Refining Catalyst Market Size 2024-2028

The refining catalyst market size is estimated to increase by USD 1.61 billion and grow at a CAGR of 4.36% between 2023 and 2028. The growth of the market depends on several factors such as the increasing adoption of FCC processes, the increasing demand for cleaner fuels, and the increasing demand for crude oil products. Rising demand for crude oil products is fueling market growth, particularly evident in the global refining catalyst market. This upsurge in demand stems from various factors, including population expansion, industrialization, and heightened consumption of petroleum products. A significant driver is the increasing global population. As the world's population continues to grow, the need for energy naturally follows suit, underscoring the crucial role of crude oil products in meeting these energy needs.

What will the Size of the Refining Catalyst Market be during the Forecast Period?

To learn more about this report, View Refining Catalyst Market Analysis Report Sample

Refining Catalyst Market Segmentation

By Product Analysis

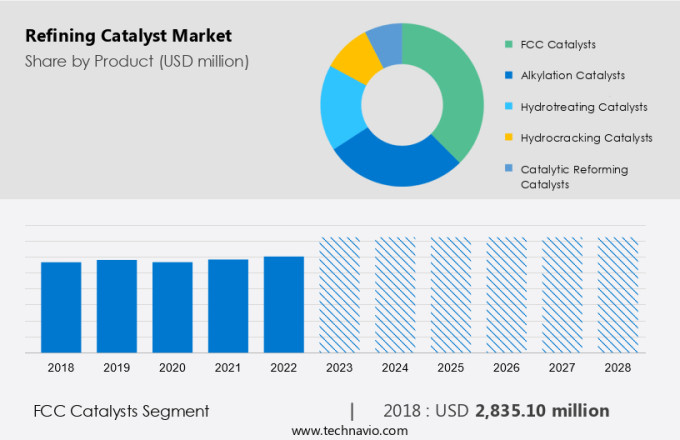

The FCC catalyst segment is estimated to witness significant growth during the forecast period. FCC catalysts are essential in the conversion of heavy hydrocarbon feedstocks into valuable lighter products, such as gasoline, diesel, and petrochemicals. FCC catalysts are efficient and effective in increasing refinery production and profitability, it has been widely applied by the oil refining industry.

Get a glance at the market contribution of various segments View the Refining Catalyst Market Analysis Report PDF Sample

The global requirement for FCC is driven by the increasing need for cleaner and higher-quality petroleum products. As global energy consumption continues to rise, the refining industry must adapt to produce fuels that meet stricter specifications while maximizing production efficiency. By improving the yield and quality of high-value products, FCC make it possible for refiners to achieve these objectives in a more profitable way.

Refining Catalyst Market Regional Analysis

For more insights on the Refining Catalyst Market Share of various regions Download PDF Sample now!

APAC is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. APAC holds a significant position in the global market. With its robust economies and growing energy requirements, countries in APAC have witnessed a significant increase in refining activities in recent years. The strategically located region, which has benefited from favorable government policies and attracted investments by major refiners around the world, is becoming a hub for oil refining.

Moreover, China is one of the key contributors to the market in APAC. The country has witnessed rapid urbanization and industrialization, leading to a surge in energy consumption. The country has become one of the largest crude oil refining centers in the world, and refining catalysts play a crucial role in enhancing the efficiency and productivity of its refineries. Such factors will increase the market growth in this region during the forecast period.

Refining Catalyst Market Dynamics and Customer Landscape

The market is witnessing significant growth, driven by the petroleum refining industry's demand for advanced technologies to produce transportation fuels. With the focus on meeting environmental regulations, there's a growing need for high-octane fuel and ultra-low sulfur diesel (ULSD). This is further fueled by the shift towards renewable energy sources and sustainable approaches. Oil refineries are increasingly investing in advanced refinery catalysts such as zeolites and fluid catalytic cracking (FCC) catalysts to enhance efficiency and reduce emissions. However, stringent regulations regarding sulfur content, nitrogen oxide, and mercury emissions pose challenges. The market is also affected by raw material demand-supply imbalances, emphasizing the importance of sustainable practices in the refining industry.

Key Market Driver

Increasing demand for crude oil products is driving growth in the market. The increased growth of petroleum products is being observed in the global refining catalyst market. This surge can be attributed to several factors, including population growth, industrialization, and increasing consumption of petroleum products. One of the main drivers of the increasing demand for crude oil products is the growing global population. As the world population continues to rise, so does the need for energy.

The need for crude oil products in the global market is also influenced by factors such as geopolitical developments and government policies. The demand for crude oil products can also be positively affected by government policies designed to reduce carbon emissions and promote the use of renewable energy sources. It is expected to increase the demand for crude oil products, which will propel the growth of the global market during the forecast period.

Significant Market Trends

The market is witnessing a significant trend driven by the rising demand for fuel with high octane numbers. This surge in demand for high-octane fuel is observed globally across various industries, including automotive, aviation, and power generation. The growing number of vehicles on the road, spurred by economic growth and urbanization, contributes to this trend. In response, there have been significant advancements in catalyst technology, particularly in fluid catalytic cracking refinery catalysts and HPC catalysts, to meet the demand for high-octane fuels. Additionally, stringent environmental regulations regarding emissions control and sulfur content further drive the need for advanced refinery catalysts. As the market continues to evolve with the demand for high-quality fuels, the refining catalyst market is expected to witness substantial growth in the forecast period.

Major Market Challenge

The rising demand for electric vehicles (EVs) is a major challenge faced by the market. Due to the increased demand for electric cars, the worldwide industry is expected to be significantly negatively affected. As more and more consumers turn toward electric vehicles as an environmentally friendly alternative to traditional gasoline engines, the demand for refined petroleum products such as gasoline and diesel is expected to decline. This, in turn, will impact the demand, which are a crucial component in the refining process during the forecast period.

However, the demand for gasoline and diesel is estimated to decrease significantly in the years ahead as EVs become more popular. Moreover, the economic situation of the refining sector is affected by a decrease in demand for refined petroleum products. during the forecast period. Refineries may face financial challenges and struggle to maintain profitability, as the demand for refined petroleum products decreases. This, in turn, will lead to refinery closures or downsizing, which will have a ripple effect on the industry during the market forecasting period.

Market Customer Landscape

The market research report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Global Market Customer Landscape

Major Refining Catalyst Market Companies

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Albemarle Corp. - The company offers refining catalysts such as fluid catalytic cracking FCC catalysts technology for the refining process as well as other refining catalysts through its brand Ketjen.

The research report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- Albemarle Corp.

- Arkema Group

- Axens

- BASF SE

- Chevron Corp.

- Clariant International Ltd.

- Dorf Ketal Chemicals I Pvt. Ltd.

- DuPont de Nemours Inc.

- Evonik Industries AG

- Exxon Mobil Corp.

- Honeywell International Inc.

- Johnson Matthey Plc

- KNT Group

- Lummus Technology LLC

- McDermott International Ltd.

- Shell plc

- Sinopec Shanghai Petrochemical Co. Ltd.

- TechnipFMC plc

- Topsoes AS

- W. R. Grace and Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Segment Overview

The market report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Product Outlook

- FCC catalysts

- Alkylation catalysts

- Hydrotreating catalysts

- Hydrocracking catalysts

- Catalytic reforming catalysts

- Type Outlook

- Zeolites

- Metals

- Chemical compounds

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Chile

- Argentina

- Brazil

- North America

You may be interested in:

- Catalyst Market by Type and Geography - Forecast and Analysis

- Environmental Catalyst Market Analysis APAC, North America, Europe, South America, Middle East and Africa - US, China, India, Germany, UK - Size and Forecast

- Oil Refining Market Research Report by Product, Fuel Type, Geography - Analysis, Industry Forecast

Market Analyst Overview

The market is witnessing significant growth driven by advancements in petroleum refining technologies and increasing demand for transportation fuel. Key players in the market are investing in advanced technologies to improve processes such as tight oil processing and production of ultra-low sulfur diesel (ULSD). Refinery catalysts like fluid catalytic cracking, alkylation, hydrotreating, and hydrocracking play a crucial role in enhancing fuel quality and meeting environmental regulations on sulfur content, nitrogen oxide, and mercury emissions. With the automotive industry focusing on green technologies and stringent emission standards, there is a growing demand for advanced refinery catalysts to ensure compliance. Global manufacturers with technical expertise are leading the market, offering sustainable solutions to address the energy demand while adhering to environmental policies and fuel norms.

Moreover, the market is experiencing significant growth driven by the petroleum refining industry and the increasing demand for oil refineries which collectively impacts the growth of the global oil refining market. Catalysts play a crucial role in various refining processes such as fluid catalytic cracking, alkylation, hydrotreating, and hydrocracking, enabling efficient and sustainable approaches to refining. With the implementation of emission control regulations and the emphasis on sustainable practices in the industry, there's a growing demand for HPC catalysts and hydroprocessing technologies. Stringent regulations regarding emissions and fuel norms drive the adoption of catalysts that help meet severe emission standards while ensuring fuel economy. Global manufacturers of refinery catalysts, leveraging entities like zeolite and potassium, are meeting the demand for high-octane fuels and addressing challenges such as metal contamination and raw material demand-supply imbalance. As transportation fuel demand continues to rise, the refining catalyst market is poised for further growth.

The global refining catalyst market is experiencing substantial growth driven by various factors. Biofuel initiatives and "Go Green" campaigns are pushing for sustainable alternatives, leading to increased demand for alkylation refinery catalysts and hydrotreating refinery catalysts. Favorable government regulations and fuel norms are also fuelling market expansion. With growing demand for high-octane fuel, hydrocracking refinery catalysts are gaining significance. Additionally, the market is witnessing a shift towards conservative and efficient refining processes to address volatile prices and reduce nitrogen oxide emissions. These catalysts play a crucial role in cracking operations, ensuring the heat balance effect while meeting stringent standards for potassium, sodium, calcium, and magnesium levels in automotive vehicles.

The Refining Catalyst Market is witnessing significant growth due to the increasing demand for petroleum derivatives such as octane number enhancers for gasoline and high octane fuel for vehicles. Heavy oil feedstocks are being converted into naphtha, jet fuel, kerosene, and ultra-low sulfur diesel using hydrotreating and hydrocracking processes, which require advanced catalysts. Noble metals like molybdenum, palladium, and zirconium play a crucial role in FCC catalyst applications for the production of petrochemical plant lube basestocks. Government norms for reducing vehicle emissions and sulfur emissions from fuel have accelerated the demand for hydro treating catalysts. Shale gas and ethanol are emerging as alternative feedstocks, leading to the development of enzyme catalysts for biodiesel production. However, supply chain disruptions due to geopolitical tensions and refinery expansions pose challenges to market growth. The refining catalyst market is also influenced by the shift towards greenhouse gas emissions reduction and the rise of electric vehicles. Calcium carbonate and other catalysts are used in the production of polymers and other petrochemicals. The market is expected to continue its growth trajectory, driven by the increasing demand for high-performance catalysts in the petrochemical and refining industries.

|

Industry Scope |

|

|

Report Coverage |

Details |

|

Page number |

191 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 1.61 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 39% |

|

Key countries |

China, US, Germany, France, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Albemarle Corp., Arkema SA, Axens, BASF SE, Chevron Corp., Clariant International Ltd., Dorf Ketal Chemicals I Pvt. Ltd., DuPont de Nemours Inc., Evonik Industries AG, Exxon Mobil Corp., Honeywell International Inc., Johnson Matthey Plc, KNT Group, Lummus Technology LLC, McDermott International Ltd., Shell plc, Sinopec Shanghai Petrochemical Co. Ltd., TechnipFMC plc, Topsoes AS, and W. R. Grace and Co. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

View Refining Catalyst Market Forecast Report PDF Sample

What are the Key Data Covered in this Refining Catalyst Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the refining catalyst market growth and forecasting of the market between 2023 and 2027

- Precise estimation of the refining catalyst market size and its contribution to the parent market

- Accurate predictions about upcoming refining catalyst market trends and analysis and changes in consumer behavior

- Growth of the market industry across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough refining catalyst market growth analysis of the market’s competitive landscape and detailed information about vendors

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this refining catalyst market forecast report to meet your requirements.