Property And Casualty Insurance Market Size 2025-2029

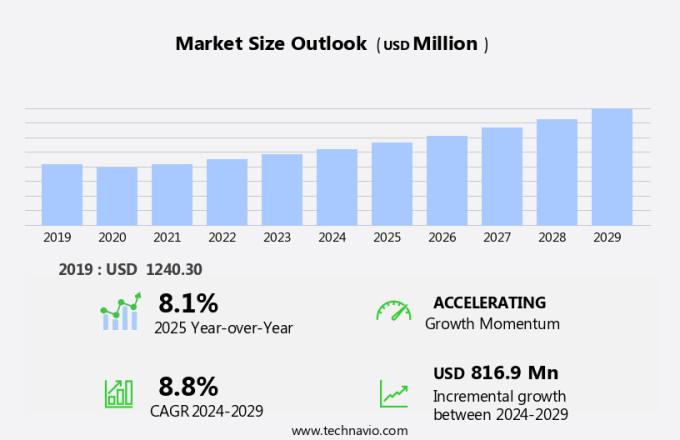

The property and casualty insurance market size is forecast to increase by USD 816.9 million, at a CAGR of 8.8% between 2024 and 2029.

- The market is experiencing significant shifts, with the increasing frequency and severity of uncertain catastrophic events posing a considerable challenge. This trend is driving insurers to reassess risk management strategies and invest in advanced technologies to mitigate potential losses. Simultaneously, inorganic growth strategies, such as mergers and acquisitions, are becoming increasingly prevalent as companies seek to expand their reach and enhance their competitive positions. Another critical issue confronting the market is the growing concern over data privacy and security. With the proliferation of digital technologies and the increasing use of customer data, insurers must prioritize robust cybersecurity measures to safeguard sensitive information and protect their reputations.

- This need for enhanced data security is likely to spur investments in advanced technologies and solutions, offering opportunities for innovative players to capitalize on this growing demand. In summary, the market is characterized by a dynamic landscape, with insurers navigating the challenges of catastrophic events, inorganic growth, and data security, while also capitalizing on opportunities for technological innovation and expansion.

What will be the Size of the Property And Casualty Insurance Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The property and casualty (P&C) insurance market continues to evolve, with dynamic market dynamics shaping various sectors. Regulatory compliance and financial reporting are crucial elements, ensuring policy sales align with insurance regulations. Commercial property insurance, including flood and earthquake coverage, requires advanced catastrophe modeling for accurate risk assessment and pricing. Insurance technology (insurtech) innovations, such as fraud detection and blockchain in insurance, streamline operations and enhance efficiency. Data breach insurance, homeowners insurance, boat insurance, and other personal lines, as well as commercial auto and workers' compensation insurance, benefit from these advancements. Umbrella insurance, liability insurance, and professional liability insurance provide risk transfer solutions, while actuarial modeling and accounting ensure accurate capital requirements and loss ratios.

How is this Property And Casualty Insurance Industry segmented?

The property and casualty insurance industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Direct business

- Agents

- Banks

- Others

- Product Type

- Fire insurance

- Motor insurance

- Marine insurance

- Aviation insurance

- Others

- End-User

- Individuals

- Businesses

- Government Entities

- Coverage Type

- Standard Policies

- Customized Policies

- Bundled Policies

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The direct business segment is estimated to witness significant growth during the forecast period.

In the dynamic the market, insurance companies play a pivotal role, offering direct business services that cater to customers' insurance needs from quotes to claims management. This all-encompassing support is a significant advantage, providing convenience and streamlining the insurance process. Competition among insurers drives innovation, with companies leveraging technology, such as actuarial modeling, insurance accounting, and catastrophe modeling, to assess risk and price policies effectively. Regulatory compliance is paramount, shaping financial reporting and capital requirements. Distribution channels, including insurance brokers and independent agents, expand reach and accessibility. Commercial property insurance, auto insurance, and workers' compensation insurance are key product offerings, with additional coverage for floods, earthquakes, motorcycles, boats, and cybersecurity.

Umbrella insurance, professional liability insurance, and liability insurance provide risk transfer solutions. Risk assessment and fraud detection are integral to underwriting, while insurance regulations ensure fair business practices. Insurtech and blockchain technology are transforming claims processing and policy administration. Catastrophe bonds offer alternative risk financing mechanisms. Overall, the market is characterized by its adaptability and responsiveness to evolving customer needs and market trends.

The Direct business segment was valued at USD 504.30 million in 2019 and showed a gradual increase during the forecast period.

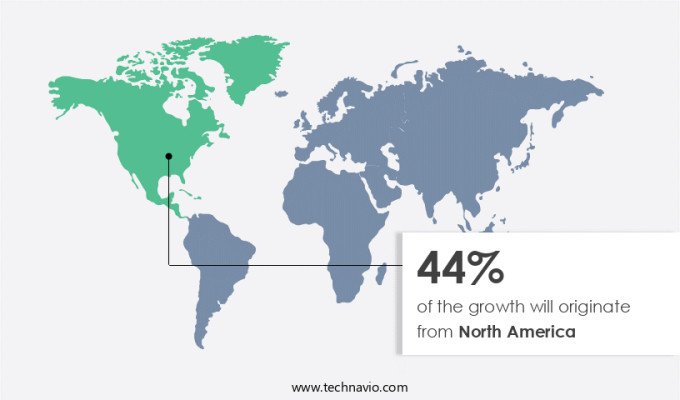

Regional Analysis

North America is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American the market is characterized by a strong regulatory environment and a diverse range of offerings. Driven by a large and affluent consumer base, there is a significant demand for insurance products, particularly in property and casualty lines. Regulatory compliance is a priority, ensuring financial stability and consumer protection. Technology plays a pivotal role in the industry's evolution, with insurers adopting digitalization and advanced tools like catastrophe modeling, actuarial modeling, and insurance technology (insurtech) for risk assessment, fraud detection, and claims processing. Product innovation is evident in areas such as data breach insurance, cybersecurity insurance, and blockchain in insurance.

Commercial property insurance, workers' compensation insurance, and professional liability insurance are popular offerings, while distribution channels, including insurance brokers and direct-to-consumer sales, cater to various customer needs. Investment strategies, capital requirements, and risk transfer are essential aspects of the market, with entities like catastrophe bonds and reinsurance playing crucial roles. The insurance landscape is dynamic, with a focus on enhancing customer experience, improving operational efficiency, and addressing emerging risks.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and intricately woven fabric of the global insurance industry, the market stands out as a vital and indispensable sector. This market is characterized by its ability to shield businesses and individuals from financial losses arising from property damages and liability claims. It encompasses a broad spectrum of risks, including commercial property, general liability, automobile, workers' compensation, and professional indemnity. Underwriters meticulously assess risks, while brokers act as intermediaries, facilitating the exchange of risk for premiums. The market is influenced by various factors, such as economic conditions, regulatory environment, and technological advancements. Innovative solutions, like telematics and parametric insurance, are revolutionizing the industry, offering customized coverage and enhanced risk management capabilities. The market: a robust, adaptive, and essential component of the risk management landscape.

Pricing models, claims processing, and policy administration are continually refined to meet the evolving needs of insurance brokers and distribution channels. Risk assessment and transfer extend to industries like motorcycle insurance, auto insurance, and renters insurance. Innovations in investment strategies and loss prevention techniques further shape the market landscape. The integration of actuarial science and advanced technology continues to redefine the P&C insurance industry, fostering a more agile and responsive market.

What are the key market drivers leading to the rise in the adoption of Property And Casualty Insurance Industry?

- The escalating frequency and unpredictability of catastrophic events serve as the primary market disruptors.

- The market has experienced significant growth due to the increasing number of natural disasters worldwide. In 2022, the Emergency Event Database (EM-DAT) recorded 387 natural calamities and disasters, resulting in the loss of 30,704 lives and affecting 185 million people. This trend has led to a heightened awareness and demand for property and casualty insurance as individuals and organizations seek protection against unexpected losses and damage caused by unforeseen events. Regulatory compliance is a critical factor driving the market's growth, ensuring insurers provide adequate coverage and meet customer needs. Policy sales in commercial property insurance, casualty insurance, flood insurance, and umbrella insurance have seen a surge as businesses and homeowners recognize the importance of risk management.

- Insurance brokers and distribution channels play a vital role in connecting consumers with insurance providers and facilitating the sales process. Advanced technologies, such as catastrophe modeling, are used to assess risks and determine premiums, providing insurers with valuable insights to manage their portfolios effectively. The combined ratio, a critical financial reporting metric, measures the profitability of insurers by comparing their earned premiums to their incurred losses and expenses. A stable combined ratio indicates a financially sound insurer, which is essential for maintaining customer trust and confidence in the market. In conclusion, the market is experiencing robust growth due to the increasing number of natural disasters and the resulting demand for risk management solutions.

- Regulatory compliance, policy sales, financial reporting, and advanced technologies are key market drivers, ensuring the industry remains responsive to the evolving needs of consumers and businesses.

What are the market trends shaping the Property And Casualty Insurance Industry?

- Inorganic growth strategies, such as mergers and acquisitions or strategic partnerships, are increasingly popular among companies in the market. This trend signifies a shift towards more aggressive business expansion tactics.

- The Property and Casualty (P&C) insurance market is driven by various factors, including risk assessment, fraud detection, and regulatory compliance. companies in this market are implementing strategies such as partnerships and mergers and acquisitions (M&A) to expand their offerings and gain competitive advantages. For instance, Allianz SE's acquisition of Aviva's property and casualty insurance business in Central and Eastern Europe strengthens its presence in the region. Similarly, AXA's strategic partnership with Microsoft leverages cloud technology and artificial intelligence for enhanced digital insurance solutions. Moreover, the increasing adoption of insurance technology (insurtech) and data breach insurance is shaping the market dynamics.

- Insurtech is transforming the industry by enabling real-time risk assessment and personalized insurance policies. Data breach insurance is becoming essential for businesses to mitigate risks and comply with regulatory requirements. Additionally, advancements in actuarial modeling, insurance accounting, and catastrophe bonds are providing companies with new opportunities. Actuarial modeling helps in risk assessment and pricing, while insurance accounting ensures financial reporting accuracy. Catastrophe bonds offer a cost-effective alternative to traditional reinsurance. Fraud detection is another critical area of focus for companies, as insurance fraud costs the industry billions annually. Blockchain technology is being explored for its potential in preventing fraud and enhancing transparency in insurance transactions.

- Overall, these trends and strategies will continue to shape the growth of the P&C insurance market during the forecast period.

What challenges does the Property And Casualty Insurance Industry face during its growth?

- Data privacy and security concerns represent a significant challenge to the industry's growth, as companies must balance the need to collect and use customer data to drive innovation and business growth with the imperative to protect that data from unauthorized access or misuse.

- The market is witnessing significant advancements in technology, transforming various aspects of the industry such as policy administration, claims processing, and pricing models. However, these technological innovations also introduce new risks, particularly in the area of cybersecurity. According to recent research, cyber threats are a major concern for businesses, with potential data breaches leading to substantial financial losses. Misuse of stolen data can result in reputational damage and erode customer trust. As such, insurers must prioritize cybersecurity measures to protect sensitive information and mitigate potential risks.

- Effective claims management and risk transfer are essential components of the market. Insurers are leveraging technology to streamline these processes, from motorcycle insurance to workers' compensation insurance. Despite these advancements, the industry remains vulnerable to cyber attacks, highlighting the need for robust security protocols and continuous monitoring to safeguard against potential threats.

Exclusive Customer Landscape

The property and casualty insurance market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the property and casualty insurance market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, property and casualty insurance market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Allianz SE - This company specializes in providing property and casualty insurance solutions, encompassing environmental liability and personal accident coverage. Our offerings cater to various risk scenarios, ensuring comprehensive protection for clients. Environmental liability insurance shields policyholders from financial responsibility for pollution-related damages, while personal accident insurance safeguards individuals against injuries or accidents. By leveraging industry expertise and customized risk management strategies, we help clients mitigate potential losses and maintain peace of mind.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allianz SE

- American International Group Inc.

- AXA Group

- Berkshire Hathaway Inc.

- Chubb Ltd.

- CNA Financial Corp.

- ICICI Bank Ltd.

- Liberty Mutual Insurance Co.

- Mitsubishi Corp.

- Munich Reinsurance Co.

- Nationwide Mutual Insurance Co.

- PICC Property and Casualty Co. Ltd.

- Sompo Holdings Inc.

- State Farm Mutual Automobile Insurance Co.

- The Allstate Corp.

- The Travelers Co. Inc.

- Toyota Motor Corp.

- Universal Insurance Holdings Inc.

- USAA

- Zurich Insurance Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Property And Casualty Insurance Market

- In January 2024, Allstate Insurance Company announced the launch of a new telematics-based auto insurance product, "Drivewise Rewards," which offers discounts based on safe driving behaviors. This innovative offering represents a significant shift towards usage-based insurance in the Property and Casualty (P&C) Insurance Market (Source: Allstate Press Release).

- In March 2024, Chubb Limited and AIG formed a strategic partnership to offer joint cyber insurance solutions. This collaboration aims to combine Chubb's underwriting expertise and AIG's advanced cyber risk assessment capabilities, enhancing their respective offerings in the rapidly growing cyber insurance segment (Source: Chubb Press Release).

- In May 2024, Liberty Mutual Insurance completed the acquisition of Ironshore Inc., a specialty property and casualty insurer, for approximately USD3 billion. This deal expands Liberty Mutual's global reach and capabilities in areas such as excess and umbrella, professional lines, and specialty risks (Source: Liberty Mutual Press Release).

- In January 2025, the European Commission approved the merger of Swiss Re and Hannover Re, creating a leading reinsurer with a combined market share of around 25%. The approval marks a significant consolidation in the reinsurance sector and sets the stage for increased competition in the P&C Insurance Market (Source: European Commission Press Release).

Research Analyst Overview

- In the dynamic the market, policy limits continue to shape the industry landscape. Personal injury and legal liability claims, including advertising injury and financial liability, necessitate careful contract negotiation between insureds and insurance underwriters. Insurance brokers play a crucial role in facilitating these negotiations, while reinsurance brokers manage risk exposure for carriers. Policy documents must clearly outline coverage for bodily injury, medical payments, and property damage. Software developers face unique risks, necessitating specialized insurance contracts. Insurance claims adjusters and investigators manage these claims, while loss control specialists and compliance officers ensure risk mitigation. Defense costs, a significant component of claims, are closely monitored by insurance actuaries and financial analysts.

- Insurance lawyers navigate complex contractual liability issues, while cybersecurity experts address the growing threat of data breaches. Risk management consultants and data scientists employ advanced analytics to assess and mitigate risk, further shaping the market. Insurers increasingly rely on reinsurance and investment managers to manage financial liabilities and optimize capital deployment.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Property And Casualty Insurance Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.8% |

|

Market growth 2025-2029 |

USD 816.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.1 |

|

Key countries |

US, China, India, Japan, Canada, Germany, South Korea, UK, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Property And Casualty Insurance Market Research and Growth Report?

- CAGR of the Property And Casualty Insurance industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the property and casualty insurance market growth of industry companies

We can help! Our analysts can customize this property and casualty insurance market research report to meet your requirements.