Polypropylene Fiber Market Size 2024-2028

The polypropylene fiber market size is forecast to increase by USD 21.05 bn at a CAGR of 5.82% between 2023 and 2028.

- The market is experiencing significant growth due to the expanding textile industry. The increasing demand for lightweight, durable, and cost-effective fibers is driving market growth. Moreover, the emergence of bio-based polypropylene is adding a new dimension to the market, offering natural fibers and eco-friendly alternatives. However, the harmful effects of polypropylene on the environment, such as microplastic pollution, pose a challenge to market growth. Producers are focusing on developing sustainable production methods and biodegradable fibers to mitigate these concerns. Additionally, advancements in technology are enabling the production of high-performance polypropylene fibers, catering to various end-use industries. Overall, the market is expected to witness steady growth In the coming years, driven by these factors.

What will be the Size of the Polypropylene Fiber Market During the Forecast Period?

- The market encompasses the production and distribution of synthetic fibers derived from propylene polymerization. This market exhibits significant growth due to the unique properties of polypropylene fibers, including their lower melting points, heat resistance, and chemical resistance to acids and alkalis. These fibers are widely used in textiles, such as technical and synthetic textiles, yarns, and staple fibers, as well as in nonwoven fabrics for various industries, including hygiene products. Polypropylene fibers offer several advantages, including lightweight and durability, making them ideal for applications in textiles, automotive, and construction industries. The market's growth is driven by product innovation and the increasing demand for sustainable, high-performance materials.

- Online platforms have also facilitated the growth of the market by enabling easy access to a wide range of polypropylene fiber products. Despite the numerous benefits, environmental concerns associated with the production of polypropylene fibers and their disposal remain a challenge for the market. The market's size and direction are influenced by factors such as the increasing demand for lightweight and durable materials, the growing popularity of synthetic fibers, and the ongoing research and development efforts to improve the sustainability of polypropylene fiber production. Polypropylene fibers are thermoplastics, meaning they are moldable at elevated temperatures, making them a versatile choice for various applications.

How is this Polypropylene Fiber Industry segmented and which is the largest segment?

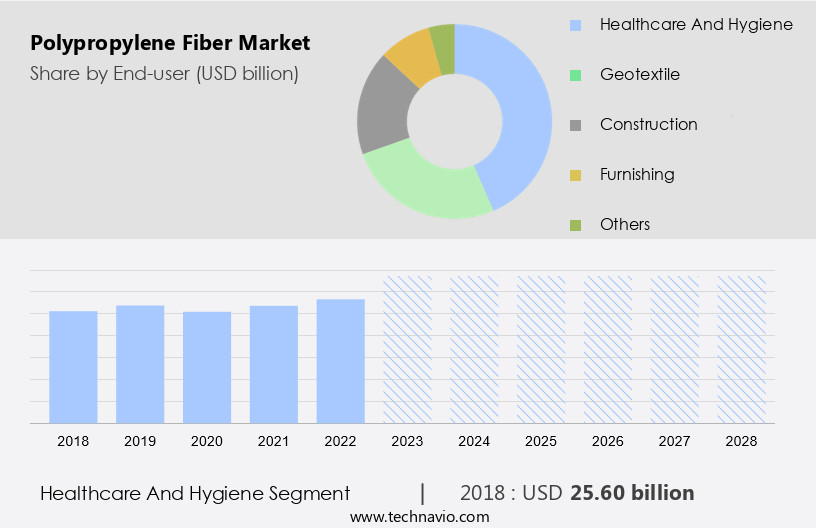

The polypropylene fiber industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Healthcare and hygiene

- Geotextile

- Construction

- Furnishing

- Others

- Type

- Staple fiber

- Continuous fiber

- Geography

- APAC

- China

- India

- Europe

- Germany

- Italy

- North America

- US

- Middle East and Africa

- South America

- APAC

By End-user Insights

- The healthcare and hygiene segment is estimated to witness significant growth during the forecast period.

The global healthcare industry is experiencing significant growth due to the increasing demand for superior quality products under highly regulated environments. Polypropylene fiber (PPF), a type of synthetic fiber derived from propylene polymerization, is gaining popularity in this sector due to its competitive cost, versatility, and ease of shaping during manufacturing. PPF is used extensively In the production of hygiene products such as surgical masks, gloves, caps, gowns, overshoes, sponges, bandages and medical tapes. Its lightweight, moisture-resistant, and heat insulating properties make it an ideal choice for these applications. Additionally, PPF's chemical resistance to acids and alkalis, as well as its heat and corrosion resistance, contribute to its suitability for use in healthcare settings.

The fiber industry, including the fabric and carpet industries, also utilizes PPF due to its elevated temperature and heat resistance. As environmental concerns become increasingly important, eco-friendly initiatives such as the use of recycled polyester, polylactic acid (PLA), and bicomponent fibers are gaining traction. Strategic collaborations and production capacity expansions are also driving innovation In the PPF market. Nonwoven fabrics, used in various applications including geotextiles, erosion control, filtration, and automotive components, are another area of growth for PPF. Overall, PPF's unique properties and versatility make it a valuable resource for the healthcare, textile, and fiber industries.

Get a glance at the market report of various segments Request Free Sample

The Healthcare and hygiene segment was valued at USD 25.60 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 53% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Polypropylene fiber (PPF), a stereoregular polymer and thermoplastic, is a significant player In the synthetic fiber market. PPF is known for its lightweight, durability, and resistance to corrosion, heat, and chemicals. These properties make it suitable for various applications, including textiles, yarns, fabrics, apparel, home furnishings, and nonwoven fabrics. China, in Northeast Asia, is the largest consumer of PPF, accounting for over 50% of global consumption in 2022. The primary drivers are the textile, apparel, and automotive industries, which benefit from PPF's heat resistance, chemical resistance, and moisture management properties. South Korea and Taiwan, In the same region, also contribute significantly due to their thriving apparel and textile exports.

Product innovation, environmental concerns, and eco-friendly initiatives are shaping the PPF market. Recycled polyester, polylactic acid (PLA), and bicomponent fibers are gaining popularity as sustainable alternatives. Strategic collaborations and production capacity expansions are also key trends. Applications include hygiene products, geotextiles for erosion control and filtration, and automotive components. PPF's lightweight, moisture, and heat insulating properties make it ideal for the fabric, fiber, and carpet industries, as well as the health care sector and home furnishing industry. The global PPF market is expected to grow, driven by these applications and increasing demand for recyclable materials.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Polypropylene Fiber Industry?

Growing textile industry is the key driver of the market.

- Polypropylene fiber, derived from the propylene polymerization process, is a popular choice In the textile industry due to its unique properties and cost-effectiveness. With lower melting points than other thermoplastics like polyester, PPF is ideal for manufacturing synthetic textiles, including yarns and fabrics for apparel and home furnishings. Its lightweight and durable nature, combined with excellent corrosion resistance, makes it suitable for various applications, such as hygiene products, automotive components, and geotextiles for erosion control, filtration, and elevated temperature use. Environmental concerns have led to increased focus on eco-friendly initiatives In the fiber industry. Polypropylene fiber can be recycled and transformed into recycled polyester or polylactic acid (PLA) fibers.

- Additionally, bicomponent fibers offer enhanced properties, such as heat insulating and moisture-wicking capabilities. The global fiber industry continues to innovate, with strategic collaborations and production capacity expansions driving growth. Governments and businesses are increasingly prioritizing sustainable practices and recyclable materials. As a result, the demand for polypropylene fiber, as a versatile and sustainable synthetic fiber, is expected to remain strong In the fabric, carpet, and health care sectors, among others.

What are the market trends shaping the Polypropylene Fiber Industry?

Emergence of bio-based Polypropylene is the upcoming market trend.

- Polypropylene fibers, derived from the stereoregular polymer known as propylene polymerization, are widely used in various industries, including textiles, carpets, and home furnishings, for producing synthetic yarns and fabrics. However, environmental concerns surrounding the production and disposal of polypropylene fibers, which are derived from fossil fuels, are increasing. To address these concerns, manufacturers are exploring alternatives to petrochemical feedstocks, such as bio-based feedstocks derived from sugarcane, corn, and soybean. The shift towards bio-based polypropylene is driven by several factors, including consumer preferences for safer and renewable sources, volatility in petroleum-based chemical prices, and regulatory pressures to reduce plastic pollution.

- The production of bio-based polypropylene from sugarcane-derived ethanol is a promising development, with commercialization expected soon. Other bio-based alternatives include bicomponent fibers made from polylactic acid (PLA) and recycled polyester. Moreover, product innovation In the fiber industry is leading to the development of lightweight and durable polypropylene fibers with heat resistance, chemical resistance, and elevated temperature stability. These fibers are used in various applications, including automotive components, nonwoven fabrics for hygiene products, and geotextiles for erosion control and filtration. The use of recyclable materials and eco-friendly initiatives is also gaining momentum In the fiber industry, with companies investing in research and development to reduce the environmental impact of polypropylene fiber production.

What challenges does the Polypropylene Fiber Industry face during its growth?

Harmful effects of polypropylene is a key challenge affecting the industry growth.

- Polypropylene fibers, derived from the propylene polymerization process, are widely used in various industries, including textiles, automotive components, and nonwovens. These fibers offer desirable properties such as lower melting points, heat resistance, and chemical resistance, making them suitable for applications in apparel, home furnishings, and hygiene products. However, concerns regarding the environmental impact of synthetic fibers, including polypropylene, have arisen due to their contribution to plastic pollution and endocrine disruption. Polypropylene fibers, like other thermoplastics, can release volatile organic compounds (VOCs) during the outgassing process, posing health hazards. Moreover, their production relies on hydrocarbon fuels, leading to unsustainable manufacturing practices.

- In response, the fiber industry has seen an increased focus on product innovation, including the use of recycled polyester, polylactic acid (PLA), and bicomponent fibers. Strategic collaborations and eco-friendly initiatives are also driving the development of more sustainable production capacities. Polypropylene fibers are used extensively In the production of staple and filament yarns, fabrics, and nonwovens. They offer lightweight and durable properties, making them ideal for applications In the fabric industry, carpet industry, and health care sector. Additionally, they are used in geotextiles for erosion control, filtration, and automotive components due to their elevated temperature and heat resistance. Despite these advantages, the environmental concerns surrounding the use of polypropylene fibers continue to be a significant challenge for the market.

Exclusive Customer Landscape

The polypropylene fiber market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the polypropylene fiber market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, polypropylene fiber market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ABC Polymer Industries LLC - Polypropylene fiber, a versatile synthetic material, is available In the market In the form of shot bags. This high-performance fiber is recognized for its durability, resistance to moisture and chemicals, and excellent tensile strength. It is widely used in various industries, including textiles, automotive, and construction, due to its unique properties. The market is driven by increasing demand from these sectors, particularly In the production of nonwovens, geotextiles, and automotive components. The market is expected to grow at a steady pace due to the rising awareness of the benefits of using polypropylene fiber in various applications. Additionally, advancements in technology and increasing production capacity are further fueling the market growth.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABC Polymer Industries LLC

- Aditya Nonwoven Fabric Pvt. Ltd.

- BASF SE

- Beaulieu International Group

- BELGIAN FIBERS SA

- Chemosvit AS

- FORTA Corp.

- Indorama Ventures Public Co. Ltd.

- International Fibres Group Holdings Ltd.

- Kolon Fiber Inc.

- Lotte Chemical Corp.

- Mapei SpA

- Mitsubishi Chemical Group Corp.

- Palmetto Industries International Inc.

- Radici Partecipazioni Spa

- Sika AG

- Silvassa Woven Sacks Pvt. Ltd.

- The Euclid Chemical Co.

- W. Barnet GmbH and Co. KG

- Zenith Fibres Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Polypropylene fibers (PPF), a type of synthetic fiber derived from the stereoregular polymerization of propylene monomer, have gained significant traction in various industries due to their unique properties. These fibers offer a range of advantages, including lower melting points, lightweight and durability, and excellent chemical resistance. Synthetic textiles, including yarns and fabrics, have seen a surge in demand for polypropylene fibers. In the apparel sector, these fibers are valued for their moisture-wicking and quick-drying properties, making them ideal for activewear and outdoor clothing. In the home furnishings industry, polypropylene fibers are used to create lightweight and breathable fabrics for upholstery and curtains.

Bicomponent fibers, which consist of two different types of fibers within a single filament, have also gained popularity In the market. These fibers offer unique properties, such as improved softness and texture, and are often used In the production of nonwoven fabrics for hygiene products and geotextiles. The production capacities of polypropylene fibers have expanded in recent years, driven by increasing demand and strategic collaborations between industry players. These collaborations have led to innovation In the field, with new applications for polypropylene fibers emerging In the automotive industry and the production of recyclable materials. Environmental concerns have become a significant factor In the fiber industry, with a growing focus on eco-friendly initiatives.

Polypropylene fibers offer some environmental advantages, as they can be recycled and are less harmful to the environment than some other synthetic fibers, such as polyester. However, there are still concerns regarding plastic pollution and the environmental impact of polypropylene fiber production. Polypropylene fibers are also used In the production of thermoplastics, which are moldable at elevated temperatures and offer excellent heat resistance and chemical resistance. These properties make polypropylene fibers ideal for use in geotextiles for erosion control and filtration applications. The fiber industry as a whole is constantly evolving, with new product innovations and applications emerging regularly.

Polypropylene fibers, with their unique properties and versatility, are poised to play a significant role in this evolution. In the fabric industry, polypropylene fibers are used to create a range of products, from lightweight and breathable fabrics for activewear to heavy-duty geotextiles for construction applications. In the carpet industry, these fibers offer excellent durability and resistance to wear and tear. The healthcare sector is another area where polypropylene fibers are gaining traction. These fibers are used In the production of disposable fiber items, such as surgical gowns and medical drapes, due to their excellent moisture-wicking properties and resistance to bacteria and other microorganisms.

In conclusion, polypropylene fibers offer a range of advantages that make them an attractive option for various industries. From their unique properties and versatility to their eco-friendly potential, these fibers are poised to play a significant role In the evolution of the fiber industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

177 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.82% |

|

Market growth 2024-2028 |

USD 21.05 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.41 |

|

Key countries |

China, US, India, Germany, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Polypropylene Fiber Market Research and Growth Report?

- CAGR of the Polypropylene Fiber industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the polypropylene fiber market growth of industry companies

We can help! Our analysts can customize this polypropylene fiber market research report to meet your requirements.