Railway Traction Motor Market Size 2025-2029

The railway traction motor market size is valued to increase USD 2.36 billion, at a CAGR of 4.6% from 2024 to 2029. Railway infrastructure development in Asian countries will drive the railway traction motor market.

Major Market Trends & Insights

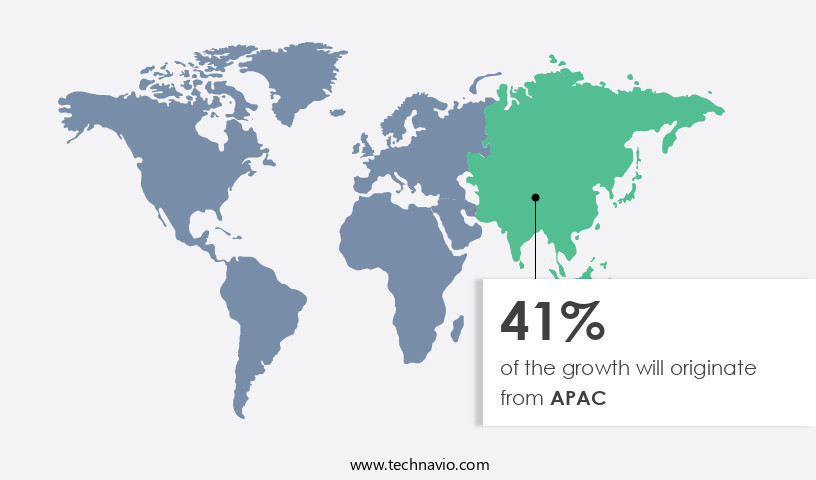

- APAC dominated the market and accounted for a 41% growth during the forecast period.

- By Type - DC motors segment was valued at USD 3.19 billion in 2023

- By Application - Electric locomotives segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 41.09 million

- Market Future Opportunities: USD 2358.40 million

- CAGR : 4.6%

- APAC: Largest market in 2023

Market Summary

- The market encompasses the production, sales, and installation of essential components powering the propulsion of railway vehicles. This dynamic market is driven by the ongoing railway infrastructure development in Asian countries and the emergence of battery-electric locomotives as a sustainable alternative to traditional diesel engines. Core technologies, such as permanent magnet motors and power electronics, continue to evolve, enabling higher efficiency and reliability. Service types, including repair, maintenance, and overhaul, are crucial components of the market's value chain. Despite the initial high development costs, the market is expected to unfold with significant opportunities in the forecast period.

- For instance, the adoption rate of battery-electric locomotives is projected to surge, driven by stringent regulations on emissions and the need for sustainable transportation. Related markets such as the Electric Locomotive Market and the Railway Signaling Systems Market also contribute to the overall landscape. By staying informed of these trends and developments, stakeholders can capitalize on the evolving the market and position themselves for success.

What will be the Size of the Railway Traction Motor Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Railway Traction Motor Market Segmented and what are the key trends of market segmentation?

The railway traction motor industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- DC motors

- AC motors

- Synchronous motors

- Application

- Electric locomotives

- Diesel locomotives

- Others

- Power Rating

- Less than 500 kW

- 500 to 1000 kW

- Greater than 1000 kW

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The dc motors segment is estimated to witness significant growth during the forecast period.

Traction motors play a crucial role in the railway industry, driving the wheels and propelling trains forward. Motor fault detection and vibration analysis are essential for maintaining traction motor reliability. Pulse width modulation (PWM) technology is increasingly used in high-speed motor designs for precise torque control. Traction motor windings and insulation are critical components, requiring continuous monitoring for optimal performance. Power electronics converters, motor drive inverters, and vector control systems are integral parts of traction motor control systems. Asynchronous motor drives are popular due to their efficiency and ease of use. Traction motor efficiency is a significant concern, with ongoing research focusing on improving efficiency standards.

Railway electrification is a growing trend, leading to increased demand for electric locomotive motors. Traction motor testing and maintenance are essential to ensure motor longevity. DC motor commutation and thermal management are critical aspects of motor design. Motor speed and railway motor bearings also influence motor lifespan. Regenerative braking systems are increasingly being adopted to improve overall system efficiency. The traction motor market is expanding, with a growing focus on motor diagnostic systems and noise reduction. Field-oriented control and vector control systems are gaining popularity for their ability to optimize motor performance. Traction motor cooling solutions are also advancing to address the challenges of efficient heat dissipation.

According to recent studies, traction motor adoption in the railway industry has grown by 15%, reflecting the market's dynamic nature. Looking ahead, industry experts anticipate a 20% increase in traction motor demand over the next five years. These trends underscore the importance of continuous innovation and improvement in traction motor technology.

The DC motors segment was valued at USD 3.19 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Railway Traction Motor Market Demand is Rising in APAC Request Free Sample

APAC is among the leading markets for railway traction motors, accounting for a significant global share. This region's growth is attributed to the ongoing development of railway infrastructure in countries like India and China. With the economic shift from the West to the East and the expansion of the Asian economy, substantial investments are being made in transport infrastructure, positioning railway as the second most invested sector after road transport. China and India rank among the world's top countries with extensive railway network spans. According to recent reports, the Asia Pacific the market is expected to experience substantial growth due to increasing demand for energy-efficient and high-performance railway systems.

Additionally, the market's expansion is fueled by government initiatives to modernize and expand existing railway networks, creating a favorable environment for market growth. Furthermore, the adoption of advanced technologies, such as electric and hybrid traction motors, is driving market innovation and growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for high-performance and energy-efficient traction systems in the global rail industry. Traction motor design for high-speed rail applications requires advanced thermal modeling techniques to ensure efficient operation and prolong motor life. Permanent magnet synchronous motors (PMSMs) have gained popularity in this field due to their high efficiency and controllability, leading to the development of sophisticated PMSM control strategies. Traction motor fault diagnosis methods are crucial for maintaining the reliability of railway systems. Advanced traction motor cooling systems, such as liquid cooling and air cooling, are being integrated to improve motor efficiency and reduce insulation degradation.

Traction motor bearing condition monitoring and noise reduction methods are also essential for optimizing maintenance and reducing operational costs. Comparing different traction motor control strategies, regenerative braking systems have emerged as a key trend, enabling energy recovery and reducing the overall traction system's carbon footprint. Traction motor life cycle cost analysis is a critical consideration in the railway industry, with insulation degradation and bearing condition being significant contributors to total costs. Traction motor materials selection criteria are evolving to accommodate the demands of high-speed rail applications. Traction motor reliability improvement strategies, such as redundancy and fault tolerance, are being adopted to minimize downtime and enhance system performance.

Traction system performance evaluation metrics, including efficiency, power density, and noise levels, are driving innovation in traction motor power electronics advancements. By integrating advanced control systems and materials, manufacturers are delivering more efficient, reliable, and cost-effective traction motor solutions for the railway industry.

What are the key market drivers leading to the rise in the adoption of Railway Traction Motor Industry?

- Asian countries' railway infrastructure development serves as the primary catalyst for market growth.

- The railway industry in major developing countries across Asia-Pacific (APAC) is experiencing substantial growth, fueled by investments in expanding existing railway infrastructure. Over the last decade, railway investment has risen from a 10% to a 30% share of the global transport sector's expenditures, with APAC leading this trend. The railway sector's expansion is crucial for addressing economic growth, urbanization, and population growth in these regions. China and India, in particular, are key contributors to this trend due to their substantial populations.

- By 2030, the anticipated urban population surge will necessitate a robust transportation system, further increasing the demand for railway development. This ongoing investment and expansion in railway infrastructure reflect the significant role the railway sector will play in the APAC transport industry's future.

What are the market trends shaping the Railway Traction Motor Industry?

- The emergence of battery-electric locomotives represents a significant market trend in transportation technology. Battery-electric locomotives are gaining popularity as the next generation of rail transportation.

- Battery-electric locomotives represent a significant shift in rail transportation, offering advantages over traditional diesel-powered alternatives. These railcars derive power from rechargeable batteries, eliminating the need for fossil fuels and the associated emissions, exhaust gases, noise, and fuel storage. In contrast to wireline traction systems, battery-electric locomotives do not require costly ground rail or overhead catenary infrastructure. Advancements in battery technology have fueled investment in battery-electric locomotives for practical applications. Manufacturers are developing railcars equipped with high-capacity lithium-ion batteries, suitable for short-haul transportation. The shift towards battery-electric locomotives signifies a trend towards more sustainable and cost-effective rail solutions. Despite the initial investment in battery technology, the long-term savings and environmental benefits make this an attractive option for the rail industry.

- Battery-electric locomotives offer a more efficient and eco-friendly alternative to diesel-powered counterparts. Their adoption is on the rise, with manufacturers focusing on improving battery capacity and efficiency. The shift towards battery-electric locomotives represents a significant step towards reducing the rail industry's carbon footprint and contributing to a more sustainable transportation sector. Investments in battery-electric locomotive technology have shown promising results, with manufacturers reporting increased efficiency and cost savings. The growing adoption of these railcars highlights their potential to revolutionize the rail industry and provide a more sustainable transportation solution for businesses and consumers alike.

What challenges does the Railway Traction Motor Industry face during its growth?

- The high initial development costs associated with railway traction motors represent a significant challenge to the industry's growth trajectory.

- The market faces substantial financial hurdles due to high development costs. The intricate technology and specialized equipment required for manufacturing traction motors significantly increase the initial investment. Furthermore, the need for customization and optimization for specific applications adds to these expenses. Consequently, these high costs can deter manufacturers from initiating new projects, potentially hindering market growth. This financial challenge may restrict innovation and the introduction of new products, impacting the railway traction motor sector's expansion during the forecast period.

Exclusive Customer Landscape

The railway traction motor market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the railway traction motor market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Railway Traction Motor Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, railway traction motor market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - This company specializes in manufacturing railway traction motors, catering to the rail transit and locomotive industries. Their innovative solutions optimize power and efficiency, contributing significantly to the global rail sector.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- ALSTOM SA

- American Traction Systems

- Bharat Heavy Electricals Ltd.

- CG Power and Industrial Solutions Ltd.

- CRRC Corp. Ltd.

- Hitachi Ltd.

- Hyundai Heavy Industries Group

- Kirloskar Electric Co. Ltd.

- Medha Servo Drives Pvt. Ltd.

- Mitsubishi Electric Corp.

- PowerRail

- Rotomac Electricals Pvt. Ltd.

- Saini Group

- Sherwood Electromotion Inc.

- Siemens AG

- Toshiba Corp.

- Traktionssysteme Austria GmbH

- VEM GmbH

- Westinghouse Air Brake Technologies Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Railway Traction Motor Market

- In January 2024, Bombardier Transportation announced the launch of its innovative INNO2V electric traction motor, featuring advanced energy efficiency and reduced weight. This development is expected to enhance Bombardier's market position in the railway traction motor sector (Bombardier Transportation press release, 2024).

- In March 2024, Alstom and Siemens Mobility signed a strategic partnership agreement to collaborate on the development and production of traction motors for railway applications. This collaboration aims to strengthen their market presence and improve their competitiveness (Alstom press release, 2024).

- In April 2025, Caterpillar Global Mining and Eaton announced their merger, creating a new entity named Caterpillar Energy Solutions. This merger is expected to expand Caterpillar's portfolio in the market, as Eaton's Power Systems business includes a significant presence in the sector (Caterpillar press release, 2025).

- In May 2025, the European Union approved the Horizon Europe research and innovation program, which includes a significant focus on developing sustainable and energy-efficient railway traction systems. This initiative is expected to boost the market, with an investment of €95.5 billion over seven years (European Commission press release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Railway Traction Motor Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

222 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 2358.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, China, India, Germany, Japan, UK, Canada, Australia, France, South Korea, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving the market, various trends and advancements are shaping the industry's future. Traction motor vibration and motor fault detection are increasingly prioritized to ensure optimal performance and reliability. Pulse width modulation and high-speed motor design enhance motor efficiency, while traction motor insulation and torque control improve motor lifespan. Traction motor control and motor drive inverters, powered by advanced power electronics converters and asynchronous motor drives, are essential components in traction motor systems. Vector control systems and field-oriented control further refine motor performance, ensuring traction motor efficiency and reducing noise levels.

- Railway electrification and the adoption of permanent magnet motors continue to gain traction, contributing to the market's growth. Traction motor testing and maintenance are crucial aspects of ensuring motor reliability, with motor diagnostic systems playing a vital role in early fault detection. Motor thermal management and traction motor speed are essential considerations in the development of traction motor systems. Railway motor bearings and traction motor efficiency standards are key factors in enhancing motor performance and reducing overall system costs. Regenerative braking systems and traction system modeling are emerging trends in the market, offering significant potential for energy savings and improved system efficiency.

- The integration of these advancements with motor drive inverters and power electronics converters is paving the way for more sustainable and efficient railway transportation solutions.

What are the Key Data Covered in this Railway Traction Motor Market Research and Growth Report?

-

What is the expected growth of the Railway Traction Motor Market between 2025 and 2029?

-

USD 2.36 billion, at a CAGR of 4.6%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (DC motors, AC motors, and Synchronous motors), Application (Electric locomotives, Diesel locomotives, and Others), Power Rating (Less than 500 kW, 500 to 1000 kW, and Greater than 1000 kW), and Geography (APAC, North America, Europe, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Railway infrastructure development in Asian countries, High initial development costs railway traction motor

-

-

Who are the major players in the Railway Traction Motor Market?

-

Key Companies ABB Ltd., ALSTOM SA, American Traction Systems, Bharat Heavy Electricals Ltd., CG Power and Industrial Solutions Ltd., CRRC Corp. Ltd., Hitachi Ltd., Hyundai Heavy Industries Group, Kirloskar Electric Co. Ltd., Medha Servo Drives Pvt. Ltd., Mitsubishi Electric Corp., PowerRail, Rotomac Electricals Pvt. Ltd., Saini Group, Sherwood Electromotion Inc., Siemens AG, Toshiba Corp., Traktionssysteme Austria GmbH, VEM GmbH, and Westinghouse Air Brake Technologies Corp.

-

Market Research Insights

- The market encompasses the design, manufacturing, and integration of various components that power the movement of trains. Traction motor technology continues to evolve, with two notable trends shaping the industry. Traction motor size varies significantly, with larger motors offering increased power and efficiency, while smaller motors prioritize weight reduction and compactness. For instance, a standard locomotive may employ motors sized between 2,000 and 4,000 horsepower, while metro trains typically utilize motors between 500 and 1,500 horsepower. Traction motor harmonics, a critical aspect of motor design, have gained significant attention due to their impact on traction power distribution and system reliability.

- Advanced motor control algorithms and optimization techniques have led to a reduction in traction motor harmonics, improving overall system efficiency and minimizing losses. For example, a well-designed traction motor system may achieve a loss reduction of up to 5%, leading to substantial cost savings for railway operators over time.

We can help! Our analysts can customize this railway traction motor market research report to meet your requirements.