Protein Microarray Market Size 2024-2028

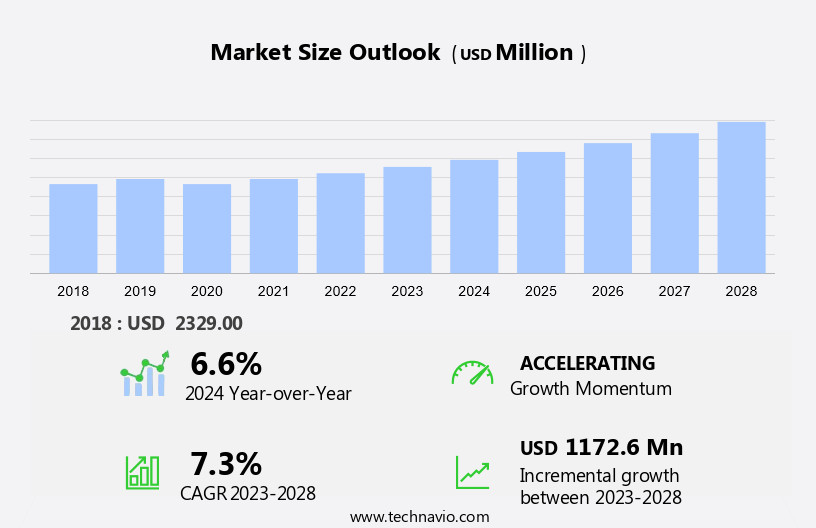

The protein microarray market size is forecast to increase by USD 1.17 billion at a CAGR of 7.3% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing adoption of microarrays In the fields of genomics and proteomics. This technology is revolutionizing research and development In these areas, enabling researchers to study proteins on a large scale. Another key trend driving market growth is the rising popularity of personalized medicines, which require the analysis of individual protein profiles. However, challenges persist In the form of standardization and accuracy issues, which need to be addressed to ensure the reliability and validity of protein microarray data. As research In these areas continues to advance, the market is expected to grow steadily, offering numerous opportunities for innovation and development.

What will be the Size of the Protein Microarray Market During the Forecast Period?

- The market encompasses a range of technologies, including functional protein microarrays, analytical microarrays, antibody microarrays, and protein chips, collectively referred to as proteomic technologies. These tools enable high-throughput screening and analysis of protein-protein interactions, biochemical activities, immune responses, and gene expression services. The market's growth is driven by the increasing demand for personalized medicine and diagnosis technologies, particularly In the context of cancer incidence and precision medicine.

- Protein microarrays play a crucial role in biomedical research, drug discovery, and biotechnology by facilitating the identification of disease biomarkers, targeted medicines, and protein expressions. Miniaturized assay systems and advanced surface chemistries further enhance the market's potential. The market's size is significant, with continuous expansion expected due to the ongoing development of novel applications and the increasing importance of proteomic technologies in various industries.

How is this Protein Microarray Industry segmented and which is the largest segment?

The protein microarray industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Class Type

- Analytical protein microarrays

- Functional protein microarrays

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By Class Type Insights

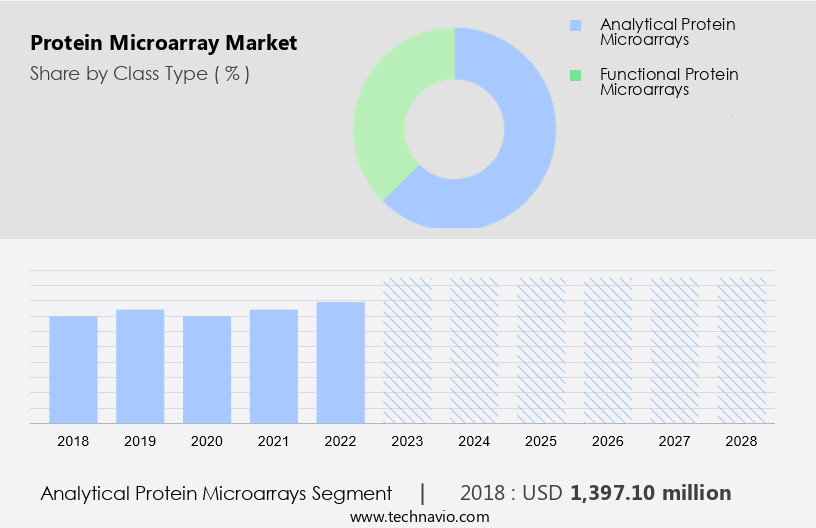

- The analytical protein microarrays segment is estimated to witness significant growth during the forecast period.

Protein microarrays, also known as protein chips, are analytical tools utilized for profiling and measuring protein interactions, biochemical activities, and immune responses. These microarrays involve immobilizing proteins or antibodies on various substrates, such as glass slides, aluminum, gold, hydrophilic polymers, or nitrocellulose slides. The most common types of protein microarrays include antibody microarrays, functional protein microarrays, and analytical microarrays. Antibody microarrays are the most prevalent type, which employs an array of antibodies on a glass microscope slide for monitoring differential protein expression profiles and clinical diagnostics. Applications of protein microarrays extend to various fields, including personalized medicine, cancer diagnosis, disease biomarkers, targeted medicines, gene expression services, and assays.

They offer advantages like high-throughput screening, multiplexed detection, and miniaturized assay systems, making them essential tools for biotechnology, pharmaceutical research, and diagnostics. Protein microarrays are crucial In the discovery and identification of biomarkers, disease mechanisms, therapeutic targets, and clinical settings. They enable the analysis of protein interactions, protein expressions, and biochemical activities, contributing to drug discovery, oncology, chronic diseases, immunology, autoimmune diseases, and infectious diseases. Microarray printing techniques, label-free detection methods, and advanced technologies like surface plasmon resonance and mass spectrometry further enhance the capabilities of protein microarrays. Additionally, the integration of artificial intelligence (AI) and machine learning algorithms facilitates more accurate and efficient data analysis.

Get a glance at the Protein Microarray Industry report of share of various segments Request Free Sample

The analytical protein microarrays segment was valued at USD 1.4 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

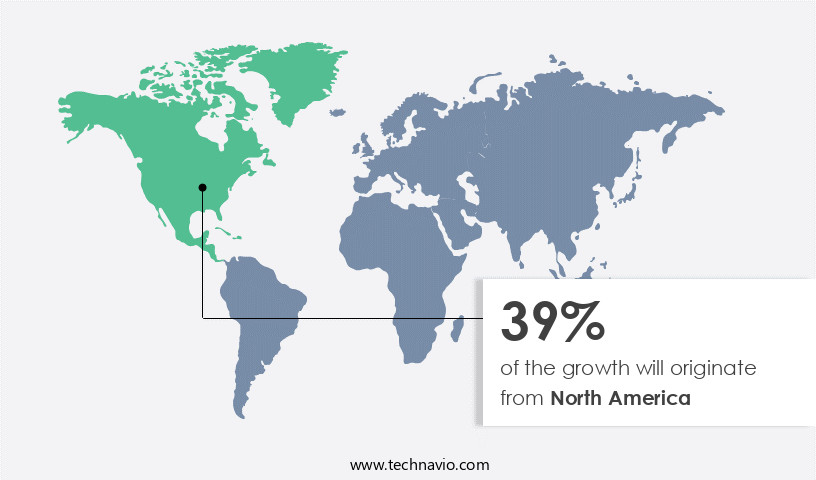

- North America is estimated to contribute 39% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Protein microarrays, also known as protein chips, are essential tools In the biotechnology industry for protein profiling, biomarker discovery, and disease diagnosis. The North American market for protein microarrays is experiencing growth due to substantial investments in healthcare research and testing In the US. The presence of strong distribution networks in countries like the US and Canada, along with the increasing focus of pharmaceutical companies on drug discovery and development, is driving market expansion. In the US, there has been a rise in healthcare spending and an increase in research projects, primarily due to the high potential of regenerative medicine. Organizations such as the National Institutes of Health (NIH) and the Biomedical Advanced Research and Development Authority (BARDA) have increased their funding for such research initiatives.

Protein microarrays are utilized in various applications, including protein interactions, biochemical activities, immune responses, and disease diagnosis. They offer miniaturized assay systems, enabling high-throughput screening and multiplexed detection. Protein microarrays are integral to proteomics, diagnostics, antibody characterization, and lab-on-chips, among other applications. They are used in research centers, academic institutes, diagnostic centers, and healthcare infrastructure to study chronic illnesses, drug development, and therapeutic targets in clinical settings. Protein microarray printing techniques include label-free detection, surface plasmon resonance, and mass spectrometry. Protein microarrays are also employed in artificial intelligence (AI) and machine learning for pharmaceutical research, molecular profiling, oncology, immunology, autoimmune diseases, and infectious diseases.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Protein Microarray Industry?

Increase in adoption of microarrays in genomics and proteomics is the key driver of the market.

- Protein microarrays, a type of microarray technology, are gaining traction In the fields of personalized medicine, diagnostics, and research. These arrays enable high-throughput analysis of protein-protein interactions, biochemical activities, immune responses, and disease biomarkers. With the increasing incidence of chronic diseases and the growing demand for targeted medicines, protein microarrays are becoming essential tools in pharmaceutical research, diagnostics, and therapeutic target discovery. Protein microarrays offer several advantages, including low sample requirements, miniaturization, and the ability to perform multiplexed detection. They are used for various applications such as antibody characterization, functional protein microarrays, and analytical microarrays. These arrays can be fabricated on various surfaces, including glass slides, aluminum, gold, hydrophilic polymers, and nitrocellulose slides. Functional protein microarrays are used to study protein-ligand interactions, while analytical protein microarrays are used for protein profiling and biomarker discovery. Protein microarrays can be used in conjunction with various detection methods, including fluorescent assays, chemiluminescent assays, and colorimetric assays. Protein microarray technology is also used In the study of disease mechanisms, clinical settings, and drug discovery. Protein microarray printing techniques include microcontact printing, inkjet printing, and photolithography.

- Label-free detection methods, such as surface plasmon resonance and mass spectrometry, are also used in protein microarray analysis. Artificial intelligence (AI) and machine learning algorithms are increasingly being used to analyze protein microarray data, enhancing the accuracy and efficiency of protein microarray analysis. Protein microarrays have numerous applications in various industries, including diagnostics, research centers, academic institutes, and diagnostic centers. They are used In the study of oncology, chronic diseases, immunology, autoimmune diseases, and infectious diseases. Protein microarrays are also used in high-throughput proteomics for the identification of therapeutic targets and biomarkers. Protein microarrays offer a cost-effective and efficient alternative to traditional protein analysis methods. They enable the analysis of large protein datasets and provide valuable insights into protein-protein interactions, protein functions, and disease mechanisms. Protein microarrays are an essential tool In the field of proteomics and are expected to play a significant role In the development of personalized medicine and precision medicine.

What are the market trends shaping the Protein Microarray Industry?

Rising popularity of personalized medicines is the upcoming market trend.

- Protein microarrays, a type of microarray technology, are gaining significance in various fields, including diagnostics, drug discovery, and research. These arrays enable the analysis of protein-protein interactions, biochemical activities, immune responses, and disease biomarkers. The technology's ability to provide multiplexed detection and high-throughput screening makes it an essential tool for understanding complex biological systems and disease mechanisms. Personalized medicine, a growing area of focus in healthcare, is driving the demand for protein microarrays. By analyzing an individual's protein expression profile, these arrays can aid In the early diagnosis of diseases, such as cancer, and the selection of targeted medicines based on an individual's genetic makeup. The identification and assessment of disease biomarkers using protein microarrays are crucial for disease diagnosis and therapeutic target discovery. These arrays can be used to study various chronic diseases, including cardiovascular diseases, autoimmune diseases, and infectious diseases. Protein microarrays are also used in research settings, such as academic institutes, research centers, and diagnostic centers, to study protein interactions, biochemical activities, and immune responses.

- The technology's miniaturized assay systems, such as lab-on-chips and microfluidics, make it an attractive option for high-throughput proteomics. The market dynamics for protein microarrays are driven by the growing awareness of chronic diseases, the need for personalized medicine, and advancements in proteomic technologies. The technology's ability to provide label-free detection, surface plasmon resonance, and mass spectrometry analysis adds to its value. Protein microarrays are fabricated using various materials, such as glass slides, aluminum, gold, hydrophilic polymers, and nitrocellulose slides. Assays and test kits for protein microarrays use various detection methods, including fluorescent assays, chemiluminescent assays, and colorimetric assays. The development of protein microarrays is also influenced by advancements in surface chemistries, high-throughput screening, and artificial intelligence (AI) and machine learning algorithms. These technologies enable the analysis of large datasets and the identification of therapeutic targets and disease mechanisms in clinical settings. In summary, protein microarrays are an essential tool for understanding complex biological systems and disease mechanisms. Their ability to aid In the early diagnosis of diseases, personalized medicine, and drug discovery makes them a valuable investment for research institutions, diagnostic centers, and pharmaceutical research organizations.

What challenges does the Protein Microarray Industry face during its growth?

Standardization and accuracy issues is a key challenge affecting the industry growth.

- Protein microarrays, a key technology In the field of proteomics, offer significant potential for personalized medicine, diagnosis, and drug development. However, challenges persist in implementing this technology for drug delivery due to technical issues. In the diagnostics industry, where precision is paramount, protein microarray assays face accuracy concerns, making them less favored. Standardization is essential for researchers to compare data from various platforms, necessitating adherence to standard technology guidelines. Non-standardization and imprecision may lead researchers to disregard raw data obtained from protein microarrays. Protein microarrays, also known as protein chips, are utilized in various applications such as protein interactions, biochemical activities, immune responses, and disease diagnosis.

- These miniaturized assay systems are integral to biotechnology, surface chemistries, high-throughput screening, and molecular profiling. Protein microarrays contribute to pharmaceutical research, biomarker discovery, disease mechanisms, therapeutic targets, and clinical settings. Protein microarray printing techniques include microarray slides (glass, aluminum, gold, hydrophilic polymers, nitrocellulose), fluorescent assays, chemiluminescent assays, and colorimetric assays. Applications extend to chronic diseases, oncology, immunology, autoimmune diseases, and infectious diseases. Protein microarrays facilitate high-throughput proteomics and mass spectrometry, artificial intelligence (AI), and machine learning. Despite challenges, the potential benefits of protein microarrays in personalized medicine, diagnostics, and drug discovery continue to drive research and innovation.

Exclusive Customer Landscape

The protein microarray market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the protein microarray market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, protein microarray market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agilent Technologies Inc.

- Applied Microarrays Inc.

- Arrayit Corp.

- Bio Rad Laboratories Inc.

- BioChain Institute Inc.

- Cambridge Protein Arrays Ltd.

- Cepheid Inc.

- Danaher Corp.

- Fluidigm Corp.

- Genotypic Technology Pvt. Ltd.

- Illumina Inc.

- LifeSpan BioSciences Inc.

- Merck and Co. Inc.

- Molecular Device LLC

- Perkin Elmer Inc.

- RayBiotech Life Inc.

- SCHOTT AG

- Sengenics Corp. LLC

- Thermo Fisher Scientific Inc.

- US Biomax Inc.Ã

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Protein microarrays, also known as protein chips, represent a significant advancement In the field of proteomics, offering a powerful tool for investigating protein-protein interactions, biochemical activities, and immune responses. These analytical platforms enable high-throughput screening and multiplexed detection, facilitating the identification of biomarkers for various diseases, including cancer and chronic illnesses. The market encompasses a range of applications, from antibody characterization and gene expression services to functional protein microarrays and assays. Functional protein microarrays provide insights into protein-ligand interactions and protein denaturation, while analytical protein microarrays enable the detection of biomolecular interactions and protein expressions. Protein microarrays are instrumental in personalized medicine and precision medicine, where they play a crucial role in disease diagnosis and drug development. They facilitate the discovery of therapeutic targets and biomarkers, contributing to a better understanding of disease mechanisms and enabling the design of targeted medicines. The technology behind protein microarrays relies on various surface chemistries, such as glass slides, aluminum, gold, hydrophilic polymers, and nitrocellulose slides. These surfaces are used to immobilize proteins and enable the detection of protein-protein interactions through techniques like electrostatic interactions, covalent bonding, and immobilizing materials.

Protein microarrays employ various assay systems, including fluorescent assays, chemiluminescent assays, and colorimetric assays, to detect protein interactions and biochemical activities. These miniaturized assay systems are essential for high-throughput screening and offer significant advantages in terms of cost, time, and sample requirements. The market is driven by the growing demand for personalized medicine and the need for more accurate and efficient diagnostic tools. The market is also fueled by advancements in biotechnology, microfluidics, and lab-on-chips, which enable the miniaturization of assays and the integration of multiple functionalities into a single platform. Research centers, academic institutes, diagnostic centers, and healthcare infrastructure are significant contributors to the market. These organizations rely on protein microarrays for research and development, biomarker discovery, and disease diagnosis. Protein microarrays have applications in various fields, including oncology, immunology, autoimmune diseases, and infectious diseases. They offer a valuable resource for pharmaceutical research, molecular profiling, and drug discovery, enabling the identification of novel therapeutic targets and biomarkers.

Thus, the market is expected to grow significantly In the coming years, driven by the increasing demand for personalized medicine and the need for more accurate and efficient diagnostic tools. The market is also expected to benefit from advancements in proteomics, microarray printing techniques, label-free detection, and surface plasmon resonance. Thus, protein microarrays represent a powerful tool for investigating protein-protein interactions, biochemical activities, and immune responses. They offer significant advantages in terms of cost, time, and sample requirements and have applications in various fields, including personalized medicine, drug discovery, and disease diagnosis. The market is expected to grow significantly In the coming years, driven by the increasing demand for more accurate and efficient diagnostic tools and advancements in proteomics and microarray technologies.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

133 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.3% |

|

Market growth 2024-2028 |

USD 1.17 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.6 |

|

Key countries |

US, Canada, Germany, China, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Protein Microarray Market Research and Growth Report?

- CAGR of the Protein Microarray industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the protein microarray market growth of industry companies

We can help! Our analysts can customize this protein microarray market research report to meet your requirements.