Europe Process Automation Market Size and Trends

The Europe process automation market size is forecast to increase by USD 2.7 billion at a CAGR of 6.6% between 2023 and 2028. The market is experiencing significant growth, driven by the increasing adoption of advanced technologies such as artificial intelligence (AI) and distributed control systems (DCS) in various industries. One notable sector is the paper and pulp industry, where the need for improved production capacity and efficient water treatment construction is leading to increased automation. In the production sector, the implementation of AI-enabled DCS solutions, such as Valmet DNA DCS, is streamlining operations and enhancing overall performance. Furthermore, the shift towards renewable energy sources is also fueling the demand for process automation, as these systems enable optimized energy usage and reduced emissions. However, challenges remain, including infrastructure and customization issues, which must be addressed for the market to continue its expansion. This market analysis report delves into these trends and challenges, providing insights into the future growth prospects of the process automation industry.

What will be Europe Process Automation Market Size During the Forecast Period?

The market is witnessing significant growth due to the increasing adoption of advanced technologies, such as the Internet of Things (IoT) and cloud-based solutions, in various industries. These technologies enable the integration of instrumentation devices, including pressure measurement, temperature measurement, level measurement, and humidity measurement, into existing systems. Process automation plays a crucial role in enhancing productivity improvement and energy efficiency in sectors like manufacturing, logistics chain, and energy production. By implementing automation systems, companies can monitor and control their processes more effectively, ensuring consistent quality and reducing human error. Safety automation systems are another critical component of the market. These systems help minimize risks and ensure compliance with regulations in industries such as oil and gas, pharmaceuticals, and food processing. Machine learning algorithms are increasingly being used to analyze data collected from IoT-connected devices and inspection processes, enabling predictive maintenance and proactive problem-solving. Cloud-based automation solutions offer several advantages, including cost savings, scalability, and flexibility.

Market Segmentation

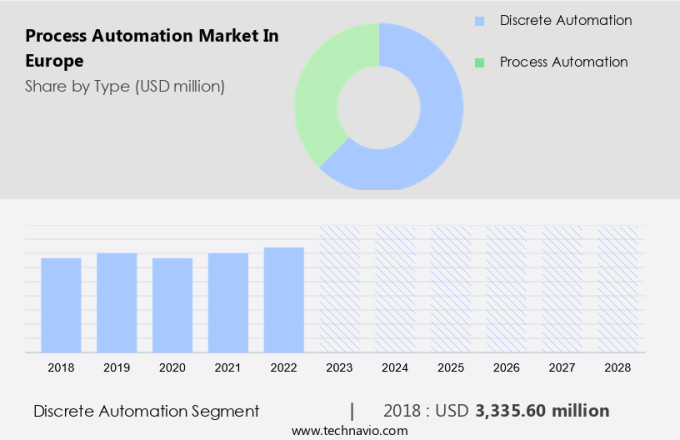

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Type

- Discrete automation

- Process automation

- Geography

- Europe

- Germany

- UK

- France

- Europe

By Type Insights

The discrete automation segment is estimated to witness significant growth during the forecast period. Process automation involves utilizing artificial intelligence (AI) to streamline and optimize various business processes. One significant industry that benefits from process automation is the paper and pulp sector. In this industry, production capacity is maximized through the implementation of distributed control systems (DCS), such as Valmet DNA DCS.

Get a glance at the market share of various segments Download the PDF Sample

The discrete automation segment was the largest segment and was valued at USD 3.34 billion in 2018. Water treatment construction and renewable energy projects are also areas where process automation plays a crucial role. DCS allows for the efficient management of manufacturing processes by automating tasks and providing real-time data. For instance, in the production of paper and pulp, DCS can optimize the manufacturing process by monitoring and controlling various parameters such as temperature, pressure, and flow rate. Hence, such factors are fuelling the growth of this segment during the forecast period.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Europe Process Automation Market Driver

Rising demand in healthcare sector is notably driving market growth. In the healthcare sector, automation technologies are being adopted to address the increasing labor shortage. Hospitals and clinics are implementing automated help desks to streamline patient registration, manage health data, and maintain treatment status. These systems automate the scheduling of patient appointments, enabling round-the-clock access for patients.

Furthermore, they help manage the growing inventory of medical supplies, preventing stock-outs and delays, and reducing the workload on procurement teams. Process automation is also being utilized in hospitals, clinics, and pharmaceutical manufacturing enterprises to enhance procedures such as filling, packing, and inspection. By increasing speed and accuracy, these automated systems contribute significantly to overall efficiency and productivity.

Europe Process Automation Market Trends

Virtualization of automation systems is the key trend in the market. In the realm of industrial automation, the implementation of virtualization technology is revolutionizing the way systems operate. By utilizing hypervisors, a crucial intermediary between virtual machines and host servers, organizations can run multiple operating systems (OS) and applications on a single physical server.

This approach, known as virtual machine technology, offers several advantages, including enhanced resource utilization and significant energy savings. Traditional physical servers are often limited to running a single OS and application at a time, leading to underutilized resources and increased operational costs. Virtualization circumvents this issue by allowing the allocation of resources to various virtual machines, each running its own OS and software. Thus, such trends will shape the growth of the market during the forecast period.

Europe Process Automation Market Challenge

Infrastructure and customization issues is the major challenge that affects the growth of the market. Process automation is a critical aspect of digital transformation for businesses seeking efficiency and cost savings. However, implementing automation solutions can be a challenging endeavor, particularly in industries such as Chemical, Petrochemical, Pulp and Paper, where complex processes and infrastructure are required.

The use of Artificial Intelligence (AI) and Cloud-Based Automation is becoming increasingly popular, but the need for advanced infrastructure and skilled personnel can pose significant obstacles. Moreover, the wireless communication aspect of automation can add to the complexity, requiring businesses to invest in reliable networks and security measures. Job displacement is another concern, as automation may lead to the need for new skill sets or even the elimination of certain jobs. Despite these challenges, the benefits of process automation are significant. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ABB Ltd: The company offers process automation products such as control systems, PLC, and industrial analytics and AI.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AMETEK Inc.

- Azbil Corp.

- Delta Electronics Inc.

- Eaton Corp plc

- Emerson Electric Co.

- Endress Hauser Group Services AG

- Fuji Electric Co. Ltd.

- General Electric Co.

- Hitachi Ltd.

- Honeywell International Inc.

- Mitsubishi Electric Corp.

- OMRON Corp.

- Robert Bosch GmbH

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Xylem Inc.

- Yokogawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Process automation is a critical aspect of modern industrial operations, enabling businesses to streamline their processes, improve productivity, and enhance safety. The global market is witnessing significant growth due to the increasing adoption of Industry 4.0 and the Internet of Things (IoT) in various sectors. Smart factories are being built to integrate automation systems, IoT connected devices, and distributed control systems (DCS) to optimize production capacity and energy efficiency. Safety automation systems, machine learning, and artificial intelligence are key technologies driving process automation. These technologies help in monitoring and controlling industrial processes, ensuring optimal performance and reducing human intervention. Instrumentation devices such as pressure, temperature, level, and humidity measurement sensors play a crucial role in process automation. Existing systems and legacy systems in industries like paper and pulp, water treatment construction, renewable energy, and chemical and petrochemical sectors are being upgraded with automation solutions to overcome communication barriers and improve data collection and mapping. Cloud-based automation solutions are gaining popularity due to their ability to provide real-time data access and analysis, enabling businesses to make informed decisions and respond quickly to changing market conditions. Robotics and software are also integral to process automation, with intelligent manufacturing practices and programmable logic controllers (PLCs) being widely used to automate industrial processes. The integration of automation systems with field instruments and industrial processes is leading to significant productivity improvement and digital transformation. However, concerns around job displacement and wireless communication security are challenges that need to be addressed to ensure a smooth transition to automated processes.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

142 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.6% |

|

Market growth 2024-2028 |

USD 2.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.2 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ABB Ltd., AMETEK Inc., Azbil Corp., Delta Electronics Inc., Eaton Corp plc, Emerson Electric Co., Endress Hauser Group Services AG, Fuji Electric Co. Ltd., General Electric Co., Hitachi Ltd., Honeywell International Inc., Mitsubishi Electric Corp., OMRON Corp., Robert Bosch GmbH, Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Xylem Inc., and Yokogawa Electric Corp. |

|

Market dynamics |

Parent market analysis, market report , market forecast , Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch