PPR and HDPE Market Size 2024-2028

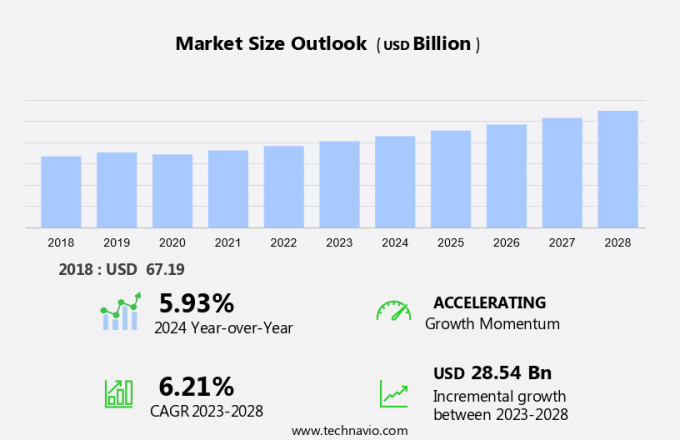

The PPR and HDPE market size is forecast to increase by USD 28.54 billion at a CAGR of 6.21% between 2023 and 2028. The market is experiencing significant growth due to the rising demand for polypropylene copolymer pipes in both residential and commercial applications. The expertise and professionalism of plumbers in heat fusing these joints ensure a long lifespan for these thermoplastic materials. Key market drivers include advancements in material science and manufacturing processes for PPR and HDPE, as well as the fluctuating cost of crude oil prices. These factors contribute to the continued popularity of PPR and HDPE pipes as cost-effective and reliable alternatives to traditional piping materials. As the construction industry continues to evolve, the demand for these materials is expected to remain strong.

What will be the Size of the Market During the Forecast Period?

The material Science and Applications Polypropylene Random Copolymer (PPR) and High-Density Polyethylene (HDPE) are two essential thermoplastic materials that have gained significant attention in various industries due to their unique properties. These materials are widely used in the manufacturing of pipes, particularly in plumbing systems, due to their superior physical and chemical characteristics. PPR, also known as Metallocene-based Polyolefins, is a thermoplastic material recognized for its flexibility, smooth surface, and cost-effectiveness. Its low density makes it an ideal choice for applications where lightweight and easy installation are crucial. PPR pipes offer excellent resistance to chemical attack and have a high impact strength, making them suitable for use in potable water applications. HDPE pipes, on the other hand, are renowned for their high strength, pressure rating, and chemical resistance. These pipes are widely used in various industries, including the transportation of water, natural gas, and industrial chemicals. HDPE's smooth surface ensures easy flow and reduces friction losses, leading to energy savings. The use of PPR and HDPE in various industries, such as medical equipment, sustainable building materials, and eco-friendly plumbing solutions, has been increasing due to their eco-friendly nature and durability.

For instance, PPR pipes are used in Aquatherm systems, which are known for their energy efficiency and low carbon footprint. The installation procedures for both PPR and HDPE pipes are user-friendly, making them popular choices for contractors and installers. The physical properties of these materials cater to various user requirements, ensuring their widespread adoption in diverse applications. PPR and HDPE's physical properties, including flexibility, low density, high hardness, impact resistance, and chemical resistance, make them indispensable in various industries. Their cost-effectiveness and ease of installation further add to their appeal. In conclusion, the market for PPR and HDPE continues to grow due to their unique properties and wide range of applications. These materials offer significant benefits, including energy efficiency, durability, and cost savings, making them valuable assets for businesses and industries. The future of PPR and HDPE looks promising as they continue to revolutionize various industries and contribute to sustainable and eco-friendly solutions.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- HDPE

- PPR

- Application

- Packaging

- Healthcare

- Construction

- Others

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Type Insights

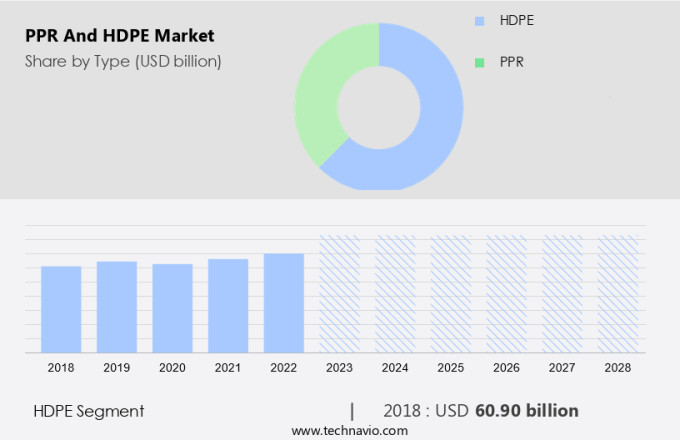

The HDPE segment is estimated to witness significant growth during the forecast period.HDPE, or High-Density Polyethylene, is a thermoplastic polymer recognized for its superior strength, durability, and chemical resistance. This versatile material is widely utilized in various industries, including construction, packaging, automotive, and agriculture. In the construction sector, HDPE pipes are a popular choice for applications such as water and gas distribution, sewage systems, and drainage systems. The pipes' impressive tensile strength, resistance to corrosion, and flexibility make them ideal for both underground and above-ground installations in construction projects. Furthermore, HDPE geomembranes are employed in landfill linings, mining applications, and environmental containment solutions, highlighting the significance of HDPE within The market. The exceptional properties of HDPE contribute to its broad usage and make it a reliable solution for numerous applications.

Get a glance at the market share of various segments Request Free Sample

The HDPE segment was valued at USD 60.90 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

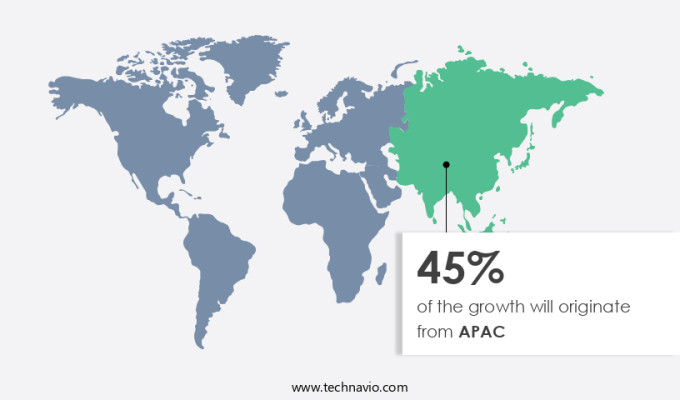

APAC is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the global market for PPR (Polypropylene Random) and HDPE (High-Density Polyethylene) materials, the Asia Pacific region holds a substantial position, with China and India being the major contributors to the revenue. The region's growth can be attributed to the increasing construction activities and government investments in developing efficient water supply systems. With approximately 37% of the world's population, these countries face a significant demand for food and water, leading to substantial investments in infrastructure projects related to irrigation and municipal water supply systems. Metallocene-based polyolefins, such as PPR and HDPE, have gained popularity due to their excellent properties, including high strength, durability, and resistance to chemicals.

Moreover, these materials are widely used in the medical equipment sector due to their biocompatibility and sterilizability. Moreover, their eco-friendly nature makes them suitable for use in sustainable building materials and eco-friendly plumbing solutions. Aquatherm, a leading company in the PPR-P pipe market, has been successful in promoting the use of these materials in various applications, including heating and cooling systems, water supply lines, and industrial processes. The company landscape for PPR and HDPE is competitive, with several key players vying for market share. Industry influencers, including material science experts and research organizations, continue to explore new synthesis methods and applications for these materials to expand their market reach.

In conclusion, the demand for PPR and HDPE materials is expected to grow significantly in the Asia Pacific region due to the increasing focus on infrastructure development and the adoption of eco-friendly materials in various industries. The use of these materials in medical equipment, sustainable building materials, and eco-friendly plumbing solutions is a testament to their versatility and value in today's market.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Rising demand for metallocene-based polyolefins is the key driver of the market. The market for High-density Polyethylene (HDPE) and Polypropylene Random Copolymer (PPR) has witnessed notable growth due to the superior properties of metallocene-based polyolefins. Metallocene catalysts have transformed the manufacturing process of these polymers, allowing for precise control over their molecular structure and resulting in enhanced performance characteristics. This has led to the increasing preference for metallocene-based PPR and HDPE in various industries. One of the primary reasons for the growing demand for metallocene-based polyolefins is their superior mechanical properties. These polymers exhibit increased strength, toughness, and resistance to impact and environmental stress cracking, making them ideal for applications where reliability is crucial.

For instance, in piping systems, metallocene-based PPR offers enhanced mechanical performance, ensuring the longevity and efficiency of the system. User requirements continue to drive the adoption of PPR and HDPE in diverse applications. The smooth surface and flexibility of these polymers make them suitable for various industries, including automotive, packaging, construction, and electrical and electronics. Moreover, their cost-effective nature, coupled with their excellent physical properties, makes them a popular choice for manufacturers seeking to optimize their production processes and reduce overall costs. In conclusion, The market is experiencing a notable increase in demand for metallocene-based polyolefins due to their superior mechanical properties and diverse applications. These polymers offer a cost-effective solution for manufacturers, enabling them to meet user requirements while ensuring product reliability and efficiency.

Market Trends

Advancements in material science and PPR and HDPE manufacturing processes is the upcoming trend in the market. The market have experienced notable advancements due to innovations in material science and manufacturing processes. These improvements have led to the creation of new PPR and HDPE formulations, additives, and production methods, enhancing the materials' properties and expanding their applications. For instance, the addition of nucleating agents and impact modifiers to PPR formulations has resulted in materials with enhanced crystallinity, impact strength, and thermal stability. These advancements have broadened the scope of PPR's use in various industries, including automotive, construction, and healthcare, where it now offers increased durability and functionality. Expertise in the field is crucial for effectively implementing these advanced PPR and HDPE solutions in residential and commercial applications. Professional plumbers and engineers play a vital role in ensuring the successful installation and maintenance of these thermoplastic materials, which boast a long lifespan and resistance to corrosion. By staying informed of the latest industry trends and advancements, professionals can provide optimal solutions for their clients, ensuring the best possible outcomes. Incorporating

Market Challenge

Fluctuating cost of crude oil prices is a key challenge affecting the market growth. The market, primarily driven by the oil and gas industry as a significant supplier of raw materials, experiences price fluctuations due to volatility in crude oil prices. These price swings can significantly impact the cost of PPR and HDPE production. In response to these price fluctuations, oil and gas industry players have implemented cost-saving measures, such as workforce reductions and rig idling. In December 2022, the price of Brent crude oil reached USD 82.45 per barrel, while WTI crude oil was priced at USD 57.52 per barrel in January 2020. However, prices plummeted to USD16 per barrel in April 2020. The hardiness and corrosion resistance of PPR and HDPE make them ideal choices for various applications, including piping systems for the oil and gas industry.

Moreover, these materials require minimal maintenance over decades, making them cost-effective in the long run. When constructing piping systems using PPR and HDPE, specialized equipment such as butt fusion and electrofusion are essential. Mechanical fittings are also necessary for additional support. Despite the need for specialized equipment, the DIY market for PPR and HDPE piping systems is growing. The materials' superior properties, including their hardness and corrosion resistance, make them a popular choice for various applications, even in the face of crude oil price volatility.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Dow Chemical Co: The company offers PPR and HDPE products through its subsidiary Chevron Phillips Chemical for a wide range of applications including pressure pipe, soap and detergent bottles, flexible packaging, coating and laminations, films, and more.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- aquatherm

- Chevron Corp.

- Eni SpA

- Exxon Mobil Corp.

- Formosa Plastics Corp.

- Georg Fischer Ltd.

- Harwal Group

- HURNER Schweisstechnik Gulf L.L.C

- Hyosung TNC Corp.

- Indian Oil Corp. Ltd.

- INEOS Group Holdings SA

- Lotte Corp.

- LyondellBasell Industries N.V.

- MOL Group

- NUPI INDUSTRIE ITALIANE SpA

- OMV Aktiengesellschaft

- Orbia Advance Corp. SAB de CV

- Reliance Industries Ltd.

- Sasol Ltd.

- Saudi Basic Industries Corp.

- Siam Cement PCL

- TotalEnergies SE

- agru Kunststofftechnik Gesellschaft mbh

- Entec Polymers

- Petro Plus Chemical

- Wienerberger AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

High-density polyethylene (HDPE) and polypropylene random copolymer (PPR), two types of metallocene-based polyolefins, have gained significant attention in various industries due to their unique properties. In material science, these thermoplastic materials are known for their high strength, chemical resistance, and long lifespan. HDPE pipes, with their high pressure rating and impact resistance, are widely used in plumbing systems for residential and commercial applications. Their smooth surface ensures minimal maintenance and ease of installation through various joining methods such as heat fusion, electrofusion, and mechanical connections. HDPE pipes are suitable for applications in gas distribution, water supply, and sewage systems.

Moreover, the PPR pipes, on the other hand, offer excellent bending capabilities and flexibility, making them ideal for DIY projects and fixed plumbing installations. Their relatively low density and smooth surface result in cost-effective installation procedures. PPR pipes are resistant to corrosion and suitable for applications in water supply and heating systems. Both HDPE and PPR pipes have a long lifespan and are eco-friendly, making them popular choices for sustainable building materials and eco-friendly plumbing solutions. Industry influencers and user requirements continue to drive the demand for these materials in medical equipment, eco-friendly plumbing solutions, and even in the manufacturing of specialized equipment.

Furthermore, the company landscape for these materials is competitive, with companies continually promoting their expertise and professional plumbers offering installation services. The properties of HDPE and PPR pipes, such as hardness, temperature resistance, and resistance to acids and alkalis, make them suitable for various industry standards and regulations.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

187 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.21% |

|

Market Growth 2024-2028 |

USD 28.54 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.93 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 45% |

|

Key countries |

US, China, India, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

aquatherm, Chevron Corp., Dow Chemical Co., Eni SpA, Exxon Mobil Corp., Formosa Plastics Corp., Georg Fischer Ltd., Harwal Group, HURNER Schweisstechnik Gulf L.L.C, Hyosung TNC Corp., Indian Oil Corp. Ltd., INEOS Group Holdings SA, Lotte Corp., LyondellBasell Industries N.V., MOL Group, NUPI INDUSTRIE ITALIANE SpA, OMV Aktiengesellschaft, Orbia Advance Corp. SAB de CV, Reliance Industries Ltd., Sasol Ltd., Saudi Basic Industries Corp., Siam Cement PCL, TotalEnergies SE, agru Kunststofftechnik Gesellschaft mbh, Entec Polymers, Petro Plus Chemical, and Wienerberger AG |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch