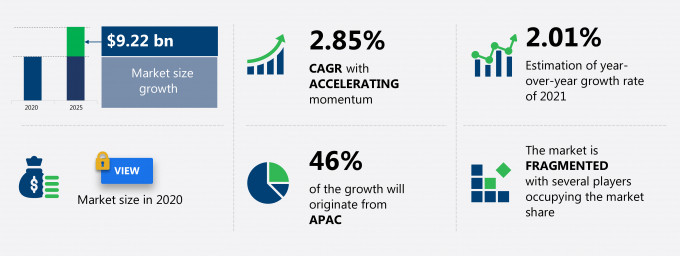

The ready to assemble furniture market share is expected to increase by USD 9.22 billion from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 2.85%.

This ready assemble furniture market research report provides valuable insights on the post-COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers ready assemble furniture market segmentation by product (home and office), distribution channel (offline and online), and geography (APAC, North America, Europe, South America, and MEA). The ready to assemble furniture market report also offers information on several market vendors, including Dorel Industries Inc., FABRYKI MEBLI FORTE SA, Flexsteel Industries Inc., Foundations Worldwide Inc., Inter IKEA Holding BV, Meubles Demeyere SA, Prepac Manufacturing Ltd., Sauder Woodworking Co., Steinhoff International Holdings NV, and Tvilum AS among others.

What will the Ready To Assemble Furniture Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Ready To Assemble Furniture Market Size for the Forecast Period and Other Important Statistics

Ready To Assemble Furniture Market: Key Drivers, Trends, and Challenges

Based on our research output, there has been an impact on the market growth during and after the post-COVID-19 era. The rapid growth in urbanization is notably driving the ready assemble furniture market growth, although factors such as the availability of alternative products may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic's impact on the ready assemble furniture industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Ready To Assemble Furniture Market Driver

One of the key factors driving the Ready To Assemble Furniture market is the rapid growth in urbanization. A rapid growth in urbanization, primarily in developing countries, has led to the emergence of numerous megacities. Urbanization has increased significantly across the world. As per data published by The World Bank Group, in 2018, 55.3% of the overall population in the world lived in urban settlements. Increased urbanization has increased the focus on building residential buildings worldwide. As per data by the UN, which was published in 2018, the total number of megacities is expected to increase from 33 in 2018 to 43 by 2030. The number of megacities is expected to increase in China, South Africa, and India, among other countries. The growth of megacities is boosting the growth of residential and commercial buildings. Furthermore, people residing in residential buildings are increasingly focusing on buying innovative and trendy furniture to enhance the aesthetics of their houses. RTA or flat-pack furniture is convenient, owing to its ease of use and trendy designs. For such reasons, the urban population prefers RTA furniture to the conventional type of furniture. Therefore, rapid growth in urbanization is fostering the growth of the ready to assemble furniture market.

Key Ready To Assemble Furniture Market Trend

Rising demand for distribution through online retail and channels is another factor supporting the Ready To Assemble Furniture market growth in the forecast period. Online marketing and branding activities help manufacturers save overall distribution costs. Various e-commerce platforms, such as Amazon, IKEA, and Tylko, provide RTA furniture for homes and offices. For instance, Ashley Home Stores Ltd. and Inter IKEA Holding market and distribute their RTA furniture through Amazon across geographies. Similarly, Tylko is an online retailer of RTA furniture products such as shelves, bookcases, shoe racks, and wall storage across the world. Such e-commerce platforms help vendors easily expand their customer base worldwide. In addition, discounts and offers provided by online retailers for purchasing RTA furniture products are attracting customers. As a result, online purchases of RTA furniture may increase. Furthermore, Vendors like IKEA, Home Reserve LLC, and Walmart Inc., among other vendors, have their online channels for the distribution of products. The ease of purchasing products without the need to visit shops, even in the case of urgent requirements, is a major factor boosting the sales of certain RTA furniture. These factors may drive the growth of the global ready to assemble furniture market in the forecast period.

Key Ready To Assemble Furniture Market Challenge

Availability of alternative products will be a major challenge for the Ready To Assemble Furniture market during the forecast period. The low durability and lack of uniqueness are the major factors for the demand for traditional assembled wooden, metallic, and plastic furniture. The easy availability, superior performance, and excellent durability of assembled furniture are expected to create a challenge for the RTA furniture manufacturers. Refurbished or reused assembled furniture at low costs is gaining popularity across the world. Assembled furniture is easily available at local shops, and it does not require professional installation, which costs extra. This, in turn, is increasing demand for this type of furniture among customers. Assembled furniture is available in an extensive range of designs. Furthermore, the availability of plenty of styles and designs of assembled furniture attracts buyers. Moreover, solidly built with superior durability is a major factor expected to raise the demand for assembled furniture as the most suitable alternative to RTA furniture. This may restrain the growth of the global ready to assemble furniture market during the forecast period.

This ready to assemble furniture market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the global ready to assemble furniture (RTA) market as a part of the global home furnishings market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the ready to assemble furniture market during the forecast period.

Who are the Major Ready To Assemble Furniture Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Dorel Industries Inc.

- FABRYKI MEBLI FORTE SA

- Flexsteel Industries Inc.

- Foundations Worldwide Inc.

- Inter IKEA Holding BV

- Meubles Demeyere SA

- Prepac Manufacturing Ltd.

- Sauder Woodworking Co.

- Steinhoff International Holdings NV

- Tvilum AS

This statistical study of the ready to assemble furniture market encompasses successful business strategies deployed by the key vendors. The ready to assemble furniture market is fragmented and the vendors are deploying growth strategies such as strong distribution across geographies and the development of innovative, multifunctional RTA furniture to compete in the market.

Product Insights and News

- Dorel Industries Inc. - The company offers assembled furniture products such as Condor Toolless TV Stand, Haven Retro Desks, and Owen tables.

To make the most of the opportunities and recover from the post-COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The ready to assemble furniture market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Ready To Assemble Furniture Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the ready to assemble furniture market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the global home furnishings market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Service

- Support activities

- Innovation

The report has further elucidated other innovative approaches being followed by manufacturer providers to ensure a sustainable market presence.

Which are the Key Regions for Ready To Assemble Furniture Market?

For more insights on the market share of various regions Request a FREE sample now!

46% of the market’s growth will originate from APAC during the forecast period. India, China, Australia, and Japan are the key markets for ready to assemble furniture market in APAC. Market growth in this region will be faster than the growth of the market in other regions.

Rising consumer inclination toward home décor, increasing average income, the booming housing industry, and the growing demand for luxury flooring will facilitate the ready to assemble furniture market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

The ready to assemble furniture market in APAC witnessed a decline in 2020 due to the outbreak of COVID-19. Countries such as China, Japan, South Korea, and India were highly affected by the COVID-19 pandemic. The governments of most countries in APAC introduced emergency legislation, which included restrictions on business activities and social gatherings, during the first half of 2020. Also, various key vendors such as IKEA and others delayed their expansion in the region due to nationwide lockdowns across various countries such as India, China, and others in 2020. This hindered the growth of the market in the region in 2020. However, the market is expected to witness a rise in home furnishing sales via e-commerce channels during the forecast period. Furthermore, the recovery from the COVID-19 pandemic and large-scale vaccination drives are anticipated to propel the market growth during the forecast period.

What are the Revenue-generating Product Segments in the Ready To Assemble Furniture Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The ready to assemble furniture market share growth by the segments. Home segment will be significant during the forecast period. RTA furniture for homes is mainly designed for enhancing home aesthetics. Home RTA furniture mainly includes bedroom furniture, living room furniture, kids room furniture, dining room furniture, kitchen furniture, and garden furniture. The home segment was the largest product segment in the global ready to assemble furniture market owing to rapid growth in urbanization, high disposable income, increased construction of residential buildings, easy transportation, and affordability.

This report provides an accurate prediction of the contribution of all the segments to the growth of the ready to assemble furniture market size and actionable market insights on post COVID-19 impact on each segment.

|

Ready To Assemble Furniture Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.85% |

|

Market growth 2021-2025 |

$ 9.22 billion |

|

Market structure |

Fragmented |

|

YoY growth (%) |

2.01 |

|

Regional analysis |

APAC, North America, Europe, South America, MEA, APAC, North America, Europe, South America, and MEA |

|

Performing market contribution |

APAC at 46% |

|

Key consumer countries |

US, China, Germany, Japan, and UK |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Dorel Industries Inc., FABRYKI MEBLI FORTE SA, Flexsteel Industries Inc., Foundations Worldwide Inc., Inter IKEA Holding BV, Meubles Demeyere SA, Prepac Manufacturing Ltd., Sauder Woodworking Co., Steinhoff International Holdings NV, and Tvilum AS |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Ready To Assemble Furniture Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive ready to assemble furniture market growth during the next five years

- Precise estimation of the ready to assemble furniture market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the ready to assemble furniture industry across APAC, North America, Europe, South America, and MEA

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of ready to assemble furniture market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch