Projector Market Size 2025-2029

The projector market size is forecast to increase by USD 4.79 billion, at a CAGR of 5.1% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing adoption of projectors in the entertainment industry. This sector's expansion is fueled by the ability of projectors to deliver immersive experiences, making them an essential tool for film screenings, live events, and virtual productions. Furthermore, the introduction of interactive projectors is broadening the market's scope, enabling new applications in education, healthcare, and other sectors.

- However, the market faces a notable challenge in the form of low lamp life, which can increase operational costs for businesses and limit the overall lifespan of projectors. Companies must address this issue through advancements in lamp technology or alternative lighting solutions to remain competitive and capitalize on the market's growth opportunities.

What will be the Size of the Projector Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities unfolding across various sectors. Projector lamps and image processing chips are at the heart of this industry, powering advanced features such as digital zoom, contrast ratio, and control panels. Mounting hardware, wireless connectivity, and user manuals ensure seamless integration and ease of use. Housing materials, brightness (lumens), and cooling systems contribute to the durability and performance of projectors. HFR support, native resolution, and optical components deliver superior image quality, while HDR support and 4k resolution cater to the latest technological demands. Laser projectors and LED projectors each offer unique advantages, with laser projectors boasting longer lamp life and LED projectors providing energy efficiency.

Projection mapping, interactive whiteboards, and 3D projection expand the applications of projectors in diverse industries. Continuous innovation in electronics components, refresh rate, and remote control enhances user experience. Wireless mirroring, smart features, and power supplies ensure compatibility with various devices. Projector manufacturers prioritize quality control, technical support, and software integration to meet evolving customer needs. The market's dynamic nature extends to optical components, color filters, throw ratio, and pixel pitch. Input lag, power consumption, and screen size cater to the demands of home theater enthusiasts and digital signage applications. DLP technology, repair services, and supply chain management further contribute to the industry's growth and innovation.

How is this Projector Industry segmented?

The projector industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- LCD

- DLP

- LCoS

- Type

- Short

- Ultra short

- Normal

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Technology Insights

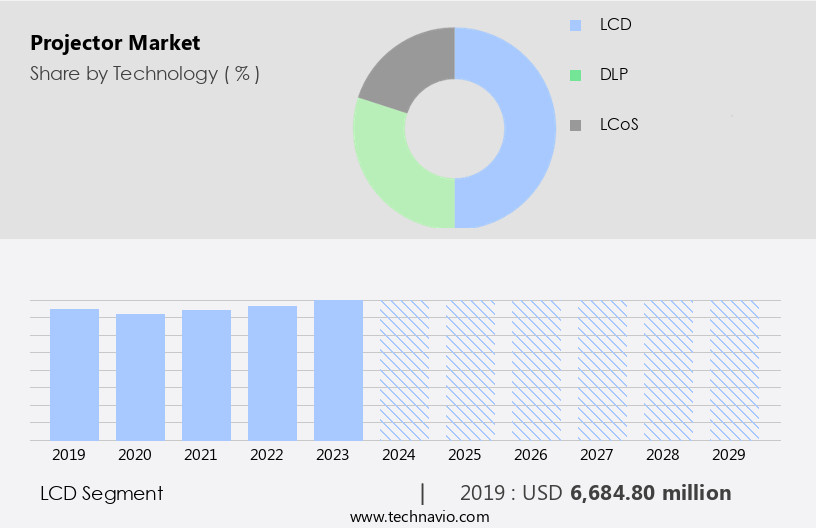

The lcd segment is estimated to witness significant growth during the forecast period.

The market encompasses innovative technologies and features, including LCD projection, which utilizes three liquid crystal panels to generate full-color images. LCD projectors, also known as 3LCDs, offer advantages such as high brightness, excellent color accuracy, and long lamp life. These projectors come with various specifications, like the Sony VPL-HW45ES, featuring full HD 3D capabilities, 1920x1080 resolution, 1.6x manual zoom lens, and lens shift. Security is a significant concern in the market, with solutions such as keystone correction and interactive whiteboards ensuring image precision and user interaction. Projection mapping and digital signage applications have gained traction, enabling immersive and harmonious experiences.

Light sources include projector lamps and LEDs, with the latter offering energy efficiency and extended lifespan. Control systems, such as remote control and control apps, provide ease of use and flexibility. Refresh rates, image processing chips, and digital zoom enhance the overall image quality. HDR support and 4k resolution offer improved contrast and detail, while cooling systems ensure optimal performance. Wireless connectivity, including wireless mirroring, enables seamless integration with various devices. Projectors cater to diverse business applications, from long-throw projectors for large venues to ultra-short-throw projectors for small spaces. Brightness, measured in lumens, is a crucial factor in determining the suitability of a projector for various environments.

Software development and integration, including HFR support, pixel pitch, and input lag, are essential aspects of modern projectors. The market also offers various housing materials, power supplies, and power consumption options. Repair services and technical support ensure seamless operation and longevity. In summary, the market is characterized by advancements in LCD technology, security features, projection mapping, light sources, control systems, and software integration, catering to diverse applications and user requirements.

The LCD segment was valued at USD 6.68 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing notable growth due to the expanding demand from industries such as industrial, education, corporate, and media and entertainment sectors. The region's rapid digital transformation is driving the evolution of these sectors, making projectors an essential tool for improved data visualization and analysis. With rising disposable income and changing lifestyles, consumers are opting for premium electronic products, including projectors. The trend of transforming TV systems into advanced projectors and screens is gaining popularity for immersive big-screen experiences. New applications, like home cinema theaters, outdoor projectors, and rooftop restaurants with screens, are fueling the market's growth in APAC.

Projectors offer various features such as high aspect ratio, advanced security, projection mapping, diverse light sources, lens shift, and control systems. Electronics components like image processing chips, digital zoom, and contrast ratio ensure image quality. Refresh rates, remote control, audio output, and wireless connectivity cater to user convenience. Software development, HDR support, and 4K resolution enhance the user experience. Focus adjustment, cooling systems, and mounting hardware ensure durability and ease of use. Laser projectors and LED projectors cater to different market segments, with laser projectors offering longer lamp life and LED projectors providing energy efficiency. Smart features like keystone correction, interactive whiteboards, and power supplies further boost the market's growth.

The market's evolution is driven by technological advancements, including image processing, 8K resolution, DLP technology, and repair services. The market in APAC is poised for continued growth, fueled by the increasing demand for advanced projection technology in various industries and applications.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market caters to businesses and individuals seeking large-scale display solutions for presentations, home theaters, and outdoor events. This dynamic market encompasses various projector technologies, including LCD, DLP, and LED, each offering unique advantages in terms of brightness, contrast, and energy efficiency. Projectors come in diverse forms, such as portable, short-throw, and ultra-short-throw models, catering to different space requirements. Additionally, advancements in 4K resolution, HDR support, and wireless connectivity further enhance the user experience. The market is driven by factors like increasing demand for immersive visual experiences, advancements in technology, and growing adoption in education and healthcare sectors. Furthermore, the rise of remote work and virtual events has fueled the need for projectors, making it an exciting and evolving market to watch.

What are the key market drivers leading to the rise in the adoption of Projector Industry?

- The entertainment industry's growing preference for projectors is the primary market driver, significantly increasing its adoption.

- Projectors continue to gain traction in various industries, particularly in entertainment, education, and digital signage. The market's growth is driven by several factors. One significant trend is the increasing adoption of projectors in the entertainment industry, including movie theaters and live events. These projectors, also known as video projectors, have replaced traditional movie projectors with their advanced features. Projectors are also increasingly used in classrooms and corporate meeting rooms. The first commercial projector was designed for movie theaters, and its success paved the way for further applications. Aspect ratio and resolution are essential considerations when choosing a projector.

- Modern projectors offer high definition, including 4K resolution and HDR support. Projectors also come with various security features, such as password protection and wireless mirroring. Projection mapping, a technology that projects images onto irregular surfaces, is another trend gaining popularity. Projectors' light sources have evolved, with LED and laser options providing longer lifetimes and lower maintenance requirements. Control systems, such as remote control and software development, enhance the user experience. Refresh rates, electronics components, and cooling systems ensure smooth operation. Audio output is another essential feature, with many projectors offering built-in speakers. Projectors are also used extensively in digital signage applications, making them an essential component of modern marketing strategies.

- With the increasing demand for immersive experiences, projectors offer a harmonious blend of image and sound, striking a chord with audiences.

What are the market trends shaping the Projector Industry?

- Interactive projectors are gaining popularity in the market as the next big trend. This technology allows users to engage directly with projected content, creating a more immersive experience.

- Interactive projectors have gained significant traction in various sectors, particularly education and corporate presentations. These devices offer the functionality of an interactive whiteboard without the need for a separate board. Instead, the projector itself becomes the interactive device, allowing users to control their computer using a stylus, pen, or fingers directly on any surface. The integration of advanced optical components, such as image processing chips and high-definition projection lamps, enhances the quality of the projected image. Moreover, interactive projectors come with features like digital zoom, hfr support, and a control panel for easy operation. The housing materials used ensure durability, while brightness (lumens) is sufficient for large rooms.

- User manuals and wireless connectivity options facilitate seamless setup and use. Interactive projectors are essential tools for business presentations, enabling immersive and harmonious experiences. Additionally, some models offer a remote app for convenient control and native resolution for crisp visuals. Quality control measures ensure consistent performance and reliability.

What challenges does the Projector Industry face during its growth?

- The low lamp life poses a significant challenge to the industry's growth trajectory. This issue, which refers to the limited durability of lamps used in various applications, can hinder advancements and innovation within the industry. Companies may face increased costs due to frequent replacements, and consumers may be dissatisfied with the short lifespan of their products. Addressing this challenge through research and development of longer-lasting lamp technologies could lead to improved industry performance and customer satisfaction.

- In the market, a significant consideration for buyers is the choice between lamp-based and LED projectors. Lamp-based projectors, utilizing LCoS technology, encounter challenges with lamp replacements every 3-5 years, which can cost approximately USD1,000 for four lamps. In contrast, LED projectors offer a longer lifespan, eliminating the need for frequent lamp replacements. However, LED projectors provide lower brightness levels and a lower-resolution image compared to their lamp counterparts. Smart features, color filters, keystone correction, and interactive whiteboards are essential considerations for users. Long-throw projectors require a larger space between the projector and the screen, while ultra-short-throw projectors can project onto a screen just inches away from the device.

- Throw ratio, pixel pitch, input lag, software integration, screen size, and optical zoom are other essential factors. Lamp-based projectors offer higher brightness levels, making them suitable for larger venues and well-lit environments. In contrast, LED projectors are more energy-efficient and offer better color accuracy. Power supplies and color filters are essential components for both types of projectors, ensuring optimal performance. When selecting a projector, businesses should consider the specific needs of their organization, including budget, desired features, and the environment in which the projector will be used. Ultimately, a projector's ability to deliver high-quality visuals, ease of use, and long-term cost-effectiveness are crucial factors in making an informed decision.

Exclusive Customer Landscape

The projector market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the projector market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, projector market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AAXA Technologies Inc. - The company showcases an array of projectors, including the P400 short throw mini model, P7 advanced projector, and the HP3 FX projector for unique visual experiences.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AAXA Technologies Inc.

- Acer Inc.

- ASUSTeK Computer Inc.

- Canon Inc.

- Hitachi Ltd.

- InFocus

- JVCKENWOOD Corp.

- Koninklijke Philips NV

- Lenovo Group Ltd.

- LG Corp.

- Magnasonic

- MicroVision Inc.

- Qisda Corp.

- Samsung Electronics Co. Ltd.

- Seiko Epson Corp.

- Shenzhen Hotack Technology Co.Ltd.

- Sony Group Corp.

- Texas Instruments Inc.

- ViewSonic Corp.

- YABER

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Projector Market

- In January 2024, leading projector manufacturer, Optoma, introduced its new ultra-short throw 4K UHD laser projector, the UHZ65, at the Consumer Electronics Show (CES) in Las Vegas (Optoma Press Release, 2024). This innovative product, featuring a throw ratio of only 0.23:1, generated significant buzz for its ability to project a 120-inch image from just 11 inches away from a wall (Optoma, 2024).

- In March 2024, Sony and Panasonic announced a strategic partnership to collaborate on developing next-generation projector technologies, including laser light sources and advanced image processing algorithms (Sony Press Release, 2024). This collaboration aimed to enhance their respective product offerings and strengthen their positions in the competitive market.

- In April 2025, Epson, the world's largest projector manufacturer, completed its acquisition of ForgeRock, a leading identity and access management company, for approximately USD2.5 billion (Epson Press Release, 2025). This strategic move was intended to expand Epson's business beyond its core hardware offerings and into the software and services sector, providing a more comprehensive solution for its customers.

- In May 2025, the European Union passed the Energy Labeling Regulation for projectors, requiring all projectors sold in the EU to meet new energy efficiency standards by 2027 (EU Press Release, 2025). This regulation aims to reduce the carbon footprint of projectors and promote more sustainable technology in the market.

Research Analyst Overview

- The market encompasses a diverse range of offerings, from home cinema models to portable and interactive variants. One notable trend is the increasing popularity of short-throw lenses, allowing for larger images in limited spaces. Manual focus and auto focus projectors cater to different user preferences, while input sources such as HDMI, USB, and wireless connectivity expand compatibility. Motion blur remains a concern for fast-action content, but advancements in technology are mitigating this issue. Professional projectors prioritize high output resolution, color gamut, and screen gain for optimal image quality. Energy efficiency is a significant concern, with eco mode and power saving features reducing power consumption.

- Interactive projectors enable user engagement through touch or pen input, while thermal management and fan speed ensure reliable operation. Home cinema projectors boast wide-angle lenses and long-throw capabilities for larger screens, while noise level and black level are crucial factors for an immersive viewing experience. Ease of use, mini projectors, and fixed-focus lenses cater to various business applications. Ambient light rejection and storage temperature are essential considerations for specific environments. Zoom lenses offer versatility, while picture modes and game mode enhance the visual experience for various applications. Output resolution, color gamut, and screen gain are essential factors for professional use, while eco mode and power saving features contribute to cost savings.

- Noise level, black level, and thermal management ensure reliable and efficient performance.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Projector Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2025-2029 |

USD 4789.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.7 |

|

Key countries |

US, China, Germany, UK, Japan, France, India, Canada, Brazil, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Projector Market Research and Growth Report?

- CAGR of the Projector industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the projector market growth of industry companies

We can help! Our analysts can customize this projector market research report to meet your requirements.