Professional Development Market Size 2025-2029

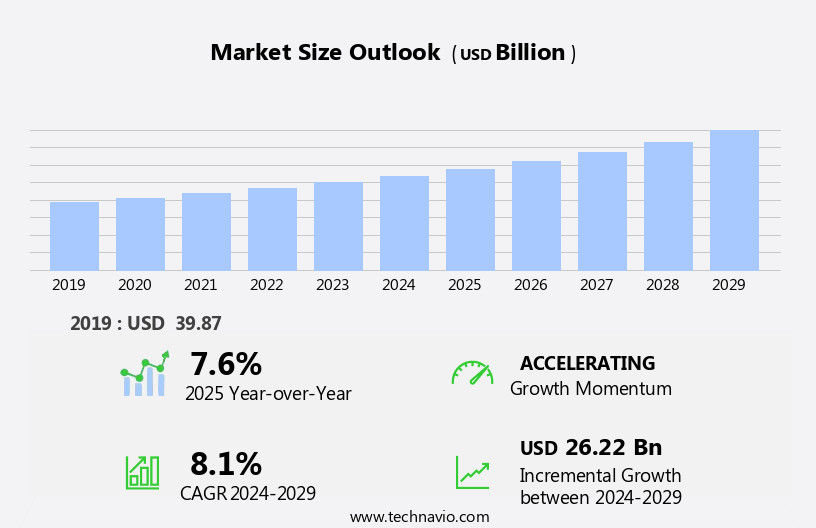

The professional development market size is forecast to increase by USD 26.22 billion at a CAGR of 8.1% between 2024 and 2029.

- The professional development market is growing rapidly, driven by technologies like AI, virtual reality, and adaptive learning, which offer personalized, interactive experiences. Mobile learning is also expanding, giving professionals flexible, on-the-go access to educational content. Open educational resources are gaining popularity, providing cost-effective, accessible training options. Despite these trends, challenges remain.

- A lack of standardization makes it hard for organizations to ensure consistent quality, while high costs can limit access, especially for small and mid-sized businesses. To succeed, companies should focus on delivering high-quality, tech-enabled training programs that meet evolving workforce needs and prioritize affordability. Addressing these issues will be key to maximizing opportunities in the expanding professional development landscape

What will be the Size of the Professional Development Market during the forecast period?

- The market continues to evolve, with dynamic industry trends shaping the landscape. Skill development remains a priority for businesses seeking to stay competitive, leading to an increased focus on content creation and employee retention. Personalized learning pathways, industry associations, and industry-specific training are essential tools in addressing the skills gap. Adaptive learning and learning communities foster engagement, while instructional design ensures effective knowledge transfer. Soft skills, talent acquisition, management training, and leadership development are integral components of professional growth. Knowledge management, augmented reality, online learning, and learning content development enable efficient and effective learning experiences. Professional certifications, learning management systems, and learning experience platforms offer opportunities for continuous learning and career advancement.

- Regulatory training, coaching programs, and performance management are crucial for maintaining compliance and optimizing human capital. Digital transformation, virtual training, and knowledge sharing are driving innovation in the market. Performance management, machine learning, and artificial intelligence are revolutionizing assessment and evaluation processes. Blended learning, assessment tools, and professional networking provide flexible and collaborative learning opportunities. A professional development budget, talent management, and career coaching are essential investments for organizations seeking to develop and retain top talent. The ongoing evolution of these trends and patterns underscores the importance of staying informed and adaptable in the ever-changing the market.

How is this Professional Development Industry segmented?

The professional development industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Online

- Offline

- End-user

- K-12

- Higher education

- Pre K-12

- Content Types

- Leadership Skills

- Technical Skills

- Soft Skills

- Compliance Training

- Providers

- EdTech Companies

- Universities

- Consulting Firms

- Industry Associations

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

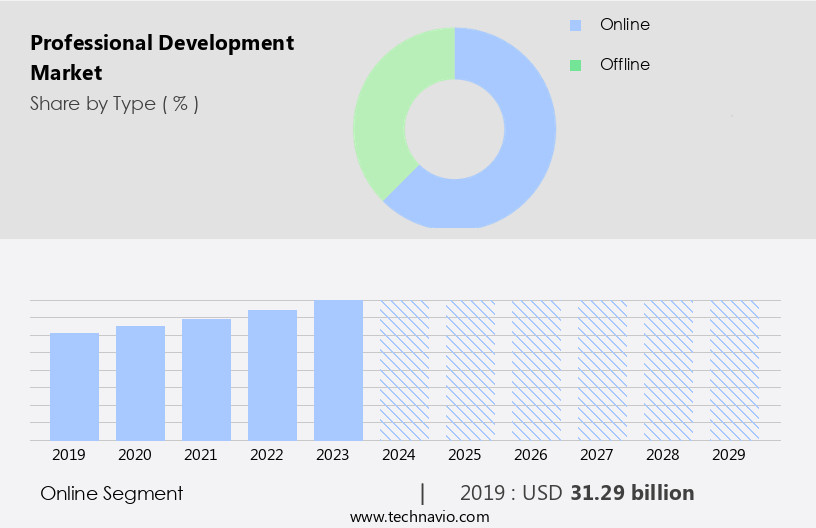

The online segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of offerings, including skill development, content creation, employee retention, personalized learning pathways, industry associations, industry-specific training, and skills gap analysis. companies are integrating technologies and digital platforms to deliver adaptive learning, learning communities, instructional design, and employee engagement. Regulatory training, coaching programs, corporate training, and management training are essential components, as is the integration of performance management, digital transformation, human capital management, and virtual training. Learning analytics, soft skills, talent acquisition, and career advancement are also critical areas of focus. Augmented reality, online learning, learning content development, and personalized learning are transforming the landscape, with professional certifications, learning management systems, learning experience platforms, and professional societies providing valuable resources.

Virtual reality, machine learning, artificial intelligence, and e-learning platforms are revolutionizing compliance training, career coaching, and professional networking. Blended learning, assessment tools, and learning design are essential elements of effective professional development programs. Organizations are increasingly investing in learning outcomes, knowledge management, technical skills, and leadership development to stay competitive. Online courses and mobile learning offer flexible, cost-effective solutions for organizations, enabling employees to access training materials and resources anytime, anywhere.

The Online segment was valued at USD 31.29 billion in 2019 and showed a gradual increase during the forecast period.

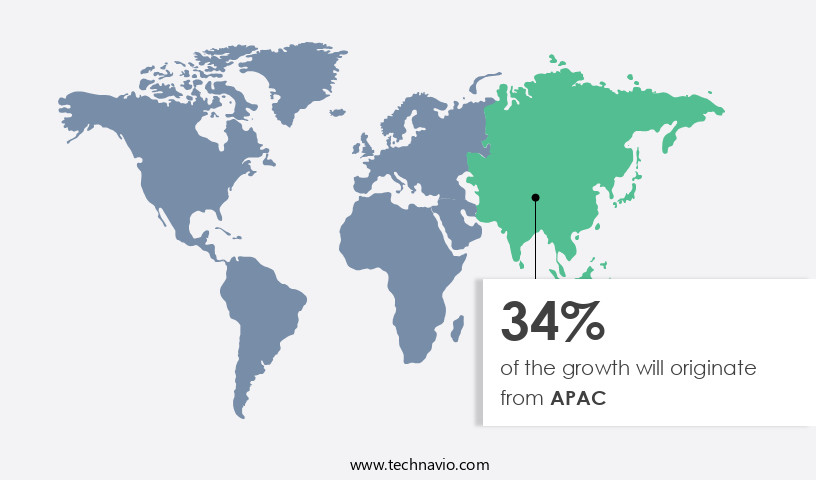

Regional Analysis

APAC is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the increasing emphasis on continuous learning and skill enhancement among organizations and individuals. In today's dynamic business landscape, professionals across various industries recognize the importance of staying current and competitive. To cater to this demand, a multitude of online courses, certifications, and training programs are available through platforms like LinkedIn Learning, Udemy, and Coursera. Furthermore, industry-specific conferences, workshops, and seminars provide valuable opportunities for networking and specialized education. Corporate training solutions tailored to specific organizations are offered by companies such as Skillsoft. With the rise of remote work and digitalization, virtual professional development options have become increasingly prevalent.

Learning analytics, machine learning, and artificial intelligence are integrated into various training programs to enhance the learning experience and improve outcomes. Soft skills, technical skills, and industry-specific knowledge are essential components of professional development. Learning management systems, learning experience platforms, and professional societies facilitate the organization and delivery of training content. Performance management, digital transformation, human capital management, and compliance training are crucial aspects of talent management. Coaching programs, career advancement opportunities, and assessment tools help employees identify and address skill gaps. Instructional design, adaptive learning, and personalized learning pathways cater to individual learning styles and needs.

E-learning platforms, online courses, and blended learning approaches offer flexibility and convenience. Incorporating knowledge management, knowledge sharing, and learning communities fosters a culture of continuous learning and collaboration. Virtual training, augmented reality, and virtual reality technologies offer immersive and interactive learning experiences. Overall, the market is evolving to meet the diverse needs of learners and organizations in a rapidly changing business environment.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Professional Development Industry?

- The integration of technological innovations into professional development courses is a primary market driver, enhancing learning experiences and fostering continuous skill development for professionals.

- Professional development is a crucial aspect of career advancement in today's dynamic business landscape. The integration of advanced technologies, such as machine learning and artificial intelligence, into e-learning platforms is revolutionizing the way professionals acquire new skills and knowledge. Adaptive learning tools, which allow virtual teachers to observe, react, and adapt to students' behavior, are an emerging feature in this domain. These tools enable personalized learning experiences, enhancing engagement and improving learning outcomes. Moreover, social media platforms and online courses offer a wealth of resources for professional development. These tools facilitate collaboration and knowledge sharing among teachers, enabling them to join groups, discuss topics, and receive feedback.

- Compliance training, career coaching, and assessment tools are other essential components of professional development programs. Blended learning, which combines traditional classroom instruction with online courses, is also gaining popularity. Professional networking platforms can help expand a professional's network, providing opportunities for learning and career growth. With the increasing importance of talent management, companies are investing more in their employees' professional development, making it a vital aspect of career advancement. The professional development budget is a significant consideration for businesses seeking to attract and retain top talent. Overall, the market is characterized by a diverse range of tools and platforms, offering endless opportunities for individuals and organizations to enhance their skills and knowledge.

What are the market trends shaping the Professional Development Industry?

- The trend toward mobile learning is gaining momentum in the market. This format enables greater flexibility and convenience for learners, making it an increasingly popular choice.

- Professional development is a crucial aspect for educators to enhance their skills and stay competitive in the evolving education industry. The integration of mobile learning in professional development programs is gaining traction due to the widespread use of smartphones and the Internet. This trend enables educators to access learning content anytime, anywhere, overcoming time constraints. Mobile learning also fosters collaboration among educators by facilitating the sharing of resources and ideas. Additionally, learners increasingly use mobiles for certification and licensure exam preparation, presenting an opportunity for companies to expand their consumer base and gain a competitive edge in the market.

- Industry associations and organizations offer industry-specific training and skill development through personalized learning pathways and adaptive learning technologies. Instructional design plays a significant role in creating engaging and effective professional development content. Furthermore, employee engagement and regulatory training are essential components of professional development programs, with coaching programs and learning communities serving as valuable resources for continuous growth.

What challenges does the Professional Development Industry face during its growth?

- The rising adoption of open educational resources poses a significant challenge to the growth of the educational industry. This trend, driven by increasing accessibility and affordability, necessitates traditional educational institutions and providers to adapt and innovate in order to remain competitive.

- The market encompasses various types of training programs, including corporate training, management training, leadership development, soft skills, and knowledge management. Mobile learning, online learning, learning content development, and personalized learning are key trends driving market growth. However, the availability of free or low-priced open-source learning materials poses a challenge. These resources, classified as full open access, are freely available immediately after publication, reducing the demand for paid professional development courses. The pervasive nature of the Internet and the abundance of free content online have decreased the reliance on education consulting services.

- Despite this obstacle, the market continues to expand due to the importance of continuous learning and talent acquisition in today's competitive business landscape. Additionally, emerging technologies such as learning analytics, augmented reality, and artificial intelligence are enhancing the effectiveness of professional development programs.

Exclusive Customer Landscape

The professional development market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the professional development market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, professional development market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

LinkedIn Learning - The company delivers expertly crafted professional development solutions, including Adobe Analytics, via Adobe Digital Learning Services. Leveraging Adobe's advanced analytics tools, we empower individuals to enhance their skill sets and stay competitive in today's data-driven business landscape. Our tailored learning experiences foster growth and innovation, ensuring that professionals remain at the forefront of industry trends.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- LinkedIn Learning

- Coursera Inc.

- Udemy Inc.

- Skillsoft Corporation

- FranklinCovey Co.

- D2L Corporation

- SAP SE

- Atos SE

- Capgemini SE

- QA Ltd.

- Learning Tree International

- Tata Consultancy Services Ltd.

- NIIT Limited

- Aptech Limited

- Tencent Classroom

- NetEase Cloud Classroom

- CJ OliveNetworks

- Hays plc

- Kroton Educacional

- Estacio Participacoes

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Professional Development Market

- In February 2024, Coursera, a leading online learning platform, announced a strategic partnership with IBM to offer industry-recognized certificates in cloud computing and artificial intelligence (IBM Press Release, 2024). This collaboration aimed to upskill the global workforce and address the increasing demand for tech talent.

- In July 2025, Microsoft acquired LinkedIn Learning for USD26.2 billion (Microsoft Investor Relations, 2025). This acquisition strengthened Microsoft's position in the market by integrating LinkedIn's learning platform with its Office 365 suite.

- In November 2024, Google Workspace unveiled Google Workspace Education and Google Workspace for Nonprofits, expanding its professional development offerings to the education and nonprofit sectors (Google Blog, 2024). These initiatives aimed to provide affordable and accessible professional development resources to these communities.

- In March 2025, Skillsoft acquired SumTotal Systems for USD1.1 billion (Skillsoft Press Release, 2025). This acquisition allowed Skillsoft to expand its offerings beyond learning and development to include talent management and human resources solutions.

Research Analyst Overview

In today's dynamic business landscape, the market is witnessing significant shifts driven by advancements in technology and evolving learning preferences. Performance dashboards and data visualization tools are increasingly being adopted to measure learning outcomes and enhance user experience. Cloud computing enables access to knowledge sharing platforms, personalized learning recommendations, and learning content libraries from anywhere. Leadership styles are evolving, with data science and emotional intelligence becoming essential skills for effective management. Learning journeys are being reimagined through gamified learning modules, skill assessments, and project management tools. Business intelligence and analytics platforms facilitate data-driven decision-making and conflict resolution. Social media marketing and digital marketing are transforming how organizations engage with their workforce, while search engine optimization and agile methodologies optimize learning and development processes.

The gig economy and remote work are shaping the future of work, necessitating digital literacy and adaptive learning algorithms. Expert networks and virtual mentorship programs foster knowledge exchange and personalized learning paths. Learning platforms employ user interface designs to ensure an optimal user experience. Negotiation skills and big data analytics are critical components of skills-based hiring strategies. In this rapidly changing landscape, organizations must stay informed and adapt to remain competitive. Learning analytics dashboards provide valuable insights into workforce development trends and help organizations make informed decisions. The integration of data analytics and data science in learning and development is revolutionizing the way businesses approach talent management and employee development.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Professional Development Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

189 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.1% |

|

Market growth 2025-2029 |

USD 26.22 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.6 |

|

Key countries |

US, China, Japan, Germany, France, Spain, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, Rest of World (ROW), and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Professional Development Market Research and Growth Report?

- CAGR of the Professional Development industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the professional development market growth of industry companies

We can help! Our analysts can customize this professional development market research report to meet your requirements.