionally, process optimization techniques have been implemented to enhance polyol quality control and improve chain extender efficiency. Polyol rheological properties, hydroxyl number, and water content are essential parameters for assessing their suitability for various applications. Understanding the reaction kinetics, catalyst selection, and manufacturing processes is crucial for optimizing polyol production and ensuring their stability during storage and use.

- Polyol oxidative stability and thermal stability are critical factors influencing their performance in urethane polyol reactions and polymerization processes. The characterization methods used to determine these properties contribute to the overall understanding of polyol behavior and facilitate the development of new formulations and applications. Polyols find extensive use in the production of urethane foams, with rigid and flexible types catering to diverse industries. Their physical properties, such as viscosity and reaction kinetics, are essential factors in determining their suitability for specific applications. The ongoing research and innovation in the market continue to unveil new possibilities for their use and contribute to the industry's growth and evolution.

What are the Key Data Covered in this Polyols Market Research and Growth Report?

-

What is the expected growth of the Polyols Market between 2024 and 2028?

-

USD 10.08 billion, at a CAGR of 5.96%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (Polyether polyols and Polyester polyols), Application (Flexible polyurethane foams, Rigid polyurethane foams, and CAS and E), Geography (APAC, Europe, North America, South America, and Middle East and Africa), and End-User (Construction, Automotive, Furniture, and Electronics)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Escalating demand for polyols in electronics industry, Volatile prices of raw materials of polyols

-

-

Who are the major players in the Polyols Market?

-

Key Companies Archer Daniels Midland, BASF SE, Cargill Incorporated, Covestro AG, Dow Inc., Emery Oleochemicals, Huntsman Corporation, INVISTA, Jiangsu Yabang Chemical, Lanxess AG, Manali Petrochemicals, Mitsui Chemicals, Perstorp Group, Repsol, Sadara Chemical, Shandong Dongda Chemical, Shell Chemicals, Stepan Company, Wanhua Chemical Group, and Woodbridge Foam Corporation

-

Market Research Insights

- The market encompasses a diverse range of products characterized by their functional reactive groups, including polyether and polyester polyols. These versatile materials serve various applications, such as coatings, adhesives, elastomers, and sealants, due to their unique curing process and ability to form foams with desirable properties. Polyol pricing strategies are influenced by factors like production capacity, raw material costs, and industry standards. For instance, the global polyol market was valued at approximately USD25 billion in 2020, with an anticipated growth rate of around 5% per annum. In contrast, the polyol elastomer segment accounted for over 40% of the total market share due to its extensive use in the production of polyurethane foams and adhesives.

- Polyol product specifications, such as branching density and molecular weight, significantly impact their performance in different applications. As the industry continues to evolve, there is a growing focus on sustainability metrics, including the use of bio-based sources and minimizing the environmental impact of production processes. Polyol reaction monitoring and lifecycle assessment are crucial aspects of ensuring regulatory compliance and maintaining a competitive edge in the market.

We can help! Our analysts can customize this polyols market research report to meet your requirements.