Renewable Electricity Generation Market Size 2024-2028

The renewable electricity generation market size is forecast to increase by USD 215.77 billion at a CAGR of 11.5% between 2023 and 2028. The market is experiencing significant growth, driven by various factors. One key trend is the implementation of tax incentives for renewable electricity generation projects, which provide financial incentives for businesses and individuals to invest in resources. Another trend is the integration of renewable energy and storage technologies, enabling the storage of excess energy for use during peak demand periods. However, the high initial cost of infrastructure and technology remains a significant challenge for market growth. Despite this, the market is expected to continue expanding due to increasing global awareness of the need to reduce greenhouse gas emissions and transition to cleaner energy sources.

What will be the Size of the Market During the Forecast Period?

The market is witnessing significant growth due to the increasing demand for clean energy sources and the need to reduce reliance on traditional fossil fuels such as coal, oil, and natural gas. Renewable energy sources, including sunlight, wind, rain, tides, waves, geothermal heat, and biomass feedstock, are becoming increasingly popular as they produce little to no greenhouse gas (GHG) emissions during energy generation. Fossil fuel-based power generation, particularly coal-based power, is facing increasing scrutiny due to its environmental impact and the associated emissions. Renewable power sources, on the other hand, offer a more sustainable and eco-friendly alternative.

Additionally, the shift towards renewable energy is being driven by various factors, including rising electricity distribution costs, power outages, and stringent emissions regulations. Hydropower systems have been a traditional source of renewable electricity, but solar power generation and wind energy are gaining significant traction. Solar energy is becoming increasingly cost-effective and efficient, making it an attractive option for energy self-sufficiency in both residential and commercial applications. Wind energy is also becoming more competitive with traditional power sources, with advancements in technology leading to increased efficiency and lower costs. The renewable energy industry is also contributing to flood control efforts in various regions by harnessing the power of hydropower systems.

Also, the demand for renewable energy is expected to continue growing as the world transitions towards a low-carbon economy. The market is expected to experience steady growth in the coming years. Solar energy and wind energy are expected to lead the way, with geothermal heat and biomass feedstock also contributing significantly. The market is expected to face challenges, including the intermittency of renewable energy sources and the need for energy storage solutions. However, advancements in technology and government support are expected to mitigate these challenges and drive growth in the market. In conclusion, the market is an exciting and dynamic space, driven by the need for clean energy sources and the desire to reduce reliance on traditional fossil fuels.

Moreover, renewable energy sources, including solar, wind, and hydropower, are expected to continue leading the way in the market, with geothermal heat and biomass feedstock also making significant contributions. The challenges facing the market, including intermittency and energy storage, are being addressed through technological advancements and government support, making the future of renewable electricity generation bright.

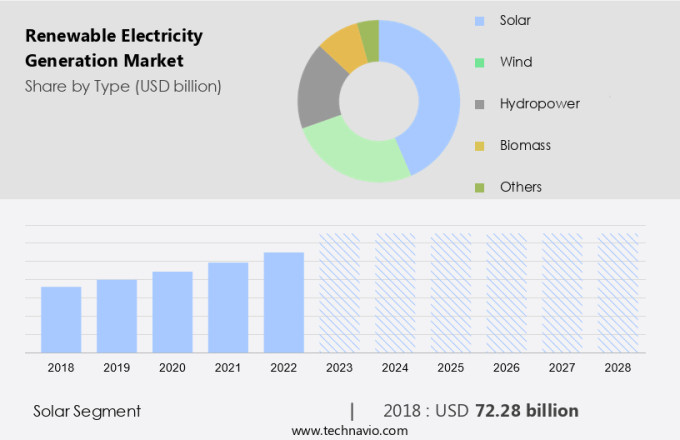

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Solar

- Wind

- Hydropower

- Biomass

- Others

- End-user

- Residential

- Industrial

- Commercial

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- Italy

- North America

- Canada

- Mexico

- US

- South America

- Middle East and Africa

- APAC

By Type Insights

The solar segment is estimated to witness significant growth during the forecast period. The market is experiencing substantial expansion, with solar power leading the charge. Solar energy projects are gaining traction to meet the escalating demand for eco-friendly and sustainable power sources. An illustrative instance is the Green River Energy Center in Utah's east, which merges solar generation with energy storage. This expansive project boasts a 400 MW solar photovoltaic capacity and a 1,600 MWh battery storage system. Hybrid projects like this one are paving the way in the industry, ensuring a steady electricity supply by offsetting production fluctuations. The fusion of solar power with energy storage systems is essential for maintaining a consistent electricity output, which is a primary challenge for renewable energy sources.

Solar PV systems and biogas plants are among the alternative energy sources that are increasingly being adopted for industrial and commercial applications. Hydropower remains a significant contributor to renewable electricity generation. As the world shifts towards cleaner energy sources, the demand for low-cost electricity from renewable sources is on the rise.

Get a glance at the market share of various segments Request Free Sample

The solar segment accounted for USD 72.28 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

APAC is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Asia Pacific (APAC) region is leading the global shift towards renewable electricity generation, fueled by ambitious national goals and substantial investments in renewable energy infrastructure. Major economies, including Japan, China, India, and Australia, are driving this growth. Japan is at the vanguard of this transition, aiming to increase renewable energy's share in its electricity production to 80% by fiscal year 2035. This goal is bolstered by the expansion of battery storage capacity and strengthened collaboration between regional power grids. In 2022, renewable energy accounted for 22% of Japan's power generation, and the country intends to eliminate nuclear and coal power usage entirely.

Additionally, renewable energy sources, such as sunlight, wind, rain, tides, waves, and geothermal heat, are increasingly replacing fossil fuels, like coal and oil, due to their environmental benefits and decreasing production costs. This trend is expected to continue, making the APAC region a significant player in the global renewable electricity market.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Tax incentives for renewable electricity generation projects is the key driver of the market. Tax incentives play a pivotal role in fostering the expansion of the wind power sector by making renewable energy projects more financially allureing for investors. These incentives lower the overall cost of capital investment, thereby improving the economic feasibility of wind power projects. For instance, the introduction of a renewable energy investment tax credit (ITC) in the 2023 Canadian federal budget significantly boosts the appeal of Canada as a prime destination for renewable energy investments worldwide. This ITC grants a 30% tax deduction for investments in renewable technologies until 2034. Being a refundable incentive, it directly reduces the tax liability of renewable energy projects, thereby augmenting their net present value (NPV).

Additionally, the shift towards a low-carbon economy, fueled by climate change concerns and dwindling fossil fuel reserves, has intensified the demand for renewable electricity generation. Smart grids, energy efficiency, electric vehicles (EVs), and vehicle-to-grid (V2G) technologies are key components of this transition. The US government's commitment to reducing greenhouse gas emissions and promoting energy security further bolsters the growth prospects of the market.

Market Trends

Integration of renewable energy and storage is the upcoming trend in the market. The renewable electricity generation sector is witnessing a significant shift towards integrating renewable energy plants with advanced storage solutions. This trend is crucial for addressing the intermittency challenges posed by renewable power sources like solar and wind.

For instance, the Green River Energy Center in Utah, spearheaded by Plus Energies, is a prime example of this trend. This project comprises a 400 MW solar power generation system coupled with a 1,600 MWh battery storage system. This integration ensures a consistent electricity supply by balancing production fluctuations. This approach is essential for ensuring energy self-sufficiency and reducing dependence on gas-based power and coal-based power generation. Moreover, it significantly decreases electricity distribution costs and power outages, making it a preferred choice for businesses and consumers alike.

Market Challenge

High initial cost of infrastructure and technology is a key challenge affecting the market growth. Renewable electricity generation through sources such as hydroelectric power, wind power, bioenergy, solar energy, and geothermal energy continues to gain traction as countries strive to meet their renewable energy targets. However, the high initial costs associated with these energy sources pose a significant challenge. For instance, geothermal and ocean energy projects require substantial capital investment due to the complex infrastructure and technology required. Marine energy projects, including tidal and wave energy systems, face similar challenges due to the need for specialized engineering solutions and deep-sea infrastructure. Ocean Thermal Energy Conversion (OTEC) technology, in particular, demands costly equipment and infrastructure development.

Additionally, these high upfront costs create a significant financial barrier, hindering the growth and expansion of these renewable energy sectors. Feed-in tariffs and emissions intensity regulations have been implemented to incentivize the adoption of renewable energy sources. However, the initial investment required for these projects remains a significant hurdle. Biomass feedstock, an essential component of bioenergy generation, also faces challenges related to availability and cost. Addressing these financial barriers through innovative financing mechanisms and technological advancements is crucial to accelerating the growth of the market.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Acciona SA - The company offers renewable electricity solutions to corporations, businesses, and organizations that are intended to minimize carbon footprints and optimize energy use.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adani Green Energy Ltd.

- BP Plc

- Brookfield Business Partners LP

- Canadian Solar Inc.

- Constellation Energy Corp

- Duke Energy Corp.

- Enbridge Inc.

- GE Vernova Inc.

- Iberdrola SA

- Innergex Renewable Energy Inc.

- Invenergy

- Orsted AS

- Plug Power Inc.

- Schneider Electric SE

- Siemens Gamesa Renewable Energy SA

- Suzlon Energy Ltd.

- Tata Power Renewable Energy Ltd.

- Vestas Wind Systems AS

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Renewable electricity generation has emerged as a key solution to address the growing energy demand and reduce reliance on fossil fuels such as coal, oil, and natural gas. Renewable energy sources, including sunlight, wind, rain, tides, waves, geothermal heat, and biomass, offer environmental benefits by reducing greenhouse gas emissions and contributing to a low-carbon economy. Renewable energy targets and feed-in tariffs are driving the growth of renewable power sources, including hydroelectric power, wind power, solar energy, and geothermal energy. Renewable energy plants, such as solar PV systems, biogas plants, and hydroelectric systems, offer various advantages, including energy efficiency, energy self-sufficiency, and low-cost electricity.

In summary, these renewable power sources also provide additional benefits, such as flood control, clean drinking water, and irrigation support. The transition to renewable electricity generation is essential to mitigate climate change and reduce the carbon footprint of the energy sector. Renewable energy demand continues to grow, driven by increasing emissions regulations and the need for unconventional power generation. The solar industry, in particular, is experiencing significant growth, with solar PV installations increasing in commercial, industrial, residential, and utility projects. Renewable energy generation also offers cost savings in the long run, as the cost of renewable electricity production continues to decrease. Smart grids and vehicle-to-grid (V2G) technology are also playing a role in optimizing energy distribution and reducing electricity production costs. Overall, renewable electricity generation is a critical component of a sustainable and low-carbon energy future.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.5% |

|

Market growth 2024-2028 |

USD 215.77 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

11.2 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 43% |

|

Key countries |

China, US, India, Germany, Japan, Canada, Italy, UK, Mexico, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Acciona SA, Adani Green Energy Ltd., BP Plc, Brookfield Business Partners LP, Canadian Solar Inc., Constellation Energy Corp, Duke Energy Corp., Enbridge Inc., GE Vernova Inc., Iberdrola SA, Innergex Renewable Energy Inc., Invenergy, Orsted AS, Plug Power Inc., Schneider Electric SE, Siemens Gamesa Renewable Energy SA, Suzlon Energy Ltd., Tata Power Renewable Energy Ltd., and Vestas Wind Systems AS |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch